|

市场调查报告书

商品编码

1521792

商业暖通空调:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Commercial HVAC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

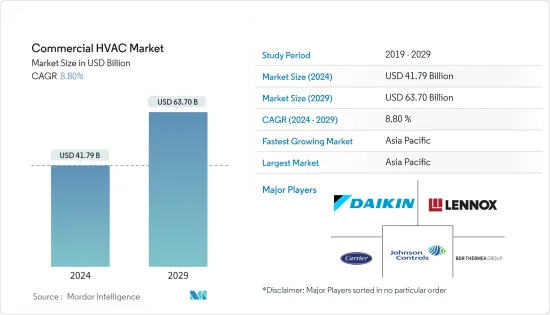

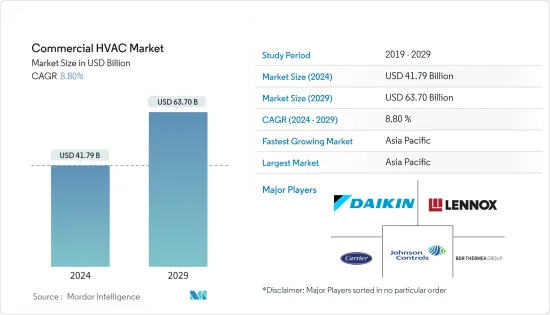

预计2024年商用暖通空调市场规模为417.9亿美元,预计2029年将达637亿美元,复合年增长率为8.80%(2024-2029年)。

主要亮点

- 办公室、餐厅、饭店、医院和学校等商业建筑需要暖气和冷气系统,为居住者提供舒适的空间。这些系统广泛用于办公室,以保持适当的温度和通风,提高员工的生产力和工作条件,并防止因湿度不足而引起的健康问题。

- 政府加强对引进节能设备的措施和投资可能会推动市场成长。例如,2024年2月,印度政府宣布将在2024-25年预算中拨款11.11兆印度卢比用于基础设施发展,创造有利于暖通空调产业成长的环境。这项投资,加上政府透过 Atmanirbhar Bharat 等倡议对自力更生的关注,预计将进一步刺激产业扩张。

- 为因应气候变迁目标,欧盟宣布必须加快高消费量建筑维修步伐,以实现更严格的节能目标。该法律草案将要求各州每年重建三座国有或占用的建筑,将其转变为「近零能耗建筑」。其中包括医院、政府大楼、学校和社会住宅,每年将进行超过 70 万次重建。

- 办公室建设的增加、温度条件的上升以及物联网和绿色技术的更多采用是推动整个商业暖通空调市场成长的一些驱动因素。此外,根据英国国家统计局的数据,2023年第一季英国建筑业附加价值毛额(GVA)比去年同期增加逾40亿英镑。

- 由于能源消耗的增加和提高系统效率的需要,市场正在看到智慧 HVAC 系统的成长趋势。买家越来越多地寻求具有物联网整合、即时监控和改进控制功能的智慧解决方案。这些智慧型系统最大限度地提高能源效率,提高舒适度,并提供对内部空间的更好控制。

- 全球能源价格上涨使得节能暖通空调系统对于节省成本具有吸引力。儘管有潜在的好处,但实施此类系统的初始成本可能会限制采用并阻碍市场扩张。

- 商业暖通空调市场受到政府法规和地方政府促进采用节能设备的新措施等因素的显着影响。例如,在过去的十年中,欧盟采取了多项措施来减少二氧化碳当量排放,以最大限度地减少能源消耗,促进可再生能源的使用,并推出了减少全球暖化影响的各类法律。

商业暖通空调市场趋势

对空调和通风设备的需求增加

- 由于都市化进程、基础设施发展以及对商业环境舒适度的日益重视等因素,商务用空调设备市场正在显着扩大。

- 空调系统在商业建筑中变得越来越普遍有几个原因。空调对于维持现代商业建筑的舒适氛围至关重要。透过使空气流过水冷或冷媒系统,这些装置可以有效降低温度,同时去除空气中过多的水分。

- 商务用空调系统往往比住宅系统更大、更复杂。这些系统由许多基本组件组成,这些组件协同工作以确保商业环境中的最大舒适度、空气品质和能源效率。正确设计、维护和安装的空调系统可以为员工、客户和业务创造积极的环境,同时促进能源的有效利用和回收。透过有效调节温度水平,无论外界温度如何,空调都有助于维持生产力水平。

- 此外,室内空气品质意识的增强、永续性法规以及物联网 (IoT) 和建筑自动化系统的整合等因素正在改变商业格局。这些变化正在为创新和市场扩张创造机会。

- 此外,一些公司正在持续投资推出各种产品,以满足商务用领域对此类空调系统的需求。例如,2024年4月,海尔宣布推出最新系列「超重型」空调。该新系列配备了该公司的HEXA逆变器和Supersonic冷却技术。

- 此外,2024年5月,开利美的印度有限公司宣布在古尔冈开设印度第一家美的冷却解决方案专卖店。这项创新的体验概念旨在改变客户购买空调产品时的体验。在美的专业店,您可以体验多种前沿的空调解决方案。该公司为商业和住宅用途提供全面的美的暖通空调解决方案。它涵盖了所有类型的VRF(可变冷媒流量)系统,满足住宅、中小型企业、办公室、大型商业建筑和计划应用的空调需求。它还包括各种分离式空调、风管机组、卡式机组和塔式机组。

- 印度製造商Voltas在2023-24年销售了超过200万台空调,创下了印度有史以来空调年销售量的最高纪录。该公司强大的线下和线上销售网路、富有创意的新品发布以及对冷却产品的稳定需求导致年度销量增长35%,第四季度加速至72%。

亚太地区预计将出现显着成长

- 印度和中国的办公室、购物中心、饭店、资料中心、医院和零售店的扩张是该地区商业暖通空调市场的主要驱动力。餐旅服务业是亚太地区暖通空调设备和服务的重要使用者。

- 旅馆业对暖通空调系统的需求和考虑几乎比其他行业都多。满足商业饭店复杂的暖气和通风需求,从住宿的舒适度和可靠性到整体效率和节能,需要采取全面的方法。因此,该地区酒店业的崛起预计将推动市场成长。

- 2024 年 1 月,印度酒店公司 (IHCL) 宣布与 IFC 的 TechEmerge永续製冷创新计画合作,在 18 个月内完成了 9 个先导计画。这凸显了该公司坚定不移地致力于推广环保实践,为印度酒店业提供高效、气候友好且具有成本效益的冷却解决方案。

- 此外,该地区的许多商业建筑正在寻求 LEED 等绿色认证,要求安装节能空调系统。根据国际能源总署(IEA)发布的报告,中国在新型热泵销量方面领先全球。根据IEA的报告,中国有大量新的热泵装置。此外,中国拥有最多的专门安装热泵等暖通空调系统的劳动力,并且在热泵製造方面拥有最大的市场占有率(45%)。

- 此外,市场上的多个参与者也支持该地区暖通空调的发展。例如,2023年11月,开利公司宣布在国家历史文化名城长沙举办年会,接待了来自全国各地的300多家商用暖通经销商。透过这次活动,该公司将让经销商有机会更多地了解其创新解决方案、帮助客户实现碳中和的计划,以及如何投资颠覆性技术以加速我们提供的下一代永续解决方案。此次活动重点在于暖通空调产业如何透过智慧、绿色建筑解决方案助力中国双碳策略的实现。

- 此外,新兴国家越来越多的资料中心、购物中心、学校、大学等正在推动暖通空调市场的需求。亚太地区持续投资建置先进资料中心。例如,ST Telemedia 全球资料中心 (STT GDC) 于 2024 年 4 月宣布,将为其位于东京的第二个资料中心设施 STT Tokyo 2 举行奠基仪式,以支持该国关键的数位基础设施需求。资料中心园区将提供高达70MW的IT容量,STT Tokyo 2计划预计完工后将产生高达38MW的容量。

商业暖通空调产业概述

商业暖通空调市场分散且竞争激烈,有多个主要企业。市场参与企业正致力于透过利用策略合作措施来扩大其国际消费群,以提高市场占有率和盈利。这些公司利用策略合作计划来增加市场占有率和盈利。 Carrier Corporation、Daikin Industries Ltd、BDR Thermea Group、Lennox International Inc. 和 Johnson Controls International PLC 等公司是该市场的重要参与者。

- 2024 年 5 月,Lennox International 宣布推出新的 HVAC 系列,可将全球暖化潜力降低「高达 78%」。 Lennox的新型暖气、通风和空调产品提供全面的产品系列,并使用环保冷媒R454B,将全球暖化潜力降低高达78%。

- 2024年3月,Panasonic Corporation宣布推出三款新型商务用空气净化热泵(A2W),采用环保天然冷媒,适用于多用户住宅、商店、办公室及其他轻型商业设施。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业价值链分析

- COVID-19副作用和其他宏观经济因素对市场的影响

第五章市场动态

- 市场驱动因素

- 主要新兴国家商业建设增加

- 节能设备的需求增加

- 市场挑战

- 节能係统的初始成本较高

第六章 市场细分

- 依零件类型

- 暖通空调设备

- 加热设备

- 空调/通风设备

- 暖通空调服务

- 暖通空调设备

- 按最终用户产业

- 款待

- 商业大厦

- 公共设施

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 澳洲

- 纽西兰

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- Johnson Controls International PLC

- Midea Group Co. Ltd

- Daikin Industries Ltd

- Robert Bosch GmbH

- Carrier Corporation

- LG Electronics Inc.

- Lennox International Inc.

- BDR Thermea Group

- Panasonic Corporation

- Danfoss A/S

第八章投资分析

第9章市场的未来

The Commercial HVAC Market size is estimated at USD 41.79 billion in 2024, and is expected to reach USD 63.70 billion by 2029, growing at a CAGR of 8.80% during the forecast period (2024-2029).

Key Highlights

- Any commercial building, including offices, restaurants, hotels, hospitals, and schools, needs heating and cooling systems to give its occupants a comfortable space. These systems are widely used in offices to maintain the right temperature and ventilation, which enhances worker productivity and working conditions while preventing health problems brought on by incorrect humidity levels.

- The increasing government initiatives and investments in the adoption of energy-efficient equipment will drive market growth. For instance, in February 2024, the Indian government's announcement to allocate INR 11.11 lakh crore for infrastructure in the 2024-25 budget created a conducive environment for the HVAC sector's growth. This investment, coupled with the government's focus on self-reliance through initiatives like Atmanirbhar Bharat, is expected to further fuel the industry's expansion.

- In an effort to meet climate change targets, the European Union declared that nations would have to renovate energy-guzzling buildings at a faster pace and adhere to stricter energy-saving targets. The draft proposal would require states to renovate three state-owned and occupied buildings each year to convert them into "near-zero energy buildings." This includes hospitals, government buildings, schools, and social housing, and it will amount to more than 700,000 renovated buildings per year.

- The increase in the construction of offices, rising temperature conditions, and rising adoption of IoT and green technologies are some of the driving factors contributing to the overall growth of the commercial HVAC market. In addition, according to the Office for National Statistics (United Kingdom), in the first quarter of 2023, the gross value added (GVA) of the construction industry in the United Kingdom was over GBP 4 billion higher than in the same period of the previous year.

- The market is witnessing a growing trend toward smart HVAC systems due to increased energy consumption and the need for higher system efficiency. Increasingly, buyers are looking for smart solutions with IoT integration, real-time monitoring, and improved controls. These intelligent systems maximize energy efficiency, improve comfort, and offer more control over interior spaces.

- The increasing energy prices worldwide make energy-efficient HVAC systems attractive for cost savings. Despite the potential benefits, the initial expenses of installing these systems could limit their widespread use and hinder market expansion.

- The commercial HVAC market is highly affected by factors such as government regulations and new initiatives by the governments of various regions to boost the adoption of energy-efficient equipment. For instance, over the past decade, several types of EU legislation have been introduced to minimize energy consumption, stimulate renewable energy use, and reduce CO2 equivalent emissions to decrease the impact of global warming.

Commercial HVAC Market Trends

Air Conditioning /Ventilation Equipment Witnessed Increasing Demand

- The market for air conditioning equipment in the commercial sector is expanding significantly due to factors such as increasing urbanization, infrastructure development, and the growing emphasis on comfort in business environments.

- There are several reasons why air conditioning systems are becoming more and more common in commercial buildings. Air conditioners are essential for preserving a comfortable atmosphere in contemporary commercial buildings. By moving air through water-cooled or refrigerant systems, these units efficiently reduce the temperature while also removing too much moisture from the air.

- Commercial air conditioning systems tend to be larger in size than domestic ones, and they are more complex. These systems are made up of a number of fundamental components that work together to ensure the highest comfort, air quality, and energy efficiency in business settings. This is because properly designed, maintained, and installed air conditioning systems create favorable environments for employees, customers, and operations while also facilitating the efficient utilization and recycling of energy. By regulating temperature levels effectively, air conditioning aids in sustaining productivity levels regardless of the external heat.

- Furthermore, the business landscape is changing due to factors like growing awareness of indoor air quality, sustainability regulations, and the integration of IoT (Internet of Things) and building automation systems. These changes present opportunities for innovation and market expansion.

- Moreover, several companies are constantly investing in introducing various products catering to the demand for these air conditioning systems in the commercial segment. For instance, in April 2024, Haier announced the launch of its latest range of "super heavy-duty" air conditioners. The new range comes with the company's Hexa Inverter and Supersonic cooling technologies.

- Further, in May 2024, Carrier Midea India Pvt. Ltd announced the opening of India's first Midea Cooling Solutions ProShop in Gurugram. This innovative experiential concept is designed to transform the customer buying experience for air-conditioning products. A wide variety of cutting-edge air conditioning solutions are available for exploration at the Midea ProShop; the company offers a comprehensive selection of Midea HVAC solutions for commercial and residential applications. This covers a full range of VRF (Variable Refrigerant Flow) systems to meet the air-conditioning needs of residential, small businesses, offices, large commercial buildings, and project applications. It also includes a variety of split air conditioners, ducted units, cassette units, and tower units.

- Voltas, an Indian manufacturer, reported sales of over 2 million air conditioners in FY 2023-24, the largest-ever annual sales of ACs in India, according to the company. The company's robust offline and online distribution network, creative new launches, and a steady demand for cooling products were all factors leading to an annual volume growth of 35%, which was accelerated by a 72% growth in Q4.

Asia-Pacific is Expected to Witness Significant Growth

- The expansion of offices, malls, hotels, data centers, hospitals, and retail outlets in India and China is a major driver for the region's commercial HVAC market. In Asia-Pacific, the hospitality sector is a significant user of HVAC equipment and services.

- The hotel industry has more needs and considerations compared to virtually any other sector when it comes to HVAC systems. A comprehensive approach is needed to meet the complex needs of commercial hotels for heating and ventilation, from guest comfort and reliability to overall efficiency and energy savings. Thus, the rising hospitality sector in the region is expected to drive the market's growth.

- In January 2024, Indian Hotels Company (IHCL) announced the completion of nine pilot projects in collaboration with IFC's TechEmerge Sustainable Cooling Innovation Program within a span of 18 months. This highlights the firm's unwavering commitment to fostering environmentally responsible practices in order to provide efficient, climate-friendly, and cost-effective cooling solutions for India's hospitality industry.

- Many commercial buildings in the region are also pursuing green certifications like LEED, which mandate the installation of energy-efficient HVAC systems. According to the report published by the International Energy Agency, China is the global leader in new heat pump sales. According to the IEA report, China has a large number of new heat pump installations. Furthermore, China boasts the largest workforce dedicated to installing HVAC systems like heat pumps and holds the largest market share in heat pump manufacturing, accounting for 45%.

- Several players in the market are also supporting the growth of HVAC in the region. For instance, in November 2023, Carrier Corporation announced that it had hosted more than 300 commercial HVAC dealers from across China during its annual conference in the designated National Famous Historical and Cultural City of Changsha. Through this event, the company will provide dealers the opportunity to learn more about its innovative solutions, the company's plan to help customers become carbon neutral, and how it is investing in disruptive technologies to accelerate next-generation sustainable solutions. The event focused on how the HVAC industry can help China achieve its dual carbon strategy with intelligent and green building solutions.

- Furthermore, the growing number of data centers, malls, schools, and universities, among others, in developing countries is driving the demand in the HVAC market. Asia-Pacific is witnessing several investments in the construction of advanced data centers. For instance, in April 2024, ST Telemedia Global Data Centres (STT GDC) announced the groundbreaking for its second data center facility in Tokyo, STT Tokyo 2, to support the demand for critical digital infrastructure in the country. The data center campus will provide up to 70 MW of IT capacity, while the STT Tokyo 2 project is estimated to generate up to 38 MW once it is completed.

Commercial HVAC Industry Overview

The commercial HVAC market is fragmented, favorably competitive, and has several prominent players. The market players are focusing on expanding their consumer base across foreign countries by leveraging strategic collaborative initiatives to increase their market share and profitability. These enterprises leverage strategic collaborative initiatives to boost their market share and profitability. Companies such as Carrier Corporation, Daikin Industries Ltd, BDR Thermea Group, Lennox International Inc., and Johnson Controls International PLC are significant players in the market.

- May 2024: Lennox International announced the launch of a new HVAC line that reduces global warming potential 'by up to 78%'. The new Lennox heating, ventilation, and air conditioning products will offer a comprehensive range of products and will use the environmentally responsible refrigerant R454B, which reduces global warming potential by as much as 78%.

- March 2024: Panasonic Corporation announced the release of three new models of commercial air-to-water (A2W) heat pumps using environmentally friendly natural refrigerants for multi-dwelling units, stores, offices, and other light commercial properties.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Commercial Construction in Major Emerging Economies

- 5.1.2 Increasing Demand For Energy Efficient Devices

- 5.2 Market Challenges

- 5.2.1 High Initial Cost of Energy-efficient Systems

6 MARKET SEGMENTATION

- 6.1 By Type of Component

- 6.1.1 HVAC Equipment

- 6.1.1.1 Heating Equipment

- 6.1.1.2 Air Conditioning /Ventillation Equipment

- 6.1.2 HVAC Services

- 6.1.1 HVAC Equipment

- 6.2 By End-user Industry

- 6.2.1 Hospitality

- 6.2.2 Commercial Buildings

- 6.2.3 Public Buildings

- 6.2.4 Other End-user Industries

- 6.3 By Geography ***

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Australia

- 6.3.5 New Zealand

- 6.3.6 Latin America

- 6.3.7 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.2 Johnson Controls International PLC

- 7.3 Midea Group Co. Ltd

- 7.4 Daikin Industries Ltd

- 7.5 Robert Bosch GmbH

- 7.6 Carrier Corporation

- 7.7 LG Electronics Inc.

- 7.8 Lennox International Inc.

- 7.9 BDR Thermea Group

- 7.10 Panasonic Corporation

- 7.11 Danfoss A/S