|

市场调查报告书

商品编码

1523313

汽车液压系统:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Automotive Hydraulic Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

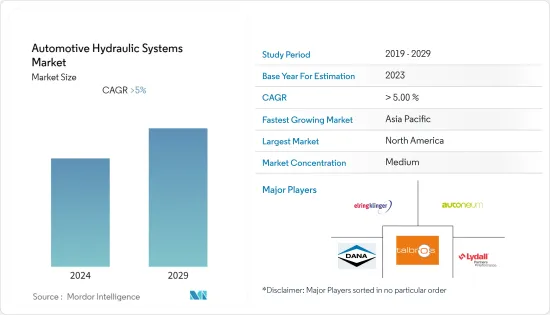

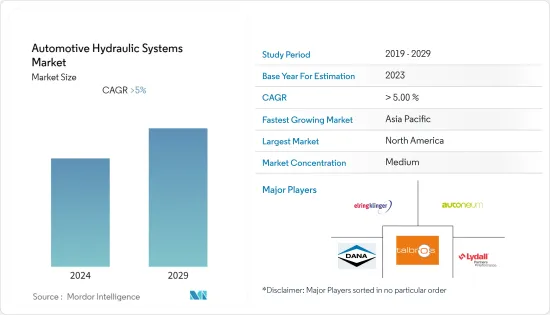

汽车液压系统市场规模预计将从 2024 年的 372.7 亿美元增至 2029 年的 492.9 亿美元,在预测期内(2024-2029 年)复合年增长率为 5.75%。

近年来,汽车液压系统市场一直在稳步成长。全球汽车产量的持续成长,特别是中国和印度等新兴市场的汽车产量,是汽车液压系统市场的主要驱动因素。乘用车和商用车需求的不断增长正在推动液压系统在各种应用中的采用,包括煞车和动力方向盘。例如

主要亮点

- 2022年中国商用车总销量为3,300,458辆,印度为933,116辆,日本为753,023辆。

液压系统具有能够以低成本安装在车辆上的巨大优势,这已被证明是推动市场的最重要因素之一。液压系统可以比电池更有效地储存和排放能量。事实证明,在需要大量动力的车辆中,油压混合动力驱动比电动驱动更有效率。汽车液压系统最常见的应用是动力方向盘、避震器和煞车。

电液系统、智慧液压元件等先进技术的整合正在提高汽车液压系统的整体性能和效率。随着汽车製造商优先考虑技术创新以保持竞争力,这一趋势正在增强。

然而,电动车的日益普及给传统液压系统带来了挑战。随着汽车产业转向电气化,某些应用(例如动力方向盘)对液压系统的需求可能会减少。

儘管存在这些挑战,汽车液压系统市场预计将继续其成长轨迹,儘管速度较慢。

汽车液压系统市场趋势

商用车将成为成长最快的市场领域

由于经济成长、都市化和运输需求的增加,商用车市场正在全球扩张。随着商用车需求的增加,对先进、高效能液压系统的需求也增加。

全球产业部门扩张导致建筑和电子商务活动增加,增加了货物运输的需求,导致商用车销售大幅成长。由于汽车液压系统在这些车辆中大量使用,因此这种增长预计将推动汽车液压系统市场。

2022年,全球商用车产量约2,374万辆,全球销售量为2,410万辆。最大的商用车市场是美国,总销量超过1,130万辆。

商用车辆,特别是重型卡车和公共汽车,需要坚固而强大的液压系统来处理高负载,提供可靠的动力方向盘。液压系统非常适合这些重型应用,使其成为商用车领域的重要组成部分。

商用车有多种用途,从送货卡车到工程车辆。液压系统具有高度可自订性和多功能性,可让製造商客製化解决方案,以满足不同商用车领域的特定要求。此外,在这个市场上运营的公司越来越多地整合先进技术以提高性能和效率。包含感测器和智慧组件的智慧液压系统非常符合商用车製造商所需的技术进步。

因此,由于运输和其他工业应用的需求不断增加,预计商用车领域在预测期内将继续大幅增长,从而对这些车辆中的液压系统的需求不断增加。

亚太地区预计将创下最高成长率

预计在预测期内,亚太地区的汽车液压系统市场将出现最高成长。该地区由中国和印度等迅速崛起为汽车中心的国家组成。中国是全球最大的汽车市场。中国经济的成长和人民可支配收入的增加正在增加该国对汽车的需求。

中国的低生产成本也推动了汽车製造业的成长,最终刺激了对液压系统的需求。 2022年,中国乘用车销量突破2,383.6万辆,商用车销量突破330万辆。

此外,由于中国和日本的存在,亚太地区的电气化也呈现较高的渗透率。中国是电动车的主要市场,在电动车技术方面取得进展的汽车製造商大多是日本企业。与亚太地区其他国家相比,中国的电动车销售呈现强劲成长。 2022年,中国电动车销量突破600万辆,其中纯电动车459万辆。

因此,随着亚太地区汽车产业的快速成长,预计未来几年对液压系统的需求也将出现积极成长。

汽车液压系统产业概况

汽车液压系统市场适度整合。汽车液压系统市场的主要企业包括罗伯特·博世有限公司、爱信精机、采埃孚集团和大陆集团。全球汽车液压系统市场主要由技术创新驱动。主要企业大力投入研发,不断推出新产品。这些公司也举办技能提升课程来培训员工。例如

- 2023 年 9 月,博世力士乐宣布在宾州伯利恆开设新的液压训练中心。中心设有三个先进的培训站,包括设备齐全的教室、会议室、休息区和咖啡馆。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 商用车需求和销售的成长推动液压系统市场

- 市场限制因素

- 全电动液压系统越来越多地取代传统液压系统成为限制因素

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 目的

- 煞车

- 离合器

- 暂停

- 其他(挺桿等)

- 成分

- 主缸

- 工作缸

- 水库

- 软管

- 车辆类型

- 客车

- 轻型商用车

- 中大型商用车

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 韩国

- 其他亚太地区

- 世界其他地区

- 南美洲

- 中东/非洲

- 北美洲

第六章 竞争状况

- 供应商市场占有率

- 公司简介

- Aisin Seiki Co. Ltd

- Robert Bosch GmbH

- ZF Friedrichshafen AG

- BorgWarner

- Warner Electric LLC

- Continental AG

- Schaeffler Technologies AG and Co.

- WABCO

- GKN PLC

- JTEKT Corporation

- FTE Automotive Group

第七章 市场机会及未来趋势

The Automotive Hydraulic Systems Market size is estimated at USD 37.27 billion in 2024, and is expected to reach USD 49.29 billion by 2029, growing at a CAGR of 5.75% during the forecast period (2024-2029).

The automotive hydraulic systems market has been growing at a steady pace in recent years. The continuous rise in global automotive production, particularly in emerging markets such as China and India, is a primary driver for the automotive hydraulic systems market. The increasing demand for passenger and commercial vehicles propels the adoption of hydraulic systems for various applications, including braking and power steering. For instance:

Key Highlights

- In China, the total commercial vehicle sales in 2022 totaled 3,300,458 units, while India and Japan registered 933,116 and 753,023, respectively.

The low cost at which hydraulic systems can be fit into vehicles is a major advantage and has proven to be one of the most important factors driving the market studied. Hydraulic systems can store and discharge energy more efficiently than electric batteries. Vehicles that require a lot of power are finding hydraulic hybrid drives to be more efficient than electric drives. The most common use of hydraulic systems in an automobile is power steering, shock absorbers, and brakes.

The integration of advanced technologies, such as electro-hydraulic systems and smart hydraulic components, is enhancing the overall performance and efficiency of automotive hydraulic systems. This trend is gaining momentum as automakers prioritize technological innovation to stay competitive.

However, the increasing adoption of electric vehicles poses a challenge to traditional hydraulic systems. As the automotive industry shifts toward electrification, the demand for hydraulic systems in certain applications, like power steering, may decline.

Despite the challenges, the automotive industry's hydraulic systems market is expected to continue its growth trajectory, albeit at a slower pace.

Automotive Hydraulic Systems Market Trends

Commercial Vehicle will be the Fastest Growing Segment in the Market

The commercial vehicle market has expanded globally, driven by economic growth, urbanization, and increased transportation needs. As the demand for commercial vehicles rises, the demand for advanced and efficient hydraulic systems also increases.

The increasing number of construction and e-commerce activities due to the expansion of the industrial sector across the world has resulted in increased demand for material transportation, which, in turn, has led to a significant increase in the sales of commercial vehicles. This growth is expected to drive the automotive hydraulic systems market, as they are used at large in these vehicles.

In 2022, around 23.74 million units of commercial vehicles were produced worldwide, whereas worldwide sales stood at 24.1 million units. The United States was the largest market for commercial vehicles, with a total sales of over 11.3 million units.

Commercial vehicles, especially heavy-duty trucks and buses, often require robust and powerful hydraulic systems to handle heavy loads, provide reliable braking systems, and ensure efficient power steering. Hydraulic systems are suitable for these heavy-duty applications, making them integral components in the commercial vehicle segment.

Commercial vehicles often have diverse applications, ranging from delivery trucks to construction vehicles. Hydraulic systems offer a high degree of customization and versatility, allowing manufacturers to tailor solutions to meet specific requirements across different commercial vehicle segments. The players operating in the market are also increasingly integrating advanced technologies for improved performance and efficiency. Intelligent hydraulic systems, incorporating sensors and smart components, align well with the technological advancements sought by commercial vehicle manufacturers.

Thus, owing to their increasing demand in transportation, as well as other industrial usage, the commercial vehicle segment is anticipated to continue to grow significantly during the forecast period, giving rise to increased demand for hydraulic systems in these vehicles.

Asia-Pacific is Expected to Witness Highest Growth Rate

Asia-Pacific is expected to be the region with the highest growth in the automotive hydraulic system market during the forecast period. The region consists of countries like China and India, which are rapidly emerging as automotive hubs. China is the biggest automotive market in the world. The growing Chinese economy and the growing disposable incomes of people in the country have increased the demand for vehicles in the country.

The low production costs in China have also favored the growth of vehicle manufacturing, ultimately fueling the demand for hydraulic systems. In 2022, China accounted for 23,836 thousand units of passenger car sales and over 3,300,000 units of commercial vehicle sales.

Furthermore, electrification in the Asia-Pacific region has also witnessed a high penetration rate due to the presence of China and Japan, as China is the leading market for electric vehicles, and most of the automakers advancing in electric vehicle technology are from Japan. Sales of electric vehicles in China have seen huge growth as compared to other countries in Asia-Pacific. In 2022, China had over 6 million unit sales of electric vehicles (EVs), with BEVs totaling 4.59 million units.

Thus, with the rapid growth of the automobile sector in the Asia-Pacific region, the demand for hydraulic systems is also expected to witness positive growth in the coming years.

Automotive Hydraulic Systems Industry Overview

The automotive hydraulic systems market is moderately consolidated. Major players in the automotive hydraulic systems market are Robert Bosch GmbH, Aisin Seiki Co. Ltd, ZF Group, and Continental AG, among others. The global automotive hydraulic systems market is driven mainly by innovations. Major companies are investing heavily in R&D and are continuously launching new products. These companies are also organizing upskilling courses to train their associates. For instance:

- In September 2023, Bosch Rexroth announced a new "Hydraulics Training Center" in Bethlehem, Pennsylvania. The center features three advanced training stations, including a fully equipped classroom, conference room, lounge area, and cafe.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Demand and Sales of Commercial Vehicles is Driving the Market for Hydraulic Systems

- 4.2 Market Restraints

- 4.2.1 Increasing Replacement of Conventional Hydraulic Systems with Fully-electric Hydraulic Systems Acts as a Restraint

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Brakes

- 5.1.2 Clutch

- 5.1.3 Suspension

- 5.1.4 Other Applications (Tappets, etc.)

- 5.2 Component

- 5.2.1 Master Cylinder

- 5.2.2 Slave Cylinder

- 5.2.3 Reservoir

- 5.2.4 Hose

- 5.3 Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Light Commercial Vehicles

- 5.3.3 Medium and Heavy-Duty Commercial Vehicles

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Spain

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Aisin Seiki Co. Ltd

- 6.2.2 Robert Bosch GmbH

- 6.2.3 ZF Friedrichshafen AG

- 6.2.4 BorgWarner

- 6.2.5 Warner Electric LLC

- 6.2.6 Continental AG

- 6.2.7 Schaeffler Technologies AG and Co.

- 6.2.8 WABCO

- 6.2.9 GKN PLC

- 6.2.10 JTEKT Corporation

- 6.2.11 FTE Automotive Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Scope of Application of Hydraulic System Opens New Growth Routes