|

市场调查报告书

商品编码

1521766

日本半导体记忆体:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Japan Semiconductor Memory - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

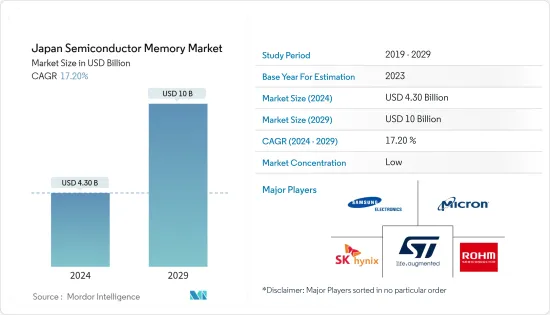

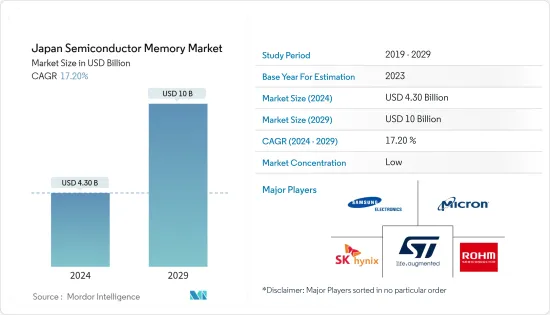

日本半导体记忆体市场规模预计到2024年将达到43亿美元,并在2029年达到100亿美元,在市场预测期间(2024-2029年)复合年增长率为17.20%。

*智慧型手机、平板电脑和其他消费性电子产品是半导体记忆体的最大消费者。随着这些设备变得更加强大和功能丰富,它们需要更多的记忆体才能正常运作。对这些设备的需求增加正在推动日本对半导体记忆体的需求。

*一些汽车 ADAS 製造商已经在使用储存设备。例如,Bosch 使用 Cypress Semiconductor 的汽车级串行 NOR 闪存,Infenion 生产基于视讯的 ADAS(高级驾驶员辅助系统)。这种用途预计能够在高达 +125°C 的温度下储存系统启动程式码和演算法。

*在自然灾害频繁的日本,企业依靠资料中心来确保业务永续营运。日本还没有产生云端巨头,因此中国和美国的企业都渴望向世界第三大经济体的企业出售云端服务。全球资料中心参与者正在日本新兴市场建立云端伺服器基地。这些因素预计将大大促进日本半导体记忆体的采用。

*此外,组织和当地大学的研究人员正在努力开发高速下一代内存,以支援人工智慧和物联网设备中不断增长的应用程式和资料量。例如,2023年5月,美光科技宣布,在日本政府的支持下,未来几年将在日本投资高达5,000亿日圆(36亿美元)用于下一代记忆体晶片。

*疫情凸显了半导体稳定供应的重要性。这导致包括日本在内的世界各地对半导体製造能力的投资增加。疫情也凸显了对供应链弹性的关注。半导体製造商现在正在寻求供应链多元化,并减少对单一材料和组件供应商的依赖。

日本半导体记忆体市场趋势

NAND快闪记忆体预计将大幅成长

*NAND解决方案针对emNAND快闪记忆体,该快闪记忆体由智慧型手机驱动,在预测期内将继续使用,并以其结构简单、高容量和低成本而闻名。其典型特征为连续式读出、架构和高密度。 NAND 快闪记忆体越来越流行用作 SSD(固态硬碟),也称为快闪记忆体和 USB 记忆体。

* 由于在家工作对电脑和智慧型手机的需求增加,NAND快闪记忆体的消费量急剧增加,其中很大一部分是由于智慧型手机平均容量的增加。智慧型手机越来越多地采用 NAND 快闪记忆体。

*在智慧型手机中,使用NAND快闪记忆体来改善多晶片封装(MCP)、迭层封装(POP)、高密度嵌入式储存以及行动装置中的MCP/POP和卡片插槽等领域的资料储存正在扩大。

*此外, NAND快闪记忆体广泛应用于汽车领域,用于存储为车载资讯娱乐系统提供支援的软体和资料,例如导航地图、音乐和视讯檔案。此外,这些记忆体还用于储存车道偏离警告、防撞和主动式车距维持定速系统等 ADAS 功能的软体和资料。

*因此,汽车销售量的成长也对市场成长产生正面影响。例如,根据日本工业协会的数据,日本乘用车新註册量将从2022年的345万辆增加到2023年的399万辆。乘用车销售量的增加和对先进车辆的需求不断增长预计将推动未来几年的市场需求。

智慧型手机/平板电脑市场预计将录得显着成长

*内存已成为智慧型手机的基本要素。需求呈指数级增长,主要是由智慧型手机的平均容量所推动的。智慧型手机中的NAND快闪记忆体记忆体可以显着提高网页浏览、阅读电子邮件、游戏甚至 Facebook 等社群网站的效能。随着智慧型手机变得越来越流行,该公司正在添加额外的功能和应用程序,以将其产品与其他製造商区分开来。例如,製造商正在整合手势控制、指纹扫描器和 GPS 功能。这推动了对快闪记忆体的需求,快闪记忆体被用作智慧型手机中的代码储存媒体。

*此外,主要智慧型手机供应商每年都会发布旗舰机型,每种机型的记忆体容量都在增加。此外,各大智慧型手机厂商每年都会发表旗舰机型,记忆体容量也会随着每次发布而增加。

*此外,每天用智慧型手机相机拍摄的照片和影片的数量也在增加。随着像素数量的增加,智慧型手机照片的尺寸呈指数级增长。此外,包括手机游戏在内的大容量智慧型手机应用程式的增加也推动了更大的储存容量。随着 5G 的推出,这种趋势可能会持续下去,因为大容量储存对于支援高速通讯、AR/VR、AI 技术和高清/4K 内容至关重要。

*据SK海力士称,随着苹果、华为、小米等主要智慧型手机製造商发布新的高规格产品,对大容量储存设备的需求正在迅速增长。为此,SK海力士在疫情到来之前推出了全球首款128层4D NAND快闪记忆体并开始量产。

*随着5G无线通讯的快速普及,智慧型手机的数量预计将增加一倍,并且需要不断升级最新型号。电子情报技术产业协会(JEITA)的数据显示,2023年12月国内智慧型手机出货量从上月的约33万台增加至约49万台。

日本半导体记忆体产业概况

日本半导体记忆体市场的特点是高度分散,主要参与者包括三星电子、美光科技、SK海力士和意法半导体等。市场参与企业正在策略性地利用联盟和收购来加强产品系列併建立永续的竞争优势。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

- 技术简介

- 宏观经济因素对市场的影响

第五章市场动态

- 市场驱动因素

- 扩大 5G 和物联网设备的渗透率

- 资料中心记忆体需求不断增加

- 消费性电子和汽车产业的需求增加

- 市场限制因素

- 疫情与美国贸易战带来的短期供应链挑战

第六章 市场细分

- 类型

- DRAM

- SRAM

- 或非快闪记忆体

- NAND快闪记忆体

- ROM和EPROM

- 其他的

- 目的

- 消费性产品

- 个人电脑/笔记型电脑

- 智慧型手机/平板电脑

- 资料中心

- 车

- 其他用途

第七章 竞争格局

- 公司简介

- Samsung Electronics Co. Ltd

- Micron Technology Inc.

- SK Hynix Inc.

- ROHM Co. Ltd.

- STMicroelectronics NV

- Maxim Integrated Products Inc.

- IBM Corporation

- Cypress Semiconductor Corporation

- Intel Corporation

- Nvidia Corporation

- Kioxia Corporation

第八章投资分析

第9章市场的未来

The Japan Semiconductor Memory Market size is estimated at USD 4.30 billion in 2024, and is expected to reach USD 10 billion by 2029, growing at a CAGR of 17.20% during the forecast period (2024-2029).

* Smartphones, tablets, and other consumer electronics are among the largest consumers of semiconductor memory. As these devices become more powerful and feature-rich, they require more memory to function properly. The increasing demand for these devices drives the demand for semiconductor memory in Japan.

* Some of the automotive ADAS manufacturers have already been using memory devices. For Example, Bosch uses the automotive-grade Serial NOR Flash memories from Cypress Semiconductor Corporation, which Infenion now acquires to manufacture its video-based Advanced Driver Assistance Systems (ADAS). The usage is expected to boost the storage of system boot code and algorithms at temperatures up to +125°C.

* As Japan is prone to natural disasters, companies in the region use data centers to secure their business continuity. Japan has not produced a cloud giant, so Chinese and American companies are rushing to sell cloud services to businesses in the world's third-largest economy. The global data center players are building homes for all those cloud servers in Japan's emerging markets. Such factors are expected to significantly boost the country's adoption of semiconductor memory.

* Moreover, researchers from organizations and regional universities are trying to develop high-speed next-generation memory to cater to the increasing applications of AI and IoT devices and their growing amount of data. For instance, in May 2023, Micron Technology announced it would invest up to JPY 500 billion (USD 3.6 billion) in Japan for the next few years, with support from the Japanese government, for next-generation memory chips.

* The pandemic highlighted the importance of having a secure supply of semiconductors. This has led to increased investment in semiconductor manufacturing capacity worldwide, including in Japan. The pandemic also increased the focus on supply chain resilience. Semiconductor manufacturers are now looking to diversify their supply chains and reduce their reliance on a single source of materials or components.

Japan Semiconductor Memory Market Trends

NAND Flash Memory is Expected to Have a Significant Growth

* NAND solution continues to be used over the forecast period, driven by smartphones, targeting emNAND flash memories that are known for their uncomplicated structure, high capacity, and low cost. Their typical features are sequential reading, architecture, and high density. NAND flash memories are becoming more popular due to their usage as Solid-State Drives (SSDs) and USB flash drives, which are called flash storage devices.

* With the rise in demand for PCs and smartphones owing to work from home, NAND flash consumption has dramatically increased, much of which is attributed to the growth of the average capacity of smartphones. This is expected to drive the demand for NAND flash, thus influencing the demand for memory packaging.

* Within smartphones, the use of NAND flash for improved data storage has grown in areas such as multi-chip packages (MCP) and package-on-package (POP), high-density embedded storage, and MCPs/POPs and card slots in handsets.

* Moreover, NAND Flash memory is widely used in the automotive segment to store the software and data that power in-vehicle infotainment systems, such as navigation maps, music, and video files. Additionally, these memories are used to store the software and data that powers ADAS features, such as lane departure warning, collision avoidance, and adaptive cruise control.

* As such, the increasing vehicle sales are also positively impacting the market growth. For instance, according to JAMA, new passenger car registrations in Japan increased from 3.45 million in 2022 to 3.99 million in 2023. The increasing sales of passenger cars and the rising demand for advanced vehicles are expected to drive the market demand in the coming years.

Smartphone/Tablet Segment Is Expected to Register a Significant Growth

* Memory storage has become an essential component in smartphones. The demand has been growing exponentially, primarily driven by the average capacity of smartphones. NAND flash memory in smartphones can significantly enhance the performance of web browsing, email loading, games, and even social network sites, such as Facebook. With the increasing adoption of smartphones, companies are adding extra features and applications to differentiate their products from other manufacturers. For instance, manufacturers are integrating gesture control, fingerprint scanners, and GPS features. This boosts the demand for flash memory, which is used as smartphone code storage media.

* Further, major smartphone vendors are launching their flagship models every year, and the memory capacity keeps increasing with each launch. By improving the scaling limits year after year, smartphone manufacturers sell smartphones at a premium by upgrading the memory capacity to boost performance.

* Additionally, the number of photos and videos users take daily through their smartphone cameras is increasing. The size of smartphone photos has grown exponentially as the number of pixels has increased. The growth in high-capacity smartphone applications, including mobile games, is another reason driving higher storage capacity. This trend would continue with the launch of 5G as high-capacity storage is essential to support high-speed communication, AR/VR, AI technology, and high-definition/4K content.

* According to Sk Hynix, the demand for high-capacity storage devices is booming due to the launch of new high-spec products by major smartphone manufacturers, such as Apple, Huawei, and Xiaomi. Hence, SK Hynix introduced the world's first '128-layer 4D NAND Flash' and put it into mass production before the pandemic arrived.

* With 5G wireless communication rapidly increasing, smartphones are expected to increase multifold, increasing the need for the latest models to raise the bar continuously. According to the Japan Electronics and Information Technology Industries Association (JEITA), the monthly domestic shipment volume of smartphones in Japan amounted to about 490 thousand units in December 2023, increasing from 330 thousand units in the previous month.

Japan Semiconductor Memory Industry Overview

The Japan semiconductor memory market is characterized by a high degree of fragmentation, featuring key players like Samsung Electronics Co. Ltd, Micron Technology Inc., SK Hynix Inc., and STMicroelectronics NV. Market participants strategically leverage partnerships and acquisitions to bolster their product portfolios and establish a sustainable competitive edge.

- In May 2023, Samsung Electronics announced to build a development facility in Yokohama in an initiative to spur collaboration between the chip industries of Japan and South Korea. The new facility will cost over JPY 30 billion (USD 222 million), and operations are expected to begin by 2025.

- In May 2023, SK Hynix Inc. announced that it had started the mass production of its 238-layer 4D NAND Flash memory. SK Hynix has developed solution products for smartphones and client SSDs, which are used as PC storage devices, adopting the 238-layer NAND technology, and has moved into mass production now. The 238-layer product - the smallest NAND in size - has a 34% higher manufacturing efficiency than the previous generation of 176-layer, significantly improving cost competitiveness.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

- 4.4 Impact of Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Penetration of 5G and IoT Devices

- 5.1.2 Growing Memory Requirement in Data Centers

- 5.1.3 Rising Demand from Consumer Electronics and Automotive Sectors

- 5.2 Market Restraints

- 5.2.1 Short term supply chain challenges due to the pandemic scenario and the US-China Trade war scenario

6 MARKET SEGMENTATION

- 6.1 Type

- 6.1.1 DRAM

- 6.1.2 SRAM

- 6.1.3 NOR Flash

- 6.1.4 NAND Flash

- 6.1.5 ROM & EPROM

- 6.1.6 Others

- 6.2 Application

- 6.2.1 Consumer Products

- 6.2.2 PC/Laptop

- 6.2.3 Smartphone/Tablet

- 6.2.4 Data Center

- 6.2.5 Automotive

- 6.2.6 Other Applications

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Samsung Electronics Co. Ltd

- 7.1.2 Micron Technology Inc.

- 7.1.3 SK Hynix Inc.

- 7.1.4 ROHM Co. Ltd.

- 7.1.5 STMicroelectronics NV

- 7.1.6 Maxim Integrated Products Inc.

- 7.1.7 IBM Corporation

- 7.1.8 Cypress Semiconductor Corporation

- 7.1.9 Intel Corporation

- 7.1.10 Nvidia Corporation

- 7.1.11 Kioxia Corporation