|

市场调查报告书

商品编码

1644451

东协电子商务物流:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)ASEAN E-commerce Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

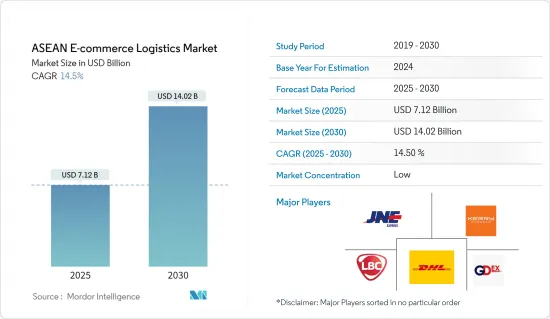

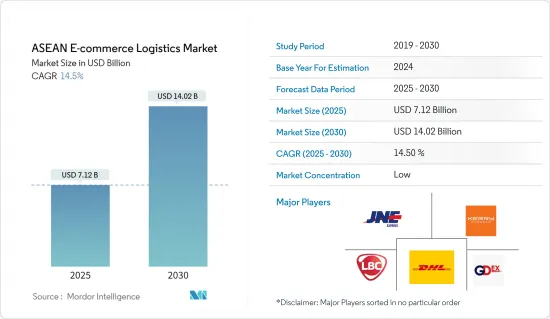

2025年东协电子商务物流市场规模估计为71.2亿美元,预计到2030年将达到140.2亿美元,预测期内(2025-2030年)的复合年增长率为14.5%。

当新冠疫情引发东南亚电子商务热潮时,宅配业者纷纷努力维持并扩大其成功。东南亚的网路零售额从4,950亿美元成长至估计的5.81亿美元。仓库的面积通常为 1,000平方公尺,但对平方公尺或 15,000平方公尺的多层仓库的需求很大。

东南亚有望经历电子商务的快速成长。东南亚五个国家名列全球成长最快的电子商务市场之列,占据前十名的一半。东南亚先前在电子商务方面落后,经常活在中国和日本的阴影下。然而,现在几乎每个国家都拥有行动设备,因此可以存取网路。这五个国家的行动普及率均接近 100%。

据业内人士透露,马来西亚人口为3280万。基准年电子商务销售额与前一年同期比较增15%至63亿美元。最受欢迎的市场是Shopee,其次是与京东合作的本地平台PGMall。最受欢迎的市场是京东、Shopee 和 Lazada。主要产品类别为电子产品和个人护理。

虽然电子商务的快速成长有助于开拓这一市场的物流,但由于地理位置复杂,对于东南亚一些国家来说,这仍然是一个挑战。管理物流营运对于电子商务企业来说是一个挑战。随着全球经济从疫情中復苏、收入水准提高,预计亚洲区域内市场将扩大,同时在电子商务产业的推动下,对快递物流服务的需求也将随之扩大。

东协电商物流市场趋势

电子商务成长推动市场

东南亚电子商务蓬勃发展。该地区的消费趋势为寻求扩张的线上零售商创造了令人兴奋的机会,数位付款领域实现了显着增长。在产品类别中,电子产品在该地区最受欢迎。电视、智慧型手机、笔记型电脑、USB 记忆棒和行动电源是此类别的畅销产品。

同时,服饰、时尚配件、婴儿用品和家具也紧随其后,这些类别的销售额在东南亚市场创下了历史新高。电商平台直播正在东南亚市场迅速扩张。数据显示,马来西亚和新加坡电商平台直播观看时间增加了200%。这一趋势也蔓延到了菲律宾,那里 60% 的品牌正在使用直播销售来吸引更多的客流量。

对社交商务的支援、互联网的广泛应用以及对某些产品类型的需求正在推动东南亚国协电子商务的成长。线上通路对于各国国内零售商来说都代表着庞大的商机。虽然这些国家在基础设施和物流服务方面落后,但透过该管道对产品的需求正在吸引投资者深入市场。

东南亚基础建设支撑市场

全球对东南亚基础设施需求的关注度日益提升,对开发中国家来说既是激励,也是忧虑。七国集团宣布支持2021年美国主导的「重建美好世界」(B3W)倡议,欧盟宣布「全球互联互通欧洲」基础设施战略。

这些倡议旨在解决开发中国家40 兆美元的基础设施缺口,但由于它们似乎与中国的「一带一路」倡议竞争,也引发了地缘政治担忧。东南亚各国政府不希望因投资决策而捲入地缘政治衝突。除了需要大量资金外,东南亚发展中国家的基础建设也因贫困和持续存在的气候变迁威胁而面临更多问题。儘管基础设施已经改善,但还需要做更多的工作。大多数人口无法获得电力、安全的饮用水或安全的道路。

规划不善和交通拥挤的城市会对日常生产力造成影响、浪费燃料并增加压力。此外,国际货币基金组织(IMF)发现,各国因效率低下而浪费了约三分之一的基础建设支出。

同时,到2023年,东南亚基础设施领域的投资将会增加。例如,2023年3月,亚洲基础设施投资银行(亚投行)向塞拉亚东南亚能源转型和数位基础设施基金(该基金)提供了超过1.2亿美元资金。该投资旨在加强该地区的绿色能源转型和技术支援的基础设施发展,同时也有望改善亚洲的跨境数位连结性。此外,AP Moller 集团计划于 2023 年 2 月向南亚和东南亚的各个基础设施平台投资超过 7.5 亿美元。因此,该地区基础设施行业的成长预计将为物流物流服务提供者创造巨大的商机。

东协电商物流产业概况

由于全部区域物流服务的需求正在快速增长,东协电子商务物流市场格局变得分散,迫使企业加强竞争力以抓住机会。因此,国际参与者正在进行策略性投资,在该地区建立物流网络,包括开设新的物流中心和智慧仓库。一些主要的公司有 JNE Express、LBC Express、GD Express、Kelly Express、Ninja Van 和 Best Express。为了保持成本竞争力,开展线上业务的公司更愿意与第三方宅配业者合作,而不是僱用内部送货人员。因此,全球公司都在积极投资,以利用该地区的成长机会。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

- 分析方法

- 研究阶段

第三章执行摘要

第四章 市场动态

- 当前市场状况

- 市场动态

- 驱动程式

- 电子商务领域的成长

- 限制因素

- 复杂产品退货

- 机会

- 增加对数位基础设施的投资

- 驱动程式

- 价值链/供应链分析

- 波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 洞察技术趋势和自动化

- 政府法规和倡议

- 供应链/价值链分析

- 电子商务市场洞察

- 聚焦-电子商务物流的关键枢纽

- 了解逆向/退货物流

- COVID-19 市场影响

第五章 市场区隔

- 按服务

- 运输

- 仓库和库存管理

- 附加价值服务(标籤、包装等)

- 按业务

- B2B(企业对企业)

- B2C(企业对消费者)

- 目的地

- 国内的

- 国际/跨境

- 按产品

- 服装与时尚

- 家电

- 家电

- 家具

- 美容及个人保健产品

- 其他(玩具、食物等)

- 按国家

- 新加坡

- 泰国

- 越南

- 印尼

- 马来西亚

- 菲律宾

- 其他东南亚国协

第六章 竞争格局

- 市场集中度概览

- 公司简介

- Deutsche Post DHL Group

- United Parcel Service

- FedEx Corporation

- Pos Indonesia

- PT Jalur Nugraha Ekakurir(JNE Express)

- PT Global Jet Express(J&T Express)

- J&T Express

- Flash Express

- Best Express

- Kerry Express

- PT Citra Van Titipan Kilat(TIKI)

- Giao Hang Nhanh

- Ninja Van

- LBC Express

- GD Express Sdn Bhd*

- 其他公司

第七章:市场的未来

第 8 章 附录

- 宏观经济指标(按活动分類的 GDP 分布、运输和宅配业的经济贡献)

- 贸易统计 - 按产品、原产国和发送国分類的进出口统计

The ASEAN E-commerce Logistics Market size is estimated at USD 7.12 billion in 2025, and is expected to reach USD 14.02 billion by 2030, at a CAGR of 14.5% during the forecast period (2025-2030).

When COVID-19 caused a surge in e-commerce throughout Southeast Asia, delivery companies struggled to sustain and expand their success. Southeast Asia's internet retail value increased from USD 495 billion to an estimated USD 581 million. Warehouses were typically 1,000 sq. mt. in size, but demand was for multi-level warehouses that could be 10,000 or 15,000 sq. mt.

Southeast Asia is poised for rapid growth in e-commerce. Five Southeast Asian countries are among the world's fastest-growing e-commerce markets, accounting for half of the top ten. Southeast Asia was previously an e-commerce laggard, digitally overshadowed by China and Japan. However, nearly all of them now have mobile devices and, as a result, internet access. The five countries' mobile penetration rates are all close to 100%.

According to industry sources, Malaysia has a population of 32.8 million people. E-commerce sales in the base year were USD 6.3 billion, up 15% from the previous year. Shopee is the most popular marketplace, followed by PGMall, a local platform that collaborates with JD. The most popular marketplaces are JD, Shopee, and Lazada. The main product categories are electronics and personal care.

Even though the rapid growth of e-commerce is driving logistics development in this market, this remains a challenge for a few countries with complex topography in Southeast Asia. Logistics operation management is a challenge for e-commerce businesses. As economies recover from the global pandemic and income levels rise, the intra-Asian market is expected to expand, with a corresponding increase in demand for express logistics services propelled by the thriving e-commerce sector.

ASEAN E-commerce Logistics Market Trends

E-commerce growth is driving the market

Southeast Asia is experiencing a surge in e-commerce. Consumer trends in the region are creating exciting opportunities for online retailers looking to expand due to massive growth in the digital payments sector. Among product categories, electronics are the most popular in the region. TVs, smartphones, laptops, USB drives, power banks, and other items are among the best-sellers in this category.

On the other hand, clothing, fashion accessories, baby products, and furniture are not far behind, with Southeast Asian markets experiencing higher-than-ever sales in these segments. Live streaming for e-commerce platforms is rapidly expanding in the Southeast Asian market. Statistics show live streaming hours on e-commerce platforms increased by 200% in Malaysia and Singapore. The trend spread to the Philippines, where 60% of brands use live selling to attract more customers to their stores.

The support of social commerce, internet penetration, and demand for some product categories drives the growth of e-commerce in ASEAN countries. The online channel has created a huge opportunity for domestic retailers in various countries. Even though these countries lag in infrastructure and logistics services, the demand for products through the channel is luring investors to dive deeply into the market.

Infrastructure development in south-east Asia supporting the market

The growing global interest in Southeast Asia's infrastructure needs has been exciting and concerning for developing countries. The G7 announced its support for the US-led 'Build Back Better World' (B3W) initiative in 2021, while the European Union unveiled its infrastructure strategy, dubbed 'Globally Connected Europe.'

These initiatives aim to address developing countries' USD 40 trillion infrastructure gap, but they also raise geopolitical concerns by appearing to compete with China's Belt and Road Initiative. Southeast Asian governments do not want to be caught in a geopolitical crossfire over investment decisions. Apart from the massive amounts of capital required, infrastructure in developing Southeast Asian countries suffers more due to poverty and the ever-present threat of climate change. While the infrastructure has improved, more is needed. The majority of the population lacks access to electricity, safe drinking water, and safe roads.

Cities with poor planning and traffic congestion alone cost them a daily loss of productivity, wasted fuel, and increased stress. In addition, the International Monetary Fund (IMF) discovered that countries waste roughly one-third of their infrastructure spending due to inefficiencies.

Meanwhile, in 2023, Southeast Asia witnessed an increasing number of investments in the infrastructure sector. For instance, in March 2023, the Asian Infrastructure Investment Bank (AIIB) granted more than USD120 million to the Seraya Southeast Asia Energy Transition and Digital Infrastructure Fund (the Fund). This investment is aimed at enhancing the region's transition to green energy and technology-enabled infrastructure development, which is also expected to improve cross-border digital connectivity within Asia. Moreover, in February 2023, A.P. Moller Group planned to invest more than USD 750 million in various infrastructure platforms in South and Southeast Asia. Thus, the growing infrastructure sector in the region is expected to create a huge opportunity for e-commerce logistics service providers.

ASEAN E-commerce Logistics Industry Overview

The ASEAN e-commerce logistics market landscape is fragmented as the demand for logistics services is growing rapidly across the region, and companies are becoming more competitive to capture this opportunity. As a result, international players are making strategic investments to establish a regional logistics network, such as opening new distribution centers and smart warehouses. Some leading players include JNE Express, LBC Express, GD Express, Kerry Express, Ninja Van, and Best Express. To maintain cost competitiveness, companies that operate online prefer to work with third-party courier providers instead of hiring in-house delivery staff. As a result, global companies are actively investing in targeting growth opportunities in the region.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Method

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS DYNAMICS

- 4.1 Current Market Scenario

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.1.1 Growing E-commerce Sector

- 4.2.2 Restraints

- 4.2.2.1 Complicated Product Returns

- 4.2.3 Opportunities

- 4.2.3.1 Increasing Investments in Digital Infrastructure

- 4.2.1 Drivers

- 4.3 Value Chain / Supply Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Insights into Technological Trends and Automation

- 4.6 Government Regulations and Initiatives

- 4.7 Supply Chain/Value Chain Analysis

- 4.8 Insights into the E-commerce Market

- 4.9 Spotlight - Key Hubs for E-commerce Logistics

- 4.10 Insights into Reverse/Return Logistics

- 4.11 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Service

- 5.1.1 Transportation

- 5.1.2 Warehousing and Inventory Management

- 5.1.3 Value-added Services (Labeling, Packaging, etc.)

- 5.2 By Business

- 5.2.1 B2B (Business-to-Business)

- 5.2.2 B2C (Business-to-Consumer)

- 5.3 By Destination

- 5.3.1 Domestic

- 5.3.2 International/Cross-border

- 5.4 By Product

- 5.4.1 Fashion and Apparel

- 5.4.2 Consumer Electronics

- 5.4.3 Home Appliances

- 5.4.4 Furniture

- 5.4.5 Beauty and Personal Care Products

- 5.4.6 Other Products (Toys, Food Products, etc.)

- 5.5 By Country

- 5.5.1 Singapore

- 5.5.2 Thailand

- 5.5.3 Vietnam

- 5.5.4 Indonesia

- 5.5.5 Malaysia

- 5.5.6 Philippines

- 5.5.7 Rest of the ASEAN

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Deutsche Post DHL Group

- 6.2.2 United Parcel Service

- 6.2.3 FedEx Corporation

- 6.2.4 Pos Indonesia

- 6.2.5 PT Jalur Nugraha Ekakurir (JNE Express)

- 6.2.6 PT Global Jet Express (J&T Express)

- 6.2.7 J&T Express

- 6.2.8 Flash Express

- 6.2.9 Best Express

- 6.2.10 Kerry Express

- 6.2.11 PT Citra Van Titipan Kilat (TIKI)

- 6.2.12 Giao Hang Nhanh

- 6.2.13 Ninja Van

- 6.2.14 LBC Express

- 6.2.15 GD Express Sdn Bhd*

- 6.3 Other Companies

7 FUTURE OF THE MARKET

8 APPENDIX

- 8.1 Macroeconomic Indicators (GDP Distribution by Activity, Contribution of Transport/Courier Industry to Economy)

- 8.2 Trade Statistics - Export and Import Statistics by product and by country of origin/destination