|

市场调查报告书

商品编码

1521756

艺术品物流:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Fine Art Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

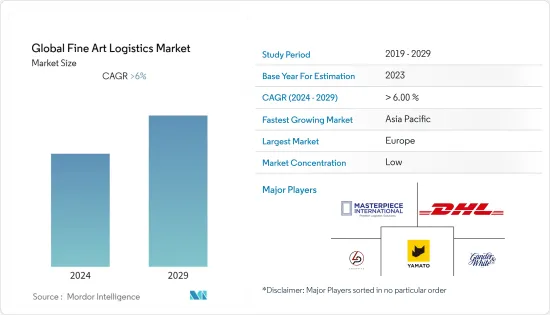

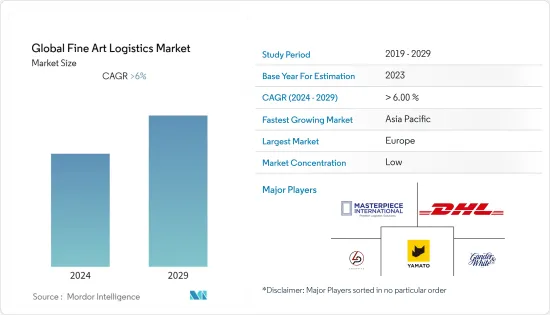

预计全球艺术品物流市场在预测期内复合年增长率将超过 6%

主要亮点

- 艺术品物流是指对绘画、雕塑、古董、工艺品等贵重、易碎艺术品的专业化运输、搬运、储存和安装。这些公司提供高端物流服务,将货物和艺术品安全可靠地从一个地点运送到另一个地点。

- 我们使用特殊的包装材料、气候控制车辆和安全的储存设施来保护艺术品在运输和储存过程中免受损坏或盗窃。利用展览、博物馆设施和其他公共艺术展示的美术物流。

- *提高艺术品运输和储存效率和安全性的需求正在推动艺术品物流行业引入新技术。 RFID标籤、GPS追踪和网路库存管理系统使运输商能够及时了解艺术品的位置和状况。

- 这可以降低遗失、损坏或被盗的风险,并确保您的艺术品按时交付。技术可以实现更准确的记录和文檔,这对于保险目的以及遵守法律要求和法规也很重要。将技术融入艺术品物流对于保持艺术品的完整性和价值,同时确保运输和储存过程顺利安全至关重要。

- 运输可能复杂且困难,因为艺术品必须仔细包装和运输以避免损坏。 2022年8月,Crozier Fine Arts Ltd收购了艺术品仓储和物流公司IFA Logistics,以扩大其在亚洲国家的业务。 Crozier Fine Arts Ltd 在伦敦、香港和纽约的扩张有助于运输作品。因此,运输服务的采用是艺术品市场参与者扩大的驱动力,创造了物流需求。

艺术品物流市场趋势

越来越多的收藏家支持艺术品物流市场的成长

- 为了确保艺术品的安全运输和储存,艺术品的价值不断上升,增加了对专业物流服务的需求。艺术收藏家愿意为这项服务付费。随着收藏家和画廊在世界各地买卖艺术品,对能够管理将艺术品从一个国家运输到另一个国家的复杂性的物流服务的需求不断增长。艺术收藏家经常参与这个过程,因为他们可能必须将他们的收藏转移到新的环境或展览。将于 2023 年 2 月举行的印度艺术博览会总监表示,艺术的范围和多样性反映出印度和南亚当代和现代艺术物流市场不断增长。

- 私人收藏家通常希望他们的艺术品在气候控制的环境中运输时得到最小心的处理。为了满足这些收藏家的需求,专门从事艺术品的物流公司成立了。 2022年11月,已故微软联合创始人保罗艾伦的私人艺术收藏竞标在纽约举行,多件作品价值超过15亿美元。

- 根据《纽约时报》报道,这是有史以来最昂贵的竞标,许多作品每件售价都超过1亿美元。乔治修拉的《Les Poseuses,Ensemble Petite Version》以 1.49 亿美元成交,创下竞标最高价。因此,私人收藏家对收藏日益增长的兴趣以及优质运输和交付服务的采用推动了美术物流市场的成长。

亚太地区未来将占据最大市场占有率

- 在亚太地区,艺术品物流市场的成长和展览市场的成熟正在推动艺术品物流公司的整合和标准化,以满足对可靠和专业的艺术品运输服务日益增长的需求。随着艺术品收购和转售兴趣的增加,亚太艺术品市场持续成长,对艺术品高效运输、储存和处理的需求也随之增加。

- 为了满足这项需求,美术物流公司针对珍贵艺术品运输和保护的特殊要求,提供专业的运输和仓储服务。为了支持印度美术物流市场的显着成长,2023 年印度艺术博览会将有 85 家参展和 71 家画廊参加。该博览会拥有大量参展、画廊和机构,展示了来自印度和南亚的各种当代、现代和数位艺术。来自印度和国外着名画廊的参与进一步强调了美术物流市场的区域影响力和重要性。

- 随着该地区线上画廊的兴起和电子商务的发展,对艺术品物流服务的需求预计将会增加。亚太地区正在大力投资建造新的博物馆和画廊,以期为该地区的企业创造新的机会。因此,预计未来几年亚太地区将在艺术品物流领域占据重要的市场占有率。

艺术品物流行业概况

艺术品物流市场的主要参与者正在考虑与当地企业建立策略伙伴关係、收购和联盟,作为扩大全球企业发展的主要策略。我们也投资技术和基础设施,以增强物流能力并提供更好的客户服务。这些企业致力于提供自订解决方案,以满足客户的特定需求,包括针对精緻和大型艺术品的专业包装和处理服务。为了满足全球对艺术品物流服务日益增长的需求,市场主要企业专注于提供优质的产品和服务。市场的主要企业包括 Yamato Transport、DHL、Gander & White、Masterpiece International 和 DB Schenker。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 目前的市场状况

- 市场技术进步

- 政府法规和市场倡议

- 运输费用注意事项

- 价值链/供应链分析

- COVID-19 对市场的影响

第五章市场动态

- 市场驱动因素

- 艺术收藏品的增加推动了对安全储存设施的需求

- 专业知识是更好处理和市场成长的关键

- 市场限制因素

- 运输成本上升

- 易碎物品难以安全包装和运输

- 市场机会

- 加大艺术品产业物流服务投入

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者/买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第六章 市场细分

- 按类型

- 运输

- 包装

- 贮存

- 按用途

- 艺术品经销商和画廊

- 竞标行

- 美术馆/博物馆

- 艺术博览会

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 西班牙

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 新加坡

- 马来西亚

- 泰国

- 其他亚太地区

- 中东/非洲

- 沙乌地阿拉伯

- 卡达

- 阿拉伯聯合大公国

- 埃及

- 其他中东和非洲

- 拉丁美洲

- 巴西

- 阿根廷

- 其他拉丁美洲

- 北美洲

第七章 竞争格局

- 市场集中度

- 公司简介

- Yamato Transport

- Gander & White

- Sinotrans

- Helu-Trans

- Hasenkamp

- Agility Logistics

- Masterpiece International

- US Art

- DHL

- DB Schenker

- Andre Chenue

- LP ART

- 其他公司

第八章市场的未来

第九章 附录

The Global Fine Art Logistics Market is expected to register a CAGR of greater than 6% during the forecast period.

Key Highlights

- Fine arts logistics refer to the specialized transportation, handling, storage, and installation of precious and fragile art objects, such as paintings, sculptures, antique pieces, and artifacts. These companies provide high-end logistics services for the safe and secure transportation of goods and artwork from one place to another.

- They use specialized packaging materials, climate-controlled vehicles, and safe storage facilities to protect works of art from damage or theft during transportation and storage. Coordination of art utilizes fine art logistics for exhibitions, museum installations, and other public displays of art.

- * The need for improved efficiency and security of art transport and storage is a driving force behind the adoption of new technologies in the fine art logistics industry. In order to provide better visibility and control of the entire logistics process, RFID tags, GPS tracking, or internet inventory management systems allow transport operators to keep track of art objects' location and condition in a timely manner.

- This helps reduce the risk of loss, damage, or theft and ensures that artwork is delivered in good time. The use of technology allows for more accurate record-keeping and documentation, which is important for insurance purposes and for complying with legal requirements and regulations. In order to preserve the integrity and value of art objects while guaranteeing a smooth and secure transport and storage process, it is essential that technology be integrated into fine art logistics.

- * Due to the need to pack and deliver the art carefully to avoid damage, transportation can be complex and difficult. In August 2022, Crozier Fine Arts Ltd acquired art storage and logistics company IFA Logistics to expand in Asian countries. In London, Hong Kong, and New York, the expansion of Crozier Fine Arts Ltd has helped transport its works. The adoption of transport services is, therefore, driven by the expansion of players in the fine art market, giving rise to a demand for logistics.

Fine Art Logistics Market Trends

A Growing Number of Collectors are Supporting the Growth of the Art Logistics Market

- In order to ensure the safe transport and storage of art, demand for specialized logistical services has increased due to an increase in its value. The art collectors are prepared to pay for this service. There is a growing demand for logistics services that can manage the complex transport of art from one country to another as collectors and galleries buy and sell artwork all over the world. This process is often attended by art collectors, as they may have to move their collections into new environments or exhibitions. According to the Director of the Indian Art Fair, in February 2023, the scope and diversity of art reflect the expansion of the contemporary and modern art logistics market in India and South Asia.

- During transport in a climate-controlled environment, private collectors often expect their art to be handled with the utmost care. This demand for high-quality service has led to the development of specialized fine art logistics companies that can meet the needs of these collectors. In November 2022, the auction of the private art collection of Paul Allen, the late Microsoft co-founder, in New York displayed various items priced at more than USD 1.5 billion.

- It was the most expensive auction in history, according to the New York Times, as many individual pieces sold for more than USD 100 million each. Georges Seurat's "Les Poseuses, Ensemble Petite Version" sold for USD 149 million and was the most expensive item in that sale. Therefore, the growth of the fine art logistics market is being driven by increasing interest in private collectors' collections as well as their adoption of good shipping and delivery services.

Asia-Pacific Holds the Largest Market Share in the Coming Years

- In Asia-Pacific, the growth of the art logistics market and the maturity of the exhibition market have led to the consolidation and standardization of art logistics companies, allowing them to meet the growing demand for reliable and professional art transport services. The need for efficient transport, storage, and handling of art is becoming increasingly important as the Asia-Pacific art market continues to grow in parallel with an increasing interest in acquiring and reselling art.

- In order to meet this need, art logistics companies provide specialized transport and safekeeping services in response to the specific requirements of carrying and protecting valuable works. In support of the significant growth in the Indian fine art logistics market, the exhibition was held with 85 exhibitors and 71 galleries at the India Art Fair 2023. A wide range of contemporary, modern, and digital art from India and South Asia is presented at the fair, which is attended by a number of exhibitors, galleries, and institutions. The regional reach and importance of the fine art logistics market are further underlined by the participation of prominent Indian and international galleries.

- The demand for fine art logistics services is expected to increase with the increasing number of online galleries and growing e-commerce in the area. Significant investments in the building of new museums and art galleries are being made in Asia-Pacific, with a view to creating new opportunities for enterprises there. Thus, Asia-Pacific is expected to hold a significant market share in the area of fine art logistics over the coming years.

Fine Art Logistics Industry Overview

Strategic partnerships, acquisitions, and collaborations with local players are the main strategies pursued by key operators in the fine art logistics market to expand their global reach. They are also investing in technology and infrastructure to increase their capacity for logistics and provide better customer service. They are dedicated to providing their clients with custom solutions in order to meet their specific needs, such as specialized packaging and handling services for delicate or large works of art. In order to meet the increasing global demand for art logistics services, key players in the market are focusing on providing quality products and services. The key players in the market are Yamato Transport, DHL, Gander and White, Masterpiece International, and DB Schenker, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Technology Advancements in the Market

- 4.3 Government Regulations and Initiatives in the Market

- 4.4 Spotlight on Transport Rates

- 4.5 Value Chain/Supply Chain Analysis

- 4.6 Impact on COVID-19 on the Market

5 Market Dynamics

- 5.1 Market Drivers

- 5.1.1 The Demand for Secure Storage Facilities is Driven by the Increase in Art Collection Value

- 5.1.2 Specialized Expertise is the Key to Better Handling and Market Growth

- 5.2 Market Restraints

- 5.2.1 High Cost of Transportation Costs

- 5.2.2 Securing the Packaging and Transport of Fragile Goods is Difficult

- 5.3 Market Opportunities

- 5.3.1 Increasing Investments in the Logistics Services in the Art Industry

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Consumers/ Buyers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Transportation

- 6.1.2 Packing

- 6.1.3 Storage

- 6.2 By application

- 6.2.1 Art Dealers and Galleries

- 6.2.2 Auction Houses

- 6.2.3 Museums

- 6.2.4 Art Fairs

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.1.3 Mexico

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 France

- 6.3.2.3 Spain

- 6.3.2.4 Italy

- 6.3.2.5 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 Australia

- 6.3.3.5 Singapore

- 6.3.3.6 Malaysia

- 6.3.3.7 Thailand

- 6.3.3.8 Rest of Asia-Pacific

- 6.3.4 Middle East and Africa

- 6.3.4.1 Saudi Arabia

- 6.3.4.2 Qatar

- 6.3.4.3 United Arab Emirates

- 6.3.4.4 Egypt

- 6.3.4.5 Rest of Middle East and Africa

- 6.3.5 Latin Maerica

- 6.3.5.1 Brazil

- 6.3.5.2 Argentina

- 6.3.5.3 Rest of Latin America

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration

- 7.2 Company Profiles

- 7.2.1 Yamato Transport

- 7.2.2 Gander & White

- 7.2.3 Sinotrans

- 7.2.4 Helu-Trans

- 7.2.5 Hasenkamp

- 7.2.6 Agility Logistics

- 7.2.7 Masterpiece International

- 7.2.8 U.S. Art

- 7.2.9 DHL

- 7.2.10 DB Schenker

- 7.2.11 Andre Chenue

- 7.2.12 LP ART

- 7.3 Other Companies