|

市场调查报告书

商品编码

1692113

NOR快闪记忆体:市场占有率分析、产业趋势与统计资料、成长预测(2025-2030)NOR Flash Memory - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

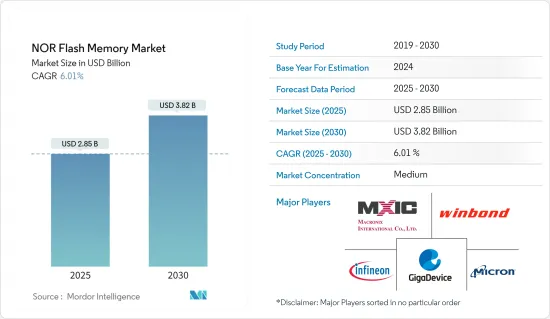

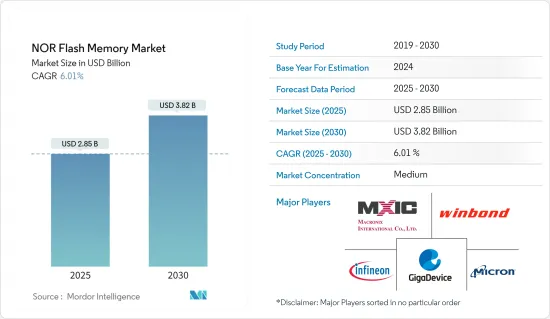

NOR快闪记忆体市场规模预计在2025年为28.5亿美元,预计到2030年将达到38.2亿美元,预测期内(2025-2030年)的复合年增长率为6.01%。

就出货量而言,预计将从2025年的50亿台成长到2030年的86.7亿台,预测期间(2025-2030年)的复合年增长率为11.63%。

由于汽车、家电等各种应用的需求不断增长,NOR 快闪记忆体领域呈现快速成长率。 NOR Flash 是一种记忆体,也是一种非挥发性储存技术。

主要亮点

- 消费性电子设备早已成为现代生活方式的重要组成部分。过去两年,受智慧型手机、智慧电视和智慧家电需求成长的推动,全球消费性电子市场重新获得成长动力。

- 然而,由于通货膨胀上升、个人消费下降以及消费者前景恶化,预计 2023 年全球智慧型手机需求将较 2022 年显着下降,预计将对 NOR 快闪记忆体市场造成拖累。由于库存和需求增加,NOR Flash 平均售价大幅下降。由于经济成长放缓、地缘政治紧张局势加剧以及产业季节性波动,终端用户消费性电子市场需求疲软,导致下游库存问题蔓延至上游记忆体晶片供应商,影响产品需求和价格。

- 相反,由于5G智慧型手机需求的增加以及各国5G网路连线的扩展,预计2024年市场将略有復苏。 5G智慧型手机的广泛应用和全球资料中心的增加将推动市场成长。考虑到快闪记忆体的性能及其对消费市场的吸引力,很容易看出需求为何增长如此迅速。

- 随着终端用户对 NOR 快闪记忆体的需求增加,研发成本预计也会增加。美光等供应商宣布将投资 150 亿美元在爱达荷州博伊西市建造一个新的製造工厂,用于生产记忆体。

- 此外,该公司计划将新製造工厂与其总部研发中心设在同一地点,以加强技术部署、提高营运效率并加快产品上市时间。这将服务于汽车、资料中心、人工智慧和5G记忆体应用等行业。这对研发和製造过程来说意味着昂贵的设置,带来了挑战。

- 展望未来,全球经济环境依然高度不确定性,记忆体产业在触及经济週期底部后正等待反弹。因此,NOR快闪记忆体的主要供应商正在努力加强研发并收益占有率份额,因为地缘政治紧张局势和低迷的市场预计不会改变这些趋势的方向。

NOR快闪记忆体市场趋势

消费性电子终端用户产业预计将占据主要市场占有率

- 目前,消费性电子产品领域是市场上最突出的领域之一。 NOR Flash 通常部署为嵌入式设备,用于在许多便携式消费产品(如相机、可穿戴设备和行动电话)中运行程式码。因此,近年来这些产品的使用量大幅增加,推动了所研究市场的需求。

- 例如,根据2023年美国消费者技术所有权和市场潜力研究,儘管经济环境复杂,但仍有约84%的美国家庭计划在未来12个月内购买科技产品,其中行动电话和无线技术产品是消费者想要购买的科技产品类别的领先者。

- 此外,智慧型手机在美国家庭中无处不在,37%的家庭计划在未来12个月内购买新智慧型手机,其中99%是重复购买者,这使得美国成为一个饱和但忠诚的科技市场。因此,到2023年,全球行动电话用户数量将从上一年的约86亿增加到近89亿。根据通讯(ITU)的数据,2019年行动上网用户数首次超过80亿。

- 5G的商业化将会在所研究的市场中引发全球趋势。例如,向 5G 的重大转变将加速对先进行动装置的需求。根据爱立信发布的行动报告,预计到2029年底,5G行动用户数将达到53亿人。

- 此外,2023年第三季将新增1.63亿5G用户,总合达到14亿人。预计此类事件也将推动对消费性电子产品的需求,从而促进所研究市场的成长。

中国可望占主要市场占有率

- 中国便携式电子设备的成长趋势以及物联网等先进技术的渗透是推动NOR快闪记忆体市场成长的一些因素。中国电销量的成长,带动了NOR Flash市场的发展。

- 根据国务院介绍,近年来我国家电业稳定成长。 2023年前七个月,电脑、通讯和电子製造业利润增加至2,763.2亿元人民币(约383.9亿美元)。预计2023年行动电话产量将达8.1亿部,其中智慧型手机产量为5.93亿部。

- 工业和资讯化部和财政部表示,中国计划增加高端电子产品供应,以扩大消费,并提振经济。中国力求2024年,5G行动电话出货量占国内行动电话市场的85%以上,将鼓励NOR快闪製造商自主开发,并支持国家经济。

- 国内消费需求旺盛,进一步刺激了电子製造业在中国的集中度,为中国物联网产品的大幅发展奠定了基础。主导大力投入基础建设,为中国的物联网发展带来了巨大利益。例如,中国公布了发展新型物联网基础设施的三年规划(2021-2023),目标是到2023年在主要城市完成新型物联网基础设施建设。这些努力预计将促进物联网智慧设备的成长,从而推动市场成长。

- 中国凭藉国内市场的稳定表现和巨大的潜力,被公认为汽车和运输业的领导者之一。除了巩固其作为全球最大汽车製造商的地位之外,中国工业信部预测到2025年国内汽车产量将达到3,500万辆。此外,基于中国汽车物流市场预测,预计到2025年,纯电动车在新能源乘用车类别中的市场占有率将达到84%,从而带来诸如将ADAS融入纯电动车等重要技术突破。

- 根据中汽协统计,2023年8月中国新能源车销量为84.6万辆,其中乘用车80.8万辆,商用电动车3.9万辆。其中,纯电动车(BEV)保有量为55.9万辆,插电式混合动力车(PHEV)保有量为24.8万辆。预计中国将在2024年达到智慧驾驶系统应用的阈值。随着自动驾驶等级的采用,汽车更换週期预计将变得更短。密集的消费者教育和媒体曝光正在加速中国消费者向智慧驾驶的转变,供应量可能会增加。

NOR快闪记忆体市场概况

NOR快闪记忆体市场半固体,由英飞凌、美光科技、北京兆易创新科技股份有限公司和华邦电子股份有限公司等大型供应商主导。较高的进入门槛使得新进业者难以进入市场,但现有供应商正在投资创新新产品的研发。

- 2024 年 4 月:美光科技公司宣布推出最新创新产品-美光串列 NOR 快闪记忆体。该记忆体旨在提高从汽车、工业到家用电子电器等各种应用的性能和可靠性。 Micron 串行 NOR 快闪记忆体具有更快的读写速度、更大的资讯储存容量和更高的耐用性。这项进步使其能够用于那些必须快速可靠地储存和搜寻资料的苛刻应用。

- 2024年2月,兆易创新半导体与EKOM Elektronik签署协议,销售该公司的产品。为了满足土耳其市场的需求并促进电子产业的健康发展,此次伙伴关係将把兆易创新的产品线扩展到能够实现必要突破的领域。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

- 宏观趋势如何影响市场

第五章市场动态

- 市场驱动因素

- 数位化不断提高以及以数据为中心的应用程式的出现

- 智慧汽车的演变

- 市场限制

- 研发和製造成本高

- 替代方案的可用性

第六章市场区隔

- 按类型

- 串行NOR快闪记忆体

- 并行NOR快闪记忆体

- 按最终用户应用程式

- 消费性电子产品

- 通讯设备

- 车

- 工业的

- 其他用途

- 按地区

- 美洲

- 欧洲

- 日本

- 中国

- 世界其他地区

- 按密度

- 2Mbit 以下的 NOR

- < 4Mbit (> 2MB) NOR

- 高达 8Mbit(超过 4MB)NOR

- 16Mbit或更少(超过8MB)NOR

- 高达 32Mbit(超过 16MB)NOR

- 高达 64 Mbit(超过 32 MB)NOR

- 其他密度

第七章竞争格局

- 公司简介

- Infineon Technologies AG

- Micron Technology Inc.

- GigaDevice Semiconductor Inc.

- Macronix International Co. Ltd

- Winbond Electronics Corporation

- Integrated Silicon Solution Inc.

- Microchip Technology Inc.

- Renesas Electronics Corporation

- Elite Semiconductor Microelectronics Technology Inc.

- Wuhan Xinxin Semiconductor Manufacturing Co. Ltd(XMC)

第 8 章供应商市场占有率

第九章投资分析

第十章 市场机会与未来趋势

第十一章定价分析

The NOR Flash Memory Market size is estimated at USD 2.85 billion in 2025, and is expected to reach USD 3.82 billion by 2030, at a CAGR of 6.01% during the forecast period (2025-2030). In terms of shipment volume, the market is expected to grow from 5.00 billion units in 2025 to 8.67 billion units by 2030, at a CAGR of 11.63% during the forecast period (2025-2030).

The NOR flash memory sectors are witnessing a rapid growth rate due to their demand growth in various applications from automotive to consumer electronics. NOR flash is a memory and one of the types of non-volatile storage technologies.

Key Highlights

- Consumer electronics devices have long been an integral part of modern lifestyles. Driven by the increasing demand for smartphones, smart TVs, and smart home appliances, the global consumer electronics market has regained its momentum over the past two years.

- However, the worldwide smartphone demand observed a noteworthy decline in 2023 compared to 2022 due to ongoing inflation, decreased consumer spending, and a weaker consumer outlook, which is expected to hamper the NOR flash memory market. The ASP of NOR flash declined significantly owing to growing stockpiles and demand. Due to weak demand in the end-user consumer electronics market as a result of sluggish economic growth, rising geopolitical tensions, and seasonal fluctuations in the industry, downstream inventory issues trickled to upstream memory chip suppliers, impacting both product demand and prices.

- On the contrary, the market is expected to recover slightly in FY 2024 owing to increased demand for 5G smartphones and growing 5G network connectivity across the nations. The increased proliferation of 5G smartphones and an increasing number of data centers worldwide drive the market's growth. Given the capabilities and attractiveness of flash memory to the consumer market, it is clear why demand for it has rapidly grown.

- Research and development costs are anticipated to increase with the growing end-user requirements for NOR flash memory. Vendors such as Micron announced an investment of USD 15 billion to build a new fabrication facility for memory manufacturing in Boise, Idaho.

- Moreover, the company plans to co-locate the new manufacturing fab with Micron's R&D center at its headquarters to enhance technology deployment and improve time to market with operational efficiency. This will cater to industries like automotive, data centers, and memory applications in artificial intelligence and 5G. This indicates the costly setup for the research and development and fabrication process and drives the challenges.

- Looking forward to the future, the global economic environment is still highly uncertain, and the memory industry is waiting to bounce back after bottoming out in the business cycle. Thus, major suppliers of NOR flash memory are working toward strengthening their R&D and increasing their revenue share for automotive products, especially EVs, as the direction of these trends is not expected to change due to geopolitical tensions or market downturns.

NOR Flash Memory Market Trends

Consumer Electronics End-user Industry Segment is Expected to Hold Significant Market Share

- Currently, the consumer electronics segment is one of the most prominent segments in the market. NOR flash is often deployed as an embedded device for code execution in many portable consumer products, such as cameras, wearables, or mobile phones. As such, the significant growth in the usage of these products in recent years is driving the demand for the market studied.

- For instance, according to the 2023 US Consumer Technology Ownership and Market Potential Study, despite complex economic times, about 84% of US households make plans to purchase tech products in the next 12 months, with mobile and wireless tech products leading the categories of tech products that consumers want to buy.

- Moreover, smartphones are omnipresent in US households, and 37% of households plan to buy a new smartphone in the next 12 months, out of which 99% will be repeat buyers, indicating a saturated but loyal technology market. As a result, in 2023, there were almost 8.9 billion mobile phone subscriptions worldwide, up from around 8.6 billion the previous year. The number of subscriptions exceeded 8 billion for the first time in 2019, according to the International Telecommunication Union (ITU).

- The commercialization of 5G proliferates global trends in the market studied. For instance, the significant transition toward 5G accelerates the demand for advanced mobile devices. According to the Ericsson Mobility Report released, 5G mobile subscriptions are anticipated to reach 5.3 billion by the end of 2029.

- Further, during the third quarter of 2023, 163 million 5G subscriptions were added to make up a total of 1.4 billion. Such events are also expected to drive the demand for consumer electronics, thereby boosting the growth of the market studied.

China is Expected to Hold a Major Market Share

- The rising trend of portable electronic devices and the penetration of advanced technologies, such as IoT, in China are among the factors driving the growth of the NOR flash memory market. The increase in consumer electronics sales in China is escalating the development of the NOR flash market.

- According to the State Council, China's consumer electronics industry has grown steadily over the past few years. In the first seven months of 2023, computer, communications, and electronic device manufacturers saw their profits rise to CNY 276.32 billion (about USD 38.39 billion). In 2023, mobile phone production reached 810 million units, including 593 million smartphones.

- The Ministry of Industry and Information Technology and the Ministry of Finance stated that China plans to surge the supply of high-end electronic devices to increase consumption and strengthen the economy. China will strive to ensure that 5G mobile phone shipments account for over 85% of the domestic mobile phone market by 2024. These initiatives will encourage NOR Flash memory manufacturers to develop in-house and support the country's economy.

- The concentration of electronics manufacturing in China has laid a foundation for the substantial development of IoT products in the country, further stimulated by high domestic consumer demand. Heavy state-led spending on enabling infrastructure has a great advantage on IoT development in China. For instance, China announced a three-year plan for new IoT infrastructure development (2021-2023), aiming to complete new IoT infrastructure in major cities by 2023. These initiatives are expected to fuel the growth of IoT-enabled smart devices and facilitate the market's growth.

- China has been recognized as one of the leaders in the automobile and transport industry due to the consistent performance of the national market and its immense potential. In addition to strengthening its position as the world's largest car manufacturer, the Chinese Ministry of Industry and Information Technology projects that domestic vehicle production will reach 35 million by 2025. Furthermore, it is projected that by 2025, the market share of BEVs in a new energy passenger car category will be 84% and lead to significant technical developments, such as integrating ADAS into BEVs based on projections from the Chinese automotive logistics market.

- According to CAAM, China's new energy vehicle sales amounted to 846,000 units, 808,000 of which were passenger EVs, and 39,000 were commercial electric vehicles during August 2023. Sales of BEVs and PHEVs were 559,000 and 248,000 vehicles, respectively. China is expected to have reached a threshold for adopting smart driving systems by 2024. Increased adoption of AD levels could shorten the vehicle replacement cycle, which is scheduled to be shorter. Intensive consumer education and media exposure, which will accelerate the shift of Chinese consumers toward intelligent driving, is likely to accompany a rise in supply.

NOR Flash Memory Market Overview

The NOR flash memory market is semi-consolidated, with major vendors such as Infineon, Micron Technology, GigaDevice Semiconductor (Beijing) Inc., and Winbond Electronics Corporation dominating it. High entry barriers make it tough for new players to enter the market, but existing vendors are investing in the research and development of new and innovative products.

- April 2024: Micron Technology Inc. announced the launch of its latest innovation, the Micron Serial NOR Flash Memory. It is designed to improve the performance and reliability of various applications, e.g., from automotive and industrial to consumer electronics. Micron Serial NOR Flash Memory offers substantial reading and writing speed improvements, more information storage capacity, and improved endurance. This advancement allows it to be used for demanding applications in which data is stored and retrieved quickly and reliably.

- February 2024: GigaDevice Semiconductor signed an agreement with EKOM Elektronik to distribute its products. To meet the needs of Turkey's market and contribute to healthy growth in the electronics sector, this partnership would extend GigaDevice's product line into areas where it can make necessary breakthroughs.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of Macro Trends in the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Digitalization and Emergence of Data-centric Applications

- 5.1.2 Increasing Evolution of Smart Vehicles

- 5.2 Market Restraints

- 5.2.1 High Cost of R&D and Fabrication

- 5.2.2 Availability of Substitutes

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Serial NOR Flash

- 6.1.2 Parallel NOR Flash

- 6.2 By End-user Application

- 6.2.1 Consumer Electronics

- 6.2.2 Communication

- 6.2.3 Automotive

- 6.2.4 Industrial

- 6.2.5 Other End-user Applications

- 6.3 By Geography

- 6.3.1 Americas

- 6.3.2 Europe

- 6.3.3 Japan

- 6.3.4 China

- 6.3.5 Rest of the World

- 6.4 By Density

- 6.4.1 2 MEGABIT and LESS NOR

- 6.4.2 4 MEGABIT and LESS (>2 MB) NOR

- 6.4.3 8 MEGABIT and LESS (>4 MB) NOR

- 6.4.4 16 MEGABIT and LESS (>8 MB) NOR

- 6.4.5 32 MEGABIT and LESS (>16 MB) NOR

- 6.4.6 64 MEGABIT and LESS (>32 MB) NOR

- 6.4.7 Other Densities

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Infineon Technologies AG

- 7.1.2 Micron Technology Inc.

- 7.1.3 GigaDevice Semiconductor Inc.

- 7.1.4 Macronix International Co. Ltd

- 7.1.5 Winbond Electronics Corporation

- 7.1.6 Integrated Silicon Solution Inc.

- 7.1.7 Microchip Technology Inc.

- 7.1.8 Renesas Electronics Corporation

- 7.1.9 Elite Semiconductor Microelectronics Technology Inc.

- 7.1.10 Wuhan Xinxin Semiconductor Manufacturing Co. Ltd (XMC)