|

市场调查报告书

商品编码

1521635

全球磁性市场:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Magnetics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

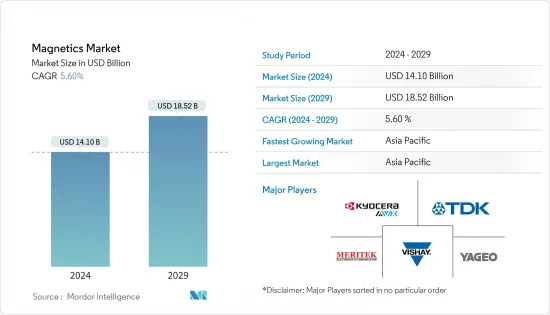

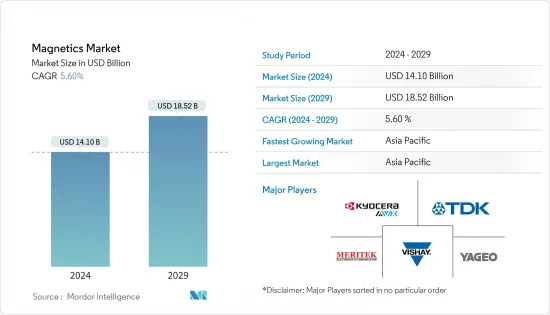

预计2024年全球磁材市场规模将达141亿美元,2024年至2029年复合年增长率为5.60%,2029年将达到185.2亿美元。

磁性元件广泛应用于先进工业设备和消费性电器产品,从冰箱、电视到通讯设备。磁性元件在汽车、仪表板显示器电压监控、内部和外部照明、气候控制以及其他系统电源方面发挥关键作用。这些零件用于行动电话、电脑、通讯系统和其他电子产品。

主要亮点

- 全球对 HPC 和 AI 的需求爆炸性成长。同样,对智慧型手机、个人电脑和基础设施的需求保持稳定。智慧型手机销售量预计将在 2024 年大幅復苏,从而推动对这些磁性元件的需求。行动电话中使用高频电感,帮助您快速稳定地上网。此外,随着行动通讯网路的进步,智慧型手机中安装的电感器数量显着增加。电感器增强了智慧型手机的各种功能,例如彩色液晶显示器和延长的电池寿命。

- 智慧型手机OEM将在 2024 年透过生成式 AI 功能和额外的储存容量来增强其支援人工智慧的智慧型手机,从而产生对更长电池寿命的需求。此外,随着技术的进步,消费者更喜欢具有先进技术的产品而不是旧设备,这推动了智慧型手机的销售。

- 全球对基于国家电网连接(超级电网)和直流电的再生能源来源(例如燃料电池、风力发电和太阳能发电)的需求不断增长,对磁性元件的需求也在增长。

- 传统上,变压器是由铁製成的,但随着材料的发展,硅钢、非晶质钢、铁氧体陶瓷等材料由于其高渗透性已开始用作变压器的铁芯材料。同样,铁或铁氧体等磁性材料用作电感器和 EMI 滤波器的核心材料,铜通常用于线圈。

- 目前,随着自动驾驶技术和ADAS技术的快速发展,汽车配备了雷达、摄影机、光达等众多感测器,磁性元件也随之快速成长。随着汽车产业的不断发展,主要供应商不断投资于产品开发和改进,以满足消费者的需求。

- 例如,2024 年 1 月,TDK 公司推出了 KLZ2012-A 系列新型电感器,为汽车音讯汇流排 (A2B) 应用提供高耐用性、宽工作范围和高电感容差。量产将于 2024 年 1 月开始。 A2B 技术的开发是为了减轻各种通讯总线电缆线束的重量,最终目标是提高车辆燃油效率。

磁性市场趋势

工业用途(马达/UPS)推动成长

- 工业马达是一种将电能转换为机械能的电气设备。它通常由交流 (AC) 源供电,例如发电机或电网。工业马达专门设计用于为各行业使用的各种设备和机器提供动力和运动。由于它们需要承受高负载并在恶劣环境中运行,因此这些马达通常比住宅或商业环境中使用的马达更耐用、更强大。工业马达和应用对磁电感不断增长的需求将推动市场的发展。

- 根据工业能源加速器的报告,全球企业消耗的大部分电力来自数以百万计的运作中的马达。这些马达对于为各个领域的基本工业流程和辅助系统提供动力至关重要,包括通风、压缩空气生成和抽水。此外,工业马达市场最近推出了设计用于交流和直流电源运行的通用马达。对这些马达的需求不断增长以及各个供应商不断增加的开发可能会增加磁性元件的应用。

- 工业马达的设计和功能在很大程度上依赖磁感应,这是产生扭矩的主要方法。透过充分理解磁感应原理并优化各种设计元素,工程师可以开发出适合各种应用的高效能、高性能马达。

- 由于资料中心投资的增加,对资料中心不断电系统(UPS)系统的需求正在强劲成长。随着各行业数位化业务和服务的拓展,对资料储存、处理和管理的需求迅速增长。因此,为了满足这些要求,人们在资料中心基础设施方面进行了大量投资。根据Cloudscene统计,截至2023年9月,中国拥有448个资料中心,比亚太地区任何其他国家都多,蕴藏着巨大的市场机会。

中国正在经历快速成长

- 由于中国家电、汽车和医疗设备产量的增加,预计在预测期内对被动电子产品的需求将保持强劲。

- Rayming PCB and Assembly表示,近年来,中国继续在电子製造业中占据主导地位。儘管最近与美国有贸易往来,但该国仍然是电子产品的重要製造地。作为大型製造业,中国约50%的笔记型电脑和行动电话出口到全球。

- 全球电子市场从2022年的35,549.4亿美元成长到2023年的37,393.7亿美元。在全球电子领域,中国占收益的很大比例。该国跻身顶级电子产品生产国。我们生产各种电子产品,从消费性电子产品到工业零件。南方东莞、深圳等城市设有工厂。我们在上海和青云也有工厂。

- 中国在笔记型电脑製造商的全球生产份额中占有显着的份额。儘管中国依赖进口半导体,但对于许多世界顶级笔记型电脑品牌来说,中国仍然是一个不错的选择。昆山和重庆是最大的两个笔记型电脑製造丛集,此外还有东莞、深圳等热门电子生产基地。这些中心以生产笔记型电脑、零件和配件而闻名。

- 中国约有160个人口超过100万的城市,而美国祇有9个。因此,电子设备製造和消费的扩展预计将增加所有家用电器和消费性电子设备中对电流管理的各种被动元件的需求。

- 过去 15 年,中国针对电动车产业所做的努力是该国近代史上最成功的产业政策案例之一。包括补贴在内的大规模政府干预使得国内工业和市场同步成长。该政策的推出时机至关重要,因为它恰逢电池技术的进步和消费者对电动车接受度的不断提高。重要的是,许多老牌汽车公司直到最近才拒绝电动车技术。

- 同时,中国竞争对手迅速抓住机会,在技术上超越了拥有数十年内燃机技术知识产权累积的跨国公司。中国也是全球领先的锂电池生产国,锂电池是电动车的关键零件。根据国际能源总署(IEA)的数据,中国生产了65%的电池和80%的正极,能源部的估计甚至更高。由此,呈现了该国汽车产业调查市场的成长前景。

磁性行业概况

磁性材料市场是分散的,由在其产品上投入大量资金的老牌厂商组成。新参与企业需要高额投资。这些公司透过强有力的竞争策略生存,主要参与者是 TDK Corporation、Yageo Corporation、Meritek Electronics Corporation、AVX Corporation(Kyocera Group)和 Vishay Intertechnolo。

2024 年 1 月,TDK Corporations 旗下子公司 TDK Ventures Inc. 投资了新加坡一家致力于数位和能源转型的高科技公司 Silicon Box。我们计划透过硅盒加速半导体封装创新市场。

2023 年 11 月,Bourns 推出了一系列空心线圈电感器,具有高自谐振频率、高 Q 值和严格的电感容差。 AC4842 RAir 线圈电感器系列提供低损耗、高频解决方案,为射频应用设计人员提供广泛的高 Q 值解决方案选择。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 磁性装置类别技术概述

- 市场宏观趋势评估

第五章市场动态

- 市场驱动因素

- 可再生能源需求增加

- 电动和自动驾驶汽车需求的增加推动磁性元件市场

- 市场挑战

- 金属价格上涨影响零件製造成本

第六章 市场细分

- 按类型

- 绕线电感

- 多层电感器

- 薄膜电感

- 铁氧体磁芯/EMC零件

- EMI滤波器

- 射频/电源变压器

- 电流检测/其他变压器

- 按最终用户使用情况

- 太阳能/风能

- 电动车/混合动力车用

- 工业(马达/UPS)

- 铁路/交通

- 消费性电子产品

- 其他最终用户用途

- 按地区

- 中国

- 日本

- 美国

- 台湾

- 东南亚

- 韩国

- 欧洲

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- TDK Corporation

- Yageo Corporation

- Meritek Electronics Corporation

- AVX Corporation(Kyocera Group)

- Vishay Intertechnology

- Panasonic Corporation

- Taiyo Yuden Co. Ltd

- Exxelia Technology

- Bourns Inc.

- Wurth Elektronik Group

- Coilcraft Inc.

第八章市场展望

The Magnetics Market size is estimated at USD 14.10 billion in 2024, and is expected to reach USD 18.52 billion by 2029, growing at a CAGR of 5.60% during the forecast period (2024-2029).

Magnetic components are widely adopted in both advanced industrial and common household appliances, ranging from refrigerators and televisions to telecommunication devices. Magnetics plays a crucial role in cars, monitoring voltage in power supplies for dashboard displays, interior and exterior lighting, climate control, and other systems. These components are used in cell phones, computers, communication systems, and other electronic products.

Key Highlights

- The global demand for HPC and AI is exploding. Similarly, the demand for smartphones, PCs, and infrastructures is stabilizing. Smartphone sales are expected to recover significantly in 2024, driving the demand for these magnetic components. High-frequency inductors are used in mobile phones, which help with fast and stable internet surfing. Furthermore, with the advancement in mobile communication networks, the number of inductors in smartphones is growing significantly. Inductors enhance various smartphones' functions, including improving color LCD and battery life.

- Smartphone OEMs are ramping up Artificial intelligence-enabled smartphones in 2024, with generative AI capabilities and an additional storage capacity, which creates demand for better battery life. Further, with the advancement in technology, consumers prefer advanced technology products compared to older devices, which drives the sales of smartphones.

- The need for inter-country power grid connections (super grid) and renewable energy sources based on direct currents, such as fuel cells, wind power, and solar power, is expanding globally, as is the demand for magnetic components.

- Traditionally, transformers were made of solid iron; however, with the development of materials, silicon steel, amorphous steel, and ferrite ceramics have been used as core materials for transformers due to their higher penetrability. Similarly, inductors and EMI filters use iron, ferrite, and other magnetic materials as core material, and coils are usually made of copper.

- With the current rapid evolution of autonomous driving technologies and ADAS, automobiles are prepared with numerous sensors such as radars, cameras, and LiDAR, resulting in dramatic growth in magnetic components. Owing to ongoing advancement in automotive sector, key vendors are continuously investing on product developments and advancement to meet consumer demand.

- For instance, in January 2024, TDK Corporation launched a new inductor KLZ2012-A series, designed for automotive audio bus (A2B) applications with high durability, a wide operation range, and greater inductance tolerance. The company announced that the mass production of these new product series started in January 2024. A2B technology was developed to decrease the weight of cable harnesses containing of a broad variety of telecommunication buses, pointing at its final goal of amplified fuel efficiency of automobiles.

Magnetics Market Trends

Industrial (Motors/UPS) to Witness the Growth

- Industrial motors are electrical devices that convert electrical energy into mechanical energy. They are commonly powered by alternating current (AC) sources like generators and power grids. Industrial motors are specifically engineered to supply power and movement to various equipment and machinery utilized in different industries. Due to their requirement to endure heavy loads and function in challenging environments, these motors are typically more durable and potent than those employed in residential or commercial settings. The growing need for magnetic inductance in industrial motor applications will drive the market.

- The Industrial Energy Accelerator reports that a significant portion of the global electrical energy consumed by companies is attributed to the millions of electrical motors in operation. These motors are crucial in powering essential industrial processes and auxiliary systems such as ventilation, compressed air generation, and water pumping across various sectors. Additionally, there has been a recent introduction of universal motors in the industrial motors market, designed to work with both AC and DC power sources. The increasing demand for these motors and growing developments by the various vendors will increase the applications of magnetic components.

- The design and functioning of industrial motors heavily rely on magnetic induction, which serves as the primary method for producing torque. Engineers can develop efficient and high-performing motors suitable for various applications by thoroughly comprehending magnetic induction principles and optimizing different design elements.

- The demand for data center uninterruptable power supply (UPS) systems is experiencing significant growth due to the increasing investments in data centers. As various industries expand their digital operations and services, there is a surge in demand for data storage, processing, and management. Consequently, substantial investments are being made in data center infrastructure to meet these requirements. According to Cloudscene, as of September 2023, there were 448 data centers in China, the most of any country or territory in the Asia-Pacific region, where market opportunities can be found significantly.

China to Witness Rapid Growth

- The demand for passive electronics is expected to remain strong in the forecast period due to increased consumer electronics, automotive, and medical equipment production in China.

- According to Rayming PCB and Assembly, China has continued dominating the electronics manufacturing industry for some years. This country is an integral manufacturing place for electronics despite its recent trade with the United States. As a large manufacturing company, China exports about 50% of laptops and cell phones globally.

- The global electronics market grew from USD 3554.94 billion in 2022 to USD 3739.37 billion in 2023. In the global electronics sector, China contributes a large percentage of revenue. This country is ranked among the top producers of electronic devices. It produces various electronics products, ranging from consumer electronics to industrial components. Cities such as Dongguan and Shenzhen in the South have factories. In addition, Shanghai and Choingun are home to factories.

- China produces a prominent share of laptop manufacturers globally. Despite China's dependence on imported semiconductors, this country remains a good option for many world-class laptop brands. Kunshan and Chongqing are the two biggest clusters for laptop manufacturing and other popular electronic production hubs, like Dongguan and Shenzhen. These hubs are known for producing laptops, components, and accessories.

- The country also holds a significant consumer market considering the country's large population, with about 160 Chinese cities having a population crossing one million people, compared to the US, having only nine cities that incorporate more than one million people. Thus, the growing electronics manufacturing and consumption are expected to drive the need for various passive components to address electric flow management in all consumer and household electronics.

- China's initiatives targeting the EV industry over the past 15 years are one of the most successful cases of industrial policy in the country's recent history. Extensive government interventions, including subsidies, enabled the domestic industry and the market to grow simultaneously. The timing of the policies was crucial because they coincided with and magnified technological advancements in battery technology and greater consumer acceptance of EVs. Importantly, many existing automotive companies dismissed EV technology until recently.

- Meanwhile, their Chinese competitors quickly grasped the opportunity to technologically leapfrog multinational corporations with decades of IP accumulated in internal combustion engine technology. China is also by far the main producer of lithium batteries globally, which are the main component in EVs. According to the International Energy Agency (IEA), the country accounts for 65% of battery and 80% of cathode production, and the Department of Energy's estimate is even higher. Thus, the growing prospect of the market studied in the country's automotive sector is shown.

Magnetics Industry Overview

The magnetics market is fragmented, comprising long-standing established players who have made significant investments in the product. The new players entering the market require high investments. The companies can sustain themselves through powerful competitive strategies, and key players are TDK Corporation, Yageo Corporation, Meritek Electronics Corporation, AVX Corporation (Kyocera Group), and Vishay Intertechnolo.

* In January 2024, TDK Corporations subsidiary TDK Ventures Inc. invested in Singaporean tech company Silicon Box for digital and energy transformation. It plans to accelerate the market for semiconductor packaging innovations through Silicon Box.

* In November 2023, The Bourns introduced an air coil inductor series with high self-resonant frequency, high Q, and tight inductance tolerance. The Model AC4842R Air Coil Inductor Series offers a low-loss, high-frequency solution that gives RF application designers a wider range of high-Q solution options.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Degree of Competition

- 4.3 Technological overview of Magnetic Device Categories

- 4.4 Assessment of Macro trends in the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand For Renewable Energy

- 5.1.2 Rising Demand For Electric and Autonomous Vehicles Drives Magnetic Components Market

- 5.2 Market Challenges

- 5.2.1 Rising Metal Prices Impacting Component Production Costs

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Wire Wound Inductor

- 6.1.2 Multi-layer Inductor

- 6.1.3 Thin Film Inductor

- 6.1.4 Ferrite Cores and EMC Components

- 6.1.5 EMI Filters

- 6.1.6 RF/Power Transformers

- 6.1.7 Current Sense and Other Transformers

- 6.2 By End-user Application

- 6.2.1 Photovoltaics and wind

- 6.2.2 EV/HEV

- 6.2.3 Industrial (Motors/UPS)

- 6.2.4 Rail/Transportation

- 6.2.5 Consumer Electronics

- 6.2.6 Other End-user Applications

- 6.3 By Geography

- 6.3.1 China

- 6.3.2 Japan

- 6.3.3 United States

- 6.3.4 Taiwan

- 6.3.5 South East Asia

- 6.3.6 South Korea

- 6.3.7 Europe

- 6.3.8 Latin America

- 6.3.9 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 TDK Corporation

- 7.1.2 Yageo Corporation

- 7.1.3 Meritek Electronics Corporation

- 7.1.4 AVX Corporation (Kyocera Group)

- 7.1.5 Vishay Intertechnology

- 7.1.6 Panasonic Corporation

- 7.1.7 Taiyo Yuden Co. Ltd

- 7.1.8 Exxelia Technology

- 7.1.9 Bourns Inc.

- 7.1.10 Wurth Elektronik Group

- 7.1.11 Coilcraft Inc.