|

市场调查报告书

商品编码

1521607

农业设备金融:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Agriculture Equipment Finance - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

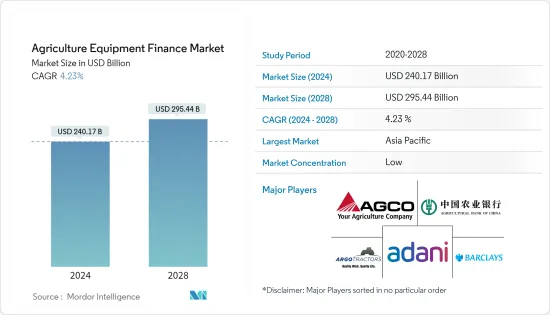

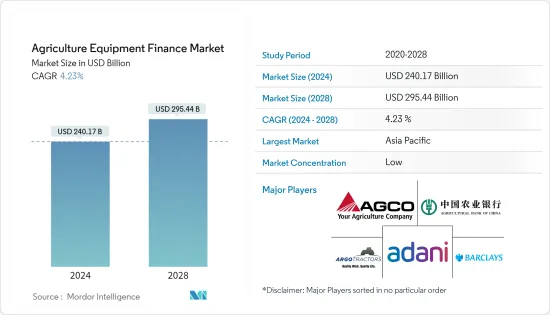

农业设备金融市场规模预计到 2024 年为 2,401.7 亿美元,预计到 2028 年将达到 2,954.4 亿美元,在预测期内(2024-2028 年)复合年增长率为 4.23%。

市场的主要驱动力是全球农业机械化趋势。推动市场发展的另一个因素是透过线上金融平台进行简单快速的资金筹措的需求不断增长。在全球层面,市场也受到区块链技术的出现的推动,区块链技术保证了相关人员贷款的即时资讯透明度。促进市场成长的其他因素包括农业设备的低进口关税。

线上金融平台也使农民、承包商和经销商更容易获得资金。这些平台允许用户在註册后几分钟内申请贷款,一旦贷款获得核准,资金就会存入。快速且方便的融资预计将成为未来几年全球农业设备融资市场成长的主要驱动力。

随着农业设备租赁提供者数量的增加,愿意投资一流、高品质设备的金融公司数量也在增加。这可能会推动未来几年农业设备融资市场的成长。农业贷款减免等计划旨在鼓励农民购买农业设备。世界各国政府正在实施此类计划,以帮助农民摆脱债务并鼓励他们转向机械化农业。

另类金融透过提供快速、轻鬆的信贷来帮助企业。多种替代融资管道提供大量中小型无抵押贷款,使中小企业更容易资金筹措。因此,未来几年农业综合企业的信贷需求预计将增加,从而推动农业和农业金融市场的成长。

农业装备金融市场趋势

农业拖拉机需求不断成长

由于农业机械化程度的不断提高以及提高生产力和效率的需求,农用拖拉机的市场规模不断扩大。人口成长、都市化、粮食需求增加以及耕作方法技术创新等因素正稳步扩大农用拖拉机市场规模。

都市化和人口向都市区迁移导致人事费用以惊人的速度上升。人事费用与生产成本直接相关。机械化降低了劳动工资。由于劳动力工资上涨和农业劳动力短缺,机械化率不断提高。政府也透过提供补贴来支持农业机械化,以获得更高的产量。技术进步也有助于提高机械化程度,提高农民对农业机械化好处的认识。

亚太地区农业机械销售成长

亚太地区是最大的农业机械市场之一。由于人口众多、对农业经济的高度依赖以及可支配收入的增加,印度、日本和中国等亚太地区新兴国家的政府正在寻找具有成本效益的方法来增加农业生产,我们专注于解决方案。

预计2023年,中国将主导亚太农业装备市场。该国的高市场占有率是由于农民数量多、种植面积大、劳动力短缺对先进农业设备的需求增加以及政府推动农业现代化和机械化的努力所致。 。

印度和中国占亚太农机市场的60%。印度和中国对农业机械化的需求正在稳步增长。主要的市场驱动因素是劳动力短缺、对农业效率的需求、订单农业、政府奖励和高劳动工资。此外,印度政府也提供补贴、低农业设备进口关税和宽鬆的信贷便利,鼓励农民实现农场机械化。

农产品金融业概况

农业装备金融市场较为分散。农业设备金融市场的参与者致力于策略联盟、合作伙伴关係、併购、区域扩张以及产品和服务推出。市场的主要企业包括阿达尼集团、爱科集团、中国农业银行、Argo Tractors SA 和巴克莱银行。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 支持农业领域女性的融资是塑造市场成长的关键趋势。

- 政府努力提供低利率贷款

- 市场限制因素

- 银行贷款利率上升是一项挑战,将影响市场成长。

- 市场成长的最大障碍之一是不断变化的排放法规。

- 市场机会

- 快速且方便的融资管道推动了全球农机融资市场的成长。

- 现代技术的使用增加以及对更高品质食品和农业生产的需求不断增长

- 价值链/供应链分析

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 深入了解农业技术发展与进步

第五章市场区隔

- 按金融类型

- 租

- 贷款

- 信用额度

- 副产品

- 联结机

- 收割机

- 牧场机械

- 其他的

- 按地区

- 亚太地区

- 北美洲

- 欧洲

- 南美洲

- 中东/非洲

第六章 竞争状况

- 供应商市场占有率

- 併购

- 公司简介

- Adani Group

- AGCO Corp.

- Agricultural Bank Ltd.of China

- Argo Tractors SpA

- Barclays PLC

- BlackRock Inc.

- BNP Paribas SA

- Citigroup Inc.

- Deere and Co.

- ICICI Bank Ltd.

- IDFC FIRST Bank Ltd.*

第七章市场机会与未来趋势

The Agriculture Equipment Finance Market size is estimated at USD 240.17 billion in 2024, and is expected to reach USD 295.44 billion by 2028, growing at a CAGR of 4.23% during the forecast period (2024-2028).

The market is mainly driven by the growing trend of farm mechanization around the world. The market is also driven by the increasing demand for simplified and fast financing through online finance platforms. The market on a global level is also being driven by the emergence of blockchain technology, which ensures real-time information transparency of a loan to all parties involved. Other factors that are contributing to the market growth include low import duty on agricultural equipment.

In addition, online financial platforms have made it easier for farmers, contractors, and dealers to access capital. These platforms allow users to apply for credit within minutes of registering, and funds are credited as soon as the loan is approved. Quick and convenient access to loans is expected to be a major driver of growth in the global farm equipment financing market over the next few years.

As the number of providers of agricultural equipment rental grows, so too does the number of finance companies willing to invest in top-notch quality equipment. This will drive the growth of the agriculture equipment finance market over the next several years. Programs like farm loan waivers are designed to encourage farmers to purchase farm equipment. Governments around the world have implemented these programs to help farmers get out of debt and encourage them to switch to mechanized farming.

Alternative finance helps businesses by providing fast and easy credit. There are many small to medium-size unsecured loans available from various alternative finance sources, which make it easier for small to medium-sized businesses to get funding. As a result, the demand for credit in agriculture-related works is expected to increase in the coming years, thus driving the growth of the agriculture & agriculture finance market.

Agriculture Equipment Finance Market Trends

Rising Demand For Tractors In Agriculture Industry

The market size of the agricultural tractor market is constantly increasing due to the increasing mechanization of the agriculture industry and the need for increased productivity and efficiency. Factors such as population increase, urbanization, food demand increase, and technological innovation in farming practices have contributed to the steady growth of the market size of agricultural tractors.

Labor costs have been rising at an alarming rate due to urbanization and the migration of people into urban areas. Labor costs are directly related to production costs. Mechanization reduces labor wages. As labor wages are rising and there is a shortage of farm labor, the rate of mechanization is increasing. The government is also supporting the increase in farm mechanization to get high yields by offering subsidies. Technological advances are also contributing to the increase in mechanization and increasing awareness among farmers of the advantages of agricultural mechanization.

Rise In The Sales Of Agriculture Equipment In Asia-Pacific

Asia Pacific is one of the largest markets for agricultural machinery. With a large population and high dependency on the agricultural economy, rising disposable income, the governments of emerging countries in the APAC region like India, Japan and China are focusing on cost-effective solutions for high agricultural production.

China is expected to dominate the Asia-Pacific agricultural equipment market in 2023. The country's high market share is due to its large number of farmers, a large area under agricultural cultivation, growing demand for advanced agricultural equipment due to labor shortage, increasing government initiatives to modernize and mechanize the agriculture sector, and the presence of many agriculture equipment manufacturers.

India and China account for 60% of the farm machinery share in Asia-Pacific. Demand for farm mechanization has been steadily increasing in India and China. The main market drivers are labor shortage, the need to improve farm efficiency, contract farming, government incentives, and a high labor wage. In addition, the Indian government offers subsidies, low import taxes on agricultural equipment, and easy financing programs that encourage farmers to mechanize their farms.

Agriculture Equipment Finance Industry Overview

The agriculture equipment finance market is fragmented. Agricultural equipment finance market companies are implanting strategic alliances, partnerships, mergers and acquisitions, geographic expansion, and product/service launches. Key players in the market are Adani Group AGCO Corp Agricultural Bank of China Ltd and Argo Tractors S.A. Barclays PLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Financing to support women in the agricultural sector is the primary trend shaping the growth of the market

- 4.2.2 Government initiatives to provide loans at a lower interest rate

- 4.3 Market Restraints

- 4.3.1 Costlier bank lending rates are a challenge that affects the growth of the market.

- 4.3.2 One of the biggest obstacles to market growth is the ever-evolving emission standards.

- 4.4 Market Opportunities

- 4.4.1 Quick and easy access to loans will drive the growth of the global agricultural equipment financing market

- 4.4.2 Increased usage of modern technologies and growing demand for high quality of food & agricultural production

- 4.5 Value Chain / Supply Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights into technological developments and advancements in agricultural industry

5 MARKET SEGMENTATION

- 5.1 By Type of Finance

- 5.1.1 Lease

- 5.1.2 Loan

- 5.1.3 Line of Credit

- 5.2 By Product

- 5.2.1 Tractors

- 5.2.2 Harvesters

- 5.2.3 Haying Equipment

- 5.2.4 Others

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.2 North America

- 5.3.3 Europe

- 5.3.4 South America

- 5.3.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Mergers & Acquisitions

- 6.3 Company Profiles

- 6.3.1 Adani Group

- 6.3.2 AGCO Corp.

- 6.3.3 Agricultural Bank Ltd.of China

- 6.3.4 Argo Tractors SpA

- 6.3.5 Barclays PLC

- 6.3.6 BlackRock Inc.

- 6.3.7 BNP Paribas SA

- 6.3.8 Citigroup Inc.

- 6.3.9 Deere and Co.

- 6.3.10 ICICI Bank Ltd.

- 6.3.11 IDFC FIRST Bank Ltd.*