|

市场调查报告书

商品编码

1521765

FIBC:市场占有率分析、产业趋势与统计、成长预测(2024-2029)FIBC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

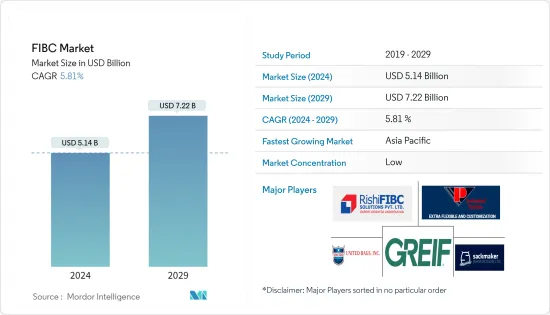

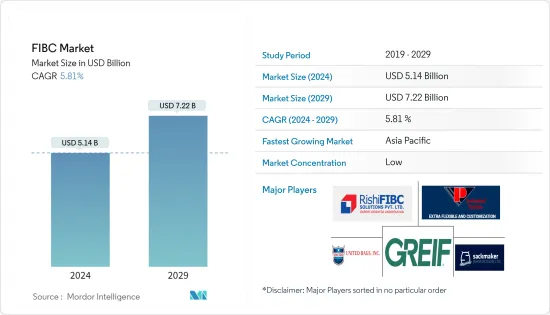

FIBC 市场规模预计到 2024 年为 51.4 亿美元,预计到 2029 年将达到 72.2 亿美元,在预测期内(2024-2029 年)复合年增长率为 5.81%。

主要亮点

- FIBC 是业界发展最快的包装解决方案之一。货柜市场成长的关键原因之一是世界工业化的快速发展。化学工业和农业领域越来越依赖集装袋来运输各种产品,包括谷物、大米、马铃薯、谷类和液体化学品。 FIBC 在炭黑、钢材、合金、矿物、水泥和沙子等建筑材料的储存和运输中也发挥着重要作用。

- 自动化和机器人技术对许多行业产生重大影响。自动化在 FIBC 製造中也逐渐成熟。高品质货柜的自动化生产和填充流程预计将在未来 FIBC 行销中发挥重要作用。 2023 年 8 月,主要企业Spiroflow 宣布推出其新一代双线散装袋填充系统。自动释放钩和滚筒输送机的组合简化了填充过程。满装的散装袋顺利、自动地从灌装机转移到输送机上。自动化还减少了手动工作。

- 随着环境问题的日益严重,永续性现已成为企业和消费者的首要任务。 FIBC 製造商和分销商正在响应对永续包装解决方案不断增长的需求。例如,2024 年 1 月,高性价比货柜製造商和供应商 Vaal Bulk Bags 宣布将专注于创新包装解决方案,并将永续性视为首要任务。透过关注环境的永续性,该公司的目标是减少散装包装对环境的影响,同时保持产品品质和功能。

- 聚乙烯 (PE) 和聚丙烯 (PPE) 是全球大多数货柜和内衬使用的两种主要原料。然而,无论是在疫情期间还是疫情之后,原料的供应都是最令人担忧的问题。因此,由于市场动盪(需求高、供给少),货柜产业出现价格上涨。近年来货柜价格大幅上涨,并已转嫁给消费者。

- 此外,参与国际贸易的各个行业的成长也增加了对 FIBC 或软质散装袋的需求。根据联合国贸易和发展会议(UNCTAD)2023年6月21日发布的最新《世界贸易最新动态》,全球商品贸易在2022年下半年下滑后,将在2023年初实现数量和金额的復苏。国际贸易的成长预计将加强对货柜在世界各地运输货物的需求。

货柜市场趋势

化学和石化领域的需求增加

- 由于其高强度和耐化学性,集装袋对于化学和石化原料的安全储存和运输至关重要。货柜(FIBC)用于包装和运输粉末、颗粒、易燃材料等危险物品。该行业的 FIBC 袋通常配备防静电功能和内衬,以避免产品污染。

- FIBC 散装袋由最高等级的聚丙烯树脂製成,几乎无法渗透所有化学物质、水、污染物、火灾和爆炸。 FIBC 散装袋可承载各种酸和碱,包括硫酸、氢氧化钠、氨水和漂白水。世界各地有多家公司提供强大容量的货柜。例如,Palmetto Industries 的 FIBC 大散装袋可容纳高达 4,000 磅的多种化学物质。

- 此外,全球化和改善的运输网络正在促进化学品和石化产品的跨境贸易,推动市场发展。此外,企业正在利用跨境贸易机会扩大业务范围、多元化收益来源并优化供应链。

- 根据美国工业理事会的数据,美国化学品製造业预计将在 2020 年从疫情导致的产量下降中恢復过来,2022 年复合年增长率为 4.3%。预计 2023 年成长率为 2.1%。化学品产量的成长预计在未来几年将扩大,导致对化学品包装的需求下降。

- 化学品包装市场专注于专门设计用于储存和运输大量化学品的包装解决方案的生产和分销。这些包装解决方案旨在满足最高的安全和监管要求,确保化学品在整个生命週期中的完整性和稳定性。例如,联合国 FIBC 袋专为危险材料的安全运输而设计和测试,因为它们符合联合国性能包装标准。这些 FIBC 专为危险材料的安全运输而设计和测试,以满足联合国性能包装标准。

亚太地区预计将出现强劲成长

- 由于亚洲和其他全球市场的需求不断增加,预计 FIBC 市场在未来几年将达到高水准。在亚太地区,中国预计将占据中间散装包装的最大市场占有率。不断成长的中国食品和饮料市场预计将在未来几年对亚太地区中型散货班轮市场的成长做出积极贡献。

- 中国是世界上最大的经济体之一,也是进出口总合最大的贸易国之一。该国被誉为世界工厂,在经历了一段时期的急剧停滞后,製成品出口贸易开始再次復苏。随着出口贸易的持续成长,预计市场对散装袋和耐用中间软质袋的需求强劲。

- 根据海关总署2023年12月报导公布的官方资料,中国出口在2023年11月小幅復苏,结束了连续六个月的下滑,成为世界第二大经济强国。 11月份出口较去年同月成长0.5%。此外,根据中国海关2024年1月发布的报告,中国的出口额在过去几年中不断增长,从2017年的22,633.5亿美元增加到2023年的约33,800.2亿美元,达到10亿美元。因此,全国出口贸易的持续成长可以归因于工业作为出口贸易中主要的二次包装产品的持续需求。

- 随着印度出口的持续成长,客自订化散装包装解决方案对于印度製造商来说变得越来越重要,特别是在食品加工、製药和化学领域。印度品牌资产基金会的数据显示,印度药品出口额从 2019 年的 191 亿美元增加到 2023 年的 254 亿美元。这种不断增长的出口趋势预计将推动整个市场对散装集装袋的需求。

- 印度政府鼓励在包装中使用可回收材料,而 FIBC 可以为此提供协助。各行业对客製化储存和运输解决方案的需求不断增加,而技术纯熟劳工的缺乏正在增加集装袋的使用,因为集装袋易于处理且具有成本效益。

- 根据印度柔性中型散装货柜协会(IFIBCA)主席介绍,自FIBCA成立以来,印度每年生产FIBCA约1万吨。目前,我们的年产量为 40 万吨。印度是包括欧洲在内的全球最大的货柜出口国之一,美国是最大的进口国之一。从 2024 年到 2029 年,随着全球市场需求的增加,产量预计将增加。

集装袋产业概述

集装袋市场目前已被分割,因为它由许多参与企业组成。市场上的几家主要企业正在不断努力实现进步。几家知名公司正在透过成立合资企业来扩大其在新兴市场的全球足迹,以巩固其市场地位。主要市场参与企业包括 Greif Inc.、United Bags Inc.、Berry Global Group Inc.、Rishi FIBC Solutions Pvt Ltd. 和 J&HM Dickson Ltd.。

- 2023 年 5 月,FlexSack 推出了一款新型聚丙烯可持续软质中型散装容器 (FIBC),由 30% 再生聚丙烯 (rPP) 製成。 FlexSack-eco 2023 含 30% (PCR) 是传统聚乙烯袋的永续替代品。编织袋的最新发展已从尼龙线缝製的聚乙烯袋的组合发展到100%回收的聚丙烯袋。

- 2023 年 8 月,由澳洲家族经营的 Sadleirs Packaging 成为全国第一家推出 FIBC 的公司,这种 FIBC 为 100% 聚丙烯,30% 可回收。根据该公司销售经理介绍,几乎所有 FIBC 配置都可以迁移到新的 FIBC Green Bag,采矿、製造、建筑、化学、乳製品和其他食品加工领域的客户都渴望尝试和迁移。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行概述

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场动态

- 市场驱动因素

- 最终用户产业对软质塑胶包装解决方案的需求增加

- 扩大便利商店、电商等流通管道的利用

- 市场限制因素

- 原物料价格剧烈波动

第六章 市场细分

- 按类型

- A型

- B型

- C型

- D型

- 依设计类型

- U盘袋

- 挡板袋

- 圆形袋

- 4侧板袋

- 其他设计类型

- 按最终用户产业

- 食品/农产品

- 化学/石化

- 药品

- 其他的

- 按地区*

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 亚洲

- 中国

- 印度

- 日本

- 澳洲/纽西兰

- 拉丁美洲

- 中东/非洲

- 北美洲

第七章 竞争格局

- 公司简介

- Greif Inc.

- United Bags Inc.

- J&HM Dickson Ltd

- Berry Global Group Inc.

- Thrace Group

- Rishi FIBC Solutions Pvt Ltd

- Bulk Lift International LLC

- BAG Supplies Canada Ltd

- Plastipak Group

- Bulk Pack Exports Ltd

- Southern Packaging LP

第八章市场的未来

The FIBC Market size is estimated at USD 5.14 billion in 2024, and is expected to reach USD 7.22 billion by 2029, growing at a CAGR of 5.81% during the forecast period (2024-2029).

Key Highlights

- FIBCs are one of the fastest-growing packaging solutions in the industry. One of the main reasons for the FIBC market growth is the fast-paced industrialization in the world. Industries in the chemical industry and agriculture increasingly depend on FIBCs to transport various products, such as grain, rice, potatoes, cereals, and liquid chemicals. FIBCs also play an important role in storing and transporting construction materials, including carbon black, steel, alloys, minerals, cement, and sand.

- Automation and robotics have made a huge impact in many industries. Automation is just beginning to take hold in FIBC manufacturing. Automated production and filling processes for high-quality bulk bags are expected to be a big part of the future of FIBC marketing. In August 2023, Spiroflow, a key Automated Handling Solutions (AHS) company, introduced a next-generation twin-line bulk bag filling system. The auto-release hook and roller conveyor combine to simplify the filling process. Full bulk bags are transferred from the filler onto the conveyors smoothly and automatically. Also, automation reduces the amount of manual intervention.

- As environmental concerns increase, sustainability is now a top priority for businesses and consumers. FIBC producers and marketers are responding to the increasing demand for sustainable packaging solutions. For instance, in January 2024, Vaal Bulk Bags, a producer and supplier of cost-effective bulk bags, unveiled its focus on commitments to innovative packaging solutions with sustainability as the top priority. By focusing on environmental sustainability, the company's goal is to reduce the environmental impact of bulk packaging while preserving the quality and functionality of the products.

- Polyethylene (PE) and polypropylene (PPE) are two of the main raw materials used in most FIBCs and liners worldwide. However, raw material availability has been the most concerning issue both during and post-pandemic periods. Therefore, with disruptive market conditions (high demand, low supply), the FIBC industry witnessed a price rise. FIBC prices have witnessed significant price increases in the past few years that are being passed onto consumers.

- Further, the growth of varied industries involved in international trade is escalating the demand for FIBC or flexible bulk bags. According to the United Nations Conference on Trade and Development's (UNCTAD) most recent Global Trade Update, released on 21 June 2023, after a decline in the latter half of 2022, global merchandise trade bounced back in terms of both volume and value in early 2023. Such a rise in international trade is expected to bolster the demand for FIBC to transport goods across the world.

FIBC Market Trends

Increasing Demand from the Chemical and Petrochemical Segment

- Due to their high strength and chemical resistance, FIBC bags are essential in safely storing and transporting chemical and petrochemical materials. FIBCs are used for packaging and transporting dangerous substances such as powder, granules, and flammable materials. FIBC bags for this industry are often equipped with anti-static features and liners to avoid product contamination.

- Made from the finest polypropylene resin, FIBC bulk bags are impervious to virtually any chemical, water, contaminant, fire, or explosion. FIBC bulk bags carry various acids and bases, including sulfuric acid, sodium hydroxide, ammonia water, and bleach. Several companies across the world provide FIBC with robust capacity. For instance, FIBC jumbo bulk bags at Palmetto Industries can hold up to 4,000 pounds of several kinds of chemicals.

- Further, globalization and improved transportation networks drive cross-border trade of chemicals and petrochemicals, which drives the market. In addition, businesses are taking advantage of cross-border trade opportunities to expand their reach, diversify their revenue sources, and optimize their supply chains.

- According to the American Chemistry Council, the chemical manufacturing sector in the United States was projected to register a CAGR of 4.3% in 2022, recovering from a decrease in production in 2020 owing to the pandemic. In 2023, the sector was expected to grow by 2.1%. Such growth in chemical production is expected to widen in the upcoming years, consequently pushing down the demand for chemical packaging.

- The chemical packaging market focuses on producing and distributing packaging solutions specifically designed for storing and transporting large volumes of chemicals. These packaging solutions are designed to meet the highest safety and regulatory requirements, guaranteeing the chemical's integrity and stability throughout its life cycle. For example, UN FIBC bags are specially designed and tested for the safe transportation of hazardous materials, as they meet the UN's performance packaging standards. These FIBCs are specially designed and tested for the safe transportation of hazardous materials, as they meet the UN's performance packaging standards.

Asia-Pacific is Expected to Witness Robust Growth

- The FIBC market is expected to reach a high level in the next few years due to increasing demand from Asia and the rest of the global market. In Asia-Pacific, China is expected to hold the largest market share in intermediate bulk packaging. The growing Chinese food and beverages market is expected to contribute positively to the growth of the Asia-Pacific medium bulk liner market in the coming years.

- China is one of the world's largest economies and one of the largest trading countries in terms of the sum of its exports and imports. The country is known as the world's factory, and its export trade for manufactured goods is again rebounding after a sudden stagnation for a brief period. With the continued growth in the export trade, the market is expected to witness robust demand for bulk and sturdy intermediate flexible bags.

- China's exports rebounded slightly in November 2023, ending a six-month streak of decline and recovering the world's second-largest economy, according to official data published in the General Administration of Customs article in December 2023. Year-on-year exports rose by 0.5% in November. Further, as per the report published by China Customs in January 2024, the country's export value increased in the past few years, reaching around USD 3380.02 billion in 2023, up from USD 2,263.35 billion in 2017. Therefore, this consistent growth in export trade across the country would be attributed to the constant demand for industrial products as the key secondary packaging products for the export trade.

- As India's exports continue to grow, especially in the areas of food processing, pharmaceuticals, and chemicals, custom bulk packaging solutions are becoming increasingly important for Indian manufacturers. According to the India Brand Equity Foundation, the value of Indian pharmaceutical exports from India increased from USD 19.1 billion in 2019 to USD 25.4 Billion in 2023. This rising export trend is expected to have created a bolstered demand for bulk FIBC across the market.

- Governments are encouraging the use of recyclable materials for packaging in India, which is something that FIBCs can help with. There is an increasing demand for customized storage and transportation solutions for various industries, and the lack of skilled labor means that more and more FIBCs are being used due to their ease of handling and cost-effectiveness.

- According to the President of the Indian Flexible Intermediate Bulk Container Association (IFIBCA), since the inception of FIBCA, the country produced around 10,000 tons of FIBCs per year. At present, it produces 400,000 tons per year. India is one of the largest exporters of FIBCs in the world, including Europe, and the United States is one of the largest importers. The growth in production is expected to increase between 2024 and 2029 with the rising demand across the global market.

FIBC Industry Overview

The FIBC market is fragmented as it currently consists of many players. Several key players in the market are constantly making efforts to bring advancements. A few prominent companies are entering into collaborations and expanding their global footprints in developing regions to consolidate their positions in the market. The major market players are Greif Inc., United Bags Inc., Berry Global Group Inc., Rishi FIBC Solutions Pvt Ltd, and J&HM Dickson Ltd.

- In May 2023, FlexSack launched its new polypropylene sustainable, flexible intermediate bulk containers (FIBCs) containing 30% recycled PP (rPP). FlexSack-eco 2023 with 30% (PCR) is a sustainable alternative to the traditional polyethylene bag. The latest development in woven bags has evolved from a combination of polyethylene bags sewn with nylon thread to 100% recycled polypropylene bags.

- In August 2023, Australia-based family-owned business Sadleirs Packaging introduced a 100% polypropylene FIBC with 30% recyclable content for the first time in the country. As per the company's sales manager, almost all FIBC configurations can be migrated to the new FIBC Green Bag, and the clients in the Mining, Manufacturing, Construction, Chemicals, Dairy, and other food processing sectors are eager to trial and migrate.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Demand for Flexible Plastic Packaging Solutions across End-user Industries

- 5.1.2 Growing Utilization of Distribution Channels such as Convenience Stores and E-commerce

- 5.2 Market Restraints

- 5.2.1 Increasing Price Volatility of Raw Materials

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Type A

- 6.1.2 Type B

- 6.1.3 Type C

- 6.1.4 Type D

- 6.2 By Design Type

- 6.2.1 U-Panel Bags

- 6.2.2 Baffle Bags

- 6.2.3 Circular Bags

- 6.2.4 4-Side Panel Bags

- 6.2.5 Other Design Types

- 6.3 By End-user Industry

- 6.3.1 Food and Agricultural Products

- 6.3.2 Chemical and Petrochemical

- 6.3.3 Pharmaceutical

- 6.3.4 Other End-user Industries

- 6.4 By Geography***

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Italy

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Japan

- 6.4.3.4 Australia and New Zealand

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Greif Inc.

- 7.1.2 United Bags Inc.

- 7.1.3 J&HM Dickson Ltd

- 7.1.4 Berry Global Group Inc.

- 7.1.5 Thrace Group

- 7.1.6 Rishi FIBC Solutions Pvt Ltd

- 7.1.7 Bulk Lift International LLC

- 7.1.8 BAG Supplies Canada Ltd

- 7.1.9 Plastipak Group

- 7.1.10 Bulk Pack Exports Ltd

- 7.1.11 Southern Packaging LP