|

市场调查报告书

商品编码

1521618

日本电子商务物流:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Japan E-commerce Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

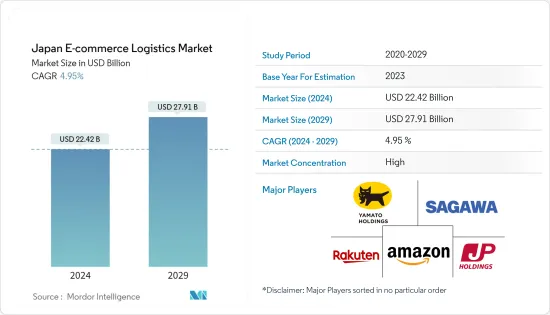

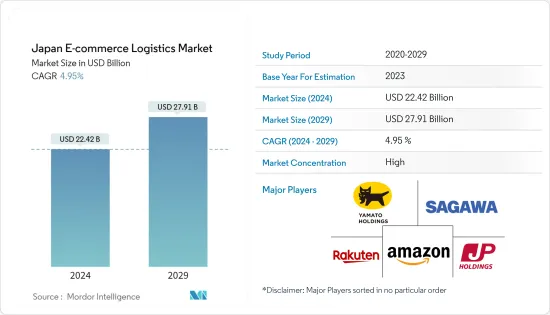

日本电商物流市场规模预计到 2024 年为 224.2 亿美元,预计到 2029 年将达到 279.1 亿美元,在预测期内(2024-2029 年)复合年增长率为 4.95%。

日本的电子商务产业近年来经历了显着的成长。日本凭藉其精通技术的人口和强大的数位基础设施,已成为全球电子商务市场的主要企业。因此,对高效率、可靠的物流服务的需求也在迅速成长。

推动日本电子商务成长的关键因素之一是网路和智慧型手机的日益普及。预计2023年日本行动上网渗透率约93.8%,2028年将达近95.6%。日本人口预计将从 2023 年的约 1.236 亿减少至 2028 年的约 1.221 亿。

消费行为的这些变化为电子商务企业创造了巨大的机会,但也为物流企业带来了挑战。

为了满足快速成长的电子商务市场的需求,日本物流公司在技术和基础设施方面进行了大量投资。我们使用先进的分类设备和即时追踪系统,确保高效的订单处理和交付。

日本物流配送服务供应商佐川急便与 SG Holdings 旗下住友商事株式会社以及 Dexterity 旗下 Dexterity Co., Ltd. 合作,透过操作配备人工智慧 (AI) 的机器人来移动小包裹卡车您现在可以将随机框加载到 .佐川急便和世界领先的物流和配送服务供应商之一的 Dexterity 将使用 Dexterity 的人工智慧来驱动机器人,将箱子装载到卡车上。 DexR的双臂机器人将学习佐川县的物流业务,并在扩大部署之前无缝整合到佐川县现有的物流基础设施中。

最后一公里配送对于日本物流公司来说是一个特别重要的议题。日本人口稠密的都市区和复杂的地址系统使得最后一哩的配送充满挑战。然而,公司已经利用创新的解决方案来克服这些挑战。例如,利用众包建立配送网路、与当地便利商店合作收集包裹,以及探索使用无人机和无人驾驶车辆的配送选项。

例如,亚马逊在东京、大阪和名古屋等主要城市提供各种产品的最后一哩配送服务。该公司正在大力投资日本的物流基础设施,包括建造新的仓库和配送中心。

日本邮政提供称为「Yu-Pack Express」的当日递送服务。该服务覆盖全国,可投递重量不超过25公斤的包裹。随着日本基础设施的改善,当日递送公司变得更有效率和业务。这正在推动日本当日送达市场的成长。

日本电商物流市场趋势

交通运输业大幅成长预测

在日本,交通运输业正在经历重大发展,以满足蓬勃发展的电子商务市场不断增长的需求。

日本电商运输领域由三大巨头公司主导,占据国内宅配市场90%以上的份额。最大的承运商 Yamato Transport 每年运输超过 18 亿件小包裹。其竞争对手佐川急便为亚马逊等主要客户提供物流服务。

运输领域的主要挑战之一是有效率、及时地交付货物。像日本这样人口众多、地域多元化的国家的物流公司必须开发创新的解决方案来克服这些挑战。根据Worldometer对联合国最新资料的分析,2024年日本人口将为122,895,594人。

日本第三大邮政组织日本邮政可能会效仿,提高基本投递费用,并与主要客户谈判更具竞争力的费率。日本邮政也采取限制策略,利用了大和和佐川留下的国内货运管理机会。 Yu-Pack 是一项以前仅向企业提供的宅配服务,现在向个人提供,并且正在经历显着增长。

儘管对近40 亿件包裹递送的需求不断增长,推动了整个行业的增长,但需要在日本境内递送的物品数量之多,给这些公司带来了压力,迫使他们寻求降低成本和改进流程的方法。

网路和智慧型手机的高普及率推动市场

近年来,日本的网路和智慧型手机普及率显着增长,使其成为世界上联繫最紧密的国家之一。凭藉先进的技术基础设施和精通技术的人口,日本很容易拥抱数位革命。

日本的网路普及率已飙升至令人印象深刻的水平,现在有很大一部分人口可以上网。根据最新资料,日本的网路普及率已达到约93.13%。这意味着大多数日本公民可以连接到互联网并享受其广泛的服务和机会。

2023年初日本社群媒体活跃用户数为9,290万,占日本人口的74.4%。 2023年初,日本行动电话用户数为1.844亿,占人口的149.1%。

日本互联网高普及率背后的驱动力之一是其强大的通讯基础设施。日本拥有发达的光缆网络,为都市区和农村地区提供快速、可靠的网路连线。这个广泛的网路为全国各地的人们提供了轻鬆存取网路的机会。

日本电子商务的兴起导致对高效、可靠的物流服务的需求增加。随着越来越多的人网路购物,无缝运输和履约变得至关重要。这为日本电商物流市场的发展铺平了道路。

日本电商物流业概况

日本的电商物流市场极具活力和竞争,多家主要企业争夺市场占有率。该市场的主要企业包括大和控股、佐川、日本邮政、亚马逊日本和乐天。

还有一些小型物流公司和新兴企业在这个行业中崭露头角。市场竞争激烈,公司不断开发创新服务,以满足电子商务领域不断变化的需求。

亚马逊的云端运算基础设施是其人工智慧服务的支柱,将在日本大幅扩张。到2027年,亚马逊计划在东京和大阪大都会圈投资22.6亿美元建造云端运算设施,以满足不断增长的客户需求。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

- 分析方法

- 调查阶段

第三章执行概述

第四章市场洞察

- 市场概况

- 目前的市场状况

- 产业技术趋势

- 政府措施和法规

- 电子商务洞察

- 价值链/供应链分析

- 供需分析

- COVID-19 对市场的影响

第五章市场动态

- 促进因素

- 扩大电子商务

- 跨境贸易活动快速成长

- 抑制因素

- 影响市场的基础建设挑战

- 影响市场的复杂法规

- 机会

- 最后一哩交付创新推动市场

- 对可持续物流的需求

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者/买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第六章 市场细分

- 按服务

- 运输

- 仓库/库存管理

- 附加价值服务(标籤、包装等)

- 按业务

- B2B

- B2C

- 按目的地

- 国内的

- 国际/跨境

- 副产品

- 时尚/服饰

- 家用电子电器

- 家用电子电器产品

- 家具

- 美容/个人护理

- 其他产品(玩具、食品等)

第七章 竞争格局

- 公司简介

- Yamato Holdings

- Sagawa

- Japan Post

- Amazon Japan

- Rakuten

- DHL Japan

- Nippon Express

- Kokusai Express

- Blue Dart

- JP Logistics Hub*

- 其他公司

第八章市场的未来

第九章 附录

The Japan E-commerce Logistics Market size is estimated at USD 22.42 billion in 2024, and is expected to reach USD 27.91 billion by 2029, growing at a CAGR of 4.95% during the forecast period (2024-2029).

The e-commerce industry in Japan has witnessed remarkable growth in recent years. With a tech-savvy population and a strong digital infrastructure, Japan has become a major player in the global e-commerce market. Consequently, the demand for efficient and reliable logistics services has also surged.

One of the key factors driving the growth of e-commerce in Japan is the increasing penetration of the Internet and smartphones. Japan's mobile internet penetration was about 93.8% in 2023 and is expected to reach nearly 95.6% by 2028. Japan's population is projected to decline from approximately 123.6 m in 2023 to approximately 122.1 m in 2028.

This shift in consumer behavior has created immense opportunities for e-commerce businesses but has also posed challenges for logistics providers.

To meet the demand of the booming e-commerce market, logistics companies in Japan have been investing heavily in technology and infrastructure. They adopt advanced sorting facilities and real-time tracking systems to ensure efficient order processing and delivery.

Sagawa Express, a Japanese logistics and delivery service provider, has partnered with Sumitomo Corporation, a subsidiary of SG Holdings Co. Ltd, and Dexterity Inc., a subsidiary of Dexterity, to power robots powered by Artificial Intelligence (AI) that can load parcel trucks with random boxes. Sagawa Express and Dexterity, one of the world's leading logistics and delivery services providers, will use Dexterity's AI to power robots that can load trucks with boxes. Before scaling deployment, the DexR's dual-arm robot learns from Sagawa Express's logistics operations, seamlessly integrating into Sagawa's existing logistics infrastructure.

Last-mile delivery has been a particular focus for logistics providers in Japan. The country's dense urban areas and complex address systems make last-mile delivery challenging. However, companies have been leveraging innovative solutions to overcome these challenges. For instance, they are utilizing crowdsourced delivery networks, partnering with local convenience stores for parcel pick-up, and exploring using drones and autonomous vehicles for delivery in certain areas.

For example, Amazon offers last-mile delivery on a wide range of products in major cities such as Tokyo, Osaka, and Nagoya. The company has invested heavily in logistics infrastructure in Japan, including building new warehouses and delivery centers.

Japan Post offers a same-day delivery service called Yu-Pack Tokkyu. This service is available nationwide and can be used to deliver packages weighing up to 25 kilograms. The growing infrastructure in Japan is making it possible for same-day delivery companies to operate more efficiently and effectively. This is helping to drive the growth of the same-day delivery market in Japan.

Japan E-commerce Logistics Market Trends

Immense growth projection for transportation segment

In Japan, the transportation segment has seen significant advancements to meet the growing demand of the booming e-commerce market.

Japan's e-commerce transportation segment is dominated by three giant companies that account for more than 90 percent of the domestic parcel delivery market. The biggest one, Yamato Transport, ships more than 1.8 billion parcels annually. A close competitor, Sagawa Express, supplies logistics services to major customers such as Amazon.

One of the key challenges in the transportation segment is the efficient and timely delivery of goods. Logistics companies in a highly populated and geographically diverse country like Japan have had to develop innovative solutions to overcome these challenges. Japan has a population of 122,895,594 as of 2024, according to Worldometer's analysis of the most recent United Nations data.

Japan Post, the country's third-largest domestic post organization, is likely to follow suit by raising its basic delivery charge and negotiating more competitive rates with key customers. Japan Post has also taken advantage of the domestic shipment management opportunities left by Yamato and Sagawa following the restriction strategy. It has seen tremendous growth in its parcel delivery service, 'Yupack,' which was previously available only to enterprise businesses and is now available to private individuals.

However, while the ever-growing demand of nearly 4 billion package deliveries is driving growth in the industry overall, the sheer volume of items that require delivery within Japan is putting pressure on these companies and forcing them all to look for cost savings and process improvements.

High internet and smart phone penetration driving the market

Japan has witnessed remarkable growth in internet and smartphone penetration over the years, making it one of the most connected countries in the world. With its advanced technological infrastructure and tech-savvy population, Japan has embraced the digital revolution with open arms.

Internet penetration in Japan has soared to impressive levels, with a significant portion of the population having access to the internet. As of the latest data, the internet penetration rate in Japan stands at around 93.13%. This means that majority of the Japanese citizens can connect to the internet and enjoy its vast array of services and opportunities.

Japan had 92.9 million active social media users at the beginning of 2023, making up 74.4% of the country's population. At the start of 2023, there were 184.4m cellular mobile connections in the country, making up 149.1% of the population.

One of the driving forces behind Japan's high internet penetration is its robust telecommunications infrastructure. The country boasts a well-developed network of fiber-optic cables, providing high-speed and reliable internet connections to both urban and rural areas. This extensive network ensures that people across the country can access the internet wit ease.

The rise in ecommerce in Japan has led to an increased demand for effcient and reliable logistics services. As more and more people turn to online shopping, the need for seamless delivery and fulfillment becomes crucial. This has paved the way for the evlution of the ecommerce logistics market in Japan.

Japan E-commerce Logistics Industry Overview

The e-commerce logistics market in Japan is quite dynamic and competitive, with several key players vying for market share. Some of the major players in the market include Yamato Holdings, Sagawa, Japan Post, Amazon Japan, and Rakuten.

There are also numerous smaller logistics companies and startups that are making their mark in the industry. The competition in the market is intense, with companies constantly innovating and expanding their services to meet the evolving needs of the e-commerce sector.

Amazon.com's cloud computing infrastructure, which is the backbone for AI services, is set to expand significantly in Japan. By 2027, Amazon.com plans to invest USD 2.26 billion in cloud computing facilities in the Tokyo and Osaka metropolitan areas to meet the increasing demand from customers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Current Market Scenario

- 4.3 Technological Trends in the Industry

- 4.4 Government Initiatives and Regulations

- 4.5 Insights into the Ecommerce

- 4.6 Value Chain / Supply Chain Analysis

- 4.7 Demand and Supply Analysis

- 4.8 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Drivers

- 5.1.1 Increasing ecommerce penetration

- 5.1.2 Surge in Cross-Border Trade Activities

- 5.2 Restraints

- 5.2.1 Infrastructure challenges affecting the market

- 5.2.2 Regulatory Complexities Affecting the Market

- 5.3 Opportunities

- 5.3.1 Last-Mile Delivery Innovations Driving the Market

- 5.3.2 Demand for Sustainable Logistics

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Consumers / Buyers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By service

- 6.1.1 Transportation

- 6.1.2 Warehousing and Inventory Management

- 6.1.3 Value-added services (labeling, packaging, etc.)

- 6.2 By Business

- 6.2.1 B2B

- 6.2.2 B2C

- 6.3 By Destination

- 6.3.1 Domestic

- 6.3.2 International/Cross Border

- 6.4 By product

- 6.4.1 Fashion and pparel

- 6.4.2 Consumer electronics

- 6.4.3 Home Appliances

- 6.4.4 Furniture

- 6.4.5 Beauty and Personal care

- 6.4.6 Other products (toys, food products, etc.)

7 COMPETITIVE LANDSCAPE

- 7.1 Overview (Market Concentration and Major Players)

- 7.2 Company Profiles

- 7.2.1 Yamato Holdings

- 7.2.2 Sagawa

- 7.2.3 Japan Post

- 7.2.4 Amazon Japan

- 7.2.5 Rakuten

- 7.2.6 DHL Japan

- 7.2.7 Nippon Express

- 7.2.8 Kokusai Express

- 7.2.9 Blue Dart

- 7.2.10 JP Logistics Hub*

- 7.3 Other Companies