|

市场调查报告书

商品编码

1687338

透明显示器:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Transparent Display - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

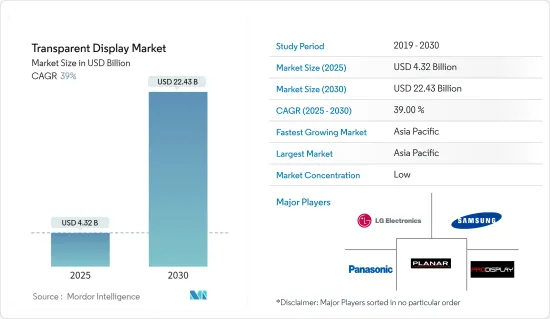

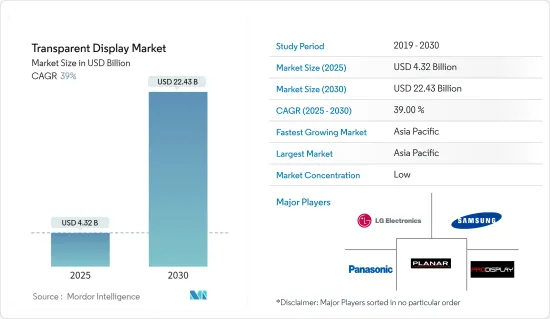

透明显示器市场规模预计在 2025 年为 43.2 亿美元,预计到 2030 年将达到 224.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 39%。

主要亮点

- 透明或透视显示器是一种电子显示器,可让使用者看到萤幕上显示的内容。这种显示器的主要应用是抬头显示器、扩增实境系统、数位电子看板和一般大规模空间光调变。

- 这种透明显示器透过透明表面传达动态或互动内容,让观众可以透过显示器看到萤幕上显示的内容。它们广泛应用于各行业的数位指示牌产品,包括零售、饭店、智慧家电、汽车等。

- 透明显示器用于提供 ADAS(高级驾驶辅助)功能,例如防撞和车道偏离警告。汽车产业正在经历数位转型,并不断专注于采用自动驾驶、车载触控萤幕显示器和电动动力传动系统等新技术,这些技术将在不久的将来推动市场发展。

- 扩增实境和虚拟实境正在开发作为下一代显示平台,以实现更好的人机互动。 AR/ VR头戴装置正在成为一种能够提供生动的 3D 视觉体验的互动式显示器,并被用于教育、工程、医疗保健、游戏等各种应用领域。 AR 和 VR 设备对轻量、紧凑、玻璃状外形规格的需求正在推动对先进显示技术的需求。

- 此外,透明显示面板製造商的大部分收益来自平均销售价格和单位出货量,这些价格和单位的波动会影响收益金额。显示面板的价格与出货量取决于多种因素,包括原料成本、产量比率、竞争、供需、定价策略、运输成本等。在显示器产业,原材料的平均销售价格(ASP)和显示面板的平均销售价格都存在很大波动,这可能使市场成长更具挑战性。

透明显示器市场趋势

零售业占主要市场占有率

- 透明显示器因其能够创造沉浸式和互动式体验而越来越受欢迎,因此在零售领域得到了广泛的应用。透明显示器使零售商能够直观地展示他们的产品,同时也提供资讯。这项发展的推动因素包括显示技术的进步、成本的降低以及以创新的演示方式吸引顾客的愿望。这些显示器用于广告、产品演示甚至互动式资讯面板,以增强整体购物体验。

- 透明显示器可让您展示产品以及随附的数位内容,为客户提供独特且引人入胜的方式来查看和与您的产品互动。零售商还可以将触控和手势控制整合到透明显示器中,以创造互动式、沉浸式的体验,让顾客了解更多有关产品的资讯并获取更多资讯。

- 透明显示器可与其他技术如扩增实境(AR)和虚拟实境(VR)无缝集成,为客户提供更具吸引力和个性化的体验。随着技术的进步,透明显示器将透过结合购物的方面和数位方面,在塑造零售业的未来方面发挥越来越重要的作用。

- 零售店数量的增加抬头显示器产品中透明显示器使用量的激增是推动零售透明显示器需求成长的一些因素。 23 财年,Reliance Retail 在印度各地拥有超过 18,000 家零售店。积极的门市扩张和同店销售额的大幅成长是 Reliance Retail 今年营收成长的主要驱动力。 Reliance Retail 是 Reliance Industries Limited 国内收益的子公司之一。

- 此外,透明显示器可以融入商店橱窗和其他战略位置,而不会阻碍视线,使零售商能够优化有限的空间用于促销或功能目的。零售业的这些优势可能会进一步创造对透明显示器的需求。

亚太地区预计将快速成长

- 该地区汽车、零售和消费等各行业对透明显示器的需求不断增长,预计将推动市场的发展。

- 该地区的汽车产业有望成为推动市场成长的关键产业之一。根据ITA的报告,中国仍是世界汽车年销售量和製造产量最大的国家,预计2025年产量将达3,500万辆。中国汽车工业协会表示,中国汽车产业在推动国家经济成长方面发挥了关键作用。儘管发展放缓,但预计该行业将继续为经济做出贡献。 2022年中国乘用车销量约2,356万辆,商用车销量约330万辆。中汽协预测,2024年中国汽车产销量仍将维持平稳成长,增幅将超过3%。

- 在日本,各终端用户产业的成长预计将刺激市场需求,并鼓励更多公司投资先进技术。例如,2023 年 6 月,JAPAN DISPLAY(JDI)推出了突破性创新:世界上第一个透明液晶超表面反射器。这项最尖端科技使得操纵毫米波在任何方向的反射成为可能。这种透明液晶超表面反射器可以无缝整合到任何具有透明度的环境中,例如窗户或广告媒体。这一惊人的发展使得安装具有更大的多功能性和适应性。

- 印度零售业有望成为推动市场成长的关键产业之一。据 Invest India 称,到 2032 年,印度零售市场规模预计将达到 2 兆美元。这一增长归因于多种社会人口和经济因素,包括都市化、收入增加和核心家庭趋势。

- 此外,预计到 2030 年,印度将成为第三大线上零售市场,到 2027 年,中小型微型企业会员预计将达到 600 万左右。随着技术的进步和消费者期望的变化,透明玻璃萤幕为零售商提供了令人兴奋的前景,使他们能够从竞争对手中脱颖而出,吸引当今消费者的注意力。

- 同样,印度电子产品市场也以其庞大的消费量而闻名,是世界上最大的电子产品市场之一。据 ICEA 称,印度是全球最大的电子产品消费市场之一,预计到 2026 年其消费额将激增至 1,090 亿美元。对行动装置、个人电脑和类似产品等各种消费性电子产品的高需求推动了巨大的市场潜力。

透明显示器市场概况

儘管透明显示器市场分散且竞争激烈,但大多数公司都拥有全球业务和强大的市场影响力。为了获得竞争优势,供应商越来越注重开发创新解决方案并建立强大的供应链。透明显示器市场的主要企业包括 Planar Systems Inc.(利亚德光电有限公司)、三星电子、LG 电子、松下公司、Pro Display 等。

2024 年 1 月,三星推出了其 MicroLED 显示技术的首个透明版本,并声称其优于其他透明萤幕。在CES上,三星发表了全新非透明76吋和非透明114吋Micro LED电视机型。三星的 110 吋 Micro LED 4K 电视售价约为 15 万美元。

2024 年 1 月,LG 电子在 CES 2024 上推出了全球首款无线透明 OLED 电视。 LG SIGNATURE OLED T 将清晰的 4K OLED 萤幕与 LG 的无线影像和音讯传输技术相结合,以前所未有的方式改变您的萤幕体验。 OLED T释放了一个几乎无限可能的世界,为使用者带来了前所未有的自由来精心规划自己的生活空间。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 产业价值链分析

- COVID-19 的副作用和其他宏观经济因素将如何影响市场

第五章 市场动态

- 市场驱动因素

- 汽车市场对先进显示器的需求不断增加

- 扩增实境和虚拟实境的发展

- 市场限制

- 在消费性产品中部署製造过程非常复杂且成本高昂。

第六章 市场细分

- 依技术分类

- LCD

- OLED

- 其他技术

- 按最终用户产业

- 零售

- 消费性电子产品

- 车

- 航太和国防

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 亚洲

- 中国

- 日本

- 印度

- 韩国

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

- 北美洲

第七章 竞争格局

- 公司简介

- Planar Systems Inc.(Leyard Optoelectronic Co.)

- Samsung Electronics Co. Ltd

- LG Electronics Co. Ltd

- Panasonic Corporation

- Pro Display

- Crystal Display Systems Ltd

- Hangzhou Hikvision Digital Technology Co. Ltd

- Nexnovo Technology Co. Ltd

- 2Point0 Concepts

- Shenzhen AuroLED Technology Co. Ltd

- BOE Technology Group

第八章投资分析

第 9 章:未来趋势

The Transparent Display Market size is estimated at USD 4.32 billion in 2025, and is expected to reach USD 22.43 billion by 2030, at a CAGR of 39% during the forecast period (2025-2030).

Key Highlights

- A transparent display or a see-through display is an electronic display that authorizes the user to see what is shown on the screen while still being able to see through it. The main applications of this type of display are head-up displays, augmented reality systems, digital signage, and general large-scale spatial light modulation.

- These transparent display screens communicate dynamic or interactive content via a transparent surface, authorizing viewers to see what is shown on the screen while still being competent to see through the display. These are widely used in digital signage products for various verticals, such as retail, hospitality, smart appliances, and automotive.

- Transparent displays are being used to provide ADAS (advanced driver assistance) features, including collision avoidance alerts and lane departure warnings. The automotive industry is going through a digital transformation, continuously focusing on adopting new technologies such as autonomous driving, automotive touchscreen displays, and electric powertrains, which will drive the market in the near future.

- Augmented and virtual reality are developing as next-generation display platforms for better human digital interactions. AR/VR headsets are emerging as interactive displays with the feature to provide vivid 3D visual experiences, used across various applications such as education, engineering, healthcare, and gaming. The demand for lightweight and compact glass-like form factors in AR and VR devices drives the demand for advanced display technology.

- Moreover, transparent display panel manufacturers make most of their money from the average selling price and the number of display panels they ship, and changes in these prices and numbers impact how much money they make. The price and number of shipments of display panels rely on many things, such as the cost of raw materials, the rate of yield, competition, supply and demand, pricing strategy, and shipping costs. In the display industry, both the average selling price (ASP) of raw materials and the average selling price of display panels change a lot, which may further challenge the market growth.

Transparent Display Market Trends

Retail Sector to Hold a Significant Market Share

- Transparent displays are significantly used in the retail sector, as they are gaining popularity for their ability to create immersive and interactive experiences. They allow retailers to showcase products visually appealingly while providing information. The development can be attributed to advancements in display technology, reduced costs, and the desire to captivate customers with innovative presentations. These displays are being utilized for advertising, product demonstrations, and even as interactive information panels, enhancing the overall shopping experience.

- The transparent displays allow products to be showcased with accompanying digital content, providing a unique and engaging way for customers to view and interact with merchandise. Also, retailers can create interactive and immersive experiences by integrating touch or gesture controls with transparent displays, enabling customers to learn more about products or access additional information.

- Transparent displays can seamlessly integrate with other technologies, such as augmented reality (AR) or virtual reality (VR), providing customers with more engaging and personalized experiences. As technology advances, transparent displays are likely to play an increasingly crucial role in shaping the future of retail by combining the physical and digital aspects of shopping.

- The rise in the number of retail outlets and an upsurge in the use of transparent displays for head-up display products are some factors responsible for driving the growth of the retail evident display demand. During fiscal year 2023, Reliance Retail had over 18 thousand retail stores across India. Aggressive store expansion and spurt in same-store sales were the primary drivers behind Reliance Retail's revenue growth for the same year. Reliance Retail is one of the country's highly profitable subsidiaries of Reliance Industries Limited.

- Further, since transparent displays can be integrated into store windows or other strategic locations without obstructing the view, retailers optimize limited space for promotional and functional purposes. Such benefits in the retail sector may further create demand for the transparent display.

Asia-Pacific is Expected to Witness Rapid Growth

- The growing demand for transparent displays across the region's various industries like automotive, retail, consumer, and others is expected to drive the market.

- The region's automotive industry is expected to be one of the significant industries contributing to the market's growth. ITA reports that China remains the global leader in annual vehicle sales and manufacturing output, projecting a production of 35 million vehicles by 2025. The Chinese automobile industry has played a significant role in driving the country's economic growth, as stated by CAAM. Despite a slowdown in development, the industry is expected to continue contributing to the economy. In 2022, China witnessed the sale of approximately 23.56 million passenger cars and 3.3 million commercial vehicles. CAAM anticipates that China's auto production and sales volumes will maintain steady growth, with an estimated increase of over 3% by 2024.

- The growth in various end-user industries in Japan is expected to fuel market demand, attracting more companies to invest in advanced technologies. For instance, in June 2023, Japan Display Inc. (JDI) unveiled a groundbreaking innovation - the world's inaugural transparent liquid crystal meta-surface reflector. This cutting-edge technology enables the manipulation of mmWave reflection in any desired direction. The transparent liquid crystal meta-surface reflector can seamlessly integrate into window glass, advertising media, or any other setting where transparency is advantageous. This remarkable development significantly enhances the versatility and adaptability of installations.

- The Indian Retail industry is expected to be one of the significant industries contributing to the market's growth. According to Invest India, by 2032, it is projected that the Indian retail market will achieve a value of USD 2 Trillion. This growth can be attributed to various socio-demographic and economic factors, including urbanization, income growth, and increased nuclear families.

- Furthermore, India is anticipated to become the third-largest online retail market by 2030 and will have approximately 6 million MSME merchants by 2027. As technology progresses and consumer expectations change, transparent glass screens offer a thrilling prospect for retailers to differentiate themselves from competitors and engage the interest of contemporary shoppers.

- Similarly, India's electronics market is renowned for its immense consumption, making it one of the largest in the world. As per ICEA, India boasts one of the most substantial electronic markets globally in terms of consumption, which is expected to soar to USD 109 billion by 2026. The high demand for various consumer electronics such as mobile devices, PCs, and similar products primarily fuels the market's remarkable potential.

Transparent Display Market Overview

The transparent display market is fragmented and competitive owing to the presence of limited players, most of whom operate globally and have a strong market presence. To gain a competitive advantage, the vendors are increasingly focusing on developing innovative solutions and establishing a robust supply chain. Some of the major players in the transparent display market are Planar Systems Inc. (Leyard Optoelectronic Co.), Samsung Electronics Co. Ltd, LG Electronics Co. Ltd, Panasonic Corporation, and Pro Display.

In January 2024, Samsung launched its first transparent version of Micro-LED display technology, which it claims is better than other transparent screens. At CES, Samsung introduced new non-transparent 76-inch and non-transparent 114-inch Micro LED models. Samsung's 110-inch micro LED 4K TV is priced at around USD150,000.

In January 2024, LG Electronics unveiled the world's first wireless transparent OLED TV at CES 2024. The LG SIGNATURE OLED T combines a transparent 4K OLED screen and LG's wireless video and audio transmission technology to transform the screen experience in ways that have never been possible before. The OLED T unlocks a world of near-limitless potential, giving users the unprecedented freedom to meticulously curate their living spaces.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Degree of Competition

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Aftereffects and other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Advanced Displays in the Automotive Market

- 5.1.2 Growth of Augmented and Virtual Reality

- 5.2 Market Restraints

- 5.2.1 Complex Manufacturing Process and Expensive to Deploy in Consumer Products

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 LCD

- 6.1.2 OLED

- 6.1.3 Other Technologies

- 6.2 By End-user Industry

- 6.2.1 Retail

- 6.2.2 Consumer Electronics

- 6.2.3 Automotive

- 6.2.4 Aerospace and Defense

- 6.2.5 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 South Korea

- 6.3.3.5 Australia and New Zealand

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Planar Systems Inc. (Leyard Optoelectronic Co.)

- 7.1.2 Samsung Electronics Co. Ltd

- 7.1.3 LG Electronics Co. Ltd

- 7.1.4 Panasonic Corporation

- 7.1.5 Pro Display

- 7.1.6 Crystal Display Systems Ltd

- 7.1.7 Hangzhou Hikvision Digital Technology Co. Ltd

- 7.1.8 Nexnovo Technology Co. Ltd

- 7.1.9 2Point0 Concepts

- 7.1.10 Shenzhen AuroLED Technology Co. Ltd

- 7.1.11 BOE Technology Group