|

市场调查报告书

商品编码

1445956

海军执行器和阀门 - 市场份额分析、行业趋势与统计、成长预测(2024 年 - 2029 年)Naval Actuators And Valves - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

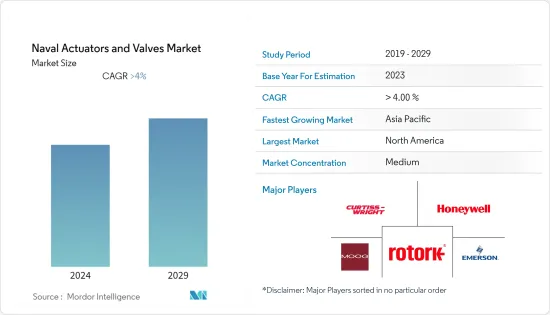

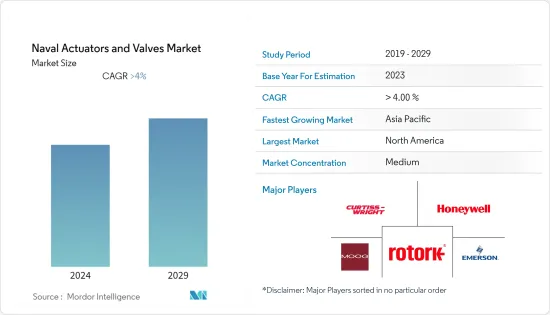

以 Equal-4.64 计算的海军执行器和阀门市场规模预计将从 2024 年的 33.4 亿美元增长到 2029 年的 41.8 亿美元,预测期内(2024-2029 年)CAGR为 4.64%。

主要亮点

- 海战方面高性能雷达和远程瞄准系统等新技术的出现推动各国实现海军能力现代化和升级。由于执行器和阀门构成所有海军舰艇子系统的关键部分,新海军舰艇的引入可能会对执行器和阀门产生并行需求,以确保系统性能符合规格。

- 预计严格的监管政策将在预测期内抑制市场的成长。海洋产业受到严格监管,主要是因为与海洋活动相关的风险。

- 先进综合作战系统的日益普及或海军部队的使用预计将为市场提供新的机会,预计将对未来一段时间的重点市场产生积极影响。

海军执行器和阀门市场趋势

国防领域预计将主导市场

当前,国际战略格局发生深刻变化,霸权主义、单边主义、强权政治不断抬头,国际安全体系格局遭到破坏,全球衝突不断升级。美国、英国、中国和印度等军事强国一直致力于增强其海军火力,并且正在进行多项舰队现代化和采购合同,以应对对其国家安全不断变化的威胁。

2022年,俄罗斯和乌克兰之间的战争进一步加剧了各国的国防预算以及重新评估全球武装部队战备状态的需要。 2022年世界军费开支较前一年成长3.7%,达到2.2兆美元的历史新高。俄乌战争是2022年支出成长的主要动力。2022年支出最大的五个国家是美国、中国、俄罗斯、印度和沙乌地阿拉伯,占全球军费开支的63%。

根据其30年造船计划,美国计划采购55艘新舰,到2024年使有效舰队规模达到314艘。在亚太地区,中国和印度等重要国家也在增强其海军舰队规模和能力,取得相对于竞争对手国家的技术优势。此类归纳计画预计将推动在设计和建造用于防御平台的新型海军舰艇时对执行器和阀门的需求。

北美将在预测期内主导市场

该市场的驱动因素是美国海军采购先进武器,以在确保国内和平与安全的同时实现该地区的军事主导地位。美国将其庞大的技术实力投入到多种武器系统的本土开发中,以增强其在陆地、空中和水上所有领域的军事实力。

在2023财年预算提案中,美国海军提出总预算要求为2,308亿美元,其中海军1,805亿美元,海军陆战队503亿美元。作为该国海军扩张项目的一部分,美国海军在 2023 财年预算中提出了对其舰队进行现代化改造的计划,其中排除和纳入了海军的各种军舰和航空母舰舰队。尼米兹号航空母舰将于 2025 财年从战斗部队撤出,并逐渐接受杰拉尔德·R·福特级航空母舰加入敏捷舰队。

该国满足其军事伙伴对先进武器的需求,如导引火箭、弹道飞弹、武装无人机、潜舰和水面战舰。该计划要求 Serco 为 SubHDR 天线基座组 (APG) 提供维修和大修,包括对相关子组件的评估和维修服务。此类感应和 MRO 计划预计将推动该地区对执行器和阀门的需求,以促进并实现与海军舰艇舰队中安装的其他控制系统的无缝整合。

海军执行器和阀门行业概述

海军执行器和阀门市场本质上是半整合的。市场上一些知名的参与者包括 MOOG Inc.、Honeywell International Inc.、Rotork PLC、Emerson Electric Co. 和 Curtiss-Wright Corporation。

在一些国家不断增长的地缘政治动盪的推动下,新兴的安全环境导致对先进海军系统的需求不断增长。为了获得长期合约并扩大其全球影响力,参与者正在大力投资购买新的海军资产。

持续的研发促进了海军舰艇整合子系统和其他技术的准确性和效率的进步。随着国防开支的激增,球员之间的竞争预计将加剧。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 市场概况

- 市场驱动因素

- 市场限制

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争激烈程度

第 5 章:市场细分

- 执行器类型

- 机械的

- 油压

- 气动

- 电力

- 杂交种

- 平台

- 防御

- 商业的

- 材料

- 铝

- 不銹钢

- 合金基

- 地理

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 欧洲其他地区

- 亚太

- 印度

- 中国

- 日本

- 韩国

- 亚太其他地区

- 拉丁美洲

- 墨西哥

- 巴西

- 拉丁美洲其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 埃及

- 以色列

- 中东和非洲其他地区

- 北美洲

第 6 章:竞争格局

- 供应商市占率

- 公司简介

- MOOG Inc.

- Honeywell International Inc.

- Rotork PLC

- Emerson Electric Co.

- Curtiss-Wright Corporation

- Flowserve Corporation

- IMI PLC

- Diakont

- Schlumberger Limited

- Wartsila Corporation

- AUMA Riester GmbH & Co. KG

- Bosch Rexroth AG (Robert Bosch GmbH)

第 7 章:市场机会与未来趋势

The Naval Actuators And Valves Market size in terms of Equal-4.64 is expected to grow from USD 3.34 billion in 2024 to USD 4.18 billion by 2029, at a CAGR of 4.64% during the forecast period (2024-2029).

Key Highlights

- The emergence of new technologies, such as high-performance radar and long-distance targeting systems, on the naval warfare front has driven nations to modernize and upgrade their naval capabilities. As actuators and valves form a critical part of all naval vessel subsystems, the induction of new naval vessels may create a parallel demand for actuators and valves to ensure systems performance as per the specifications.

- Stringent regulatory policies are expected to restrain the market's growth during the forecast period. The marine industry is heavily regulated, primarily because of the risks associated with marine activities.

- The increasing popularity of advanced integrated combat systems or the use of naval forces is expected to provide new opportunities for the market, which is anticipated to positively affect the market in focus during the upcoming period.

Naval Actuators And Valves Market Trends

Defense Segment is Expected to Dominate the Market

Due to the profound changes in the international strategic landscape, the configuration of the international security system has been undermined by the growing hegemonism, unilateralism, and power politics that have fueled several ongoing global conflicts. Military powerhouses, such as the United States, the United Kingdom, China, and India, have been focused on augmenting their naval firepower, and several fleet modernization and procurement contracts are underway to address the evolving threats to their national security.

In 2022, the war between Russia and Ukraine further fueled the defense budgets across various countries and the need to reassess the operational readiness of the armed forces globally. The world military expenditure rose by 3.7% in 2022 from the previous year to reach a record high of USD 2.2 trillion. The Russia-Ukraine war was a major driver of the growth in spending in 2022. The five biggest spenders in 2022 were the United States, China, Russia, India, and Saudi Arabia, accounting for 63% of the global military spending.

According to its 30-year shipbuilding plan, the US envisions procuring 55 new ships to achieve an effective fleet size of 314 ships by 2024. In Asia-Pacific, prominent countries such as China and India are also enhancing their naval fleet size and capabilities to achieve technological superiority over their rival countries. Such induction programs are envisioned to drive the demand for actuators and valves in designing and constructing new naval vessels for defense platforms.

North America to Dominate the Market during the Forecast Period

The market is driven by the procurement of advanced weaponry by the US Navy to achieve military dominance in the region, besides ensuring internal peace and security. The United States has invested its vast technological prowess toward the indigenous development of several weapon systems to foster its military prowess over all dominion - land, air, and water.

In the FY2023 budget proposal, the US Navy proposed a total budget request of USD 230.8 billion, including USD 180.5 billion for the Navy and USD 50.3 billion for the Marine Corps. As part of the country's naval expansion projects, the US Navy, in its FY2023 budget, proposed plans to modernize its fleet with the exclusion and inclusion of various warships and carrier fleets in the Navy. The USS Nimitz is to be removed from the battle force by the FY2025, gradually accepting the Gerald R Ford-class carriers to be inducted readily into the fleet of agile force.

The country caters to the demand from its military partners for advanced weaponry, such as guided rockets, ballistic missiles, armed UAVs, submarines, and surface warships. The program entails Serco providing repair and overhauls to the SubHDR Antenna Pedestal Group (APG), including evaluation and repair services to related sub-components. Such induction and MRO programs are envisioned to drive the demand for actuators and valves in the region to facilitate and enable seamless integration with other control systems installed in the fleet of naval vessels.

Naval Actuators And Valves Industry Overview

The naval actuators and valves market is semi-consolidated in nature. Some prominent players in the market include MOOG Inc., Honeywell International Inc., Rotork PLC, Emerson Electric Co., and Curtiss-Wright Corporation.

The emerging security environment, fueled by the growing geopolitical unrest in several countries, is resulting in the growing demand for advanced naval systems. To gain long-term contracts and expand their global presence, players are investing significantly in the procurement of new naval assets.

Continuous R&D has been fostering the advancements of accuracy and efficiency of subsystems and other technologies integrated onboard naval vessels. The competition between the players is expected to increase with the surge in defense expenditure.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Actuator Type

- 5.1.1 Mechanical

- 5.1.2 Hydraulic

- 5.1.3 Pneumatic

- 5.1.4 Electrical

- 5.1.5 Hybrid

- 5.2 Platform

- 5.2.1 Defense

- 5.2.2 Commercial

- 5.3 Material

- 5.3.1 Aluminum

- 5.3.2 Stainless Steel

- 5.3.3 Alloy-based

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Latin America

- 5.4.4.1 Mexico

- 5.4.4.2 Brazil

- 5.4.4.3 Rest of Latin America

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Egypt

- 5.4.5.4 Israel

- 5.4.5.5 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 MOOG Inc.

- 6.2.2 Honeywell International Inc.

- 6.2.3 Rotork PLC

- 6.2.4 Emerson Electric Co.

- 6.2.5 Curtiss-Wright Corporation

- 6.2.6 Flowserve Corporation

- 6.2.7 IMI PLC

- 6.2.8 Diakont

- 6.2.9 Schlumberger Limited

- 6.2.10 Wartsila Corporation

- 6.2.11 AUMA Riester GmbH & Co. KG

- 6.2.12 Bosch Rexroth AG (Robert Bosch GmbH)