|

市场调查报告书

商品编码

1640418

木质素产品 -市场占有率分析、产业趋势/统计、成长预测(2025-2030)Lignin Products - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

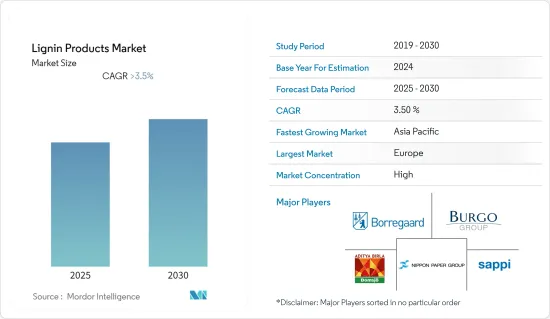

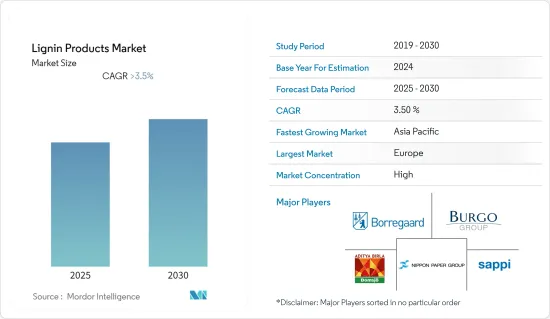

预计木质素产品市场在预测期内将维持3.5%以上的复合年增长率。

COVID-19 大流行对市场产生了负面影响。这是因为製造设施和工厂因封锁和限製而关闭。供应链和运输中断进一步阻碍了市场。但2021年,产业復苏,市场需求恢復。

主要亮点

- 短期内,混凝土外加剂中磺酸盐消费量的增加和动物饲料需求的增加预计将推动市场的发展。

- 另一方面,研发活动与消费性产品之间的差距可能会阻碍所研究市场的成长。

- 然而,替代化石原料的日益普及预计将在预测期内提供大量机会。

- 虽然欧洲在消费量方面占据市场主导地位,但亚太地区预计在预测期内复合年增长率最高。

木质素产品市场趋势

混凝土添加剂可望主导市场

- 木质素及其产品用作混凝土添加剂,例如黏合剂和抑尘剂。木质素用作玻璃绒隔热材料中的黏合剂。改善沥青结合料的性能。

- 磺酸盐木质素历来被用于道路上以稳定路面和控制灰尘。木质素基产品比通常应用于路面的石油和盐基产品更安全、更经济。例如,根据美国人口普查局的数据,2022年美国高速公路和公路计划建设支出为1,098.1亿美元,较2021年增加9%。因此,增加道路建设投资预计将在预测期内创造对木质素产品的需求。

- 从地区来看,欧洲在作为混凝土添加剂的木质素消费方面处于领先地位。然而,亚太地区预计在预测期内复合年增长率最快。

- 亚太地区正在进行的大型基础设施计划预计将提振该地区的市场。例如,根据印度品牌公平基金会(IBEF)的数据,在2022-2023年联邦预算中,印度政府向印度国家公路管理局(NHAI)拨款172.4亿美元。因此,预计日本对木质素产品的需求。

- 根据土木工程师协会(ICE)的研究,到2030年,全球建筑业规模预计将达到8兆美元,其中中国、印度和美国是主要推动力。

- 建筑业的成长预计将增加对包括混凝土添加剂在内的各种建筑化学品的需求,最终将推动木质素产品市场的发展。

欧洲主导市场的前景

- 由于德国和英国等国家的存在,预计欧洲将在预测期内主导市场。

- 由于各种负面影响,欧盟(EU)对各领域的化学品使用实施了严格的规定。肥料、其他农业化学品和水处理化学品是主要问题。

- 为了避免这些后果,该地区对生物基产品的需求正在增加,预计这将推动德国对木质素产品的需求。

- 例如,德国超过 20% 的新建筑使用天然材料,例如木质素製成的混凝土外加剂。

- 此外,根据2030年FTIP(联邦交通基础设施计画),联邦政府宣布2016年至2030年间将在德国道路投资1,476亿美元。其中,744亿美元将专门用于结构维护和基础设施更换。

- 德国是航太和汽车工业的主要枢纽,这些领域对碳纤维的需求不断增加。例如,在义大利,2021年汽车产量为795,856辆,比2020年增加2%。预计这将推动木质素需求。木质素用于生产低成本碳纤维而不影响性能。

- 此外,在英国,政府计划在2020年至2050年间将GDP的1-2%投资于基础设施,作为国家生产力投资基金(NPIF)的一部分,以便为人们提供更好的基础设施。此外,英国也是浓缩饲料、饲料补充剂和混合饲料的主要生产国。例如,英国英国国家统计局的数据,2021年製造商的牲畜饲料销售额为51.4亿英镑(70.7亿美元),比2020年增加15.8%。

- 由于上述因素,预计欧洲在预测期内将主导全球市场。

木质素产品产业概况

木质素产品市场是一体化的。该市场的主要企业包括(排名不分先后)Borregaard AS、Domsjo Fabriker、Sappi、Burgo Group SpA、Nippon Paper Industries 等。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 对高品质混凝土外加剂的需求不断增加

- 饲料需求增加

- 增加分散剂中木质素的使用

- 抑制因素

- 研发与消费性产品之间的差距

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 来源

- 纤维素乙醇

- 牛皮纸浆

- 亚硫酸盐纸浆

- 产品类型

- 磺酸盐

- 硫酸盐木质素

- 高纯度木质素

- 目的

- 混凝土添加剂

- 餵食

- 香草醛

- 分散剂

- 树脂

- 活性碳

- 碳纤维

- 塑胶/聚合物

- 苯酚及其衍生物

- 其他用途(混合、吸附剂等)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 其他北美地区

- 欧洲

- 德国

- 英国

- 法国

- 北欧国家

- 欧洲其他地区

- 其他的

- 巴西

- 沙乌地阿拉伯

- 其他国家

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率分析**/排名分析

- 主要企业策略

- 公司简介

- Borregaard AS

- Burgo Group SpA

- Domsjo Fabriker

- GREEN AGROCHEM

- Ingevity Corporation

- NIPPON PAPER INDUSTRIES CO., LTD.

- Rayonier Advanced Materials

- SAPPI

- Stora Enso

- The Dallas Group of America

- UPM

- WUHAN EAST CHINA CHEMICAL CO.,LTD

第七章 市场机会及未来趋势

- 化石原料的替代品越来越受欢迎

The Lignin Products Market is expected to register a CAGR of greater than 3.5% during the forecast period.

The COVID-19 pandemic negatively impacted the market. This was because of the shutdown of the manufacturing facilities and plants due to the lockdown and restrictions. Supply chain and transportation disruptions further created hindrances for the market. However, the industry witnessed a recovery in 2021, thus rebounding the demand for the market studied.

Key Highlights

- Over the short term, increased consumption of lignosulfonates in concrete admixtures and the rising demand for animal feed are expected to drive the market.

- On the flip side, the existing gap between R&D activities and consumer products is likely to hinder the growth of the market studied.

- However, the increasing popularity of substituting fossil-based raw materials is anticipated to provide numerous opportunities over the forecast period.

- Europe dominated the market in terms of consumption, however, Asia-Pacific is expected to have the highest CAGR during the forecast period.

Lignin Products Market Trends

Concrete Additives are Expected to Dominate the Market

- Lignin and its products use concrete additives such as binders and dust suppressants. They are used as binders for glass wool building insulation. They improve the performance of asphalt binders.

- Lignin sulphonate has been historically used on roads for surface stabilization and dust control. Lignin-based products are safer and more economical than petroleum- and salt-based products typically applied to road surfaces. For instance, according to the US Census Bureau, in 2022, the value of construction spending on highway and street projects in the United States amounted to USD 109.81 billion, which showed an increase of 9% compared with 2021. Therefore, increasing investments in road construction are expected to create demand for lignin-based products over the forecast period.

- Geographically, Europe leads the way in consuming lignin as a concrete additive. However, Asia-Pacific is expected to register the fastest CAGR over the forecast period.

- The significant infrastructure projects underway in Asia-Pacific are expected to boost the regional market. For instance, according to the India Brand Equity Foundation (IBEF), In the Union Budget 2022-2023, the Indian government allocated USD 17.24 billion to the National Highways Authority of India (NHAI). Therefore, this is expected to create demand for lignin-based products in the country.

- According to a study by the Institution of Civil Engineers (ICE), the global construction industry is expected to reach USD 8 trillion by 2030, primarily driven by China, India, and the United States.

- The growing construction industry is expected to increase the demand for various construction chemicals, including concrete additives, which will eventually drive the market for lignin-based products.

Europe is Expected to Dominate the Market

- The European region is expected to dominate the market during the forecast period due to the presence of countries like Germany and the United Kingdom.

- The European Union imposed stringent regulations on the use of chemicals in various segments due to various adverse effects. Fertilizers, other agricultural chemicals, and water treatment chemicals are major concerns.

- To avoid these consequences, the demand for bio-based products has increased in the region, which, in turn, is expected to propel the demand for lignin products in Germany.

- For instance, more than 20% of the new constructions in Germany use natural materials, such as concrete admixtures made from lignin.

- Moreover, under the 2030 FTIP (Federal Transport Infrastructure Plan), the federal government announced it will invest USD 147.6 billion in Germany's roads from 2016 to 2030. USD 74.4 billion will be allocated for structural maintenance and replacement infrastructure.

- Being the major hub for aerospace and automotive industries, Germany witnessed an increased demand for carbon fibers from these segments. For instance, In Italy, automotive production in 2021 amounted to 795,856 units, showing an increase of 2% compared with 2020. This is expected to drive the demand for lignin. Lignin is used in the production of low-cost carbon fibers without compromising performance.

- Additionally, in the United Kingdom, to provide better infrastructure to the population across the country, the government has planned to invest 1-2% of the GDP in infrastructure between 2020 and 2050 as part of the National Productivity Investment Fund (NPIF). In addition, the United Kingdom is a major producer of concentrated animal feed, feed supplements, and unmixed feeds. For instance, according to Office for National Statistics (UK), manufacturers' sales of farm animal feed had a value of 5.14 billion British pounds (USD 7.07 billion) in 2021, which showed an increase of 15.8% compared with 2020.

- Based on the factors above, Europe is expected to dominate the global market during the forecast period.

Lignin Products Industry Overview

The Lignin Products Market is consolidated in nature. The major players in this market include (not in a particular order) Borregaard AS, Domsjo Fabriker, Sappi, Burgo Group SpA, and Nippon Paper Industries Co. Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Need for High-quality Concrete Admixtures

- 4.1.2 Rising Demand for Animal Feed

- 4.1.3 Increasing Use of Lignin in Dispersants

- 4.2 Restraints

- 4.2.1 Gap Between R&D and Consumer Products

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Source

- 5.1.1 Cellulosic Ethanol

- 5.1.2 Kraft Pulping

- 5.1.3 Sulfite Pulping

- 5.2 Product Type

- 5.2.1 Lignosulfonate

- 5.2.2 Kraft Lignin

- 5.2.3 High-purity Lignin

- 5.3 Application

- 5.3.1 Concrete Additive

- 5.3.2 Animal Feed

- 5.3.3 Vanillin

- 5.3.4 Dispersant

- 5.3.5 Resins

- 5.3.6 Activated Carbon

- 5.3.7 Carbon Fibers

- 5.3.8 Plastics/Polymers

- 5.3.9 Phenol and Derivatives

- 5.3.10 Other Applications (Blends, Sorbents, etc.)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Rest of North America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Nordic Countries

- 5.4.3.5 Rest of Europe

- 5.4.4 Rest of the World

- 5.4.4.1 Brazil

- 5.4.4.2 Saudi Arabia

- 5.4.4.3 Other Countries

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Borregaard AS

- 6.4.2 Burgo Group SpA

- 6.4.3 Domsjo Fabriker

- 6.4.4 GREEN AGROCHEM

- 6.4.5 Ingevity Corporation

- 6.4.6 NIPPON PAPER INDUSTRIES CO., LTD.

- 6.4.7 Rayonier Advanced Materials

- 6.4.8 SAPPI

- 6.4.9 Stora Enso

- 6.4.10 The Dallas Group of America

- 6.4.11 UPM

- 6.4.12 WUHAN EAST CHINA CHEMICAL CO.,LTD

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Popularity of Substituting Fossil-based Raw Materials