|

市场调查报告书

商品编码

1550330

日本商务用暖通空调:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Japan Commercial HVAC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

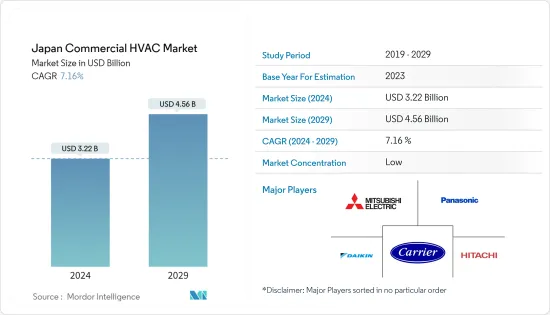

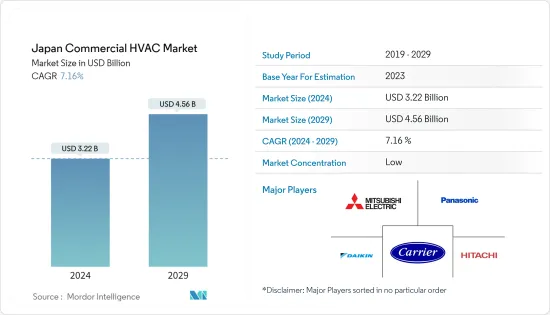

日本商务用暖通空调市场规模预计到 2024 年为 32.2 亿美元,预计到 2029 年将达到 45.6 亿美元,在预测期内(2024-2029 年)复合年增长率为 7.16%。

主要亮点

- 暖通空调系统对于在商业建筑中创造舒适的室内环境是必要的。控制办公空间的温度和通风,以提高员工的工作效率和福祉。此外,它还有助于降低与湿度管理不良相关的健康风险。

- 日本日益严重的污染问题使环保建筑成为人们关注的焦点,为希望在日本市场扩大业务的产业相关人员提供了一系列投资前景。

- 据国际能源总署(IEA)称,日本将更新其建筑规范,要求所有新建建筑到 2030 年实现零能耗,现有建筑到 2050 年达到这一标准。该标准旨在提高建筑物的能源效率,预计将刺激市场需求。

- 此外,开发中国家资料中心、仓库、购物中心、教育机构和其他设施的增加正在推动对商务用暖通空调系统的需求。国内资料中心建置投资快速增加。例如,2024 年 4 月,ST Telemedia World 资料 Centers (STT GDC) 宣布在东京建造第二个资料中心设施 STT Tokyo 2,以满足日本对关键数位基础设施日益增长的需求。资料中心园区将提供高达70MW的IT容量,STT Tokyo 2计划预计竣工后将产生高达38MW的电力。

- 不断上涨的能源成本使得节能暖通空调系统越来越有吸引力,并具有潜在的节约潜力。然而,与安装相关的高昂初始成本可能会阻碍广泛接受和市场扩张。

- 日本商务用暖通空调市场较为分散,众多公司则占较小的市场占有率。商务用暖通空调市场的主要市场参与企业正专注于新产品开拓、策略联盟、收购和业务扩张,以满足客户不断增长的需求,进一步推动市场成长。

- 例如,2023年8月,DAIKIN INDUSTRIES工业宣布计画在茨城县筑波未来市购买土地,新建一座空调专用製造工厂。这项经过深思熟虑的决定进一步推动了该公司提高国内产能和巩固其在日本市场地位的目标。

- 此外,该国公共建筑的扩建预计将支持市场成长。例如,2024年6月,花旗宣布在日本设立花旗商业银行(CCB)。这项倡议是花旗计划在目标丛集内的策略成长市场建立 CCB 并推动显着扩张的计画的关键要素。

- 此外,日本的商务用暖通空调产业深受宏观经济因素的影响,例如政府法规和旨在促进使用节能设备的新措施。例如,日本设定了 2030 年将温室气体 (GHG)排放减少 46% 的目标,并计划进一步减少 50%。

日本商务用暖通空调市场趋势

暖通空调设备占据主要市场占有率

- 单分流系统是小型商业建筑的首选 HVAC 系统。它具有成本效益,并且可以让您精确控制每个房间的温度。

- 商务用空间中的 VRF 系统可有效循环加热和冷却所需的冷却剂量。这些先进的空调系统允许企业同时管理其场所内的多个空调区域。

- 此外,空气调节机(AHU)从外部环境和室内空气中收集空气,过滤掉污染物,并调节商业建筑内的温度和湿度。处理后的空气被循环回到大气中。由于其设计和操作,AHU 比传统商店空调机组更有效率。空调机组有潜力降低商业设施内的成本并减少能源使用。

- 在日本,由于游客增加而导致的酒店业扩张预计将推动对商务用暖通空调系统的需求。在日本,游客可以选择多种度假住宿设施,包括城市饭店、商务旅馆、渡假饭店、日式旅馆和团体住宿设施。根据厚生劳动省统计,截至2023年3月末,日本註册的旅馆、旅馆数量约90,700家,较前一年大幅增加。

- 日本入境旅游成长迅速,市场优先考虑国内旅游活动。儘管近年来住宿客人数量不断增加,但只有五分之一的住宿是外国人。

商业建筑领域占据主要市场占有率

- 商业建筑部分包括办公大楼、零售店、展示室和仓库等基础设施。暖气和冷气系统对于任何商业建筑都至关重要,因为它们为居住者提供舒适的环境。

- 商务用暖通空调系统很复杂,包括暖气、通风和空调元件。专为满足大型建筑的独特要求而量身定制,确保卓越的室内空气品质、能源效率和居住者满意度。

- 商务用暖通空调系统透过协调三大系统的功能,有效调节室内温度、控制湿度并维持空气品质。空调装置使用冷媒来冷却室内空间并帮助除湿。暖气系统使用水、散热器盘管或瓦斯来提高室内温度。通风系统透过过滤系统清洁空气,并透过风扇确保适当的空气循环。

- 在预测期内,该国办公空间的扩张可能会推动对暖通空调服务和设备的需求。据国土交通省称,2023 年日本将启动约 9,580 个办公大楼建设计划。这些办公大楼的占地面积与去年持平。

- 此外,主要零售商正在扩大在日本的业务,对商务用暖通空调系统和服务产生了很高的需求。高效的 HVAC 系统可以透过改善零售空间的空气品质来带来显着的好处。这包括去除污染物、过敏原和难闻的气味,最终改善购物体验并确保顾客和员工的健康。

- 2024年1月,IKEA宣布计划在北部关东地区开设新店。商店位置优越,旨在满足当地社区的需求,为人口超过 700 万的地区提供服务。宜家前桥店展现了宜家对永续性的奉献精神,并将成为日本最环保的宜家商场。

日本商务用暖通空调产业概况

日本的商务用暖通空调市场较为分散,由多家公司组成。市场上的公司不断努力透过推出新产品、扩大业务、进行策略併购、联盟和合作来提高其市场占有率。主要公司包括开利株式会社、Daikin Industries Ltd.、三菱电机株式会社、日立製作所、Panasonic Corporation等。

- 2024年5月,Midia推出了EVOX G3热泵系统。 EVOX系列的这一新系列由EVOX G3热泵和EVOX G3空气调节机(AHU)组成。美的 EVOX G3 热泵的尺寸从 1.5 吨到 5 吨不等,配备增强型蒸汽喷射 (EVI) 技术和多层热交换器,即使在恶劣的天气条件下也能提供可靠的温暖,无需补充热量。

- 2024 年 3 月,Panasonic Corporation宣布推出三款新型商务用空气对水 (A2W) 热泵型号,这些型号采用环保天然冷媒,专为多用户住宅、商店、办公室和其他轻型商业设施而设计。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业价值链分析

- COVID-19副作用和其他宏观经济因素对市场的影响

第五章市场动态

- 市场驱动因素

- 日本商业建筑的增加

- 节能设备的需求增加

- 市场挑战

- 节能係统的初始成本较高

第六章 市场细分

- 依零件类型

- 暖通空调设备

- 加热设备

- 空调/通风设备

- 暖通空调服务

- 暖通空调设备

- 按最终用户产业

- 款待

- 商业大厦

- 公共设施

- 其他的

第七章 竞争格局

- 公司简介

- Johnson Controls International PLC

- Midea Group Co., Ltd.

- Daikin Industries, Ltd.

- Robert Bosch GmbH

- Carrier Corporation

- Valliant Group

- LG Electronics Inc.

- Lennox International Inc.

- Mitsubishi Electric Corporation

- Panasonic Corporation

- Hitachi Ltd.

- Danfoss A/S

第八章投资分析

第9章市场的未来

The Japan Commercial HVAC Market size is estimated at USD 3.22 billion in 2024, and is expected to reach USD 4.56 billion by 2029, growing at a CAGR of 7.16% during the forecast period (2024-2029).

Key Highlights

- HVAC systems are necessary for creating comfortable indoor environments in commercial buildings. In office spaces, they regulate temperatures, provide ventilation, and boost employee productivity and well-being. Furthermore, they assist in reducing health risks related to poor humidity control.

- Increasing levels of pollution in Japan have led the country to focus on eco-friendly buildings, presenting various investment prospects for industry players aiming to grow their footprint in the Japanese market.

- According to the International Energy Agency (IEA), Japan has updated its building standards, mandating that all new buildings achieve zero-energy performance by 2030 and existing structures meet this criterion by 2050. These standards, aimed at enhancing energy efficiency in buildings, are projected to stimulate market demand.

- Moreover, the increasing number of data centers, warehouses, shopping centers, educational institutions, and other facilities in developing nations is fueling the demand for commercial HVAC systems. The country is experiencing a surge in investments in the construction of data centers. For instance, in April 2024, ST Telemedia Global Data Centres (STT GDC) revealed plans to begin construction on its second data center facility in Tokyo, STT Tokyo 2, in response to the growing need for critical digital infrastructure in the country. The data center campus is expected to offer a maximum of 70 MW of IT capacity, and the STT Tokyo 2 project is expected to generate up to 38 MW upon completion.

- Energy-efficient HVAC systems are increasingly attractive in the country because of the escalating energy costs, providing potential savings. Nevertheless, the substantial upfront expenses linked to installation could hinder widespread acceptance and market expansion.

- The commercial HVAC market in Japan is fragmented, with a large number of players occupying a small market share. Key market players operating in the commercial HVAC market are focusing on new product development, strategic partnerships, acquisition, and expansion to meet the growing demand from customers, further supporting market growth.

- For instance, in August 2023, Daikin Industries, Ltd announced plans to acquire land in Tsukubamirai City, Ibaraki Prefecture, Japan, with the intention of establishing a new manufacturing plant dedicated to air conditioners. This calculated decision is set to bolster the company's domestic production capacity and further its objective of strengthening its position within the Japanese market.

- Furthermore, the rising expansion of public buildings in the country will support market growth. For instance, in June 2024, Citi revealed the introduction of Citi Commercial Bank (CCB) in Japan. This initiative is a crucial component of Citi's plan to establish CCB in strategic growth markets within targeted clusters to facilitate significant expansion.

- Additionally, the commercial HVAC industry in Japan is significantly influenced by macroeconomic elements like governmental regulations and fresh endeavors aimed at promoting the use of energy-efficient equipment. For instance, Japan has set a target to reduce its greenhouse gas (GHG) emissions by 46% by 2030, with a further ambition to achieve a 50% reduction.

Japan Commercial HVAC Market Trends

HVAC Equipment Holds the Significant Market Share

- The single split system is the preferred HVAC system for small commercial buildings. It is cost-effective and allows for precise control over the temperature in each room.

- VRF systems in commercial space efficiently circulate the precise amount of refrigerant required for heating or cooling purposes. These advanced air conditioning systems enable businesses to manage multiple air conditioning zones within their premises simultaneously.

- Moreover, Air Handling Units (AHUs) collect air from the external environment and indoor air, filter out contaminants, and regulate the temperature and humidity in the commercial building. The treated air is then circulated back into the atmosphere. Because of their design and operation, AHUs are more efficient than traditional retail air conditioning units. They can potentially lower costs and decrease energy usage within commercial establishments.

- The rising expansion of the hospitality sector in Japan due to growing tourism will propel the demand for commercial HVAC systems in the country. In Japan, travelers can choose from various holiday accommodations, including city hotels, business hotels, resorts, ryokan, and group lodgings. According to the Ministry of Health, Labour and Welfare of Japan, as of the end of March 2023, Japan had seen a surge in the number of registered hotels and inns, totaling around 90,700 establishments, which was a significant increase compared to the previous year.

- Despite Japan's rapid growth in inbound tourism, the market prioritizes domestic travel activities. Although the number of lodging guests has continuously increased in recent years, foreign nationals account for only one-fifth of overnight guests.

Commercial Building Segment Holds the Significant Market Share

- The commercial building segment compromises infrastructures, such as office buildings, retail, showrooms, and warehouses, among others. Heating and cooling systems are essential to any commercial building, as they provide occupants with a comfortable environment.

- Commercial HVAC systems are intricate, including elements for heating, ventilation, and air conditioning. They are tailored to meet large buildings' particular requirements to guarantee excellent indoor air quality, energy efficiency, and occupant satisfaction.

- Commercial HVAC systems effectively regulate indoor temperature, control humidity levels, and maintain air quality by coordinating the functions of three key systems. Air conditioning units cool indoor spaces by utilizing refrigerants, which also help in dehumidifying the air. Heating systems raise indoor temperatures using water, radiator coils, or gas. Ventilation systems clean the air with filtration systems and ensure proper air circulation with fans.

- The rising expansion of office space in the country will drive the demand for HVAC services and equipment during the projected timeline. According to the Ministry of Land, Infrastructure, Transport, and Tourism, approximately 9,580 office construction projects commenced in Japan in 2023. The floor area of these office constructions remained consistent with the previous year.

- Moreover, leading retail players are expanding their presence in the country, thus creating high demand for commercial HVAC systems and services. An efficient HVAC system offers a significant benefit by enhancing the air quality in the retail space. This involves removing pollutants, allergens, and unpleasant odors, ultimately improving the shopping experience and ensuring the well-being of both customers and employees.

- In January 2024, IKEA revealed plans to open a new store in the northern Kanto region of Japan. This store has been strategically located to serve the needs of the local communities, encompassing an area with a population of more than seven million individuals. Demonstrating IKEA's dedication to sustainability, IKEA Maebashi is set to become Japan's most environmentally friendly IKEA store, boasting the smallest operational climate impact.

Japan Commercial HVAC Industry Overview

The Japanese commercial HVAC market is fragmented and consists of several players. Companies in the market continuously try to increase their market presence by introducing new products, expanding their operations, or entering into strategic mergers and acquisitions, partnerships, and collaborations. Some of the major players include Carrier Corporation, Daikin Industries Ltd, Mitsubishi Electric Corporation, Hitachi Ltd, Panasonic Corporation, and many more.

- In May 2024, Midea has introduced the EVOX G3 heat pump system. This new iteration of the EVOX series consists of the EVOX G3 Heat Pump and EVOX G3 Air Handling Unit (AHU). Available in sizes ranging from 1.5-ton to 5-ton units, the Midea EVOX G3 heat pumps are equipped with Enhanced Vapor Injection (EVI) technology and a multi-layer heat exchanger, guaranteeing reliable warmth without the need for auxiliary heat, even in extreme weather conditions.

- In March 2024, Panasonic Corporation unveiled three new commercial air-to-water (A2W) heat pump models that utilize eco-friendly natural refrigerants designed for use in multi-dwelling units, stores, offices, and other light commercial properties.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Commercial Construction in the country

- 5.1.2 Increasing Demand For Energy Efficient Devices

- 5.2 Market Challenges

- 5.2.1 High Initial Cost of Energy Efficient Systems

6 MARKET SEGMENTATION

- 6.1 By Type of Component

- 6.1.1 HVAC Equipment

- 6.1.1.1 Heating Equipment

- 6.1.1.2 Air Conditioning /Ventillation Equipment

- 6.1.2 HVAC Services

- 6.1.1 HVAC Equipment

- 6.2 By End-User Industry

- 6.2.1 Hospitality

- 6.2.2 Commercial Buildings

- 6.2.3 Public Buildings

- 6.2.4 Others

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Johnson Controls International PLC

- 7.1.2 Midea Group Co., Ltd.

- 7.1.3 Daikin Industries, Ltd.

- 7.1.4 Robert Bosch GmbH

- 7.1.5 Carrier Corporation

- 7.1.6 Valliant Group

- 7.1.7 LG Electronics Inc.

- 7.1.8 Lennox International Inc.

- 7.1.9 Mitsubishi Electric Corporation

- 7.1.10 Panasonic Corporation

- 7.1.11 Hitachi Ltd.

- 7.1.12 Danfoss A/S