|

市场调查报告书

商品编码

1521739

离岸风力发电施工船 -市场占有率分析、产业趋势/统计、成长预测(2024-2029)Offshore Wind Construction Vessel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

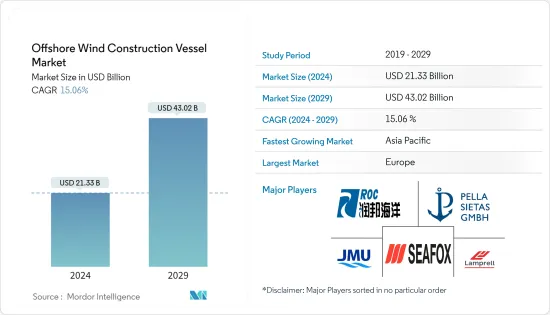

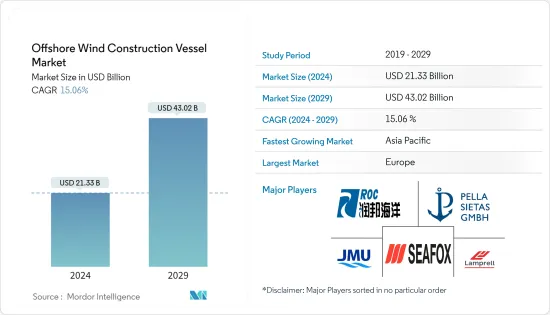

离岸风力发电施工船市场规模预计到2024年为213.3亿美元,预计到2029年将达到430.2亿美元,在预测期内(2024-2029年)复合年增长率为15.06%。

主要亮点

- 从中期来看,离岸风力发电装置增加和全球可再生能源需求等因素预计将成为预测期间离岸风力发电施工船舶市场的最大驱动力之一。

- 另一方面,离岸风力发电施工船高昂的建造和营运成本预计将在预测期内对市场构成威胁。

- 然而,船舶设计、推进系统和自动化的不断进步已经带来了更有效率的风力施工船。预计这一因素将在未来为市场创造一些机会。

- 亚太地区在市场上占据主导地位,并且可能在预测期内实现最高的复合年增长率。中国、越南、日本等国海上风力发电安装计划数量不断增加,正在推动市场发展。

离岸风力发电施工船市场趋势

常规自升式船舶预计将成长

- 典型的自升式船舶是设计用于在恶劣的海洋环境条件下运作的装置。具有船体和多个可以延伸到海底的圆柱形或格子状的腿,以提供用于顶起船舶并从水面上进行安装、维护和各种其他活动的稳定平台。它们的设计和操作相对简单,使其成为离岸风力发电建造和维护作业的理想选择。

- 自升式船舶的主要优点之一是它们可以在海上提供稳定的高架工作平台。这种稳定性对于塔架、机舱、涡轮机和叶片等风力发电部件的精确定位和安装至关重要。即使在恶劣的天气条件下,高架工作平台也有助于安全、有效率地进入涡轮机进行维护和修理工作。

- 随着离岸风力发电设施的增加,传统自升式船舶的需求预计将大幅增加。随着各国寻求安装离岸风力发电设施,传统的自升式船舶的操作和维护远不如此类船舶复杂,而且价格也相对便宜。

- 根据国际可再生能源机构(International Renewable Energy Agency 2023)预测,2023年全球离岸风力发电累积装置容量将达到7,266千万瓦,而2022年为6,196千万瓦,复合年增长率超过17%。

- 为了满足这些市场需求,自升式船舶营运商和造船厂正在大力投资设计和建造新型、最先进的船舶。这些船舶配备了动态定位系统、运动补偿起重机和整合控制系统等先进技术,以提高营运效率和安全性。

- 例如,2023年5月,丹麦安装公司Cadeler宣布已开始开发一系列新的传统升降式式离岸风电安装船。该公司与 MAN Energy Solutions 合作开发了一种更小的发动机,可将这些船舶的重量减轻 50%。这将为更先进的推进系统创造空间,而不会增加船舶重量,并有望以与传统船舶相当的价格建造先进船舶。

- 因此,由于技术进步和海上风力发电探勘的增加,预计传统自升式船舶在预测期内将大幅成长。

亚太地区主导市场

- 亚太地区预计将主导离岸风力发电施工船舶市场,各国都为可再生能源和海上风力发电製定了雄心勃勃的目标。由于快速的经济成长和都市化,中国、越南、印度、日本和韩国等该地区国家的能源需求正在快速成长。海上风力发电已成为满足日益增长的能源需求、同时抑制碳排放和解决空间限制的理想解决方案。

- 据国际可再生能源机构称,近年来亚太地区的海上能源产能大幅增加。其规模是世界上最大的之一。 2023年,亚太地区离岸风力发电将达到40.25吉瓦,超过全球装置容量的55%。这意味着该地区海上风力发电部署正在增加,推动市场成长。

- 亚太地区各国政府正在实施雄心勃勃的可再生能源目标和支持政策,为离岸风力发电的开发创造有利的环境。例如,中国的目标是到2030年安装40吉瓦的离岸风力发电容量,日本的目标是10吉瓦,韩国的目标是820吉瓦。这些进一步推动了该地区离岸风力发电施工船舶市场的发展。

- 此外,该地区在造船、钢铁生产和重型机械等领域的成熟製造能力为发展强大的离岸风电供应链(包括风力发电机零件、船舶和配套基础设施)奠定了坚实的基础。

- 因此,亚太地区将在预测期内主导市场。

离岸风力发电船舶产业概况

全球离岸风力发电施工船舶市场正进入半固体状态。该市场的主要企业包括 Lamprell Energy Ltd、Pella Sietas GmbH、Japan Marine United Corporation、Seafox 和 Nantong Rainbow Offshore & Engineering Equipments。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章执行概述

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规政策

- 市场动态

- 促进因素

- 增加离岸风力发电的引进

- 对可再生能源的兴趣日益浓厚

- 抑制因素

- 初始资本投资高

- 促进因素

- 供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品服务的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 船型

- 自航自升船

- 普通自升式船

- 重型装运船隻

- 地区:2029 年之前的市场规模和需求预测(仅按地区)

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 西班牙

- 北欧的

- 俄罗斯

- 土耳其

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 澳洲

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 中东/非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 奈及利亚

- 埃及

- 卡达

- 南非

- 其他中东/非洲

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 北美洲

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Lamprell Energy Ltd

- Xiamen Shipbuilding Industry Co. Ltd

- Pella Sietas GmbH

- Japan Marine United Corporation

- Shanghai Zhenhua Heavy Industries Co. Ltd

- Nantong Rainbow Offshore & Engineering Equipments Co. Ltd

- COSCO SHIPPING Heavy Transport Inc.

- Fred. Olsen Windcarrier

- Deme Group

- Seafox

- Market Ranking/Share Analysis

第七章 市场机会及未来趋势

- 技术创新进展

The Offshore Wind Construction Vessel Market size is estimated at USD 21.33 billion in 2024, and is expected to reach USD 43.02 billion by 2029, growing at a CAGR of 15.06% during the forecast period (2024-2029).

Key Highlights

- Over the medium term, factors such as increasing offshore wind energy installations and the global renewable energy imperative are expected to be among the most significant drivers for the offshore wind construction vessel market during the forecast period.

- On the other hand, the cost of building and operating offshore wind construction vessels is high, which will pose a threat to the market during the forecast period.

- However, continued advancements in vessel design, propulsion systems, and automation led to more efficient wind construction vessels. This factor is expected to create several opportunities for the market in the future.

- The Asia-Pacific region dominates the market and will likely register the highest CAGR during the forecast period. China, Vietnam, Japan, and others drive it due to the growing number of offshore wind energy installation projects in these countries.

Offshore Wind Construction Vessel Market Trends

Normal Jack-Up Vessels Expected to Witness Growth

- Normal jack-up vessels are units designed to operate in harsh offshore environmental conditions. They have hulls and several cylindrical or lattice legs that can be extended to the seabeds, allowing the vessel to be jacked up and providing a stabilized platform for performing installation, maintenance, or various other activities from above the water surface. Due to their relatively more straightforward designs and operations, they are ideal for offshore wind farm construction and maintenance activities.

- One of the primary advantages of jack-up vessels is their ability to provide a stable and elevated working platform in offshore locations. This stability is critical for accurately positioning and installing wind energy components, such as tower sections, nacelles, turbines, and blades. The elevated platform also facilitates safe and efficient access to the turbines for maintenance and repair work, even in challenging weather conditions.

- As the number of offshore wind installations rises, the demand for normal jack-up vessels is expected to increase significantly. Various countries are exploring offshore wind energy installations, and compared to their counterparts, normal jack-up type vessels offer far less complexity in terms of operating and maintaining while also being relatively cheaper.

- According to the International Renewable Energy Agency 2023, the cumulative offshore wind energy installation globally was 72.66 GW in 2023 compared to 61.96 GW in 2022, registering a CAGR of over 17%, signifying the growing traction of offshore wind energy installation, which, in turn, drives the demand for normal jack-up vessels.

- To meet these market demands, jack-up vessel operators and shipyards have invested heavily in designing and constructing new, state-of-the-art vessels. These vessels are equipped with advanced technologies, such as dynamic positioning systems, motion-compensated cranes, and integrated control systems, to enhance their operational efficiency and safety.

- For instance, in May 2023, Danish installation firm Cadeler announced that the company worked on a new series of normal jack-up offshore wind installation vessels. The company teamed up with MAN Energy Solutions to develop a small engine that would reduce the weight of these vessels by 50%. This is expected to create room for a more advanced propulsion system without increasing the vessel weight, which leads to advanced vessels at a similar price to traditional vessels.

- Hence, the normal jack-up vessels are expected to grow significantly during the forecast period due to increased technological advancements and exploration of offshore wind energy.

Asia-Pacific to Dominate the Market

- Asia-Pacific is poised to dominate the offshore wind construction vessel market, driven by various countries setting ambitious renewable and offshore wind energy targets. Countries in the region, such as China, Vietnam, India, Japan, and South Korea, are experiencing a surge in energy demand due to rapid economic growth and urbanization. Offshore wind energy has emerged as an ideal solution to meet the growing energy demand while controlling carbon emissions and tackling space constraints.

- According to the International Renewable Energy Agency, offshore energy capacity in Asia-Pacific has risen significantly in recent years. It is one of the largest in the world. In 2023, the region's installed offshore wind energy capacity was 40.25 GW, which was more than 55% of the global installed capacity. This signifies the increased adoption of offshore wind energy in the region, propelling the market growth.

- Governments across the Asia-Pacific have implemented ambitious renewable energy targets and supportive policies, creating a conducive environment for offshore wind farm development. For instance, China has set a target of installing 40 gigawatts (GW) of offshore wind capacity by 2030, while Japan aims for 10 GW, and South Korea targets 8.2 GW by the same year. They are further driving the offshore wind construction vessels market in the region.

- Additionally, the region's well-established manufacturing capabilities in sectors such as shipbuilding, steel production, and heavy machinery provide a solid foundation for developing a robust offshore wind supply chain, including producing wind turbine components, vessels, and support infrastructure.

- Thus, the Asia-Pacific region will dominate the market during the forecast period.

Offshore Wind Construction Vessel Industry Overview

The global offshore wind construction vessel market is semi-consolidated. Some of the key players in this market are Lamprell Energy Ltd, Pella Sietas GmbH, Japan Marine United Corporation, Seafox, and Nantong Rainbow Offshore & Engineering Equipments Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Offshore Wind Energy Installation

- 4.5.1.2 Growing Imperative Toward Renewable Energy

- 4.5.2 Restraints

- 4.5.2.1 High Initial Capital Investment

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Self-propelled Jack-up Vessel

- 5.1.2 Normal Jack-up Vessel

- 5.1.3 Heavy Lift Vessel

- 5.2 Geography [Market Size and Demand Forecast till 2029 (for regions only)]

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 France

- 5.2.2.3 United Kingdom

- 5.2.2.4 Italy

- 5.2.2.5 Spain

- 5.2.2.6 NORDIC

- 5.2.2.7 Russia

- 5.2.2.8 Turkey

- 5.2.2.9 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Australia

- 5.2.3.4 Japan

- 5.2.3.5 South Korea

- 5.2.3.6 Malaysia

- 5.2.3.7 Thailand

- 5.2.3.8 Indonesia

- 5.2.3.9 Vietnam

- 5.2.3.10 Rest of Asia-Pacific

- 5.2.4 Middle East and Africa

- 5.2.4.1 Saudi Arabia

- 5.2.4.2 United Arab Emirates

- 5.2.4.3 Nigeria

- 5.2.4.4 Egypt

- 5.2.4.5 Qatar

- 5.2.4.6 South Africa

- 5.2.4.7 Rest of Middle East and Africa

- 5.2.5 South America

- 5.2.5.1 Brazil

- 5.2.5.2 Argentina

- 5.2.5.3 Colombia

- 5.2.5.4 Rest of South America

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Lamprell Energy Ltd

- 6.3.2 Xiamen Shipbuilding Industry Co. Ltd

- 6.3.3 Pella Sietas GmbH

- 6.3.4 Japan Marine United Corporation

- 6.3.5 Shanghai Zhenhua Heavy Industries Co. Ltd

- 6.3.6 Nantong Rainbow Offshore & Engineering Equipments Co. Ltd

- 6.3.7 COSCO SHIPPING Heavy Transport Inc.

- 6.3.8 Fred. Olsen Windcarrier

- 6.3.9 Deme Group

- 6.3.10 Seafox

- 6.4 Market Ranking/Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Technological Innovation