|

市场调查报告书

商品编码

1692526

全球灌装机市场:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Global Filling Machines - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

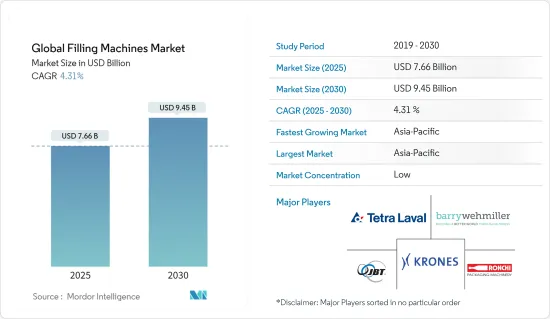

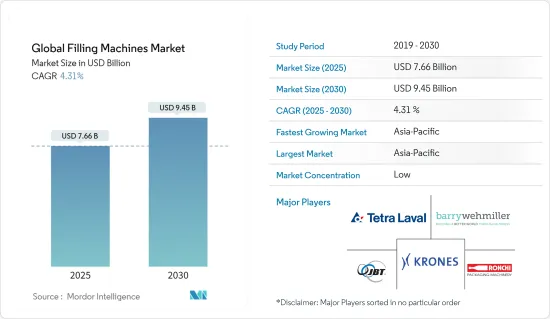

预计 2025 年全球灌装机市场规模为 76.6 亿美元,到 2030 年将达到 94.5 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.31%。

对便利食品包装的需求推动了全球包装尺寸的缩小,而自动化生产线则使包装解决方案供应商能够发挥创造力和效率。因此,一致性正在推动自动灌装机市场的成长。

主要亮点

- 消费者购买力的提高是推动灌装机市场成长的主要因素之一。此外,各行业的快速发展、自动化和先进机械的日益普及、对产品标准化和卫生要求的不断提高以及个人对包装产品的偏好都在推动灌装机市场的成长。

- 对快速消费品和药品的需求不断增长,迫使製造商加快生产线。人们越来越需要能够快速填充原料同时保持体积和重量准确性的填充机。此外,随着消费者对产品健康和安全的意识不断增强,无菌包装也日益普及。

- 自动化灌装机简化了组装流程,提高了整个包装流程的效率。因此,预计预测期内包装产业对自动灌装机的需求将会增加。

- 由于产品的复杂性,製造商在安装灌装机时面临独特的挑战。例如,化学品具有腐蚀性和易燃性,因此製造商必须满足严格的健康和安全要求。散装容器经常用于工业领域,并且通常需要专门的填充机。包装设备需要大量的资本投资,主要用于初始设定。如果消费者了解灌装机的标准和规定,灌装机市场可能会扩大。

- 新冠疫情也增加了包装的需求,包括填充过程。包装曾经被认为是额外成本,但由于疫情期间的卫生问题,包装已成为人们的首选。此外,随着 COVID-19 疫情威胁的日益加剧,製药业对灌装机的需求也在增加。

灌装机的市场趋势

食品和饮料领域需求的增加将推动市场成长

- 过去几年,食品和饮料经历了健康成长,伴随这一趋势而来的是重大变化。该行业正日益从模仿转向创新。新技术正在推动包装产业的发展。随着包装食品和饮料的需求增加,市场价值也在增加。随着全球食品服务业的持续成长,北美、亚太地区和欧洲的明显趋势开始推动市场对灌装机的需求。

- 食品和饮料行业包括加工、包装和分销生食的企业。其中包括生鲜食品、预製食品、酒精和非酒精饮料、包装商品等。

- 智慧包装是一种巧妙的包装产品的方式。将科技融入包装可以为消费者提供便利、安全和资讯。去年,SIG推出了下一代灌装技术,这是一项代表高水准创新的技术杰作。瑞士无菌纸盒包装公司 SIG 推出了灌装技术的重大创新 SIG NEO。 SIG NEO 的填充速度高达每小时 18,000 包,是世界上最快的家庭纸盒包装填充机。 SIG 推出了 Combivita,这是一款装有 SIG NEO 的新型家庭无菌纸盒包装。

- 此外,2022 年 12 月,Sofda 推出了 Precision Fill 迷你咖啡袋装置。使用附带的脚踏板,MINI 使用者每分钟可以填充四到十个袋子。使用触控萤幕控制面板,使用者可以对机器进行编程,以半自动方式填充多个袋子。

- 由于快速扩张、合作、新产品发布以及主要供应商的投资,市场预计将继续成长。例如,2022 年 4 月,Syntegon 向客户和供应商开放了位于印度果阿的 Verna 工厂:该公司举办了一场内部展览,展示其广泛的食品包装解决方案组合。 Syntegon 凭藉 BVK 2000 迷你袋成型-填充-封口机,为糖果零食提供了高速解决方案。

亚太地区占据灌装机市场主导地位

- 中国医疗保健市场规模庞大且成长迅速,大型跨国製药公司纷纷入驻,为灌装机带来了商机。这些公司是中国医药市场收益最多的公司。

- 在印度,灌装机近年来取得了显着的成长。推动市场成长的主要因素是全国包装趋势的快速变化。灌装和包装领域已大量采用新技术。

- 食品饮料产业在国家食品链中发挥着至关重要的作用。全球消费者对安全、卫生和健康食品和饮料的需求不断增加,推动了对瓶装产品的需求。这导致了对灌装机的需求,这一趋势可能会在预测期内持续下去。

- 日本是继美国之后製药业成长最快的国家之一,这得益于其对学名药和疫苗的持续创新。日本政府也透过放鬆对国际公司在该地区投资的管制来促进这一成长,从而推动了所研究市场对包装和填充机械的需求。

- 亚太地区的其他国家包括印尼、澳洲、新加坡、泰国、韩国和马来西亚等几个国家。推动市场发展的因素包括国际伙伴关係的激增、生物相似药的兴起、成品药出口的成长以及学名药市场的强劲成长。

灌装机产业概况

在灌装机市场,製造商众多,竞争激烈,因为有许多大公司,如JBT Corporation、Tetra Pak International SA、Krones AG等,他们提供相同类型的机器,为客户提供最佳体验的机器,并在广告上投入大量资金。市场中有大量具有中等盈利(CAGR)的参与者,从而形成了强大的竞争环境以抢占市场占有率,并且预计在预测期内竞争对手之间的整体敌意将会加剧。 2022 年 10 月,GEA 在德克萨斯州弗里斯科开设了一个新的最先进的食品加工和包装技术中心。该工厂位于达拉斯郊外,占地 15,000 平方英尺,拥有 40 多台 GEA 食品生产机器。该设施由熟练的食品技术人员运营,可让来自北美和南美的客户测试单个机器到整个加工生产线并培训员工。 2022 年 3 月,Syntegon 旗下的 Ampac 将在 08.1 展厅 B-050 展位上展示一系列全新且扩展的瓶装和杯装灌装机,适用于液体至高黏性食品。除了成熟的 Apack FCL 外,线性填充机 LFS 还提供适合所有卫生等级的解决方案,从清洁到无菌。新的 SmartFill 填充方法用途广泛,涵盖多种黏度。它不仅可以准确填充乳製品,还可以填充涂抹酱、蘸酱和熟食等纯素菜餚。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业价值链分析

- 产业吸引力-波特五力模型

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 最近的技术创新正在推动对自动灌装机的需求

- 食品和饮料领域需求的增加将推动成长

- 市场挑战

- 法规的动态变化导致需要机器标准化

第六章市场区隔

- 设备类型

- 无菌

- 旋转

- 体积

- 净重

- 其他设备类型

- 类型

- 自动的

- 半自动

- 地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 其他亚太地区

- 拉丁美洲

- 墨西哥

- 巴西

- 其他拉丁美洲

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 其他中东和非洲地区

- 北美洲

第七章竞争格局

- 公司简介

- Tetra Pak International SA(Tetra Laval Group)

- JBT Corporation

- Sidel Group(Tetra Laval Group)

- Ronchi Mario SPA

- Barry-Wehmiller Companies Inc.

- Coesia Group

- Krones AG

- GEA Group Aktiengesellschaft

- Syntegon Technology GmbH

- KHS GmbH

第八章投资分析

第九章:市场的未来

The Global Filling Machines Market size is estimated at USD 7.66 billion in 2025, and is expected to reach USD 9.45 billion by 2030, at a CAGR of 4.31% during the forecast period (2025-2030).

The demand for convenient food packaging is driving packaging miniaturization worldwide, and the automation of production lines enables packaging solution providers to leverage ingenuity and efficiency. Therefore, consistency is driving the growth of the automatic filling machine market.

Key Highlights

- Increasing consumer purchasing power is one of the major factors accelerating the growth of the filling machine market. In addition, the rapid development of various industries, increasing introduction of automated and advanced machinery, increasing need for product standardization and desirable hygiene, and individuals' preference for packaged products boost the growth of the filling machine market.

- Growing demand for fast-moving consumer goods and pharmaceuticals is forcing manufacturers to increase the speed of their production lines. There is a growing need for filling machines that can quickly fill materials while maintaining volumetric and weight accuracy. Additionally, aseptic packaging increases as consumers become more conscious of healthy and safe products.

- Automated filling machines ease the process on the assembly line and increase the efficiency of the whole packaging process. This is expected to boost the demand for automated filling machines in the packaging industry during the forecast period.

- Due to the complexity of the product, manufacturers face unique challenges when installing filling machines. For instance, chemicals can be corrosive or flammable, so manufacturers must meet strict health and safety requirements. Industry often uses bulk containers, which often require dedicated filling machines. Packaging equipment primarily requires higher capital investment for the initial setup. The market for filling machines is likely to be expanded once consumers know the standards and regulations of machines.

- The COVID-19 pandemic also resulted in increased demand for packaging, including the packaging that includes the filling process. Packaging that was considered an additional cost became preferred owing to hygiene concerns during the pandemic. Moreover, the pharmaceutical industry witnessed increased demand for filling machines with the growing threat of the COVID-19 pandemic.

Filling Machines Market Trends

Rising Demand from Food and Beverage Segment to Propel the Market Growth

- Food and beverages have witnessed healthy growth over the past couple of years, and with this trend, there have been some significant shake-ups. The sector has moved increasingly from imitation to innovation. New technology is driving the packaging industry. As the demand for packed food and beverages increases, the market value also increases. With the continuing increase in the global food service industry, trends apparent in North America, APAC, and Europe have begun to boost the demand for filling machines in the market.

- The food and beverage industry encompass businesses that process, package, and distribute raw food materials. This includes fresh, prepared foods as well as alcoholic and nonalcoholic beverages and packaged items.

- Smart packaging is a clever way to package products. Technology can now be embedded into the packaging to provide consumers with more convenience, security, and information. SIG launched its next-generation filling technology, a technical masterpiece with advanced innovations in the previous year. SIG, an aseptic carton packaging company in Switzerland, has unveiled SIG NEO, a significant innovation in filling technology. With a speed of up to 18,000 packs per hour, SIG NEO is the world's fastest-filling machine for family-size carton packs. SIG launches Combivita, a new family-size aseptic carton pack, which will be filled on SIG NEO machines.

- Additionally, in December 2022, Sovda launched the Precision Fill Mini Coffee Bagging Machine. MINI users can fill between four and ten bags per minute using the included foot pedal. Users can program a machine to fill several bags semi-automatically through a touchscreen control panel.

- The market is expected to grow in the future owing to rapid expansion, collaboration, the launch of new products, and investment by key vendors in the market. For example, in April 2022, Syntegon opened its doors at the Verna site in Goa, India, to customers and suppliers: The company hosted an in-house show to present its broad portfolio of packaging solutions for food products. With the BVK 2000 mini-bag form, fill, and seal machine, Syntegon showcased a high-speed solution for confectionery products.

Asia Pacific to Dominate the Filling Equipment Market

- China's large and rapidly growing healthcare market has been a target of opportunity for filling machinery due to the presence of major multinational pharmaceutical companies. These companies are among the most significant revenue earners in the Chinese pharmaceutical market.

- In India, filling machinery has witnessed significant growth in recent years. The key factors that drive the market's growth include the rapid changes in packaging trends across the country. There has been significant adoption of new techniques for filling and packaging.

- The food and beverage industry plays a vital role in food chains in the country. Increasing consumer needs for safe, hygienic, and healthy food and beverage products worldwide have raised the demand for bottled products as these products are readily available and ready to consume. This, in turn, creates demand for filling machines, and the trend is likely to continue in the projected timeframe.

- Japan has one of the fastest-growing pharmaceutical industries after the United States, as it constantly focuses on the steady innovation of generic and patented drugs and vaccines. The Japanese government also contributes to this growth through deregulations for international companies to invest in the region, boosting the demand for packaging and filling machinery in the market studied.

- The scope of the Rest of the Asia-Pacific region includes multiple countries such as Indonesia, Australia, Singapore, Thailand, South Korea, and Malaysia. The market is driven by the surge of international partnerships, biosimilars, an expansion in the export of finished formulations, and a robust generics market.

Filling Machines Industry Overview

The filling machines market has a lot of manufacturers and fierce competition because there are a lot of big companies like JBT Corporation, Tetra Pak International SA, Krones AG, and others that offer the same types of machines, deliver the best in experience machines to their customers, and spend a lot of money on advertising. Since the market contains many companies and moderate profitability (CAGR), which creates strong rivalry conditions to capture share in the market, the overall intensity of competitive rivalry is expected to be high over the forecast period. In October 2022, GEA opened a brand-new, cutting-edge food processing and packaging technology center in Frisco, Texas. The 15,000-square-foot facility, located in the Dallas suburbs, has more than 40 GEA pieces of food product manufacturing machinery. The adaptable facility, run by highly skilled food technologists, gives customers from North and South America a chance to test individual machines up to a whole processing line and train staff. In March 2022, Ampack, a Syntegon business, showcased its freshly extended array of bottle and cup filling machines for liquid to extremely viscous foods at exhibit B-050 in Hall 08.1. The linear filling machine LFS now completes the portfolio in addition to the tried-and-true Ampack FCL, offering solutions for all hygienic levels from clean to aseptic. The new SmartFill dosing approach offers greater versatility and works with a variety of viscosity ranges. It can accurately fill dairy goods as well as vegan dishes like spreads, dips, and delicatessen items.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter Five Forces

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Recent Innovations in Technology are Driving the Demand for Automated Filling Machines

- 5.1.2 The Rise in Demand from the Food and Beverage Segment to Propel Growth

- 5.2 Market Challenges

- 5.2.1 Need for Standardization of Machines Due to Dynamic Changes in Regulations

6 MARKET SEGMENTATION

- 6.1 Equipment Type

- 6.1.1 Aseptic

- 6.1.2 Rotary

- 6.1.3 Volumetric

- 6.1.4 Net weight

- 6.1.5 Other Equipment Types

- 6.2 Type

- 6.2.1 Automated

- 6.2.2 Semi-Automated

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 Rest of Asia Pacific

- 6.3.4 Latin America

- 6.3.4.1 Mexico

- 6.3.4.2 Brazil

- 6.3.4.3 Rest of Latin America

- 6.3.5 Middle East and Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 Rest of Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Tetra Pak International SA (Tetra Laval Group)

- 7.1.2 JBT Corporation

- 7.1.3 Sidel Group (Tetra Laval Group)

- 7.1.4 Ronchi Mario SPA

- 7.1.5 Barry-Wehmiller Companies Inc.

- 7.1.6 Coesia Group

- 7.1.7 Krones AG

- 7.1.8 GEA Group Aktiengesellschaft

- 7.1.9 Syntegon Technology GmbH

- 7.1.10 KHS GmbH