|

市场调查报告书

商品编码

1519948

Chrome:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Chromium - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

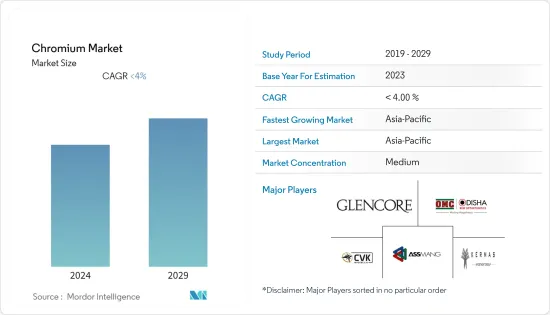

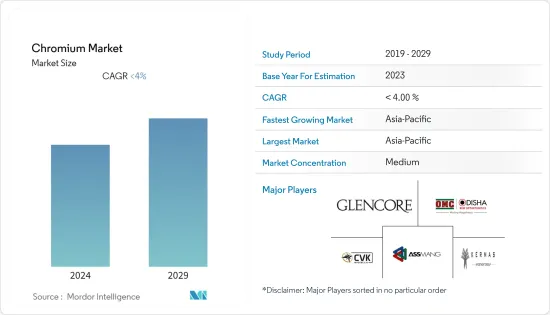

铬市场规模预计到2024年将达到43.19千吨,到2029年将达到52.33千吨,在预测期内(2024-2029年)复合年增长率为3.91%。

由于全球对汽车、建筑和施工行业的限制,COVID-19 大流行对铬市场产生了重大影响。然而,从 2021 年开始,该行业正在成长,预计市场在预测期内将以相同的速度成长。

主要亮点

- 从中期来看,冶金应用需求的增加和工业中耐火材料使用的增加预计将推动市场成长。

- 然而,接触铬会导致健康和环境影响,预计这将阻碍市场成长。

- 未来几年,三价铬硬铬电镀製程的市场开拓预计将带动市场成长。

- 亚太地区在过去几年中一直引领市场,预计在预测期内仍将保持最高的复合年增长率。

铬合金市场趋势

冶金应用预计未来将成长

- 铬在冶金过程中用于提高淬透性、衝击强度、耐腐蚀性、对其他金属的抗氧化性和许多其他性能,并用于重型机械、建筑领域和其他应用。

- 根据美国地质调查局的数据,2023 年全球矿场生产了约 4,100 万吨铬。南非占大部分份额(1,800万吨),约占总产量的45%。

- 铬在不銹钢的生产中发挥重要作用,因为即使加热到非常高的温度,它也不会硬化并保持耐腐蚀性。同样,铬用于提高铝的强度和耐用性,帮助其即使在高温下也能保持其形状。

- 根据世界钢铁协会统计,2023年全球粗钢产量达18.497亿吨,较2022年的18.315亿吨成长约1%。预计在预测期内将进一步增加。

- 从全球来看,亚太地区的钢铁产量最多,特别是中国、日本和印度。此外,预计中国仍将是最大的钢铁消费国。由于消费復苏,预计该国粗钢产量在预测期内将增加。

- 2023年北美地区粗钢产量为1.096亿吨,较2022年增加5.3%。 2022年美国产量为8,070万吨,较2022年成长7.6%。

- 冶金过程涉及将铬与民用和军用飞机引擎中的其他金属混合,例如用于运输酸、肥料和其他吸水材料的不銹钢罐车和散装料斗拖车,可以製造重要零件。

- 在汽车工业中,铬主要用于汽车零件外部和内部的电镀和化学处理。根据国际汽车工业协会(OICA)的数据,2022年全球汽车产量约8,501万辆,较2021年的8,020万辆成长5.99%。

- 在北美,根据OICA的数据,2022年汽车产量为14,798,146辆,比2021年的13,467,065辆成长9.88%。此外,在北美,2022 年电动车销量为 1,108,000 辆,而 2021 年为 748,000 辆。

- 因此,汽车产量的增加和钢铁製造业的需求预计将推动铬市场的需求。

亚太地区主导市场

- 亚太地区有可能成为全球最大的市场。这是因为中国、印度等地区製造业高度发达,冶金业需求不断增加。

- 亚太地区在不銹钢生产中使用的铬比其他地区都多。这是由于不銹钢在全球所有製造业中的重要性日益增加。

- 根据世界钢铁协会统计,2023年亚洲粗钢产量为13.672亿吨,较2022年成长0.7%。

- 2023年中国粗钢产量达10.191亿吨,较2022年成长约0.6%。 2023年印度粗钢产量达1.402亿吨,较2022年增加11.8%。

- 铬在汽车工业中也很重要。由于中国是汽车产量最多的国家,因此该国的铬市场预计将以非常快的速度成长。

- 亚太地区的生产和销售主要由中国、印度和日本等国家主导,这些国家拥有大型汽车製造商和大量生产基地。

- 根据中国工业协会预测,2022年汽车产量将达到2,700万辆,使中国成为全球最重要的汽车生产基地,较2021年成长3.4%。

- 在中国,重点是扩大电动车的生产和销售。为此,该公司设定了2025年每年生产700万辆电动车的目标。目标是到2025年中国新车产量的20%是电动车。

- 印度已成为该地区第二大汽车製造商。根据印度汽车工业协会(SIAM)统计,2022-2023年印度生产的汽车数量较2021-2022年增加约12.55%,达到2,593,187,867辆。

- 根据日本工业协会(JAMA)统计,2023财年日本国内汽车产量成长14.84%,达8,998,538辆。

- 化学工业在亚太地区正在迅速扩张。铬在氧化过程、乙烯聚合以及聚乙烯和1-Hexene工业中使用的寡聚物催化剂中用作催化剂,这些品质预计将在未来几年推动铬市场的发展。

- 因此,预计上述因素将在未来几年对市场产生重大影响。

铬产业概览

铬市场本质上是部分整合的,少数大公司控制很大一部分市场。一些主要公司包括(排名不分先后)Kermas Investment Group、Assmang Proprietary Limited、CVK Madencilik、Odisha Mining Corporation Ltd 和 Glencore。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章 简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 冶金应用需求不断成长

- 工业中耐火材料的使用不断增加

- 其他司机

- 抑制因素

- 健康影响

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 买方议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模:基于数量)

- 按用途

- 化学

- 冶金

- 耐火材料

- 其他用途(玻璃抛光、工业催化剂、颜料)

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 北欧的

- 土耳其

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 奈及利亚

- 卡达

- 埃及

- 阿拉伯聯合大公国

- 其他中东和非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)**/市场排名分析

- 主要企业策略

- 公司简介

- Al Tamman Indsil FerroChrome LLC

- Assmang Proprietary Limited

- CVK Madencilik

- Glencore

- Hernic Ferrochrome(Pty)Ltd(Hernic)

- International Ferro Metals(IFM)

- Kermas Investment Group

- MVC Holdings LLC

- Odisha Mining Corporation Ltd

- Tenaris

- YILDIRIM Group of Companies

第七章 市场机会及未来趋势

- 三价铬硬铬镀层的研发

- 其他机会

The Chromium Market size is estimated at 43.19 kilotons in 2024, and is expected to reach 52.33 kilotons by 2029, growing at a CAGR of 3.91% during the forecast period (2024-2029).

The COVID-19 pandemic had a big effect on the chromium market because of the global restrictions on the auto, building, and construction industries. However, since 2021, industries have grown, and the market is expected to do the same during the forecast period.

Key Highlights

- Over the medium term, the growing demand for metallurgical uses and increasing refractory applications in industries are expected to drive market growth.

- However, exposure to chromium can cause health and environmental effects, which are expected to hinder market growth.

- In the coming years, the development of the trivalent chromium hard chrome plating process is likely to lead to market growth.

- Asia-Pacific has led the market for the past few years, and it is also expected to register the highest CAGR during the forecast period.

Chromium Market Trends

Metallurgical Applications to Witness Growth in Future

- Chromium is being utilized in metallurgical processes to improve its hardenability, impact strengths, resistance to corrosion, oxidation to other metals, and many other properties for use in heavy machinery, the construction sector, and other applications.

- According to the US Geological Survey, roughly 41 million metric tons of chromium were produced globally from mines in 2023. With around 45% of the total production, South Africa accounted for the majority share (18 million metric tons).

- It is an important part of making stainless steel because, even when heated to very high temperatures, it keeps its hardening and corrosion-resistant properties. In the same way, chromium is used to make aluminum stronger and more durable and to keep its shape when heated at high temperatures.

- According to the World Steel Association, global crude steel production in 2023 reached 1,849.7 million tons, registering a growth of about 1% compared to 1,831.5 million tons in 2022. It is further expected to increase during the forecast period.

- The most significant quantity of steel globally is produced in Asia-Pacific, particularly in countries like China, Japan, and India. China is also projected to remain the largest consumer of iron and steel. The country's production of crude steel is likely to increase during the forecast period, owing to the recovery in consumption.

- Crude steel production in North America was 109.6 million tons in 2023, increasing by 5.3% compared to 2022. The United States produced 80.7 million tons in 2022, increasing by 7.6% from 2022.

- In metallurgical processes, mixing chromium with other metals can help make important parts for commercial and military aircraft engines, such as stainless steel tankers, acids, and bulk hopper trailers used to move fertilizers and other materials that absorb water.

- In the auto industry, chromium is mostly used for electroplating and conversion coatings on the outside and inside of car parts. According to the International Organization of Motor Vehicle Manufacturers (OICA), in 2022, around 85.01 million vehicles were produced across the globe, witnessing a growth rate of 5.99% compared to 80.20 million vehicles in 2021.

- In North America, according to the OICA, automotive production in 2022 accounted for 14,798,146 units, an increase of 9.88% compared to that in 2021, which was reportedly 13,467,065 units. Additionally, in North America, the sales of electric vehicles in 2022 accounted for 1,108 thousand units, compared to 748 thousand unit sales in 2021.

- Therefore, a rise in the number of vehicles manufactured, along with demand in the steel manufacturing industry, is expected to fuel the market demand for chromium.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific is likely to be the biggest market in the world. This is because China, India, and other parts of the region have very well-developed manufacturing sectors, and the metallurgical industry is increasing its demand.

- Asia-Pacific uses more chromium to make stainless steel than any other region. This is because stainless steel is becoming more important in every manufacturing sector around the world.

- According to the World Steel Association, Asia produced 1,367.2 million tons of crude steel in 2023, an increase of 0.7% compared to 2022.

- China's crude steel production in 2023 reached 1,019.1 million tons, an increase of about 0.6% compared to 2022. India's crude steel production in 2023 reached 140.2 million tons, which increased by 11.8% compared to 2022.

- Chromium is also important in the auto industry. Since China makes the most cars, the market for chromium in that country is expected to grow at a very fast rate.

- The production and sales in Asia-Pacific are primarily dominated by countries like China, India, and Japan, which consist of large automotive manufacturers and a vast number of production bases within the countries.

- According to the China Association of Automobile Manufacturers (CAAM), with a total vehicle production of 27 million units in 2022, China has the most significant automotive production base in the world, registering an increase of 3.4 % compared to 2021.

- In China, the main focus is to increase production and sales of electric vehicles. To this end, the country has set a target to produce 7 million electric vehicles per year by 2025. By 2025, the goal is to bring electric vehicles into 20 % of total new vehicle production in China.

- India has become the second-largest automotive vehicle manufacturer in the region. According to the Society of Indian Automobile Manufacturers (SIAM), during FY 2022-2023, the total number of automobiles manufactured in the country grew by about 12.55% compared to FY 2021-2022 and reached 2,59,31,867 units.

- According to the Japan Automobile Manufacturers Association (JAMA), motor vehicle production in the country in 2023 grew by 14.84% and was valued at 8,998,538 units.

- In Asia-Pacific, the chemical industry is rapidly expanding. Chromium is employed as a catalyst in oxidation processes, ethylene polymerization, and oligomerization catalysts used in the industrial manufacture of polyethylene and 1-hexene, and these qualities are projected to boost the chromium market in the coming years.

- Therefore, the aforementioned factors are expected to significantly impact the market in the coming years.

Chromium Industry Overview

The chromium market is partially consolidated in nature, with a few major players dominating a significant portion of the market. Some of the major companies are (not in any particular order) Kermas Investment Group, Assmang Proprietary Limited, CVK Madencilik, Odisha Mining Corporation Ltd, and Glencore.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand for Metallurgical Uses

- 4.1.2 Increasing Refractory Applications in Industries

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Associated Health Effects

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 By Application

- 5.1.1 Chemical

- 5.1.2 Metallurgical

- 5.1.3 Refractory

- 5.1.4 Other Applications (Glass Polishing, Industrial Catalysts, and Pigments )

- 5.2 By Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Malaysia

- 5.2.1.6 Thailand

- 5.2.1.7 Indonesia

- 5.2.1.8 Vietnam

- 5.2.1.9 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Spain

- 5.2.3.6 NORDIC

- 5.2.3.7 Turkey

- 5.2.3.8 Russia

- 5.2.3.9 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Colombia

- 5.2.4.4 Rest of South America

- 5.2.5 Middle East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Nigeria

- 5.2.5.4 Qatar

- 5.2.5.5 Egypt

- 5.2.5.6 United Arab Emirates

- 5.2.5.7 Rest of Middle East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Al Tamman Indsil FerroChrome L.L.C

- 6.4.2 Assmang Proprietary Limited

- 6.4.3 CVK Madencilik

- 6.4.4 Glencore

- 6.4.5 Hernic Ferrochrome (Pty) Ltd (Hernic)

- 6.4.6 International Ferro Metals (IFM)

- 6.4.7 Kermas Investment Group

- 6.4.8 MVC Holdings LLC

- 6.4.9 Odisha Mining Corporation Ltd

- 6.4.10 Tenaris

- 6.4.11 YILDIRIM Group of Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Trivalent Chromium Hard Chrome Plating

- 7.2 Other Opportunities