|

市场调查报告书

商品编码

1521315

热处理钢板:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Heat-treated Steel Plates - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

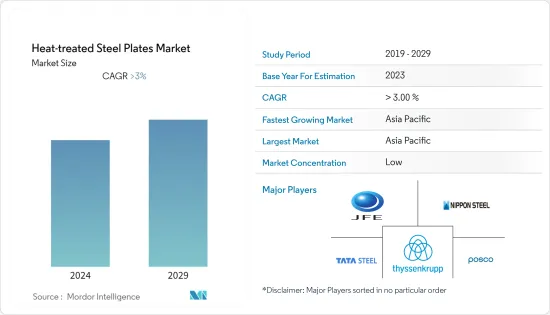

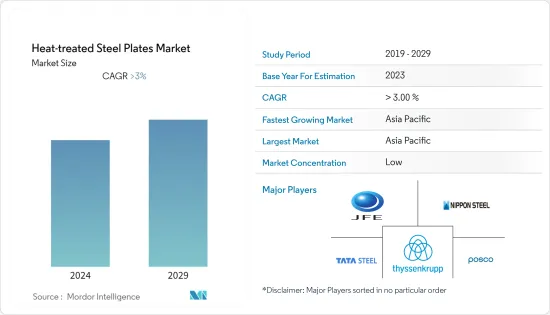

热处理钢板市场规模预计到2024年为73.3亿美元,预计到2029年将达到90.2亿美元,在预测期内(2024-2029年)复合年增长率将超过4%。

2020 年市场受到 COVID-19 的显着影响。疫情迫使多个国家实施封锁,全球几乎所有产业的製造设施都关闭了一段时间。工业生产中断影响了金属生产,尤其是钢铁生产。此外,建设产业在此期间经历了暂时的放缓。目前市场已经从疫情中恢復过来,并且正在以相当快的速度成长。 COVID-19 对 2020 年市场产生了负面影响。然而,市场预计将在2022年达到疫情前的水平,并继续保持稳定成长。

主要亮点

- 重型机械生产应用的扩大和新兴国家建设产业需求的增加正在推动市场成长。

- 原材料价格的波动预计将阻碍热处理钢板市场的成长。

- 扩大在能源和电力领域的应用预计将是未来的机会。

- 由于工业化和建筑业的快速成长,亚太地区预计将主导全球热处理钢板市场。

热处理钢板市场趋势

扩大机器生产应用

- 热处理钢板用于提高钢的机械和化学性能而不改变其原有性能。因此,它被用于各种最终用户行业。

- 由于热处理钢板的特性,汽车和工业机械的需求不断增加。在钢种中,碳钢占有很大份额,用途广泛。

- 热处理钢板用于生产机械设备,如齿轮齿、起重机电缆捲筒、轮圈、煞车鼓、机器蜗桿钢、轮圈、铁路车轮、曲轴、液压离合器、电力传输线、锅炉配件、等马苏。

- 印度工业和内贸促进部提案2022年对工业机械领域投资约250亿印度卢比(约3.2亿美元),与前一年同期比较%。

- 此外,我们还在中国进行了多项投资和扩张,以满足专业机械不断变化的需求。例如,中国矿山设备製造商奈普矿机于2022年10月宣布将在塞尔维亚设立全资子公司,并投资2,500万美元在该国建造生产基地。

- 总体而言,工业机械应用的增加和发展中地区需求的下降预计将影响未来几年对热处理钢板的需求。

亚太地区主导市场

- 亚太地区拥有高度发展的中国、日本和印度製造业,以及多年来持续投资发展的汽车、建筑、能源和电力产业,预计将主导全球市场。

- 近年来,能源和电力产业的需求大幅成长。热处理钢板用于锅炉、储存槽、压力容器和其他最常用于水力发电厂、核能发电厂和其他能源发电厂的结构部件。

- 亚太地区火力发电产业录得成长,其中中国是该产业成长的主要推手。中国拥有的燃煤发电厂比世界上任何其他国家或地区都多。截至2022年7月,中国当地运作燃煤发电厂1,118座。这大约是排名第二的印度的四倍。中国煤炭发电量占全球一半以上。

- 中国在「十四五」规划(2021-2025年)中设定了约1,100GW的燃煤发电容量目标。因此,网路营运商国家电网和中国电力委员会的目标是在国内开发数百个新的燃煤发电厂。超过一半的燃煤发电厂正在亏损,许多电厂的运转率低于50%。

- 此外,亚太地区的建设产业正在不断成长。印度、日本和中国近年来经历了不错的成长。

- 在日本,国土交通省宣布,2022年将建造约859,500套住宅,与前一年同期比较增加0.4%。

- 国内重建计划对市场成长做出了重大贡献。例如,八重洲重建计划包括办公大楼、饭店、住宅、零售和教育设施,预计将于 2023 年完工。其他计划包括芝浦铬 (Shibaura Chrome) 重建项目和新桥大厦 (Shinbashi Building) 重建项目,其中包括办公室、零售和住宅空间。

- 工业化的快速进步、机械设备的使用增加、新兴市场的建筑业以及发电厂数量的增加预计将在未来几年推动亚太地区热处理钢板市场的发展。

热处理钢板产业概况

热处理钢市场分为几个部分。研究市场的主要企业(排名不分先后)包括POSCO、新日铁、塔塔钢铁有限公司、JFE Mineral & Alloy Company, Ltd.、蒂森克虏伯钢铁欧洲公司等。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 增加机器生产中的使用

- 新兴国家建筑业需求不断成长

- 其他司机

- 抑制因素

- 原物料价格波动

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(以金额为准的市场规模)

- 钢种

- 碳钢

- 不銹钢

- 合金钢

- 按热处理类型

- 退火

- 回火

- 正火化

- 淬火

- 按行业分类

- 汽车/重型机械

- 建筑/施工

- 造船/近海结构

- 能源/电力

- 其他(金属加工、运输等)

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧的

- 土耳其

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 奈及利亚

- 卡达

- 埃及

- 阿拉伯聯合大公国

- 其他中东和非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- ArcelorMittal

- Baosteel Group

- HYUNDAI STEEL

- JFE Mineral & Alloy Company,Ltd.

- NIPPON STEEL CORPORATION

- NUCOR

- Outokumpu

- POSCO

- TATA STEEL LIMITED

- thyssenKrupp Steel Europe

第七章 市场机会及未来趋势

- 拓展能源电力领域的应用

- 其他机会

The Heat-treated Steel Plates Market size is estimated at USD 7.33 billion in 2024, and is expected to reach USD 9.02 billion by 2029, growing at a CAGR of greater than 4% during the forecast period (2024-2029).

The market was significantly impacted by COVID-19 in 2020. Several countries were forced to go in lockdown owing to the pandemic scenario, which led to a shutdown of manufacturing facilities of almost every industry worldwide for a specified time. Disruption of industrial production impacted metals production, especially steel production. Furthermore, the building and construction industry experienced a temporary slowdown during the period. Currently, the market has recovered from the pandemic and is growing at a significant rate. COVID-19 negatively impacted the market in 2020. However, the market reached pre-pandemic levels in 2022 and is expected to grow steadily in the future.

Key Highlights

- The increasing applications in the production of heavy machinery and growing demand from the construction industry in developing countries are driving the market growth.

- Fluctuating raw material prices is expected to hinder the market growth for heat-treated steel plates.

- Increasing application in the energy and power sector is expected to act as an opportunity in the future.

- Due to rapid industrialization and the growing construction sector, the Asia-Pacific region is expected to dominate the heat-treated steel plates market, globally.

Heat-Treated Steel Plates Market Trends

Growing Applications for Machinery Production

- Heat-treated steel plates are used to improve the mechanical and chemical properties of steel without changing any original characteristics. Hence, they are being used by various end-user industries.

- The demand from the automobile and industrial machinery has been growing because of heat-treated steel plate properties. Among all the types of steel, carbon steel has a major share and is used in different applications.

- Heat-treated steel plates are employed to produce machinery equipment, such as gear teeth profile, crane cable drum, gear wheel, brake drum, machines worm steel, flywheel, railway wheels, crankshaft, hydraulic clutches, electric transmission lines, boiler mountings, etc.

- The Department for Promotion of Industry and Internal Trade in India proposed investment value of nearly INR 25 billion (~ USD 320 million) in 2022 towards the industrial machinery sector, a significant increase of nearly 29% compared to previous year.

- Further, in China, several investment and expansion have been made to meet the developing need of speacialist machinery. For example, Naipu Mining Machinery, a Chinese manufacturer of mining equipment in October 2022, announced the investment of USD 25 million to set up a wholly owned subsidiary in Serbia and build a production base in the country.

- Overall, increasing applications for industrial machinery and a decrease in demand in developing regions are expected to impact the demand for heat-treated steel plates through the years to come.

Asia-Pacific to Dominate the Market

- Asia-Pacific region is expected to dominate the global market owing to the highly developed manufacturing sector in China, Japan, and India, coupled with the continuous investments done in the region to advance the automotive, construction, energy, and power sector through the years.

- The demand from the energy and power sector has been growing significantly in recent years. Heat-treated steel plates are being used for boilers, storage tanks, pressure vessels, and other structural parts most commonly used in hydropower stations, nuclear, and other energy generation plants.

- The Asia-Pacific thermal sector is registering growth, with China primarily driving the growth of the sector. China has the most coal-fired power plants of any country or territory in the world. On the Chinese Mainland as of July 2022, there were 1,118 operational coal power plants. This is approximately four times the number of such power plants in India, which came in second place. China accounts for more than half of worldwide coal electricity generation.

- China, under its 14th Five-Year Plan (2021-2025), has set the target for coal-power capacity to about 1,100 GW. Thus, the network operator, State Grid, and the China Electricity Council have been targeting to develop hundreds of new coal-fired power stations in the country. The country has been looking forward to developing power plants despite overcapacity in the sector, where more than half of the coal-power plants have been witnessing loss, and few plants have been running at less than 50% of their capacity.

- Moreover, the construction industry in Asia-Pacific has constantly been growing. India, Japan, and China have witnessed decent growth in recent years.

- In Japan, according to the Ministry of Land, Infrastructure, Transport, and Tourism (MLIT) Japan, in 2022, approximately 859.5 thousand housing developments were initiated in Japan, which represented an increase of 0.4% compared to the previous year.

- Redevelopment projects in the country have been one of the prominent contributors to the growth of the market. For instance, the Yaesu redevelopment project, which includes office, hotel, residential, retail, and educational facilities, is due to be completed by 2023. Other projects include the Shibaura chrome redevelopment and the new Shimbashi building redevelopment with office, retail, and residential spaces.

- With the rapid growth of industrialization, increasing usage of machinery equipment, and construction industries in developing countries, the rising power generation plants are expected to drive the market for heat-treated steel plates in Asia-Pacific through the years to come.

Heat-Treated Steel Plates Industry Overview

The heat-treated steel plates market is partly fragmented in nature. The major players in the studied market (not in any particular order) include POSCO, NIPPON STEEL CORPORATION, TATA STEEL LIMITED, JFE Mineral & Alloy Company,Ltd., and thyssenKrupp Steel Europe, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Applications in Machinery Production

- 4.1.2 Growing Demand from Construction Industry in Developing Countries

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Fluctuating Raw Material Prices

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Steel Type

- 5.1.1 Carbon Steel

- 5.1.2 Stainless Steel

- 5.1.3 Alloy Steel

- 5.2 By Heat Treatment Type

- 5.2.1 Annealing

- 5.2.2 Tempering

- 5.2.3 Normalizing

- 5.2.4 Quenching

- 5.3 By End-user Industry

- 5.3.1 Automotive and Heavy Machinery

- 5.3.2 Building and Construction

- 5.3.3 Ship Building and Off-Shore Structures

- 5.3.4 Energy and Power

- 5.3.5 Others (Metalworking, Transportation, etc.)

- 5.4 By Geography

- 5.4.1 Asia Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 NORDIC

- 5.4.3.7 Turkey

- 5.4.3.8 Russia

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Nigeria

- 5.4.5.4 Qatar

- 5.4.5.5 Egypt

- 5.4.5.6 UAE

- 5.4.5.7 Rest of Middle-East and Africa

- 5.4.1 Asia Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ArcelorMittal

- 6.4.2 Baosteel Group

- 6.4.3 HYUNDAI STEEL

- 6.4.4 JFE Mineral & Alloy Company,Ltd.

- 6.4.5 NIPPON STEEL CORPORATION

- 6.4.6 NUCOR

- 6.4.7 Outokumpu

- 6.4.8 POSCO

- 6.4.9 TATA STEEL LIMITED

- 6.4.10 thyssenKrupp Steel Europe

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Applications in Energy and Power

- 7.2 Other Opportunities