|

市场调查报告书

商品编码

1521408

探针卡:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Probe Card - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

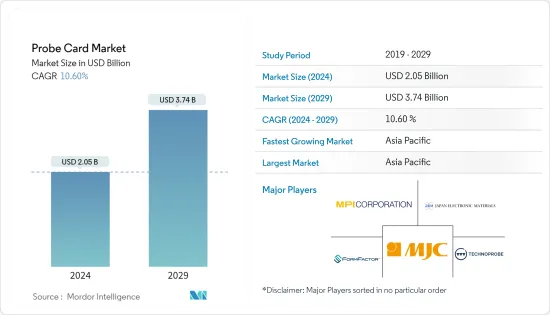

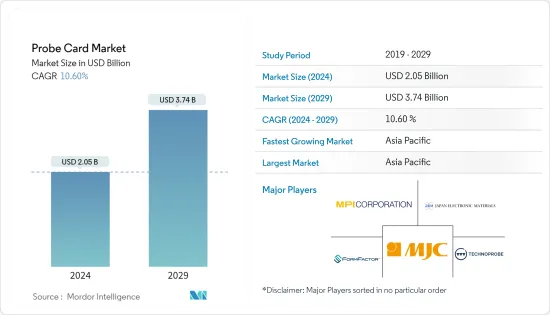

探针卡市场规模预计到2024年将达到20.5亿美元,到2029年将达到37.4亿美元,在预测期内(2024-2029年)复合年增长率为10.60%。

主要亮点

- 半导体产量的增加以及政府和主要供应商建立半导体晶圆代工厂的持续投资正在推动市场成长。

- 封装技术的进步将进一步推动对用于测试半导体晶片的高效探针卡的需求。 MEMS 技术因其在测试过程中的优势和准确性而正在推动探针卡市场的发展。半导体晶片在汽车、通讯、家用电子电器和医疗等各行业的使用不断增加也推动了市场的成长。

- 然而,与探针卡相关的高成本限制了市场的成长。原材料价格上涨导致探针卡的製造成本增加,限制了市场的成长。

- 随着家用电子电器、汽车、机器人和其他应用对半导体记忆体晶片(主要是DRAM、晶圆代工厂IC和逻辑IC)的需求增加,对测试晶片功能的探针卡的需求也在增加。由于消费者需求不断增长,半导体製造的快速成长正在推动 DRAM、晶圆代工厂和逻辑 IC 市场的发展。

- 与探针卡相关的高成本带来了限制市场成长的多重挑战。初始投资要求高、生产和维护成本增加、可扩展性和灵活性降低、新技术采用缓慢以及中小型企业的进入障碍是导致探针卡成本高的一些因素。

- 美国之间持续的贸易紧张局势对记忆体市场的成长产生了重大影响。从中国角度来看,美国商务部于2022年10月实施的商业限制为记忆体产能扩张带来了不确定性。因此,未来五年内存产业主要企业长江储存和长鑫储存的晶圆产能预计将限制在总合约180kWpm。

探针卡市场趋势

MEMS 在技术领域占据主导地位

- 对 MEMS 探针卡的需求正在增加。 MEMS 探针卡是半导体测试过程的重要组成部分,因为它们有助于半导体装置和测试设备之间准确可靠的电气连接。

- MEMS 探针卡由小型探针组成,可与半导体装置的垫片建立接触并促进电气测试。这些探头采用半导体製造方法製造,结构紧凑且功能强大。

- MEMS 技术允许製造以微米级精度接触 iC I/O 和电源连接的探针。由于其精度,MEMS 探针非常适合满足先进封装和先进半导体製程节点的细间距、高引脚数需求。

- 然而,并非所有 MEMS 探头都是一样的。 MEMS 探针卡具有先进的 2.5/3D 封装、汽车行业测试 IC 所需的宽温度范围、射频应用中对高频宽和高效讯号完整性的新要求,以及一次接触数千次的能力,我们处于这些发展的最前沿。

- 多年来,汽车中安装的积体电路 (IC) 数量持续增加。行动连接、汽车安全和电动车等汽车应用的持续发展预计将推动半导体含量达到前所未有的水平。特别是,即使在恶劣的工作条件下,汽车安全和功率的进步也需要卓越的性能和可靠性,这对 MEMS 探针卡产生了很高的需求。

- 随着驾驶员辅助系统的引入变得更加严格,对 MEMS 探针卡的需求预计将会增加。此外,由于政府的支持和燃油价格的上涨,电动车变得越来越受欢迎。

- 例如,国际能源总署(IEA)预测,在净零情境下,到2030年,电动车(EV)销售将占汽车总销量的约65%。为了实现这一目标,从 2023 年到 2030 年,电动车销量每年需要成长 25% 左右。电动车销售的快速成长将对 ADAS 和资讯娱乐系统产生巨大需求,进而增加 MEMS 探针卡的需求。

- 据 OICA 称,2023 年全球汽车产量将达到约 9,400 万辆。与前一年同期比较,这一数字增加了约 10%。中国、日本和德国是最大的汽车和商用车生产国。

亚太地区预计将经历显着成长

- 考虑到各个区域行业不断变化的动态,亚太地区预计将继续为市场成长做出重大贡献。该地区拥有知名半导体製造商、主要半导体材料供应商、先进设备和特殊半导体,主要集中在中国和日本。

- 韩国在全球高频宽记忆体(HBM)和动态随机存取记忆体(DRAM)市场的竞争优势也是探针卡市场的驱动力。出于安全、自动化、电气化和安全目的将半导体整合到车辆电子设备中也促进了该地区探针卡市场的成长。

- 该地区正在积极投资汽车产业,以创造更新、更永续的未来。因此,对 IGBT 半导体、AC-DC 转换器和汽车 IC 的需求很高,从而推动了该地区对探针卡的需求。中国汽车及旅游产业以其强劲的国内市场表现和广阔的未来性而享誉全球。根据中国工业和资讯化部预测,到2025年,中国汽车产量预计将达到3,500万辆,巩固其全球第一汽车製造商的地位。

- 根据韩国投资局 (Invest Korea) 报道,韩国政府已将电动车 (EV) 补贴扩大到 2023年终。韩国政府的目标是到2030年将氢能和电动车在新车销量中的比例提高33%。

- 据NITI Ayog称,到2030年,印度电动车金融业预计将达到500亿美元。印度政府制定了雄心勃勃的电动车普及率目标,即到 2030 年私家车达到 30%、巴士达到 40%、商用车达到 70%、两轮车达到 80%。 SMEV的资料显示,印度四轮电动车销量大幅成长,24财年售出90,432辆,较上年度。

- 中国处于5G基础设施发展的前沿。根据工信部的报告,2023年我国5G基地台数量为338万个。网路服务的激增将增加对智慧型手机、笔记型电脑和平板电脑设备的需求,进一步创造有利于该国市场成长的环境。

- 例如,根据中国国家统计局的数据,2023 年 12 月中国家用电子电器及家用电子电器销售额为772.5 亿元人民币(10.67 美元),而2024 年1 月/2 月为772.5 亿元人民币(10.67 美元)。

探针卡产业概述

由于跨国公司和中小企业的存在,探针卡市场高度分散。该市场的主要参与企业包括 Formfactor Inc.、Technoprobe SpA、Micronics Japan、Japan Electronic Materials Corporation 和 Mpi Corporation。市场参与企业正在采取联盟和收购等策略来加强其产品供应并获得可持续的竞争优势。

*2024 年 5 月 - FormFactor 宣布其在 TechInsight 客户满意度调查中的出色表现再次获得认可。透过这项调查,半导体製造商对全球供应商的客户服务、高效能和产品品质进行评估。 FormFactor 连续 11 年被选为测试子系统的领先供应商,特别是在探针卡製造领域。

*2024 年 3 月 - Micronics Japan 的德国子公司 MJC Europe Gmbh 决定于 2024 年 1 月搬迁至新办公室。这项策略性倡议的目的是加强逻辑晶片探针卡和测试插座的销售,特别关注欧洲汽车相关领域。慕尼黑新办公室地理位置优越,位置欧洲半导体产业的中心。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行概述

第四章市场洞察

- 市场概况

- COVID-19 后遗症和其他宏观经济因素对市场的影响

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 技术简介

- 价格走势分析

第五章市场动态

- 市场驱动因素

- 对消费性电子产品和物联网的需求增加

- 电子产品小型化

- 半导体产业的技术进步与创新

- 市场挑战/限制

- 与探针卡相关的高成本

- 消费者缺乏对探针卡解决方案优势的认识

第六章 市场细分

- 依技术

- MEMS

- 垂直的

- 悬臂

- 特殊技术

- 其他的

- 按用途

- DRAM

- 闪光

- 晶圆代工厂与逻辑

- 参数

- 其他的

- 按类型

- 标准探针卡

- 先进探针卡

- 按地区*

- 北美洲

- 欧洲

- 亚洲

- 澳洲/纽西兰

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 供应商市场占有率分析 ~2023

- 公司简介

- Formfactor Inc.

- Technoprobe SPA

- Micronics Japan Co. Ltd

- Japan Electronic Materials Corporation

- Mpi Corporation

- Feinmetall Gmbh

- Korea Instruments Co. Ltd

- Wentworth Laboratories Inc.

- GGB Industries Inc.

- Protec Mems Technology

- Nidec SV Probe

- Star Technologies Inc.

- Willtechnology Co Ltd

- TSE Co. Ltd

第八章投资分析

第9章 市场的未来

The Probe Card Market size is estimated at USD 2.05 billion in 2024, and is expected to reach USD 3.74 billion by 2029, growing at a CAGR of 10.60% during the forecast period (2024-2029).

Key Highlights

- Increased semiconductor production and continuous government and key vendor investment in establishing semiconductor foundries are driving the growth of the market.

- The advancement in packaging technology further boosts the demand for highly efficient probe cards to test semiconductor chips. MEMS technology gained traction in the probe card market due to the benefits and accuracy it offers during testing. The augmented use of semiconductor chips in several industry verticals, including automotive, communication, consumer electronics, and healthcare, is also increasing the growth of the market.

- However, the high cost associated with the probe cards restricts the growth of the market. An increase in the prices of raw materials enhances the production cost of probe cards, which, in turn, restricts the growth of the market.

- The increased demand for semiconductor memory chips, mainly DRAM and Foundry and Logic ICs, across consumer electronics, automotive and robotics, and other applications creates a huge demand for probe cards to test the chips' functionality. Due to growing consumer demand, exponential growth in semiconductor manufacturing drives the DRAM, foundry, and logic IC market.

- The high cost associated with probe cards presents multiple challenges that are restricting the growth of the market. Significant initial investment requirements, increased production and maintenance costs, reduced scalability and flexibility, slower adoption of new technologies, and barriers to entry for smaller players are some of the factors that result in higher costs for probe cards.

- The ongoing trade tensions between China and the United States have significantly impacted the growth of the memory market. From a Chinese standpoint, the commercial restrictions imposed by the US Department of Commerce in October 2022 created uncertainty regarding the expansion of memory production. As a result, the combined wafer capacities of the top memory companies, YMTC and CXMT, are expected to be limited to approximately 180kWpm over the next five years.

Probe Card Market Trends

MEMS to Dominate the Technology Segment

- The demand for MEMS probe cards is increasing. They are essential components in the semiconductor testing process, as they facilitate accurate and dependable electrical connection between the semiconductor device and the testing equipment.

- MEMS probe cards consist of tiny probes that establish contact with the pads on a semiconductor device, facilitating electrical testing. These probes are manufactured utilizing semiconductor fabrication methods, which allow for their small dimensions and exceptional functionality.

- MEMS technology allows for the production of probes that contact the I/Os and power connections on ICs at micron-level perfection. Due to their accuracy, MEMS probes are suitable for supporting the fine-pitch and high-pin count requirements of advanced packaging and advanced semiconductor process nodes.

- However, not all MEMS probes are created equal. MEMS probe cards are at the forefront of these developments, addressing issues with advanced 2.5/3D packages, the wide temperature ranges needed to test ICs for the automotive industry, the emerging requirements for high bandwidth and efficient signal integrity in RF applications, and lowering the cost to test thousands of DRAM memory devices in a single touch down.

- Over the years, the integrated circuit (IC) content in automobiles has consistently increased. The continuous development of automotive applications, such as mobile connectivity, automotive safety, and electrically powered vehicles, is anticipated to push the semiconductor content to unprecedented levels. Particularly, the advancements in automotive safety and electrical power will necessitate exceptional performance and reliability, even in challenging operating conditions, which create high demand for MEMS probe cards.

- With the increasing stringency in the implementation of driver assistance systems, the demand for MEMS probe cards is expected to grow. In addition, electric vehicles are gaining traction due to government support and increased fuel prices.

- For instance, the International Energy Agency (IEA) projected that electric vehicle (EV) sales will make up approximately 65% of total car sales by 2030 in the Net Zero Scenario. In order to achieve this, there must be an annual growth rate of around 25% in EV sales from 2023 to 2030. Such an exponential growth in EV sales creates a huge demand for ADAS systems and infotainment systems, resulting in increased demand for MEMS probe cards.

- According to OICA, in 2023, approximately 94 million motor vehicles were produced worldwide. Indicating an increase of around 10% compared to the previous year. China, Japan, and Germany were among the largest producers of cars and commercial vehicles.

Asia Pacific Expected to Witness Significant Growth

- Considering the changing dynamics of various regional industries, Asia-Pacific is anticipated to remain among the prominent contributors to the market's growth. The region has well-known semiconductor manufacturers, major semiconductor materials suppliers, advanced equipment, and specialized semiconductors, primarily in China and Japan.

- South Korea's competitive advantage in the global high-bandwidth memory (HBM) and dynamic random-access memory (DRAM) markets is another driving force behind the probe card market. The integration of semiconductors into automotive electronics for safety, automation, electrification, and security purposes also contributes to the growth of the probe card market in the region.

- The region is highly investing in its automotive industry, owing to a newer and sustainable future. This creates a high demand for IGBT semiconductors, AC-DC converters, automotive ICs, etc., thus propelling the demand for probe cards in the region. The Chinese automotive and mobility industry is globally renowned for its strong performance in the domestic market and promising prospects. The Chinese Ministry of Industry and Information Technology forecasts that the country's vehicle production is expected to hit 35 million by 2025, solidifying its position as the top car manufacturer worldwide.

- According to a report from Invest Korea, the South Korean government expanded electric vehicle (EV) subsidies until the end of 2023. By 2030, the government of Korea aims to increase the share of hydrogen and electric vehicles in new vehicle sales by 33%.

- According to NITI Ayog, India's EV finance industry is expected to reach USD 50 billion by 2030. The Indian government has set ambitious targets for EV adoption, aiming for 30% for private cars, 40% for buses, 70% for commercial vehicles, and 80% for two-wheelers by 2030, as stated in the NITI Ayog report. According to SMEV data, India witnessed a remarkable surge in the sale of four-wheel electric vehicles, with 90,432 units sold in FY 2024, showcasing a significant increase compared to the previous fiscal year.

- China is at the forefront of 5G infrastructure development. As reported by MIIT, China had 3.38 million 5G base stations in FY 2023. The widespread availability of internet services increases the demand for smartphones, laptops, and tablets, further creating a conducive environment for the growth of the country's market.

- For instance, according to the National Bureau of Statistics of China, the sales of consumer electronics and household appliances in China increased to CNY 130.95 billion (USD 18.08) in January/February 2024, compared to CNY 77.25 billion (USD 10.67) in December 2023.

Probe Card Industry Overview

The Probe Card market is highly fragmented due to the presence of global players and small and medium-sized enterprises. Some of the major players in the market are Formfactor Inc., Technoprobe SpA, Micronics Japan Co Ltd, Japan Electronic Materials Corporation, and Mpi Corporation. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

* May 2024 - FormFactor announced that it has been acknowledged again for its outstanding performance in TechInsight's customer satisfaction survey. Semiconductor manufacturers globally assess their suppliers on customer service, high performance, and product quality through this survey. FormFactor has been consistently selected as a leading provider of Test Subsystems for eleven consecutive years, particularly in producing probe cards.

* March 2024 - MJC Europe Gmbh, a German subsidiary of Micronics Japan Co. Ltd, decided to move to a new office in January 2024. This strategic relocation aims to enhance sales prospects for probe cards and test sockets designed for logic chips, specifically focusing on the automotive sector in Europe. The company's new office in Munich is strategically positioned within the semiconductor industry hubs of Europe.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Technology Snapshot

- 4.5 Pricing Trend Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in Demand for Consumer Electronics and IOT

- 5.1.2 Miniaturization of Electronic Products

- 5.1.3 Technological Advancement And Innovations in Semiconductor Industry

- 5.2 Market Challenges/restraints

- 5.2.1 High Costs Associated with Probe Cards

- 5.2.2 Lack of Awareness Among Consumers Regarding The Benefits of Probe Card Solution

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 MEMS

- 6.1.2 Vertical

- 6.1.3 Cantilever

- 6.1.4 Speciality

- 6.1.5 Other Technologies

- 6.2 By Application

- 6.2.1 DRAM

- 6.2.2 Flash

- 6.2.3 Foundry and Logic

- 6.2.4 Parametric

- 6.2.5 Other Applications

- 6.3 By Type

- 6.3.1 Standard Probe Card

- 6.3.2 Advanced Probe Card

- 6.4 By Geography***

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Vendor Market Share Analysis - 2023

- 7.2 Company Profiles*

- 7.2.1 Formfactor Inc.

- 7.2.2 Technoprobe S.P.A.

- 7.2.3 Micronics Japan Co. Ltd

- 7.2.4 Japan Electronic Materials Corporation

- 7.2.5 Mpi Corporation

- 7.2.6 Feinmetall Gmbh

- 7.2.7 Korea Instruments Co. Ltd

- 7.2.8 Wentworth Laboratories Inc.

- 7.2.9 GGB Industries Inc.

- 7.2.10 Protec Mems Technology

- 7.2.11 Nidec SV Probe

- 7.2.12 Star Technologies Inc.

- 7.2.13 Willtechnology Co Ltd

- 7.2.14 TSE Co. Ltd