|

市场调查报告书

商品编码

1519911

汽车煞车卡钳:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Automotive Brake Caliper - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

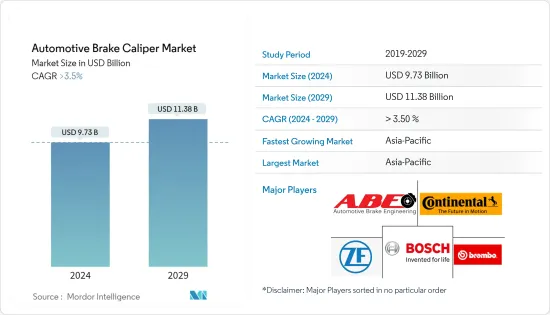

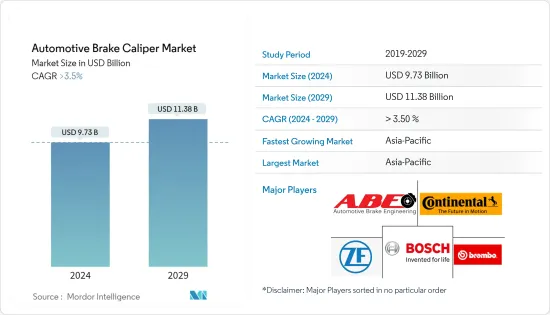

预计2024年汽车煞车卡钳市场规模为99.7亿美元,预计2029年将达到135亿美元,在预测期内(2024-2029年)复合年增长率预计将超过3.80%。

汽车煞车卡钳的需求主要是由于人们对汽车安全性的关注增加、汽车中越来越多地采用碟式煞车、各国政府的汽车安全标准以及世界各地生产的汽车数量的增加。预计这些因素将在预测期内推动市场成长。

考虑到这种情况,煞车卡钳製造商正在采用先进技术。欧盟 7 排放法规计画于 2025 年 7 月生效,大陆集团于 2023 年 6 月开发了一款煞车卡钳,可减少煞车粉尘并满足煞车粉尘法规。

选择正确的替换煞车衬是车辆整体安全的重要因素。市场逐渐转向轻量材料和复合材料以生产更轻的电动和混合动力汽车汽车,并为即将推出的车辆开发先进的煞车系统,预计将促进成长。政府法规和标准主要负责车辆安全模组中煞车卡钳的采用。

2023年6月,美国公路安全管理局提案了新的联邦机动车辆安全标准。该指令强制要求轻型车辆配备自动紧急煞车 (AEB) 系统,包括行人 AEB (PAEB)。

FMVSS标准旨在确保新车能够在安全运行所需的一定距离内停止。目前,FMVSS 135 和 126 标准适用于新车和大多数上路车辆。与先前的 FMVSS 105 标准相比,FMVSS 135 在相同煞车距离下所需的踏板力减少约 25%。

将于 2025 年 7 月生效的欧 7 排放标准是最严格的法规,不仅适用于传统废气排放,也适用于电动车 (EV)。据报道,这些即将出台的法规将首次限制煞车粉尘的产生量以及轮胎磨损导致的微塑胶的释放。

随着消费者越来越意识到先进的安全功能和技术,公司也开始专注于製造具有先进安全系统的车辆。这项因素可能会在预测期内推动市场成长。

汽车煞车钳市场趋势

固定煞车卡钳的需求预计将增加

汽车煞车卡钳市场由研发和技术创新驱动。人们正在发现新技术来生产可成功整合到汽车中的可靠煞车零件。

本田、宝马、丰田、梅赛德斯-奔驰和日产等主要企业的目标是提供最好的煞车系统,使汽车能够在最短的距离和时间内停下来,而不会对车内的乘客造成震动或影响。 3D 列印和积层製造使製造商能够生产复杂的零件。冒险运动和赛车的成长预计将刺激煞车卡钳市场的扩大。

固定煞车卡钳预计会有很高的需求,因为它们具有减轻车辆重量和残余扭矩等优点。对高性能、低碳车辆的需求不断增长预计将增加对固定煞车卡钳的需求。高压晶粒製程可能会在业界获得巨大的发展动力,因为它广泛用于钢製卡钳的生产。

随着汽车需求的不断增长,煞车卡钳製造商正在努力将新产品和技术推向市场。例如,2023 年 11 月,Neotech 在 SEMA 2023 上推出了先进的 6 活塞煞车卡钳,彻底改变了汽车性能。

亚太地区预计将占据主要市场份额

预计亚太地区在预测期内将占据市场的主要份额。该地区的成长主要由印度、中国和日本等顶级汽车生产国推动。此外,这些市场对乘用车的需求增加是由于人口可支配收入的增加、汽车工业的崛起、购买新车的贷款和资金筹措的增加以及许多其他原因。

例如,印度汽车工业以乘用车销售为主,包括中小型汽车。上年度汽车出口量为4,285,809辆。

汽车煞车卡钳在汽车中发挥着重要作用,因为它们是复杂的零件排列,其唯一目的是使汽车减速或完全停止。

因此,由于上述因素,亚太地区预计将占据汽车行业最大的市场占有率,从而提振汽车煞车卡钳的需求。

汽车煞车卡钳产业概况

汽车煞车卡钳市场由全球和地区知名企业整合和主导。公司采用新产品发布、联盟和合併等策略来维持其市场地位。例如

- 2023 年 12 月,Apec Automotive 显着扩展了煞车能力,并在其多样化的产品系列中引入了 32 个新零件号,其中包括旨在增强各种车型的製动力的六个煞车卡钳。

- 2023年9月,大陆集团宣布针对售后市场推出ATE电子式驻煞车系统。卡钳。

- 2023 年 6 月,大陆集团推出了新型绿色卡钳,该卡钳与电动车 (EV) 相容,并透过利用再生煞车系统和传统煞车系统来减少煞车粉尘和能源消耗。

Comline 的卡钳系列自 2020 年首次亮相以来,在英国汽车煞车市场中脱颖而出,凭藉该品牌的良好声誉提供了 1,000 多种独特的卡钳。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 人们对汽车安全的兴趣日益浓厚

- 市场限制因素

- 开发一种高效且经济高效的碟式煞车替代品

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 按车型分类

- 客车

- 商用车

- 摩托车

- 按卡尺类型

- 固定式

- 浮动式/滑动式

- 按活塞材料类型

- 铝

- 钢

- 钛

- 苯酚

- 按最终用户

- OEM

- 售后市场

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 韩国

- 其他亚太地区

- 世界其他地区

- 南美洲

- 中东/非洲

- 北美洲

第六章 竞争状况

- 供应商市场占有率

- 公司简介

- ZF Friedrichshafen AG

- Automotive Brake Engineering(ABE)

- Continental AG

- Brakes International

- Brembo SpA

- Akebono Brake Corporation

- Centric Parts

- Wilwood Engineering Inc.

- EBC Brakes

- Apec Braking

- ATL Industries

- Robert Bosch GmbH

第七章市场机会与未来趋势

The Automotive Brake Caliper Market size is estimated at USD 9.97 billion in 2024, and is expected to reach USD 13.5 billion by 2029, growing at a CAGR of greater than 3.80% during the forecast period (2024-2029).

The demand for the automotive brake caliper market is mainly attributed to increasing concerns toward vehicle safety, growing adoption of disc brakes in vehicles over drum brakes, governments' vehicle safety norms, and growth in global vehicle production. These factors are anticipated to boost the market's growth during the forecast period.

Considering the scenario, brake caliper manufacturers are adopting advanced technologies. In June 2023, Continental developed a brake caliper that reduces brake dust and meets the brake dust regulations, as Euro 7 emission regulations are scheduled to come into effect from July 2025.

Selecting the correct replacement brake linings is an important component in the overall safety of the vehicle. The gradual shift toward lightweight and composite materials to produce lighter electric and hybrid vehicles and develop advanced braking systems for upcoming vehicles are expected to boost the market's growth. Government regulations and standards have mainly contributed toward the adoption of brake calipers in vehicle safety modules.

In June 2023, the National Highway Safety Administration proposed a new Federal Motor Vehicle Safety Standard. It directs that light vehicles should require automatic emergency braking (AEB) systems, including pedestrian AEB (PAEB).

The FMVSS standards are designed to ensure that new vehicles can stop within a certain distance, which is necessary for safe driving. Currently, FMVSS 135 and 126 standards are applied to new cars and most vehicles on the road. Compared to the earlier FMVSS 105 standard, FMVSS 135 requires ~25% reduction in pedal effort for the same stopping distance.

The Euro 7 emission standards, set to take effect in July 2025, are described as the most stringent regulations, extending beyond traditional tailpipe emissions to encompass electric vehicles (EVs). Reports indicate that these upcoming regulations will, for the first time, govern the quantity of brake dust produced and the release of microplastics from tire wear.

As consumers are gaining awareness about advanced safety features and technologies, companies are also focusing on manufacturing vehicles with advanced safety systems. This factor may boost the market's growth during the forecast period.

Automotive Brake Caliper Market Trends

Fixed Brake Calipers are Expected to be in High Demand

The automotive brake caliper market is driven by research, development, and innovation. New technologies are being discovered to manufacture reliable braking parts and components that can be incorporated well into an automobile.

Some key players, such as Honda, BMW, Toyota, Mercedes-Benz, and Nissan, aspire to offer the best braking systems to help vehicles stop at minimum distance and time without any jerks and shocks to the passenger inside. 3-D printing and additive manufacturing have allowed manufacturers to produce complex parts and components. Growth in adventure sports and racing is expected to fuel the expansion of the brake caliper market.

Fixed brake calipers are expected to be in high demand as they offer advantages like weight reduction and residual torque to vehicles. The growing demand for high-performance and low-carbon-emitting vehicles is expected to fuel the need for fixed brake calipers. The high-pressure die-casting process is likely to gain significant momentum in the industry as it is extensively used in making steel calipers.

With the growing automotive demand, brake caliper manufacturers are working to provide new offerings and technologies to the market. For instance, in November 2023, Neotech revolutionized automotive performance with the launch of an advanced 6 Piston Brake Caliper at SEMA 2023.

Asia-Pacific is Expected to Hold a Major Share in the Market

Asia-Pacific is expected to hold a major share of the market studied during the forecast period. The regional growth is mainly driven by the top-producing automotive countries like India, China, and Japan. Moreover, the growing demand for passenger vehicles in these markets is due to the growing disposable income of the population, the rising automotive industry, the growing availability of loans and funding to purchase new vehicles, and many others.

For instance, the Indian automotive industry is dominated by passenger car sales, which include small and midsized cars. The total number of automobiles exported stood at 42,85,809 in the previous year.

Automotive brake calipers play an important role in vehicles as they are complex arrangements of components with the sole objective of slowing down or bringing the vehicle to a complete stop.

Therefore, as per the above-mentioned factors, Asia-Pacific is expected to hold the largest market share in the automotive industry, thereby boosting the demand for automotive brake caliper market.

Automotive Brake Caliper Industry Overview

The automotive brake caliper market is consolidated and led by globally and regionally established players. The companies are adopting strategies such as new product launches, collaborations, and mergers to sustain their market positions. For instance,

- In December 2023, Apec Automotive elevated its braking capabilities with a significant expansion, introducing 32 new part numbers to its diverse range, including six brake calipers designed to enhance stopping power across various vehicles.

- In September 2023, Continental unveiled the expansion of its aftermarket ATE electronic parking brake calipers, catering to over 5 million vehicle identification numbers (VIO), including popular European brands like BMW, Volkswagen, Audi, and Volvo between 2016 and 2021.

- In June 2023, Continental introduced a new Green Caliper to reduce brake dust and energy consumption, catering to electric vehicles (EVs) by leveraging both regenerative and conventional braking systems.

Comline's caliper range has stood out in the UK automotive brake market since its debut in 2020, offering over 1,000 unique caliper references bolstered by the brand's esteemed reputation.

Some of the major players in the market include Continental AG, Automotive Brake Engineering (ABE), Robert Bosch GmbH, and ZF Friedrichshafen AG.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Concerns Toward Vehicle Safety

- 4.2 Market Restraints

- 4.2.1 Development of Efficient and Cost-effective Braking Alternatives to Disc Brakes

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Commercial Vehicles

- 5.1.3 Two-wheelers

- 5.2 By Caliper Type

- 5.2.1 Fixed

- 5.2.2 Floating/Sliding

- 5.3 By Piston Material Type

- 5.3.1 Aluminum

- 5.3.2 Steel

- 5.3.3 Titanium

- 5.3.4 Phenolics

- 5.4 By End User

- 5.4.1 OEM

- 5.4.2 Aftermarket

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 India

- 5.5.3.2 China

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Rest of the World

- 5.5.4.1 South America

- 5.5.4.2 Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 ZF Friedrichshafen AG

- 6.2.2 Automotive Brake Engineering (ABE)

- 6.2.3 Continental AG

- 6.2.4 Brakes International

- 6.2.5 Brembo SpA

- 6.2.6 Akebono Brake Corporation

- 6.2.7 Centric Parts

- 6.2.8 Wilwood Engineering Inc.

- 6.2.9 EBC Brakes

- 6.2.10 Apec Braking

- 6.2.11 ATL Industries

- 6.2.12 Robert Bosch GmbH