|

市场调查报告书

商品编码

1521647

平板拖车:市场占有率分析、产业趋势、成长预测(2024-2029)Flatbed Trailer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

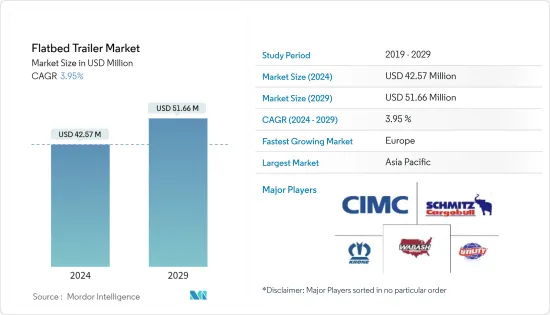

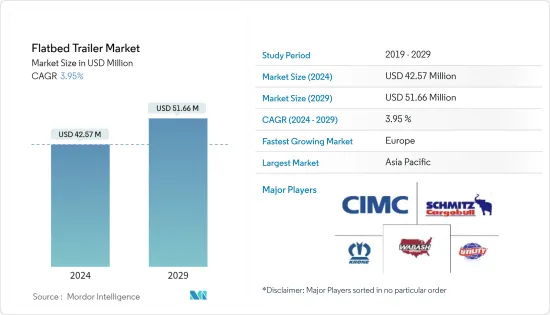

平板拖车市场规模预计到 2024 年为 4,257 万美元,预计到 2029 年将达到 5,166 万美元,在预测期内(2024-2029 年)复合年增长率为 3.95%。

近年来,由于工业化程度提高、贸易全球化以及建筑和基础设施行业扩张等多种因素,平板拖车市场经历了稳定增长。

平板拖车市场对专门用于运输超大和不规则形状货物(例如机械、建筑材料和工业设备)的专用拖车的需求不断增长。这些专用拖车提供更高的承载能力、可调节的配置和先进的固定机制,以确保各种货物的安全运输。

此外,技术进步在塑造平板拖车市场前景方面发挥着重要作用。轻质材料、空气动力学设计和远端资讯处理系统等创新正在帮助现代平板拖车提高燃油效率、降低营业成本并增强安全功能。这些进步对于希望优化业务并维持市场竞争力的车队营运商和物流公司极具吸引力。

GDP成长、基础设施投资和建设活动等经济因素也在推动平板拖车的需求方面发挥重要作用。快速都市化和工业化趋势的新兴经济体为市场扩张提供了丰厚的机会,而成熟市场则需要技术升级和车辆现代化来保持效率和竞争力。

平板拖车市场的竞争格局的特点是现有参与者和区域製造商迎合特定细分市场和市场条件。策略伙伴关係、併购和产品多元化策略是市场参与企业为巩固市场地位和扩大基本客群所采取的常见策略。

平板拖车市场趋势

低底盘拖车主导平板拖车市场

低底盘拖车因其独特的设计和在各行业的多功能用途而在平板拖车市场占据主导地位。这些拖车的甲板高度较低,非常适合运输高重型设备、机械和大型货物。

低底盘拖车因其能够承载大而重的负载,同时在运输过程中保持稳定性和可操作性而被广泛使用。建筑、采矿、能源和基础设施开发等行业依靠低底盘拖车将专用设备和材料有效地运送到工地。较低的甲板高度允许运输高大且笨重的物品,而不会超过道路或高速公路的高度限制。

此外,低底盘拖车还具有安全优势,因为它们采用低重心设计,可降低翻车风险并提高运输过程中的稳定性。当远距和具有挑战性的地形运输重型机械和设备时,此功能尤其重要。此外,低底盘拖车通常配备坡道,以方便装卸,提高物流业务的效率。

拖车设计的技术进步和创新也影响了低底盘拖车在平板拖车市场的主导地位。製造商不断努力透过使用轻质材料和先进的悬吊系统来提高低底盘拖车的性能、耐用性和效率。这些创新有助于提高燃油效率、降低维护成本并提高操作员的整体生产力。

此外,不断扩大的全球基础设施计划、建设活动和工业发展进一步推动了对低底盘拖车的需求。拉丁美洲和非洲等新兴国家正在经历快速的都市化和基础设施投资,导致对重型设备运输解决方案的需求增加。 低底盘拖车透过提供可靠、高效的运输服务,对于促进这项发展至关重要。

亚太地区主导平板拖车市场

多种因素正在推动亚太地区对平板拖车的需求不断增长,包括製造规模扩大、建设活动活性化以及国际贸易量增加。这些趋势推动了对平板拖车的需求,因为它们需要高效的运输解决方案来移动重型设备、建筑材料和其他大型货物。

此外,亚太地区广阔的区域格局和多元化的行业格局为平板拖车製造商和供应商提供了广泛的商机。中国、印度、日本和韩国等国家在大型製造地、基础设施投资和有利的政府政策的支持下处于市场成长的前沿。

特别是,中国对亚太地区和全球平板拖车市场做出了巨大贡献。该国蓬勃发展的製造业、广泛的道路网络扩张和强劲的出口导向经济正在推动平板拖车的强劲需求。

中国的「一带一路」倡议(BRI)也刺激了整个亚洲的基础设施和贸易互联互通,进一步推动了对平板拖车等运输设备的需求。

该地区的另一个主要市场印度正在经历快速的基础设施发展和都市化,推动了建筑和运输行业对平板拖车的需求。印度政府的「印度製造」等倡议以及对高速公路、铁路和港口等基础设施计划的投资正在推动对平板拖车的需求,以实现高效的物流和货物运输。

亚太地区已成为平板拖车出口到其他全球市场的重要枢纽。製造商利用该地区经济高效的生产能力和熟练的劳动力来服务北美、欧洲和其他运输需求不断增长的地区的国际市场。

平板拖车产业概况

平板拖车市场逐渐整合,主要参与者包括公用事业拖车製造公司、中国国际海运货柜(集团)有限公司、Fahrzeugwerk Bernard KRONE GmbH &Co.KG 和 Wabash National。该行业的公司寻求透过建立合资企业和合作伙伴关係以及引进技术先进的产品来提高竞争力。例如

- 在 ProMat 2023 上,Slip Robotics 展示了其自动拖车装卸系统 (ATLS)。

- 该系统旨在自动导航至牵引拖车并运输至目的地,展示了物流自动化的先进能力。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 市场限制因素

- 价值链/供应链分析

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 按类型

- 低底盘拖车

- 阶梯式甲板拖车

- 拉伸双落拖车

- 其他的

- 按吨位

- 25吨以下

- 25-50吨

- 51-100吨

- 100吨以上

- 按长度

- 28-45 英尺

- 45 英尺或以上

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 西班牙

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 韩国

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东

- UAE

- 沙乌地阿拉伯

- 其他中东和非洲

- 北美洲

第六章 竞争状况

- 供应商市场占有率

- 公司简介

- Schmitz Cargobull AG

- Utility Trailer Manufacturing Company

- China International Marine Containers(Group)Ltd

- Fahrzeugwerk Bernard KRONE GmbH & Co. KG

- Wabash National

- Manac Inc.

- Hyundai Translead

- Mac Trailer Manufacturing Inc.

- Kentucky Trailer

- Krone GmbH & Co. KG

第七章 市场机会及未来趋势

The Flatbed Trailer Market size is estimated at USD 42.57 million in 2024, and is expected to reach USD 51.66 million by 2029, growing at a CAGR of 3.95% during the forecast period (2024-2029).

The flatbed trailer market has experienced steady growth in recent years, driven by various factors such as increasing industrialization, globalization of trade, and expansion in the construction and infrastructure sectors.

The flatbed trailer market is the growing demand for specialized trailers designed to transport oversized or irregularly shaped cargo, such as machinery, construction materials, and industrial equipment. These specialized trailers offer enhanced load-bearing capacity, adjustable configurations, and advanced securing mechanisms to ensure the safe transportation of diverse goods.

Moreover, technological advancements have played a crucial role in shaping the flatbed trailer market landscape. Innovations such as lightweight materials, aerodynamic designs, and telematics systems have led to improved fuel efficiency, reduced operating costs, and enhanced safety features in modern flatbed trailers. These advancements appeal to fleet operators and logistics companies seeking to optimize their operations and maintain a competitive edge in the market.

Economic factors such as GDP growth, infrastructure investments, and construction activity also play a vital role in driving demand for flatbed trailers. Emerging economies with rapid urbanization and industrialization trends present lucrative opportunities for market expansion, while mature markets undergo technological upgrades and fleet modernization initiatives to maintain efficiency and competitiveness.

The competitive landscape of the flatbed trailer market is characterized by a mix of established players and regional manufacturers catering to specific market segments and geographic regions. Strategic partnerships, mergers and acquisitions, and product diversification strategies are common tactics industry participants employ to strengthen their market position and expand their customer base.

Flatbed Trailer Market Trends

Lowboy Trailers is Dominating The Flatbed Trailer Market

Lowboy trailers dominate the flatbed trailer market due to their unique design and versatile applications across various industries. These trailers are characterized by their low deck height, which makes them ideal for transporting tall and heavy equipment, machinery, and oversized cargo.

The widespread usage of lowboy trailers can be attributed to their ability to accommodate large and heavy loads while maintaining stability and maneuverability during transportation. Industries such as construction, mining, energy, and infrastructure development rely heavily on lowboy trailers to efficiently transport specialized equipment and materials to job sites. Their low deck height enables the transportation of tall and bulky items without exceeding height restrictions on roads and highways.

Furthermore, lowboy trailers offer advantages in terms of safety as their design lowers the center of gravity, reducing the risk of rollovers and improving stability during transport. This feature is particularly crucial when hauling heavy machinery and equipment over long distances or challenging terrains. Additionally, lowboy trailers typically feature ramps for easy loading and unloading, enhancing efficiency in logistics operations.

Technological advancements and innovations in trailer design also influence the dominance of lowboy trailers in the flatbed trailer market. Manufacturers continually strive to improve the performance, durability, and efficiency of lowboy trailers through the use of lightweight materials and advanced suspension systems. These innovations contribute to fuel efficiency, reduce maintenance costs, and enhance operators' overall productivity.

Moreover, the global expansion of infrastructure projects, construction activities, and industrial development further drives the demand for lowboy trailers. Emerging economies in regions such as Latin America and Africa are witnessing rapid urbanization and infrastructure investments, leading to increased demand for heavy equipment transportation solutions. Lowboy trailers are critical in facilitating these developments by providing reliable and efficient transportation services.

Asia Pacific Dominates the Flatbed Trailer Market

Various factors, including the expansion of manufacturing sectors, increased construction activities, and rising international trade volumes, drive the growing demand for flatbed trailers in Asia-Pacific. These trends necessitate efficient transportation solutions for the movement of heavy machinery, construction materials, and other oversized cargo, thus driving the demand for flatbed trailers.

Moreover, Asia-Pacific's vast geographical expanse and diverse industrial landscape present a wide range of opportunities for flatbed trailer manufacturers and suppliers. Countries like China, India, Japan, and South Korea are at the forefront of market growth, supported by their large manufacturing bases, infrastructure investments, and favorable government policies.

China, in particular, stands out as a major contributor to the flatbed trailer market in Asia-Pacific and globally. The country's booming manufacturing sector, extensive road network expansion, and robust export-oriented economy fuel significant demand for flatbed trailers.

China's Belt and Road Initiative (BRI) has also spurred infrastructure development and trade connectivity across Asia, further driving the need for transportation equipment like flatbed trailers.

India, another key market in the region, is witnessing rapid infrastructure development and urbanization, driving demand for flatbed trailers in the construction and transportation sectors. The Indian government's initiatives, such as "Make in India" and investments in infrastructure projects like highways, railways, and ports, are bolstering the demand for flatbed trailers for efficient logistics and cargo transportation.

Asia-Pacific serves as a significant hub for flatbed trailer exports to other global markets. Manufacturers leverage the region's cost-effective production capabilities and skilled workforce to cater to international markets in North America, Europe, and other regions with growing transportation needs.

Flatbed Trailer Industry Overview

The flatbed trailer market demonstrates moderate consolidation, with key players including Utility Trailer Manufacturing Company, China International Marine Containers (Group) Ltd, Fahrzeugwerk Bernard KRONE GmbH & Co. KG, and Wabash National. Companies in this sector strive for a competitive edge by engaging in joint ventures and partnerships and by introducing technologically advanced products. For instance,

- At ProMat 2023, Slip Robotics showcased its automated trailer loading/unloading system (ATLS), featuring an omnidirectional robot engineered to handle up to 8 full pallets with a combined weight capacity of 6 tons.

- This system is designed to autonomously navigate into a tractor-trailer for transportation to its destination, demonstrating advanced capabilities in logistics automation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Porters 5 Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Lowboy Trailers

- 5.1.2 Step Deck Trailers

- 5.1.3 Stretch Double Drop Trailers

- 5.1.4 Others

- 5.2 By Tonnage

- 5.2.1 Below 25 T

- 5.2.2 25 T-50 T

- 5.2.3 51 T-100 T

- 5.2.4 Above 100 T

- 5.3 By Length

- 5.3.1 28-45 Foot

- 5.3.2 Greater Than 45 Foot

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 UK

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East

- 5.4.5.1 UAE

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Schmitz Cargobull AG

- 6.2.2 Utility Trailer Manufacturing Company

- 6.2.3 China International Marine Containers (Group) Ltd

- 6.2.4 Fahrzeugwerk Bernard KRONE GmbH & Co. KG

- 6.2.5 Wabash National

- 6.2.6 Manac Inc.

- 6.2.7 Hyundai Translead

- 6.2.8 Mac Trailer Manufacturing Inc.

- 6.2.9 Kentucky Trailer

- 6.2.10 Krone GmbH & Co. KG