|

市场调查报告书

商品编码

1690743

纸箱板-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Cartonboard - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

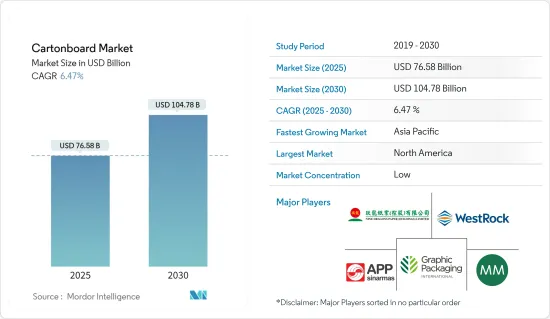

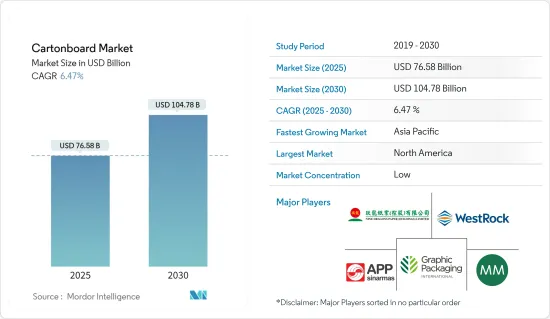

预计 2025 年纸板市场规模为 765.8 亿美元,到 2030 年将达到 1,047.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.47%。

关键亮点

- 纸板容器由纸板製成,纸板由三层或更多层木质纤维素纤维组成。纸箱纸板因其坚固和刚性的特性而越来越受欢迎,从而推动了产品需求。多个终端用户产业在运输、储存和包装方面对纸板的使用不断增加,推动了市场的成长。

- 纸板市场受到电子商务产业的显着影响,由于消费行为的改变、都市化进程的加速以及人口购买力的提高,电子商务产业正在蓬勃发展。此外,具有环保意识的消费者对环保产品的偏好导致他们自愿转向使用纸板等永续包装,而纸板正在迅速获得市场认可。

- 电子商务对包装的需求不断增长以及感测器和其他技术与包装材料的整合。电子商务带来了新的包装问题,例如产品安全、开箱体验、防伪措施和最终交付优化,这导致人们对初级包装和二级包装融合的兴趣日益浓厚,尤其是大型电子商务零售商。

- 作为塑胶包装的可持续替代品,对纸质包装的需求不断增长,促进了市场的成长。与其他包装材料相比,纸板的碳排放更低,因此越来越受到製造商的欢迎。纸板具有较高的防潮阻隔性和适合印刷的表面性能,这就是为什么它在製药应用中得到越来越多应用的原因。

- 近年来,受需求增加、供应问题以及纸浆和造纸行业的其他市场变化等因素的影响,纸张价格不断上涨。此外,由于原材料短缺和运输问题等供应链中断而导致的纸张供不应求也会影响产品的供应。这种供需失衡导致纸张价格大幅上涨,凸显了对经济復苏和供应链动态敏感的产业所面临的挑战。

纸箱纸板市场趋势

饮料业预计将实现最快成长

- 消费者对果汁、酒精饮料和碳酸饮料等饮料的需求不断增长,推动了对纸板包装的需求。饮料行业正变得越来越活跃,为製造商提供了多种成长机会,以利用饮料行业的创新包装需求。纸板具有很高的防潮性,可确保饮料的新鲜度和风味,并延长产品的保存期限。

- 固态未漂白硫酸盐 (SUS) 或未漂白牛皮纸板是一种坚韧、可印刷的材料,常用于包装产业。它结合了牛皮纸的强度和白色饰面,常用于製作饮料盒和容器。纸板的一面通常涂有黏土,以使其适合印刷。

- 多年来,人们一直在努力提高饮料容器的回收能力。这是透过与回收商、技术供应商和设备供应商联合投资建设新设施来实现的。 2023 年 6 月,利乐公司和斯道拉恩索公司在波兰投资约 2,900 万欧元(3,150 万美元)建造了一条新的饮料纸盒回收生产线。该生产线旨在将波兰的饮料纸盒年回收能力从 25,000 吨提高到 75,000 吨。

- 包装行业的多家公司正在投资生产永续饮料纸盒。身为饮料纸盒与环境联盟(ACE)的成员,利乐致力于在2030年实现欧盟饮料纸盒收集率90%、回收率70%的产业目标。

- 液体包装纸板/利乐包装是成长最快的包装类型之一,主要受非酒精饮料的推动。根据美国农业部(USDA)的数据,2023年美国果菜汁总额将达到9.267亿美元,其中出口额排名前几的国家是加拿大、墨西哥和日本。

- 人们对可回收包装材料和纸板的强大可回收性的认识正在不断提高。 2023 年 2 月,利乐和 Saveboard 在澳洲新南威尔斯州推出了首批饮料纸盒回收设施之一。这是我们实现共同环境目标的一项重大成就。该工厂是该国第一个此类工厂,它重复使用纸箱来製造用于住宅和办公室的低碳建筑材料,使其成为永续产品,且不会消耗任何多余的水、黏合剂或化学物质。

预计亚太地区将占据主要市场占有率

- 由于城市人口的成长、电子商务包装行业的发展、纸浆价格的下降以及人们对环保包装使用意识的提高,中国的纸箱包装市场预计将实现成长。该国不断发展的製药和电子商务行业正在推动对纸板包装的需求。据国际贸易局称,阿里巴巴、京东和拼多多是主导该国电子商务市场的线上平台。

- 中国的包装产业不断发展并变得更加先进。过去几年,塑胶一直是水果的主要包装,但随着法规从塑胶包装转向纸张和纸盒包装,该地区的趋势正在改变。此外,随着人们对安全和环境保护的日益关注,安全包装很可能成为未来几年食品包装的重点。

- 印度纸板市场的成长受到各种消费品、药品、纺织品、有组织零售、化妆品和电子商务行业对高品质包装的持续需求的推动。果肉、果汁和其他浓缩物的消费量不断增长,推动了印度对纸板的需求不断增长。此外,印度蓬勃发展的电子商务产业也有望推动市场成长。

- 在日本,即饮饮料和能量饮料的流行趋势日益增长,导致饮料消费量增加,从而推动了市场的成长。根据美国农业部 (USDA) 的数据,2023 年日本消费最多的饮料将是咖啡、绿茶和碳酸饮料。日本从美国进口非酒精饮料,有助于推动市场成长。

- 在澳大利亚,食品饮料、电子商务、製药以及美容化妆品领域对瓦楞包装的需求强劲,对折迭纸盒等二次包装的需求也在增加。澳洲非酒精饮料的消费量高以及食品零售业的不断增长正在推动对瓦楞包装的需求。据澳洲统计局称,2023年食品、饮料和非酒精饮料的销量将达到1,480万吨,这将推动包装产业的发展。

纸箱纸板市场概况

纸箱纸板市场较为分散。主要参与企业包括亚洲浆纸集团(APP)、Mayr-Melnhof Karton AG(MM集团)、玖龙纸业控股有限公司、Westrock公司和Graphic Packaging Holding公司。这些公司正在采取联盟和收购等策略措施来加强产品系列确保持久的竞争力。

- 2023 年 9 月 Smurfit Kappa 与 WestRock 合併后,Smurfit WestRock 将成为一家专注于永续发展的全球性公司。此次合併旨在利用纸质包装业务的协同效应和互补优势,在永续包装领域建立强大的全球影响力。

- 2023 年 4 月 Mayr-Melnhof Karton AG(MM 集团)宣布了一项全面投资计划,以加强其在波兰领先的瓦楞纸板和造纸厂。该计画分为三部分,价值约 6.6 亿欧元(7.216 亿美元),包括降低能源和二氧化碳成本、整合纸浆资源和进入袋装牛皮纸市场的措施。这些策略性倡议旨在维持工厂的长期生存能力和环境永续性。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 地缘政治情势如何影响市场

- 纸箱板-进出口分析

第五章市场动态

- 市场驱动因素

- 电子商务领域需求强劲

- 轻量材料需求的不断增长以及印刷技术的潜在创新将推动个人护理领域的成长

- 市场限制

- 营运成本增加

第六章市场区隔

- 按产品等级

- 漂白纸板

- 未漂白纸板

- 折迭式箱板

- 白线刨花板

- 液体包装纸板

- 食品服务委员会

- 按最终用户

- 饮料

- 食物

- 製药和医疗

- 化妆品和盥洗用品

- 烟草

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 亚洲

- 中国

- 印度

- 日本

- 澳洲和纽西兰

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 埃及

- 北美洲

第七章竞争格局

- 公司简介

- Asia Pulp & Paper Group(APP)

- Mayr-Melnhof Karton AG(MM Group)

- Nine Dragons Paper Holdings Limited

- Westrock Company

- Graphic Packaging Holding Company

- Stora Enso OYJ

- International Paper Company

- Metsa Board

- Smurfit Kappa Group

- Pankaboard OYJ

第八章投资分析

第九章:市场的未来

The Cartonboard Market size is estimated at USD 76.58 billion in 2025, and is expected to reach USD 104.78 billion by 2030, at a CAGR of 6.47% during the forecast period (2025-2030).

Key Highlights

- A carton board container is made from paperboard, which comprises three or more layers of pliers of cellulose fiber made from wood. The growing popularity of carton boards is attributable to their sturdy and rigid properties, thus boosting product demand. The rising use of carton boards for shipping, storage, and packaging purposes for multiple end-user industries is driving market growth.

- The carton board market is significantly influenced by the booming e-commerce industry, driven by evolving consumer behavior, rising urbanization, and the increasing purchasing power of the population. Furthermore, environmentally conscious consumers are favoring eco-friendly products, leading to a voluntary shift toward sustainable packaging like paperboard, which is gaining market acceptance rapidly.

- The packaging industry, being ever-evolving, has been impacted by technological advancements in two significant ways: the rising demand for packaging in e-commerce and the integration of sensors and other technologies into packaging materials. E-commerce has brought forth new packaging concerns such as product safety, unpacking experiences, anti-counterfeiting measures, optimization for final delivery, and a growing interest, especially among major e-commerce retailers, in merging primary and secondary packaging.

- The growing demand for paper-based packaging as a sustainable alternative to plastic packaging is contributing to market growth. Carton board has a low carbon footprint compared to other packaging materials, which has increased its popularity among manufacturers. The use of carton board packaging for pharmaceutical applications is growing as it provides a high moisture barrier and good surface properties for printing.

- In recent years, the price of paper has soared due to factors like increasing demand, availability issues, and other market changes in the pulp and paper industry. Also, the supply shortages of paper due to disruptions in the supply chain, including raw material shortages and transportation problems, can hamper product availability. This supply-demand imbalance significantly escalated paper prices, highlighting the industry's challenges influenced by economic recovery and supply chain dynamics.

Cartonboard Market Trends

The Beverage Segment is Expected to Record the Fastest Growth

- The growing consumer demand for beverages such as fruit juices, alcoholic beverages, and carbonated drinks drives the demand for carton board packaging. The beverage industry is becoming increasingly dynamic, providing manufacturers with several growth opportunities to invest in innovative packaging needs in the beverage industry. Carton board provides high resistance to humidity that ensures the freshness and flavors of the beverages, lengthening the products' shelf-life.

- Solid unbleached sulfate (SUS), or unbleached kraft paperboard, is a strong and printable material commonly used in the packaging industry. It is often used to make beverage boxes and containers, combining Kraft paper's sturdiness with a white finish. One side of the board is typically coated with a clay coating to make it suitable for printing.

- For many years, efforts have been made to increase the ability to recycle beverage containers. This has been achieved through joint investments with recyclers, technology suppliers, and equipment providers to build new facilities. In June 2023, Tetra Pak and Stora Enso invested roughly EUR 29 million (USD 31.5 million) in a new recycling line for beverage cartons in Poland. This line was intended to multiply the country's yearly recycling capacity of beverage cartons - from 25,000 to 75,000 tonnes.

- Various companies in the packaging industry invest in manufacturing sustainable cartons for beverages. As a member of the Alliance for Beverage Cartons and the Environment (ACE), Tetra Pak is dedicated to achieving the industry objective of having a 90% collection rate and a 70% recycling rate for beverage cartons in the EU by 2030.

- Liquid carton boards/tetra packs are one of the fastest-growing packaging types, driven by non-alcoholic beverages. According to the US Department of Agriculture (USDA), in 2023, the United States exported fruit and vegetable juices totaling a value of USD 926.7 million, with the top countries being Canada, Mexico, and Japan.

- Awareness regarding recyclable packaging material and the robust recyclability feature of carton boards is rising. In February 2023, Tetra Pak and Save Board disclosed one of the first beverage carton recycler facilities in New South Wales, Australia. This was a major accomplishment toward the collective environmental objectives. It was the first of its kind in the country; it reuses the cartons to create low-carbon building materials for homes and offices without consuming any extra water, adhesives, or chemicals, thus making it a sustainable product.

Asia-Pacific is Expected to Hold a Significant Market Share

- China's market for carton board packaging is projected to grow due to the growing urban population, an evolving e-commerce package industry, declining pulp prices, and improving awareness of the use of eco-friendly packaging. The growing pharmaceutical and e-commerce industry in the country is boosting the demand for carton board packaging. According to the International Trade Administration, Alibaba, JD.com, and Pinduduo are the domestic online platforms that dominate the country's e-commerce market.

- The Chinese packaging sector continues to evolve and become more advanced. For the past few years, most fruit package options have been made of plastic; however, the trend is changing in the region, with regulations changing from plastics to paper and carton packages. In addition, given the increasing concern about safety and environmental protection, safe packaging is set to become a significant focus for food packaging over the next few years.

- India's carton board market's growth is driven by continued demand for quality packaging of various consumer goods products, pharmaceuticals, textiles, organized retail, cosmetics, and e-commerce industries. The growing consumption of fruit pulps, juices, and other concentrates drives the growing demand for carton boards in India. Also, the rapidly growing e-commerce industry in India is expected to boost market growth.

- The growing beverage consumption in Japan due to the rising trend of ready-to-drink beverages and energy drinks drives the market growth. According to the US Department of Agriculture (USDA), coffee, green tea, and carbonated drinks were the most consumed beverages in Japan in 2023. Japan imports non-alcoholic beverages from the United States, boosting the market growth.

- Australia witnessed huge demand for corrugated packaging in the food and beverage, e-commerce, pharmaceutical, and beauty and cosmetics sectors, increasing the demand for secondary packaging, such as folding cartons, in the country. The high consumption of non-alcoholic beverages and the growing food retail sector in the country boosts the demand for packaging. According to the Australian Bureau of Statistics, 14.8 million tons of food and non-alcoholic beverages were sold in 2023, enhancing the packaging industry.

Cartonboard Market Overview

The carton board market is fragmented. Key players include Asia Pulp & Paper Group (APP), Mayr-Melnhof Karton AG (MM Group), Nine Dragons Paper Holdings Limited, Westrock Company, and Graphic Packaging Holding Company. These companies employ strategic maneuvers like partnerships and acquisitions to fortify their product portfolios and secure a lasting competitive edge.

- September 2023: Smurfit WestRock emerged as a sustainability-focused global force following the merger of Smurfit Kappa and WestRock. This consolidation aimed to synergize its paper-based packaging businesses, capitalizing on its complementary strengths to establish a formidable presence in sustainable packaging on a global scale.

- April 2023: Mayr-Melnhof Karton AG (MM Group) greenlit a comprehensive investment initiative designed to fortify Poland's major cardboard and paper mill. Valued at approximately EUR 660 million (USD 721.6 million), this three-part plan entails measures to curtail energy and CO2 expenses, integrate pulp resources, and penetrate the sack kraft paper market. These strategic moves were geared toward positioning the plant for sustained long-term viability and environmental sustainability.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of the Geo-Political Scenarios on the Market

- 4.5 Cartonboard - EXIM Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Strong Demand from the E-commerce Sector

- 5.1.2 Growing Demand for Lightweight Materials and Scope for Printing Innovations Propelling Growth in the Personal Care Segment

- 5.2 Market Restraints

- 5.2.1 Increasing Operational Costs

6 MARKET SEGMENTATION

- 6.1 By Product Grade

- 6.1.1 Solid Bleached Board

- 6.1.2 Solid Unbleached Board

- 6.1.3 Folding Boxboard

- 6.1.4 White-lined Chipboard

- 6.1.5 Liquid Packaging Board

- 6.1.6 Food Service Board

- 6.2 By End-User

- 6.2.1 Beverage

- 6.2.2 Food

- 6.2.3 Pharmaceutical and Healthcare

- 6.2.4 Cosmetics and Toiletries

- 6.2.5 Tobacco

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.2.5 Spain

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 Australia and New Zealand

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Argentina

- 6.3.4.3 Mexico

- 6.3.5 Middle East and Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 South Africa

- 6.3.5.4 Egypt

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Asia Pulp & Paper Group (APP)

- 7.1.2 Mayr-Melnhof Karton AG (MM Group)

- 7.1.3 Nine Dragons Paper Holdings Limited

- 7.1.4 Westrock Company

- 7.1.5 Graphic Packaging Holding Company

- 7.1.6 Stora Enso OYJ

- 7.1.7 International Paper Company

- 7.1.8 Metsa Board

- 7.1.9 Smurfit Kappa Group

- 7.1.10 Pankaboard OYJ