|

市场调查报告书

商品编码

1521692

绿色物流:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Green Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

绿色物流市场规模预计到2024年为1.28兆美元,预计到2029年将达到1.91兆美元,在预测期内(2024-2029年)复合年增长率为8.29%。

绿色物流市场的成长受到物流企业社会责任(CSR)活动的增加、运输业越来越多地采用电动车、不断加强的环境立法以及全球供应链中人工智慧的日益使用等因素的刺激。一直是。

UPS、DHL 和 FedEx 等公司越来越多地使用混合电动车和生物柴油汽车等替代燃料。高效的储存和包装有助于减少材料使用和一次性塑胶包装。可重复使用的容器已成为进一步的策略,有助于减少废弃物并降低与包装处置相关的成本。

为了满足不断变化的交付需求,公司正在转向电动车。与石油/柴油汽车相比,电动车的运作成本更低,破坏性也更小,因为它们每英里的电量只有燃油/柴油汽车的一半,并且不需要维修或换油。

2022年,全球将销售约66,000辆电动客车和60,000辆中重型卡车,约占所有客车销量的4.5%和所有卡车销量的1.2%。

为因应环境挑战,中国作为亚太最大经济体,正积极推动绿色物流。电动车、清洁能源来源和智慧交通系统等领域都在投资。在以拥抱绿色技术(尤其是混合动力汽车汽车和电动车)而闻名的日本,物流公司现在越来越多地采用永续燃料。

2022年,中国预计将销售54,000辆新电动客车和约52,000辆M&H卡车,占中国总销量的18%或4%,占全球新车销量的约85,000%。此外,许多公车和卡车都是中国品牌在拉丁美洲、北美和欧洲生产的。

例如,日邮物流于2023年4月推出了名为「Yuksen Book & Claim」的新服务。它使用可持续航空燃料,使客户能够透过航空货运实现永续发展。

绿色物流市场趋势

绿色仓库需求增加

推动智慧仓储市场发展的几个关键因素包括多通路物流网络的出现、人们对绿色倡议日益浓厚的兴趣以及消除物流业务中浪费的永续性。

面对全球气候危机,现有的仓储业务增加了能源消耗和废弃物产生,无法继续下去。永续储存正在成为应对这些挑战的一线希望。永续仓储描述了一种创新方法,透过关注资源的有效利用、减少碳排放和推广自然能源,使企业和环境受益。

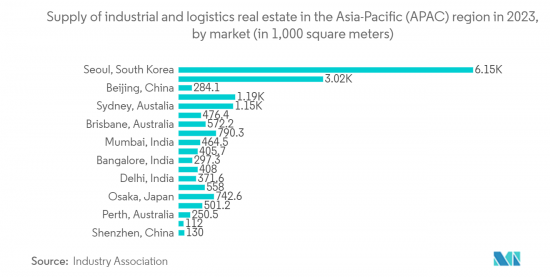

为了提高 3PL 和 4PL服务供应商的国际认可度,必须建造符合 BREEAM 和 LEED 等公认的全球标准的仓库。预计这一成长趋势将持续下去,到 2026 年,需求将成长 16.6%,达到 6,150 万平方英尺,供应量将相应增加到 6,190 万平方英尺,比 2023 年的预计成长 15.8%。

2023年8月,Infor宣布Zofri将实施Infor的WMS仓库管理系统,以改善客户服务,这是供应链中最重要的绩效指标之一。 Infor WMS 解决方案使用 Amazon Web Services (AWS) 在云端部署,并由 Infor 拉丁美洲合作伙伴 Cerca Technology 实作。

2023 年 5 月,Manhattan Associates 宣布重新架构其曼哈顿主动堆场管理解决方案,以扩展其整合供应链的愿景。透过重新设计堆场管理,使其在单一云端原生平台上与业界领先的仓库和运输管理解决方案无缝协作,曼哈顿完成了数位集成,将物流和物流结合到了我正在努力做到的物理世界中。

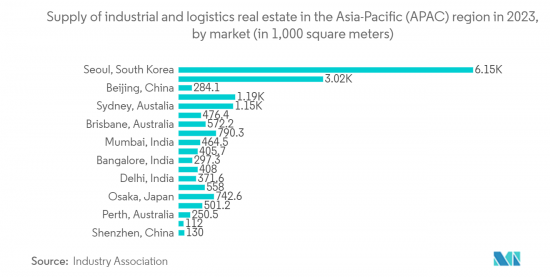

亚太地区主导市场

随着印度等新兴国家响应第四次工业革命并引入新的数位技术,该地区的市场正在扩大。

此外,印度还致力于改善其物流基础设施并在这一领域推广电动车。例如,2003 年 1 月,联邦快递扩大了其车队,在印度引进了 30 辆 Ace Tata 电动车,作为到 2040 年全球向无碳营运转型的一部分。在绿色物流领域,韩国也正在实施减少排放、提高物流效率的措施。

亚太地区正在加大对绿色供应市场计划的投资。例如,印度承诺到2030年将排放强度降低45%,到2070年实现净零排放。这项承诺得到了 42 亿美元(3500 亿印度卢比)能源转型资本投资的支持,以确保绿色物流行业减少对环境的影响并拥抱绿色出行。

其他国家如澳洲、新加坡和纽西兰正在亚太地区逐步采用永续物流实践。为了减少碳排放,新加坡的运输公司正在采用电动车和多种可再生解决方案。 Ninja Van 新加坡推出了电动车测试试验计画和重新推出环保产品等倡议,以最大程度地减少对环境的影响,并为永续物流业做出贡献。

绿色物流产业概况

绿色物流市场相对分散,既有大型的全球参与企业,也有小型的本地参与企业,且占据市场占有率的参与企业数量相当多。世界各国政府和监管机构正在采取严格的环境法规和政策,这是绿色交通市场的关键驱动力。这些法规管理物流业务的各个方面,例如排放控制、废弃物管理、能源效率和永续性。

另一方面,由于终端使用领域的环保意识不断提高,对智慧绿色仓库的需求不断增加,以及用于最后一英里交付和仓储的光达无人机的不断发展,对于在市场上运营的市场参与企业来说存在着巨大的成长机会。主要参与企业包括联合包裹服务公司、AI Futtaim Logistics、Bollore Logistics、Yusen Logistics 和 DHL International GmbH。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行概述

第四章市场动态

- 市场概况

- 市场驱动因素

- 扩大电动车在物流业的应用

- 全球物流产业越来越多地采用人工智慧 (AI)

- 市场限制因素

- 对占交通运输大部分的石化燃料的依赖

- 实施绿色采购的高成本阻碍了潜在投资者

- 市场机会

- 最终用途产业的环保意识不断增强

- 增加为最后一哩交付和仓库开发的光达无人机数量

- 价值链/供应链分析

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 对市场的影响

第五章市场区隔

- 按最终用户

- 医疗保健

- 製造业

- 车

- 银行/金融服务

- 零售/电子商务

- 其他的

- 依业务类型

- 仓储业

- 分配

- 附加价值服务

- 依业务类型

- 仓储业

- 公路运输

- 海运

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 西班牙

- 欧洲其他地区

- 亚太地区

- 印度

- 中国

- 日本

- 韩国

- 其他亚太地区

- 拉丁美洲

- 拉丁美洲

- 中东

- 非洲

- 北美洲

第六章 竞争状况

- 市场集中度概览

- 公司简介

- United Parcel Service

- AI Futtaim Logistics

- Bollore Logistics

- Bowling Green Logistics

- GEODIS

- Yusen Logistics Co., Ltd

- DHL International GmbH

- Mahindra Logistics Ltd

- XPO Logistics

- Agility Public Warehousing Company KSCP

- CEVA Logistics*

- 其他公司

第七章 市场机会及未来趋势

第8章附录

The Green Logistics Market size is estimated at USD 1.28 trillion in 2024, and is expected to reach USD 1.91 trillion by 2029, growing at a CAGR of 8.29% during the forecast period (2024-2029).

The growth of the green logistics market is stimulated by factors such as increased corporate social responsibility (CSR) activities undertaken by logistics undertakings, growing EV adoption in the transport sector, rising environmental legislation, and increasing use of artificial intelligence in the global supply chain.

Alternative fuels, such as hybrid electric and biodiesel vehicles, are increasingly used by companies like UPS, DHL, or FedEx. Efficient storage and packaging help reduce the amount of materials used and single-use plastic containers. Reusable containers, which help to reduce waste and costs related to packaging disposal, are a further strategy.

Businesses are increasingly switching to electric vehicles to meet these evolving delivery needs. EV fleets have lower operating costs and less disruption than gas or diesel vehicles, at half the price of electricity per mile and no need for repairs or oil changes.

In 2022, almost 66,000 electrical buses and 60,000 medium and heavier trucks were sold worldwide, about 4.5% of all buses and 1.2 % of truck sales.

To address environmental challenges, China, as the largest economy in the Asia Pacific region, is actively promoting green logistics practices. Investments in electric vehicles, clean energy sources, and intelligent transport systems have been made in the country. Japan, which has been known to embrace green technologies, particularly hybrids and electric vehicles, is now seeing the adoption of sustainable fuels by logistics companies.

In 2022, China sold 54,000 new EV buses and is expected to sell approximately 52,000 M&H trucks, accounting for 18% or 4% of all sales in the country and around 85 % worldwide. Moreover, many buses and trucks are made by China's brands in Latin America, North America, and Europe.

For example, Yusen Logistics Co. Ltd launched a new service in April 2023 called "Yuksen Book & Claim," which uses sustainable aviation fuel and enables its customers to grow sustainably using air freight forwarding.

Green Logistics Market Trends

The Demand for Green Warehouses is Rising

Several critical factors, like the emergence of multi-channel distribution networks, a growing focus on green initiatives, and sustainability to reduce waste in logistics operations, are driving the development of intelligent warehousing markets.

In the face of a worldwide climate crisis, continuing with existing warehouse practices that increase energy consumption and waste generation is impossible. Sustainable storage is emerging as a beacon of hope in the fight against these challenges. Sustainable warehousing offers an innovative approach that benefits enterprises and the environment by emphasizing the effective use of resources, reducing carbon emissions, and promoting renewables.

To achieve international visibility between 3PL and 4PL service providers, building warehouses that meet recognized global standards such as BREEAM and LEED is essential. The growth trend is expected to continue, with demand to increase by 16.6% to reach 61.5 million sq. ft and the supply correspondingly rising to 61.9 million sq. ft by 2026, which will be an increase of 15.8% from the 2023 estimated numbers.

In August 2023, Infor announced that Zofri will implement the Infor WMS warehouse management system to improve customer service, one of the most critical performance indicators in the supply chain. The Infor WMS solution will be deployed in the cloud, powered by AWS (Amazon Web Services), and implemented by Cerca Technology, Infor's partner in Latin America.

In May 2023, Manhattan Associates announced its re-imagined Manhattan Active Yard Management solution to expand its vision of a unified supply chain. By redesigning yard management to work seamlessly with its industry-leading warehouse and transportation management solutions on a single cloud-native platform, Manhattan is completing the digital unification of distribution and logistics, where they come together in the physical world.

Asia-Pacific dominates the market

The region's market is growing as emerging economies such as India adjust to the Fourth Industrial Revolution and adopt new digital technologies.

In addition, India focuses on improving logistics infrastructure and promoting electric vehicles in the sector. For example, in January 2023, as part of its global transition to carbon-free operations by 2040, FedEx Express increased its fleet by installing 30 Ace TATA electric vehicles in India. In the area of Green Logistics, South Korea has also been making progress with implementing initiatives to reduce emissions and improve logistics effectiveness.

Asia Pacific is further investing in projects in the green supply market. For instance, India is committed to reducing its emissions intensity by 45% by 2030 and achieving net zero emissions by 2070. To ensure that the green logistics sector reduces its environmental impact and embraces green mobility, this commitment is supported by a capital investment of USD 4,200 million (INR 35,000 crore) for energy transition.

Other countries such as Australia, Singapore, and New Zealand are progressively adopting sustainable logistics practices in Asia-Pacific. To reduce their carbon footprint, freight companies in Singapore have adopted electric vehicles and several renewable solutions. Ninja Van Singapore has introduced initiatives like an EV test pilot program or relaunching eco-friendly versions of its products to minimize the environmental impact and contribute to a sustainable logistics sector.

Green Logistics Industry Overview

The Green Logistics market is relatively fragmented, with large global players and small and medium-sized local players, with quite a few players occupying the market share. Governments and regulators worldwide adopt stringent environmental regulations and policies, which have been significant drivers of the green transport market. Different aspects of logistics operations, such as emission control, waste management, energy efficiency, and sustainability, are provided for in these Regulations.

On the other hand, there is a remarkable growth opportunity for market players operating on the market due to growing environmental awareness in end-use sectors, increasing demand for intelligent green warehouses, and increased development of lidar drones for last-mile delivery and warehouse. Significant players include United Parcel Service, AI Futtaim Logistics, Bollore Logistics, Yusen Logistics Co. Ltd, and DHL International GmbH.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing adoption of EVs in the logistics industry

- 4.2.2 Increase in adoption of artificial intelligence (AI) in the global logistics industry

- 4.3 Market Restraints

- 4.3.1 Dependency on fossil fuels, majority for transportation

- 4.3.2 The high costs of implementing green procurement practices discourage potential investors

- 4.4 Market Opportunity

- 4.4.1 Increased environmental consciousness among end-use industries

- 4.4.2 Rise in development of lidar drones for last mile delivery and warehouses

- 4.5 Value Chain / Supply Chain Analysis

- 4.6 Porter's Five Force Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Impact of Covid-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By End User

- 5.1.1 Healthcare

- 5.1.2 Manufacturing

- 5.1.3 Automotive

- 5.1.4 Banking and Financial services

- 5.1.5 Retail and E-commerce

- 5.1.6 Others

- 5.2 By Business Type

- 5.2.1 Warehousing

- 5.2.2 Distribution

- 5.2.3 Value-Added Services

- 5.3 By Mode of Operation

- 5.3.1 Storage

- 5.3.2 Roadways Distribution

- 5.3.3 Seaways Distribution

- 5.3.4 Others

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 US

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 UK

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia Pacific

- 5.4.4 LAMEA

- 5.4.4.1 Latin America

- 5.4.4.2 Middle East

- 5.4.4.3 Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 United Parcel Service

- 6.2.2 AI Futtaim Logistics

- 6.2.3 Bollore Logistics

- 6.2.4 Bowling Green Logistics

- 6.2.5 GEODIS

- 6.2.6 Yusen Logistics Co., Ltd

- 6.2.7 DHL International GmbH

- 6.2.8 Mahindra Logistics Ltd

- 6.2.9 XPO Logistics

- 6.2.10 Agility Public Warehousing Company K.S.C.P.

- 6.2.11 CEVA Logistics*

- 6.3 Other Companies