|

市场调查报告书

商品编码

1521439

音乐团体与艺术家:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Musical Groups And Artists - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

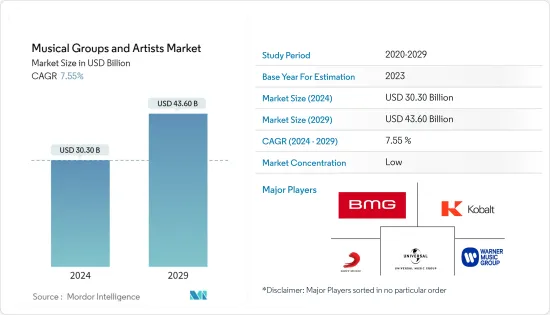

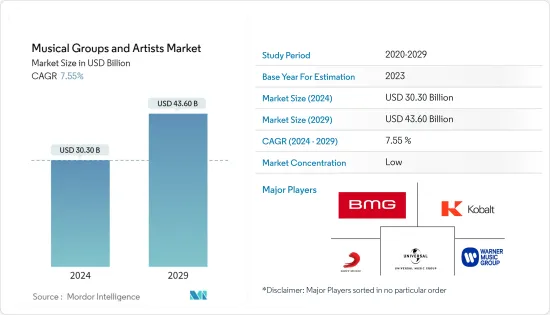

音乐团体和艺术家的市场规模预计到 2024 年为 303 亿美元,预计到 2029 年将达到 436 亿美元,在预测期内(2024-2029 年)复合年增长率为 7.55%。

主要亮点

- 数位平台和社交媒体的兴起使独立艺术家能够在不依赖传统唱片公司的情况下创作和发行音乐。独立艺术家可以直接与粉丝联繫,保留创新控制权,并可以存取各种数位传输管道。

- 来自不同流派和背景的艺术家之间的合作变得越来越受欢迎。协作计划和功能可帮助艺术家扩大粉丝群、尝试不同的风格并创造独特的音乐体验。

- 音乐产业变得更加全球化,来自不同国家和文化的艺术家获得了国际认可。串流平台促进了不同地区音乐的发现,导致韩国流行音乐、拉丁音乐和非洲节奏等流派在全球流行。

- 社群媒体平台已成为艺术家宣传音乐、与粉丝互动和建立强大线上形象的重要工具。数位行销策略,包括有针对性的广告和与影响者的合作,在接触和扩大粉丝群方面发挥关键作用。

音乐团体和艺术家的市场趋势

现场音乐占领市场

- 现场音乐预计将成为音乐团体和艺术家行业的主要推动力。着名的现场音乐活动组织者将客户满意度放在首位,并推出了各种行动应用程式以提高客户的可近性和便利性。

- 此外,我们也提供门票销售、商品销售、住宿等服务。此外,活动组织者正在与线上票务提供者合作,以认识到智慧型手机在年轻人中越来越流行来预订音乐活动门票。

- 5G技术的日益普及预计将导致音乐活动市场更多地使用数位平台进行门票预订、订餐、酒店住宿等。这些进步将显着增强音乐产业,并促进音乐团体和艺术家产业的整体成长。

音乐产业数位收入

- 数位音乐产业主要是由数位化程度的提高和互联网的普及所推动的。促进音乐产业成长的主要因素包括艺术家的线上音乐发行、广告成本以及串流媒体服务激增导致的销售增加。

- 此外,基于行动的音乐应用程式的兴起和基于订阅的服务的激增在促进音乐团体和艺术家行业的扩张方面发挥关键作用。

- 儘管有这些积极的趋势,该行业仍面临重大挑战,特别是在与使用线上平台和票务供应商相关的隐私和资料安全问题方面。

音乐团体和艺人产业概览

音乐团体和艺术家市场竞争非常激烈。随着实体专辑销售的下降,艺术家们正在实现收入来源多元化。他们依赖串流版权费、商品销售、品牌合作伙伴关係、赞助以及 Patreon 和群众集资等粉丝支持平台等收入来源。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态与洞察

- 市场概况

- 市场驱动因素

- 现场音乐的日益普及推动市场

- 市场限制因素

- 虚拟和线上活动的竞争

- 市场机会

- 音乐团体和艺术家空间的创新

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

- 对市场创新的见解

- COVID-19 对市场的影响

第五章市场区隔

- 按类型

- 音乐节

- 音乐会

- 音乐表演

- 其他类型

- 按类型

- 岩石

- 流行音乐

- EDM

- 其他流派

- 按收入来源

- 票

- 赞助

- 其他收入来源

- 按年龄组别

- 20岁以下

- 21-40岁

- 40岁以上

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 荷兰

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 南非

- 阿拉伯聯合大公国

- 其他中东和非洲

- 北美洲

第六章 竞争状况

- 市场集中度概况

- 公司简介

- BMG Rights Management GmbH

- Kobalt Music Group, Ltd.

- Sony Music Entertainment

- Universal Music Group

- Warner Music Inc

- Live Nation Entertainment, Inc.

- AEG Presents

- The Madison Square Garden Company

- C3 Presents

- StubHub

第七章 市场趋势

第 8 章 免责声明与出版商讯息

The Musical Groups And Artists Market size is estimated at USD 30.30 billion in 2024, and is expected to reach USD 43.60 billion by 2029, growing at a CAGR of 7.55% during the forecast period (2024-2029).

Key Highlights

- The rise of digital platforms and social media has empowered independent artists to produce and distribute their music without relying on traditional record labels. Independent artists can connect directly with their fans, retain creative control, and access various digital distribution channels.

- Collaborations between artists from different genres and backgrounds have become increasingly popular. Collaborative projects and features help artists expand their fan base, experiment with different styles, and create unique musical experiences.

- The music industry has become more globalized, with artists from different countries and cultures gaining international recognition. Streaming platforms have facilitated the discovery of music from various regions, leading to the popularity of genres such as K-pop, Latin music, and Afro beats on a global scale.

- Social media platforms have become essential tools for artists to promote their music, engage with fans, and build a strong online presence. Digital marketing strategies, including targeted advertising and influencer collaborations, play a crucial role in reaching and expanding the fan base.

Musical Groups And Artists Market Trends

Live Music Dominated the Market

- Live music is anticipated to be a key driver of the musical groups and artists industry. Prominent live music event organizers are prioritizing customer satisfaction and introducing various mobile applications to enhance accessibility and convenience for customers.

- Additionally, they provide services such as ticket sales, merchandise, and accommodation. Furthermore, event organizers are forming partnerships with online ticket providers, recognizing the prevalent use of smartphones among the youth for booking tickets to music events.

- The increasing penetration of 5G technologies is expected to further enhance the utilization of digital platforms in the music event market for tasks such as ticket booking, meal ordering, and hotel accommodation. These advancements are poised to significantly bolster the music industry and contribute to the overall growth of the musical groups and artists industry.

Digital Revenue of The Music Industry

- The digital music industry is primarily driven by increased digitization and widespread internet penetration. Key contributors to the music industry's growth include online music distribution by artists, advertising spending, and augmented sales resulting from the popularity of streaming services.

- Additionally, the rise in mobile-based music applications and the surge in subscription-based services play pivotal roles in fostering the expansion of musical groups and the artists industry.

- Despite these positive trends, the industry faces significant challenges, particularly in terms of privacy and data security concerns associated with the use of online platforms and ticket vendors.

Musical Groups And Artists Industry Overview

The music groups and artists market is highly competitive. With the decline in physical album sales, artists have diversified their revenue streams. They rely on income sources, including streaming royalties, merchandise sales, brand partnerships, sponsorships, and fan-supported platforms such as Patreon and crowdfunding. The major players are BMG Rights Management GmbH, Kobalt Music Group, Ltd., Sony Music Entertainment, Universal Music Group, and Warner Music Inc..

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Popularity of Live Music Drives The Market

- 4.3 Market Restraints

- 4.3.1 Competition From Virtual And Online Events

- 4.4 Market Opportunities

- 4.4.1 Technological Innovations In Musical And Artists Market

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights on Technology Innovation in the Market.

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Music Festivals

- 5.1.2 Music Concerts

- 5.1.3 Music Shows

- 5.1.4 Other Types

- 5.2 By Genre

- 5.2.1 Rock

- 5.2.2 Pop

- 5.2.3 EDM

- 5.2.4 Other Genres

- 5.3 By Revenue Source

- 5.3.1 Tickets

- 5.3.2 Sponsorship

- 5.3.3 Other Revenue Sources

- 5.4 By Age Group

- 5.4.1 Below 20 Years

- 5.4.2 21 to 40 Years

- 5.4.3 Above 40 Years

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 France

- 5.5.2.3 United Kingdom

- 5.5.2.4 Italy

- 5.5.2.5 Netherlands

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Rest of Asia Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest Of South America

- 5.5.5 Middle East & Africa

- 5.5.5.1 South Africa

- 5.5.5.2 UAE

- 5.5.5.3 Rest of Middle East & Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concetration Overview

- 6.2 Company Profiles

- 6.2.1 BMG Rights Management GmbH

- 6.2.2 Kobalt Music Group, Ltd.

- 6.2.3 Sony Music Entertainment

- 6.2.4 Universal Music Group

- 6.2.5 Warner Music Inc

- 6.2.6 Live Nation Entertainment, Inc.

- 6.2.7 AEG Presents

- 6.2.8 The Madison Square Garden Company

- 6.2.9 C3 Presents

- 6.2.10 StubHub*