|

市场调查报告书

商品编码

1445948

甘蔗收割机 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029 年)Sugarcane Harvesters - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

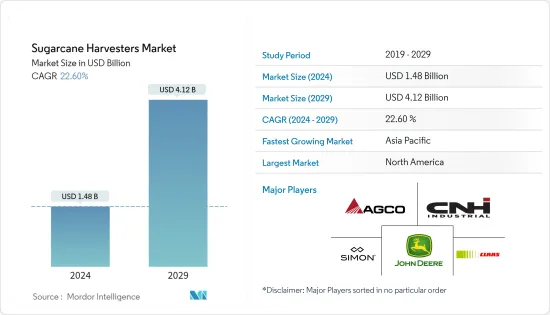

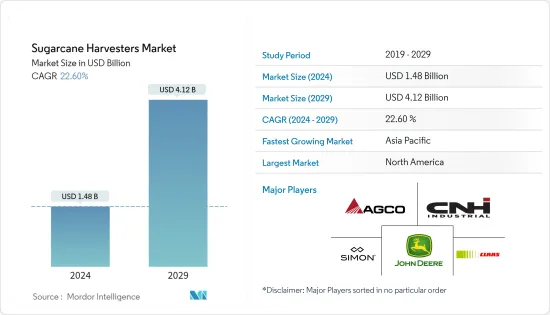

甘蔗收割机市场规模预计到 2024 年为 14.8 亿美元,预计到 2029 年将达到 41.2 亿美元,在预测期内(2024-2029 年)CAGR为 22.60%。

主要亮点

- 该国甘蔗收穫期间的甘蔗产业机械化水平需要提高。然而,该国机械应用的增加推动了收割机市场的发展。此外,政府政策有利于在该地区采用机械化收割农作物,这反过来又推动了市场。

- 此外,国内人口对糖的消费量增加以及人口增加所带来的需求,加上机械保证的甘蔗产量和生产率的增加,有利于市场的成长。

- 过去十年,由于从农村地区迁移到城市,收穫季节的劳动力短缺保持相对稳定。政府支持农民购买或租用机械,并一直在推广甘蔗收割机的使用。

- 巴西、印度、中国、巴基斯坦和泰国是全球主要的甘蔗生产国。根据粮食及农业组织 (FAO) 的数据,巴西 2021 年甘蔗产量为 71.576 亿吨,其次是印度,产量为 4.053 亿吨,中国为 1.072 亿吨。

- 许多国家越来越多地在农业收割机中采用现代技术,以及政府对采用现代农业机械的支持力度加大,是推动研究市场成长的一些因素。

甘蔗收割机市场趋势

农业劳动力的减少推动甘蔗收割机市场的发展

- 平均而言,发展中经济体有较大比例的人口依赖农业。然而,随着每年大量人口迁移到城市地区,这一比例逐渐下降。据印度食品和农业委员会(ICFA)称,到2050年,印度农业工人的比例预计将下降25.7%。这导致该国对农业设备的需求不断增加。

- 与其他主要生产市场(即巴西和南美洲其他国家、印度和中国)相比,东南亚甘蔗产业(特别是甘蔗收穫)的机械化程度仍然较低。由于农业劳动力减少,农业劳动力价格不断上涨。

- 根据美国农业部(USDA)的报告,过去十年中,占农业就业大部分的农场就业人数下降了81%,劳动时间下降了83%。由于工人在非农业部门寻求更高的工资和其他收入机会,农业劳动力减少。

- 此外,农场结构向更少、更大的方向转变,以及更大、更快的拖拉机、联合收割机和自动化饲餵设备等节省劳动力的技术的发展,减少了对农场工人的需求。在研究的最后十年中,总工作时间持续下降,但速度比前几十年慢。这导致对糖收割机等农业机械的需求增加,预计在预测期内将进一步成长。因此,甘蔗收割机是农民的完美解决方案,可以节省时间和金钱并提高生产力。

亚太地区是成长最快的市场

- 亚太地区预计将成为成长最快的市场,其中印度是该地区的主导市场。影响市场成长的驱动因素是针对印度农民具体需求的技术创新。印度和中国等国家农业劳动力的下降使得农民高度依赖农业机械,尤其是在收穫后活动。

- 政府各项政策补贴的支持环境正在鼓励农民购买农机,预计需求在预测期内将进一步成长。泰国是甘蔗收割机械化的重要机会市场,泰国是全球最大的甘蔗生产国之一,仅次于巴西和印度。

- 近年来,劳动力短缺和工资水平高,严重影响了农作物的及时收穫。由于劳动力短缺的问题,印度政府向农民提供机械补贴,并在考虑所有安全特性的情况下允许使用。例如,2023 年 2 月,位于果阿邦达班多拉 Dayanandnagar-Tisk 的 Sanjivani 糖厂。据称,该机器状况良好,在进行了包括更换电池和给某些部件上油等名义维修后开始工作。投入运作后,机器收穫了约 300 吨工厂农场种植的甘蔗。该工厂一直在使用来自邻州的团队来收穫全州生产的甘蔗。政府透过工厂承担采伐成本。为了节省时间,工厂购买了机器

- 此外,2021年10月,中国蔗糖产量预计为925万吨,比上年新修订的预估增加45万吨,但仍略低于干旱前的水平。这项预测成长主要是由于正常天气条件的预期恢復以及甘蔗价格的稳定。

- 天气条件的预期改善、甘蔗价格的稳定以及政府的支持预计将促进未来几年市场的成长。

甘蔗收割机产业概述

甘蔗收割机市场本质上是适度整合的。 Deere & Company、CNH Industrial NV、AGCO Corporation、Simon Group 和 Claas KGaA mBH 是该市场的一些知名参与者。这些企业正在透过与国内製造商合作来扩大其在许多区域市场的影响力,以巩固其在市场上的立足点。新产品发布、合作和收购是该国市场领先公司采取的主要策略。除了创新和扩张之外,研发投资和开发新颖的产品组合可能成为未来几年的关键策略。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 市场概况

- 市场驱动因素

- 市场限制

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争激烈程度

第 5 章:市场细分

- 类型

- 整秆收割机

- 斩波收割机

- 地理

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 法国

- 葡萄牙

- 西班牙

- 欧洲其他地区

- 亚太

- 印度

- 中国

- 泰国

- 日本

- 澳洲

- 亚太其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 非洲

- 南非

- 非洲其他地区

- 北美洲

第 6 章:竞争格局

- 最常用的策略

- 最活跃的公司

- 市占率分析

- 公司简介

- New Holland Agriculture

- Massey Ferguson

- AGREEVISION

- Tropical agricultural Machine Group

- Deere & Company

- Tirth Agro Technology

- Zoomlion Heavy Machinery

- Weldcraft Industries

- Orchard Machinery

- CNH Industrial NV

- AGCO Corporation

- CLAAS KGaA mbH

- Simon Group

第 7 章:市场机会与未来趋势

The Sugarcane Harvesters Market size is estimated at USD 1.48 billion in 2024, and is expected to reach USD 4.12 billion by 2029, growing at a CAGR of 22.60% during the forecast period (2024-2029).

Key Highlights

- The mechanization of the sugar cane sector needs to improve in the country during sugar cane harvesting. However, the increased adoption of machinery in the country has driven the harvester's market. Furthermore, government policies favor the adoption of mechanization in harvesting the crop in the region, which, in turn, drives the market.

- Also, the increased domestic consumption of sugar by the population and the demand that resulted from an increase in population, together with an increase in the production and productivity of sugarcanes that is ensured by machinery, favor the market's growth.

- Labor shortages during the harvest season due to migration from rural areas to cities have remained relatively stable over the past decade. The government supports farmers in buying or hiring machinery and has been promoting the use of sugarcane harvesters.

- Brazil, India, China, Pakistan, and Thailand are the leading sugarcane producers worldwide. According to Food and Agriculture Organization (FAO), Brazil produced 7157.6 million metric tons of sugarcane in 2021, followed by India with 405.3 million metric tons and China with 107.2 million metric tons.

- The increasing adoption of modern techniques in agriculture harvesters in many countries and the increase in government support towards adopting modern agricultural machinery are some of the factors driving the growth of the market studied.

Sugarcane Harvesters Market Trends

Decline in Farm Labor Driving the Market for Sugarcane Harvesters

- On average, developing economies have larger percentages of the population dependent on agriculture. However, the percentages have decreased over time as a large number of people migrate to urban areas every year. According to the Indian Council of Food and Agriculture (ICFA), the percentage of agriculture workers in India is estimated to decline by 25.7% in 2050. This has led to increasing demand for agricultural equipment in the country.

- The mechanization of the sugar cane sector, and in particular sugar cane harvesting, remains low across Southeast Asia relative to other major producing markets, namely Brazil and others in South America, India, and China. Due to decreasing agricultural labor, the prices of farm labor are rising.

- According to the United States Department of Agriculture (USDA) report, farm employment, which accounts for most agricultural employment, fell by 81%, and labor hours worked declined by 83% over the past decade. Farm labor declined as workers sought higher wages and other income opportunities in the non-farm sector.

- In addition, the transformation of the farm structure toward fewer and larger farms and the development of labor-saving technologies-such as bigger and faster tractors and combines and automated feeding equipment-reduced demand for farm workers. Total hours worked continued to decline in the last decade of the study, though more slowly than in previous decades. This resulted in an increase in demand for agricultural machinery such as sugar harvesters and is expected to grow further during the forecast period. Thus, sugarcane harvesters are the perfect solutions for farmers, saving time and money and improving their productivity.

Asia-Pacific is the Fastest-growing Market

- The Asia-Pacific region is expected to be the fastest-growing market, with India being the dominant market in this region. The driving factor, which influenced the market's growth, is technological innovations with respect to the specific needs of Indian farmers. The decline in the agriculture workforce in countries such as India and China is making farmers highly dependent on farming machinery, especially in post-harvesting activities.

- The supportive environment in terms of subsidies by various government policies is encouraging farmers to purchase farming machinery, and the demand is projected to grow further during the forecast period. Thailand is a key opportunity market for the mechanization of sugarcane harvesting, with Thailand being one of the largest producers of sugar cane globally, behind Brazil and India.

- In recent years, laborer scarcity and high wage rates highly affected the harvesting of crops in time. Owing to the issues of labor shortage, the Government of India provided machinery to the farmers with subsidies and allowed the usage considering all the safety features. For instance, in February 2023, Sanjivani sugar factory at Dayanandnagar-Tisk in Dharbandora, Goa. The machine is said to be in good condition and began working after nominal servicing involving changing its battery and oiling some parts. After it became operational, the machine harvested about 300 metric tonnes of canes cultivated within the farm of the factory. The factory had been using teams from neighboring states to harvest canes produced across the state. The government, through the factory, bears the cost of harvesting. To save time, the factory procured the machine

- Additionally, in October 2021, cane sugar production in China was estimated at 9.25 million metric tons, up 450,000 metric tons from the previous year's newly revised estimate but still slightly lower pre-drought levels. This predicted increase was mainly due to the expected return of normal weather conditions as well as stable sugarcane prices.

- The anticipated improvement in weather conditions, stable sugar cane prices, and government support are expected to enhance the market's growth in the coming years.

Sugarcane Harvesters Industry Overview

The sugarcane harvesters market is moderately consolidated in nature. Deere & Company, CNH Industrial NV, AGCO Corporation, Simon Group, and Claas KGaA mBH are some of the prominent players in this market. These players are expanding their presence in many regional markets by partnering with domestic manufacturers to strengthen their foothold in the market. New product launches, partnerships, and acquisitions are the major strategies adopted by the leading companies in the market in the country. Along with innovations and expansions, investments in R&D and developing novel product portfolios will likely be crucial strategies in the coming years.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Whole Stalk Harvesters

- 5.1.2 Chopper Harvesters

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Mexico

- 5.2.1.4 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 France

- 5.2.2.2 Portugal

- 5.2.2.3 Spain

- 5.2.2.4 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 India

- 5.2.3.2 China

- 5.2.3.3 Thailand

- 5.2.3.4 Japan

- 5.2.3.5 Australia

- 5.2.3.6 Rest of Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of south America

- 5.2.5 Africa

- 5.2.5.1 South Africa

- 5.2.5.2 Rest of Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Most Active Companies

- 6.3 Market Share Analysis

- 6.4 Company Profiles

- 6.4.1 New Holland Agriculture

- 6.4.2 Massey Ferguson

- 6.4.3 AGREEVISION

- 6.4.4 Tropical agricultural Machine Group

- 6.4.5 Deere & Company

- 6.4.6 Tirth Agro Technology

- 6.4.7 Zoomlion Heavy Machinery

- 6.4.8 Weldcraft Industries

- 6.4.9 Orchard Machinery

- 6.4.10 CNH Industrial N.V.

- 6.4.11 AGCO Corporation

- 6.4.12 CLAAS KGaA mbH

- 6.4.13 Simon Group