|

市场调查报告书

商品编码

1692492

印度电子商务物流 -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)India E-commerce Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

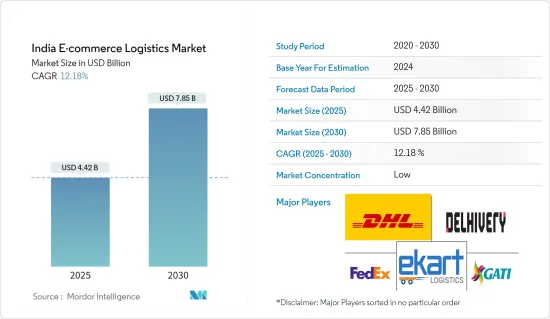

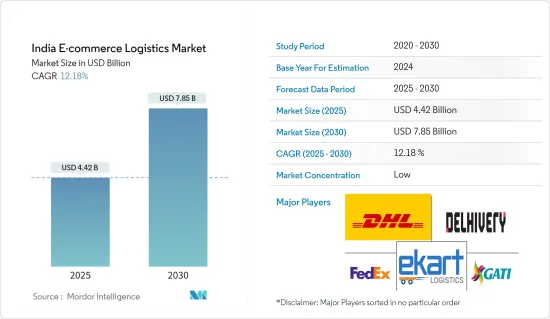

印度电子商务物流市场规模预计在 2025 年为 44.2 亿美元,预计到 2030 年将达到 78.5 亿美元,预测期内(2025-2030 年)的复合年增长率为 12.18%。

在第一波新冠疫情期间,许多零售商由于收益立即受到打击而关闭了商店。但慢慢地我开始适应了。据印度政府出口促进机构印度品牌资产基金会称,到2024年,线上零售渗透率预计将达到10.7%,而2019年为4.7%。随着送货上门需求的增加,零售商正在与物流公司合作,为订单配送提供便利,为企业和零售商提供便利。

据印度非政府行业协会和倡导组织印度工商联合会(FICCI)称,预计印度零售市场将以每年10%的速度成长,到2026年达到1.6兆美元。印度零售市场占国内生产总值)的10%,约占就业人数的8%。印度是全球第五大零售目的地,吸引了许多新参与者。未来五年,网路商店预计将呈指数级增长,并与实体店相提并论。

由于线上零售商高度依赖第三方物流服务供应商,预计这将对印度的电子商务物流行业产生积极影响。

印度电商物流市场趋势

电子商务销售成长推动市场扩张

印度的电子商务市场正在大幅成长,印度品牌资产基金会预测,到2034年,印度将超过美国,成为全球第二大电子商务市场。预计到2027年,印度的电子商务市场规模将达到1,970亿美元,高于2023年的1,027.5亿美元。

该电子商务业务帮助商家在全球范围内销售,并透过行销工具扩展业务,帮助他们在 Facebook 和 Google 上建立、执行和分析宣传活动。商家可以从单一仪表板管理订单、交付和付款,从而获得极大的灵活性。透过当日配送流程和灵活的选择,电子商务商店的消费者体验得到了明显改善。这些效率正在推动电子商务销售的当前成长,并且可能持续成长。

随着互联网和智慧型手机用户数量的预期增长,越来越多的公司进入电子商务行业。线上零售商与第三方物流 (3PL) 供应商合作管理库存、包装、交付、仓储和追踪等运输问题。这直接促进了物流业的收益。

印度网路使用者数量不断增加

Statista 预测,到 2027 年,网路用户数量将达到 1,232,330,000。预计都市区和农村地区的网路使用者数量都将增加,这表明网路存取将呈现动态增长。根据印度互联网和行动协会(IAMAI)的报告,印度是仅次于中国的全球第二大网路市场。由于行动连线的增强、女性购买行为的增加以及农村地区的广泛采用,用户数量正在逐渐增加。

根据印度品牌股权基金会的数据,「数位印度」计画将协助印度网路使用者数量在2023年达到6.92亿。在所有网路连线中,55%位于都市区,97%为无线网路。预计到2030年印度智慧型手机用户数将达到8.874亿,且数量将持续增加。印度是全球数据消费量最高的国家,每人每月消耗 14.1GB。

印度电商物流业概况

印度电商物流市场竞争格局分散。随着全部区域对物流和服务的需求迅速增长,企业正在加强竞争力,以利用巨大的机会。印度政府的支持性政策允许 B2B 电子商务领域 100% 的外国直接投资,近年来数位素养的提高吸引了新的国际公司在印度开设商店。因此,国际物流公司正在透过建立区域物流网络进行策略性投资,包括开设新的配送中心和智慧仓库。代表公司包括联邦快递公司、DHL、Aramex等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查结果

- 调查前提

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 当前市场状况

- 产业技术趋势

- 政府措施和法规

- 电子商务洞察

- 价值链/供应链分析

- 需求和供应分析

- COVID-19 市场影响

第五章市场动态

- 市场驱动因素

- 网路和智慧型手机的普及率不断提高

- 都市化和生活方式的改变

- 政府倡议

- 市场限制

- 基础设施薄弱,最后一英里交付

- 机会

- 投资物流基础设施

- 跨境电子商务与逆向物流

- 与电子商务公司合作

- 波特五力分析

- 新进入者的威胁

- 购买者和消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第六章市场区隔

- 按服务

- 运输

- 仓库和库存管理

- 附加价值服务(标籤、包装)

- 按业务

- B2B

- B2C

- 目的地

- 国内的

- 国际/跨境

- 按产品

- 服装与时尚

- 家电

- 家电

- 家具

- 美容和个人保健产品

- 其他产品(玩具、食品等)

第七章竞争格局

- 市场集中度概览

- 公司简介

- FedEx Corporation

- Delhivery Pvt. Ltd

- Ekart Logistics

- Blue Dart Express Ltd

- Shadowfax

- Xpress Bees

- DTDC

- Ecom Express Logistics

- Gati-Kintetsu Express Private Limited

- DHL

- Mahindra Logistics Ltd*

- 其他公司

第八章:市场的未来

第九章 附录

- 宏观经济指标(按活动分類的 GDP 分布、运输和仓储业对经济的贡献)

- 资本流动洞察(运输和仓储领域的投资)

- 电子商务与消费者支出统计

- 对外贸易统计 - 出口和进口,按产品、目的地/原产国

The India E-commerce Logistics Market size is estimated at USD 4.42 billion in 2025, and is expected to reach USD 7.85 billion by 2030, at a CAGR of 12.18% during the forecast period (2025-2030).

During the first wave of COVID-19, many retailers shut down their stores as their revenue was hit instantly. However, it started to adapt gradually. As per the India Brand Equity Foundation, an Indian government export promotion agency, online penetration of retail is expected to reach 10.7% by 2024 compared to 4.7% in 2019, due to which many retailers started working on click-and-collect services and started partnering with logistics companies to keep their business moving forward. As the demand for door deliveries has increased, retailers are facilitating order deliveries with logistics companies to comfort companies and retailers.

India's retail market is expected to witness an annual growth rate of 10% with USD 1.6 trillion by 2026, as per the Federation of Indian Chambers of Commerce & Industry (FICCI), a non-governmental trade association and advocacy group based in India. The Indian retail market accounts for 10% of the country's gross domestic product (GDP) and around 8% of employment. India is the world's fifth-largest global destination in retail, leading to several new players' entries. In the next five years, online stores are expected to grow drastically and become equal to physical stores.

Since online retailers depend more on 3PL service providers, it is expected to influence the Indian e-commerce logistics sector positively.

India E-commerce Logistics Market Trends

The Growth of E-commerce Sales is Driving the Expansion of the Market

The Indian e-commerce market is growing predominantly and is expected to surpass the United States to become the second-largest e-commerce market in the world by 2034, as per the India Brand Equity Foundation. The Indian e-commerce market is expected to reach USD 197 billion by 2027 from USD 102.75 billion in 2023.

The e-commerce business helps the sellers sell globally and market the business using marketing tools that help create, execute, and analyze campaigns on Facebook and Google. The sellers can use a single dashboard to manage orders, shipping, and payments, which is highly flexible. The improvement of consumer experiences in e-commerce stores is evident through the same-day delivery process and flexible options. Due to these efficiencies, there is continuous growth in e-commerce sales across the existing and upcoming years.

The number of players entering the e-commerce industry is gradually increasing due to the expectation of increased penetration on the internet and smartphone users. Online retailers are partnering with third-party logistics (3PL) providers to manage issues related to delivery, such as inventory, packaging, shipping, warehousing, and tracking. This is directly contributing to the revenue of the logistics industry.

The Number of Internet Users in India is Increasing

Statista expects the number of internet users to reach 1,232.33 million by 2027. It is estimated to increase in urban and rural regions, indicating dynamic growth in access to the Internet. India is the second largest online market globally, ranking only behind China, according to a report by the Internet and Mobile Association of India (IAMAI). Due to the increase in mobile connectivity, growth in the purchasing behavior of women, and penetration in rural areas, the number of users has increased gradually.

The Digital India program drove the number of internet users to 692 million in 2023, per the India Brand Equity Foundation data. Of the total internet connections, 55% were in urban areas, 97% were wireless. The number of smartphone users in India is expected to reach 887.4 million by 2030, which shows an increase in users. India has the highest data consumption rate worldwide, at 14.1 GB of data per person a month.

India E-commerce Logistics Industry Overview

The competitive landscape of the Indian e-commerce logistics market is fragmented; as the demand for logistics services is growing rapidly across the region, companies are becoming more competitive to capture the huge opportunity. Policy support from the Indian government has allowed 100% FDI in B2B e-commerce, and the recent rise in digital literacy has led to new international players setting up their bases in India. This has, in turn, led the international logistics players to make strategic investments by establishing a regional logistics network, such as opening new distribution centers and smart warehouses. Some of the leading players include FedEx Corporation, DHL, and Aramex.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Technological Trends in the Industry

- 4.3 Government Initiatives and Regulations

- 4.4 Insights into the E-commerce

- 4.5 Value Chain/Supply Chain Analysis

- 4.6 Demand and Supply Analysis

- 4.7 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Internet and Smart Phone Penetration

- 5.1.2 Urbanization and Lifestyle Changes

- 5.1.3 Government Initiatives

- 5.2 Market Restraints

- 5.2.1 Poor Infrastructure and Last Mile Delivery

- 5.3 Opportunities

- 5.3.1 Investments in the Logistic Infrastructure

- 5.3.2 Cross-Border E-commerce and Reverse Logistics

- 5.3.3 Collaborations with E-commerce Companies

- 5.4 Porter's Five Forces Analysis

- 5.4.1 Threat of New Entrants

- 5.4.2 Bargaining Power of Buyers/Consumers

- 5.4.3 Bargaining Power of Suppliers

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Service

- 6.1.1 Transportation

- 6.1.2 Warehousing and Inventory Management

- 6.1.3 Value-added Services (Labeling, Packaging )

- 6.2 By Business

- 6.2.1 By B2B

- 6.2.2 By B2C

- 6.3 By Destination

- 6.3.1 Domestic

- 6.3.2 International/Cross Border

- 6.4 By Product

- 6.4.1 Fashion and Appareal

- 6.4.2 Consumer Electronics

- 6.4.3 Home Appliances

- 6.4.4 Furniture

- 6.4.5 Beauty and Personal Care Products

- 6.4.6 Other Products (Toys, Food Products, Etc.)

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 FedEx Corporation

- 7.2.2 Delhivery Pvt. Ltd

- 7.2.3 Ekart Logistics

- 7.2.4 Blue Dart Express Ltd

- 7.2.5 Shadowfax

- 7.2.6 Xpress Bees

- 7.2.7 DTDC

- 7.2.8 Ecom Express Logistics

- 7.2.9 Gati-Kintetsu Express Private Limited

- 7.2.10 DHL

- 7.2.11 Mahindra Logistics Ltd *

- 7.3 Other Companies

8 FUTURE OF THE MARKET

9 APPENDIX

- 9.1 Macroeconomic Indicators (GDP Distribution by Activity, Contribution of Transport and Storage Sector to Economy)?

- 9.2 Insights on Capital Flows (Investments in the Transport and Storage Sector)

- 9.3 E-commerce and Consumer Spending-related Statistics

- 9.4 External Trade Statistics - Exports and Imports, by Product and by Country of Destination/Origin