|

市场调查报告书

商品编码

1694029

汽车产业 NOR 快闪记忆体:市场占有率分析、产业趋势与成长预测(2025-2030 年)NOR Flash Memory For The Automotive Industry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

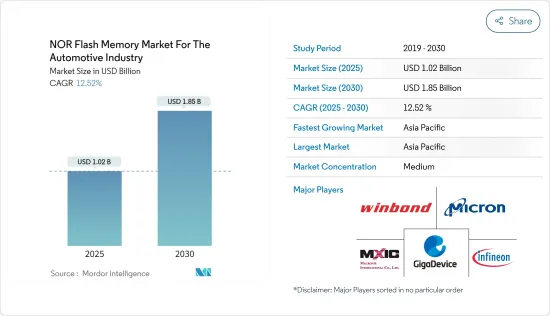

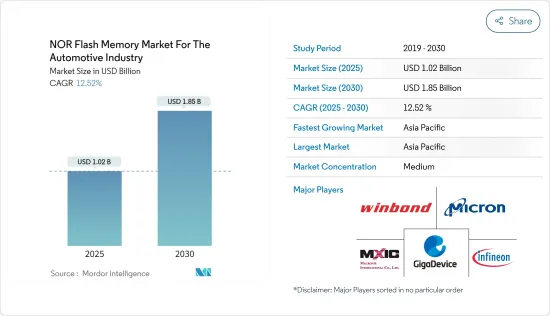

预计汽车产业 NOR 快闪记忆体市场将从 2025 年的 10.2 亿美元成长到 2030 年的 18.5 亿美元,预测期内(2025-2030 年)的复合年增长率为 12.52%。

由于从资讯娱乐到仪表板等多种应用领域的需求不断增长,NOR 快闪记忆体领域呈现出快速的成长率。

关键亮点

- NOR Flash 是一种记忆体,也是一种非挥发性储存技术。它用于需要以 1 位元组为单位写入和读取资料的应用程式。该产品旨在提供比 NAND 更低的记忆体密度,并在最终用户装置中消耗更高的功率。

- 传统汽车技术的发展虽然注重速度、安全性、舒适性和能源效率,但现在的重点正逐渐转向开发更多能够利用新能源的创新车型。作为道路上的移动设备,汽车曾经是独立的实体,与外部设备没有任何互动。

- 然而,随着行动网路的快速发展,这一障碍已经被打破,汽车不再只是道路上孤立的设备。汽车的远端控制,或汽车与设备(如交通灯)之间的通讯,在可预见的未来是可以实现的。智慧汽车的历史可以追溯到1990年代初,当时的瑞士手錶公司Swatch。发明家尼古拉斯·哈耶克对开发高效能、都市化的汽车的想法很感兴趣。他最初将这个想法带给了大众汽车。

- 因此,包括比亚迪、特斯拉、蔚来、小鹏和华为在内的许多电动车製造商都投资了智慧汽车技术,将其视为电动车的关键卖点。最近,2024 年 1 月,中国电动车巨头比亚迪推出了璇玑智慧汽车系统,旨在透过自动停车和语音辨识等功能追赶竞争对手。

- 随着终端用户对 NOR 快闪记忆体的需求增加,研发成本预计也会增加。美光等供应商已投资 150 亿美元在爱达荷州博伊西建立新製造工厂,用于生产记忆体。

- 此外,该公司计划将新製造工厂与美光总部研发中心设在同一地点,以加强技术部署并透过提高营运效率来缩短产品上市时间,从而服务于汽车、资料中心、人工智慧和 5G 记忆体应用等行业。这意味着研究、开发和製造设置成本高昂,从而带来挑战。

- 世界各国政府都采取量化宽鬆措施,印钞票刺激经济。这项倡议在过去几年发挥了作用,但随着通膨担忧的加剧,过去的奖励策略这次可能不再奏效。晶片产业正处于超级週期,即在强劲需求的推动下经历长期扩张。

- 同时,新冠疫情导致从物流到原材料等所有领域成本普遍上涨。俄罗斯突然入侵乌克兰,导致能源和原物料市场大幅波动,进一步加剧通膨压力。例如,由于持续的地缘政治紧张局势、战争和通货膨胀率上升,旺宏电子 2023 年第四季的 NOR 收入与去年同期(2022 年)相比下降了 29%。

NOR快闪记忆体市场趋势

ADAS成为成长最快的应用

- ADAS(进阶驾驶辅助系统)利用科技协助驾驶安全驾驶。透过利用人机介面,ADAS 正在提高车辆和道路的安全性。这些系统依靠感测器和摄影机等自动化技术来识别潜在的障碍物或驾驶员错误并做出适当的反应。 ADAS 使车辆能够了解周围环境并管理转向、煞车和停车等驾驶任务。在ADAS中,NOR Flash记忆体和装置的重要性至关重要。

- 近年来,汽车应用对 NOR 快闪记忆体的需求不断增加。一个典型的例子是 ADAS,其中 NOR Flash 的使用量预计将大幅增加。 NOR 快闪记忆体对于安全关键型系统至关重要,因此在各种 ADAS(进阶驾驶辅助系统)中至关重要。它的非挥发性、可编程性和速度使其成为可靠而高效的选择。透过让主机处理器能够直接从快闪记忆体执行程式码,无需将程式码传输到外部 DRAM。

- ADAS 在汽车产业正经历显着的市场成长。如今,许多 ADAS 应用都使用摄影机(尤其是倒车摄影机)来帮助驾驶员识别附近的危险。先进的感测摄影机可实现更先进的功能,包括自动避碰、车道变换和停车辅助。感测摄影机比观看摄影机需要更复杂的处理,因此高效的 SoC 对于维持这项先进技术至关重要。随着程式规模的不断扩大,对于兼具高密度和高性能的NOR快闪记忆体的需求也不断增长。

- ADAS 的整合正在推动对乘用车安全性和舒适性的巨大需求。这一成长主要受到美国、日本、中国和德国等已开发国家政府法规的推动,这些法规要求实施 ADAS 以确保乘客安全。

- 此外,自动驾驶汽车的日益普及也推动了市场扩张。例如,英特尔预测,到 2030 年,全球汽车销售将超过 1.014 亿辆,预计自动驾驶汽车将占同年汽车註册量的 12% 左右。与此转变同步,支援 ADAS(进阶驾驶辅助系统)出现所必需的工具和储存设备(如 NOR Flash 产品)也取得了重大发展。

- 亚太地区、北美和欧洲的许多国家都已实施法规,要求在车辆中整合各种 ADAS 技术,以减少道路事故。例如,欧盟推出了「零事故愿景」计划,旨在到2050年消除道路交通事故死亡人数,到2030年将伤亡人数减少50%。欧盟已强制要求使用ADAS、自动紧急煞车等基本安全功能,市场前景庞大。

中国占主要市场占有率

- 中国汽车製造业的成长推动了汽车产业对 NOR 快闪记忆体的需求。国内汽车厂商数量的增加以及汽车投资的不断增长,使得汽车采用先进电子系统的趋势日益明显。这种趋势对 NOR 快闪记忆体提出了更高的要求,它有助于能源管理、提高系统可靠性并实现汽车电子产品的紧凑设计。

- 同样,国际能源总署 (IEA) 预测,在净零情境下,到 2030 年电动车 (EV) 销量将占汽车销量的 65% 左右。为实现此目标,2023年至2030年间,电动车销量需要以每年约25%的速度成长。到2022年,中国将占全球电动车新註册量的近60%。在中国,电动车在国内汽车总销量中的占比预计将从2021年的16%增长到2022年的29%,超过2025年达到20%的全国目标。此外,到2023年,中国电动车销量将达到800万辆。

- 根据中国工业协会预测,2022年中国汽车销量将达到近2,690万辆,与前一年同期比较去年同期成长2.1%。这一成长标誌着2022年销售额连续第二年成长。随着汽车销售的成长,对具有先进功能的汽车的需求也在增长,这反过来又推动了对NOR快闪记忆体的需求。

- 根据OICA称,汽车产量将从2019年的5%成长到2022年的7%。中国政府正在向电动车製造商提供财政奖励,以鼓励他们使用电动车。纯电动车,单次充电可行驶 400 公里以上,可获得 12,600 元人民币(约 2,000 美元)的补贴。续航里程300-400公里的电动车将获得9,100元人民币(约1,400美元)的补贴。

- 车用NOR Flash记忆体广泛应用于智慧网联、马达、电池、电控系统、智慧驾驶座、新能源汽车ADAS等领域。

- 无人商店配备了先进的电子系统和技术,并依靠 NOR 快闪记忆体实现多种用途,包括管理和储存感测器资料以及为即时决策演算法提供支援。

- 例如,2024年3月,提供人工智慧和网路技术的公司百度在武汉推出了名为Apollo Go的24/7机器人计程车服务,代表了中国的自动驾驶产业。此举是百度扩大自动驾驶叫车服务平台策略努力的一部分。因此,这些功能需要NOR快闪记忆体来存储软体应用程序,从而增加了对NOR快闪记忆体的需求。

NOR快闪记忆体产业概况

汽车产业的 NOR 快闪记忆体市场处于半固体,主要企业包括华邦电子股份有限公司、旺宏电子国际、英飞凌科技股份公司、美光科技公司和兆易创新半导体公司。该市场的参与企业正在透过伙伴关係和收购来加强其产品供应并获得可持续的竞争优势。

- 2024年3月-聚辰科技宣布推出最新的Nor Flash功能安全解决方案,为汽车产业带来一场技术革命。 Giantec 最新的 Nor Flash 功能安全解决方案采用发达的技术和严格的品管标准,以实现更高的安全性和可靠性。

- 2023 年 9 月-旺宏电子国际宣布其 OctaFlash 记忆体系列已获得 SGS TUV Saar 颁发的 ISO 26262 ASIL D(汽车安全完整性等级)认证。此次 ISO 26262 ASIL D 认证体现了旺宏电子的持续成功,OctaFlash 已发展成为汽车市场强大的快闪记忆体解决方案,在最大限度地提高汽车功能安全性方面发挥关键作用。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 科技趋势

- 工业供应链分析

- 宏观趋势如何影响市场

第五章市场动态

- 市场驱动因素

- 智慧汽车的演变

- 研发和製造高成本

第六章市场区隔

- 按密度

- 低密度(32MB或更少)

- 中等密度(32MB至128MB)

- 高密度(128MB 或更大)

- 按应用

- ADAS

- 资讯娱乐

- 仪表丛集等

- 按地区

- 美洲

- 欧洲

- 日本

- 中国

- 拉丁美洲

- 中东和非洲

第七章竞争格局

- 公司简介

- Winbond Electronics Corporation

- Macronix International Co. Ltd

- Infineon Technologies AG

- Micron Technology Inc.

- Gigadevice Semiconductor Inc.

- Giantec Semiconductor Co.,ltd

第 8 章 供应商排名分析

第九章 市场机会与未来趋势

The NOR Flash Memory Market For The Automotive Industry is expected to grow from USD 1.02 billion in 2025 to USD 1.85 billion by 2030, at a CAGR of 12.52% during the forecast period (2025-2030).

The NOR flash memory sectors are witnessing a rapid growth rate due to the demand growth in multiple applications, from infotainment to instrument clusters.

Key Highlights

- NOR flash is a memory and one of the types of non-volatile storage technologies. It is used for applications where individual bytes of data need to be written and read. The products are built to offer lower memory densities compared to NAND and enhance the power consumption in end-user devices.

- Conventional automotive technology development usually emphasizes speed, safety, comfort, and energy-saving ability; however, the current focus has gradually shifted to developing a more innovative model capable of using new energy. As a mobile device on the road, the car used to be a separate individual without any interaction with any external device.

- However, with the rapid development of mobile networks, this barrier has broken through, and the vehicle is no longer simply an isolated device on the road. The remote control of a car, or even the communication between vehicles or cars and devices (such as traffic signals,) is in the foreseeable future. The story of the Smart Car can be traced back to the early 90s and the Swiss watch company Swatch, where inventor Nicolas Hayek was interested in the idea of developing an efficient and urbanized vehicle. He initially brought the idea to Volkswagen.

- Thus, many EV manufacturers, such as BYD, Tesla, Nio, Xpeng, and Huawei, have been investing in smart car technologies, seeing them as major selling points for their EVs. Recently, in January 2024, Chinese electric vehicle (EV) giant BYD launched its Xuanji smart car system, seeking to catch up with rivals with functions such as automated parking and voice recognition.

- Research and development costs are expected to increase with the growing end-user requirements for NOR flash memory. Vendors like Micron have invested USD 15 billion in constructing a new fabrication facility for memory manufacturing in Boise, Idaho.

- In addition, the company is also planning to co-locate the new manufacturing fab with Micron's R&D center at the company's headquarters to enhance the technology deployment and improve time to market with operational efficiency to cater to industries like automotive, data centers, and memory applications in artificial intelligence and 5G. This indicates the costly research, development, and fabrication setup and drives the challenges.

- Governments worldwide have been printing money and adopting quantitative easing measures to stimulate economies. This has worked over the past few years, but with looming inflation concerns, all those stimulus measures in the past might not work this time. The chip industry is in a super cycle, a period of prolonged expansion driven by robust demand.

- At the same time, COVID-19 disruptions have brought wide-ranging rises in the cost of everything from logistics to raw materials. The sudden outbreak of the Russian invasion of Ukraine has sparked huge fluctuations in energy and materials markets, further adding to inflationary pressure. For instance, Macronix International Co., Ltd. NOR revenue in Q4 2023 declined by 29% compared to the same period in the previous year(2022) due to ongoing geopolitical tensions, war, and increased inflation.

NOR Flash Memory Market Trends

ADAS to be the Fastest Growing Application

- Advanced driver-assistance systems (ADAS) utilize technologies to aid drivers in safely operating a vehicle. By utilizing a human-machine interface, ADAS enhances both car and road safety. These systems rely on automated technology, including sensors and cameras, to identify potential obstacles or driver mistakes and react appropriately. ADAS empowers a vehicle to understand its environment and manage driving tasks like steering, braking, parking, etc. The importance of NOR Flash memory and devices is crucial in ADAS.

- The need for NOR flash memory in automotive applications has increased recently. A prime example of this is ADAS, where the utilization of NOR Flash is projected to increase significantly. NOR flash memory is crucial in various advanced driver-assistance systems (ADAS) as it is integral to safety-critical systems. Its non-volatile nature, programmability, and speed make it a dependable and efficient choice. Allowing the host processor to run code directly from the flash memory eliminates the need to transfer it to an external DRAM.

- ADAS has experienced a significant market expansion in the automotive industry. Currently, numerous ADAS applications use cameras, particularly backup cameras, to aid drivers in recognizing nearby dangers. Advanced sensing cameras offer even more sophisticated features, such as automated collision avoidance, lane changing, parking assistance, etc. Since sensing cameras necessitate more intricate processing than viewing cameras, highly efficient SoCs will be essential to sustain this advanced technology. The need for NOR Flash memory that offers both high density and high performance will persistently rise alongside the expansion in program size.

- The rise in demand for safety and comfort in passenger cars due to the integration of ADAS has been significant. This growth is primarily fueled by government regulations in developed countries like the United States, Japan, China, and Germany mandating the implementation of ADAS for passenger safety.

- Moreover, the increasing popularity of autonomous vehicles is also driving market expansion. For example, Intel predicts global car sales will exceed 101.4 million units by 2030, with autonomous vehicles expected to represent around 12% of car registrations by the same year. Alongside this shift, there has been a noticeable advancement in the development of essential tools and memory devices like NOR flash products to support the emergence of advanced driver assistance systems (ADAS).

- Many countries in Asia Pacific, North America, and Europe have enforced rules mandating the integration of different ADAS technologies in cars to reduce road accidents. For instance, the European Union has introduced Vision Zero, a project to eliminate road fatalities by 2050. The governing body aims to decrease injuries and deaths by 50% by 2030. It has made it compulsory to include essential safety features like ADAS and automatic emergency braking, creating substantial market prospects.

China to Hold Major Market Share

- The demand for NOR flash memory in China's automotive industry is fueled by the country's growing automotive manufacturing sector. The increasing number of domestic automotive manufacturers and rising investments in automobiles are leading to the trend of incorporating advanced electronic systems into automobiles. This trend results in a higher requirement for NOR flash memory, which aids energy management, improves system dependability, and allows for compact designs in automotive electronics.

- Similarly, the International Energy Agency (IEA) has projected that electric vehicle (EV) sales will make up approximately 65% of total car sales by 2030 in the Net Zero Scenario. To achieve this, there should be an annual growth rate of around 25% in EV sales from 2023 to 2030. China accounted for nearly 60% of all new electric car registrations worldwide in 2022. Within China, the proportion of electric cars in total domestic car sales increased from 16% in 2021 to 29% in 2022, surpassing the national target of a 20% sales share by 2025. Also, in 2023, Eight million electric vehicles were sold in China.

- According to the CAAM (China Association of Automobile Manufacturers), in 2022, the total number of vehicle sales in China reached nearly 26.9 million, representing a 2.1% growth from the year before. This growth indicates the second consecutive year of increasing sales in 2022. As automotive sales increase, the demand for automobiles with advanced features grows, consequently driving the demand for NOR flash memory.

- According to OICA, the motor vehicle production grew from 5% in 2019 to 7% in 2022. The Chinese government offers financial incentives to electric vehicle manufacturers to encourage their use. Vehicles that are completely electric and can travel over 400 km on a single charge qualify for subsidies of RMB 12,600 (around USD 2000). Electric vehicles ranging from 300-400 km are eligible for subsidies of RMB 9100 (approximately USD 1400).

- The automotive NOR flash memories are extensively utilized in intelligent networking, motors, batteries, electronic control systems, intelligent cockpits, and ADAS for new energy vehicles.

- Autonomous vehicles incorporate advanced electronic systems and technologies that rely on Nor flash memory for various purposes, such as managing and storing the sensor data and facilitating real-time decision-making algorithms.

- For instance, in March 2024, Baidu Inc., a provider of AI and internet technologies, introduced a 24/7 robot taxi service called Apollo Go in Wuhan, representing China's autonomous driving industry. This move is part of Baidu's strategic efforts to expand its autonomous ride-hailing service platform. Thus, these features require NOR flash memory for storing software applications, contributing to the demand for NOR flash memory.

NOR Flash Memory Industry Overview

The NOR flash memory market for the automotive industry is semi-consolidated with the presence of significant players like Winbond Electronics Corporation, Macronix International Co. Ltd, Infineon Technologies AG, Micron Technology Inc., and Gigadevice Semiconductor Inc. Players in the market are adopting partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- March 2024 - Giantec announced the launch of the latest Nor Flash functional safety solution, bringing a technological revolution to the automotive industry. Giantec's latest Nor Flash functional safety solution incorporates developed technology and strict quality control standards for higher safety and reliability.

- September 2023 - Macronix International Co. Ltd announced that its OctaFlash memory line has received ISO 26262 ASIL D (Automotive Safety Integrity Level) certification from SGS TUV Saar, ensuring makers of automotive electronic systems that OctaFlash meets the highest level of safety in automotive electronics. This ISO 26262 ASIL D certification reflects how Macronix is building on our success both in OctaFlash's evolution as a powerful Flash-storage solution for the automotive market and in playing a key role in maximizing the functional safety of vehicles.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Trends

- 4.4 Industry Supply Chain Analysis

- 4.5 Impact of Macro Trends in the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Evolution of Smart Vehicles

- 5.1.2 High Cost of R&D and Fabrication

6 MARKET SEGMENTATION

- 6.1 By Density

- 6.1.1 Low (Less Than 32mb)

- 6.1.2 Medium (32mb to 128mb)

- 6.1.3 High (> 128mb)

- 6.2 By Application

- 6.2.1 ADAS

- 6.2.2 Infotainment

- 6.2.3 Instrument Cluster and Other

- 6.3 By Geography

- 6.3.1 Americas

- 6.3.2 Europe

- 6.3.3 Japan

- 6.3.4 China

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Winbond Electronics Corporation

- 7.1.2 Macronix International Co. Ltd

- 7.1.3 Infineon Technologies AG

- 7.1.4 Micron Technology Inc.

- 7.1.5 Gigadevice Semiconductor Inc.

- 7.1.6 Giantec Semiconductor Co.,ltd