|

市场调查报告书

商品编码

1523391

全球冷藏培养箱市场:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Global Refrigerated Incubators - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

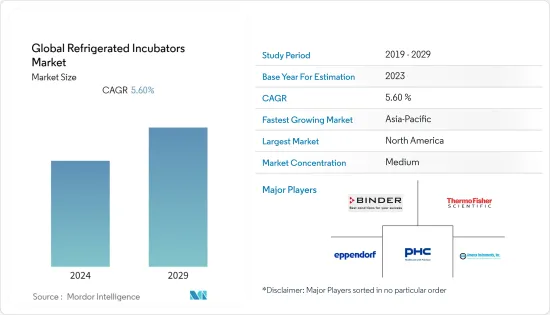

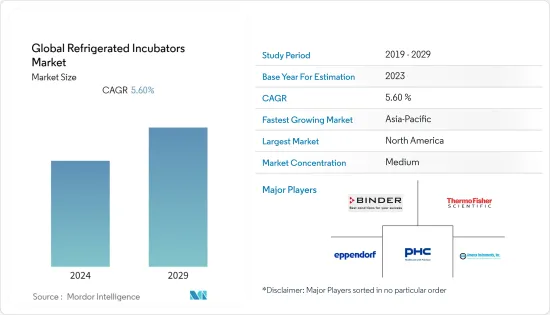

预计2024年全球冷藏培养箱市场规模将达6.5664亿美元,2024-2029年预测期间复合年增长率为5.60%,2029年将达到8.6228亿美元。

由于针对感染疾病的研究活动越来越多地采用冷藏培养箱以及冷藏培养箱的技术进步等因素,预计冷藏培养箱市场在预测期内将成长。

随着与感染疾病相关的研究的进展,对冷藏培养箱的需求预计会增加,以维持研究中涉及的特定试剂和微生物所需的最佳温度。例如,2023年9月,芝加哥大学从国家过敏和感染疾病研究所(NAID)获得了1,240万美元的联邦支持,用于支持新兴感染疾病的研究活动和监测。如此广泛的研究计画预计将增加对冷藏培养箱的需求,以维持所研究微生物的最佳温度。

此外,冷藏培养箱还包括密码保护设定、开门警报、自动净化循环、自校准、预设警报、超温警报、恆温器、安全可重复培养、高环境温度培养等。技术进步和最新趋势将推动冷藏培养箱的销售。例如,Thermo Scientific 的新型冷藏培养箱,如 Heratherm 冷藏培养箱、Peltier 低温培养箱和精密植物生长室,均采用强大的压缩机技术。该技术旨在为需要在高于或低于正常实验室环境温度的温度下保持热稳定性和均匀性的应用提供最佳温度条件。

此外,市场主要企业的新产品发布和策略活动正在对所研究市场的成长产生积极影响。例如,2023年9月,Esco Lifesciences推出了Isotherm,这是一款冷藏培养箱,融合了预热室技术、微处理器PID技术、自动除霜系统和其他先进功能。有110公升、170公升、240公升等多种尺寸。

因此,由于上述因素(例如冷藏培养箱研究的增加和技术进步),预计调查市场将在预测期内呈现成长。然而,替代培养箱的可用性可能会阻碍市场成长。

全球冷藏培养箱的趋势

预计 51-200 公升细分市场在预测期内将出现显着成长

- 51-200 公升冷藏培养箱由强大、高效的可携式装置组成,配有内部风扇,可防止热失衡并保持恆温。此类培养箱透过即时控制减少日常手动和重复的设备操作。

- 51-200 公升冷藏培养箱的广泛应用包括微生物分析、细菌计数测定、高于和低于室温的生物样品孵育以及加速老化测试。例如,2023 年 11 月,奥克拉荷马州立大学创新基金会推出了创新园区计划,以有效储存和管理人类、植物和动物生物检体,以供未来的研究活动使用,我们的目标是透过基因组分析能力扩展我们的服务。这些因素有力地支持了实验室采用冷藏培养箱。

- 此外,冷冻在生技药品的维护中起着至关重要的作用,人们越来越认识到冷藏培养箱的重要性,其中包括提供高效製冷的51-200公升冷藏培养箱。因此,由于上述因素,预计目标族群对这些产品的采用将会增加,并推动市场成长。

- 因此,由于上述因素(包括研究应用),51-200公升细分市场预计将在预测期内显着成长。

预计北美在预测期内将出现强劲成长

- 由于慢性病和感染疾病负担高、研究投资高以及大公司在该地区的存在等因素,预计北美在预测期内将出现显着增长。该地区慢性病和感染疾病发生率很高,需要冷藏培养箱来维持治疗产品的最佳温度。例如,根据美国疾病管制与预防美国(CDC)2023年11月发布的资料,2022年至2023年美国约有3,100万人感染流感。此外,根据加拿大政府2023年12月发布的资料,2023年8月至2023年12月,加拿大报告了超过163起实验室确诊的流感疫情。预计这些因素将有助于北美市场的成长。

- 此外,该地区市场参与企业和製造商的集中预计也将推动该国冷藏培养箱市场的成长。例如,2023年2月,北美PHC公司(PHCNA)宣布推出PHCbi品牌VIP ECO SMART超低温冷冻库系列,应用于学术研究机构及製药公司等设施。该地区这些持续的产品核可预计将推动该国市场的成长。

- 因此,由于慢性病和感染疾病的高负担以及市场领导者的存在等上述因素,预计北美市场将成长。

全球冷藏培养箱产业概况

冷藏培养箱市场本质上是分散的,因为有多家公司在全球和地区运作。主要参与企业包括 Binder GmbH、Thermo Fisher Scientific、PHC Holdings Corporation、Eppendorf AG 和 Amerex Instruments Inc。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 在针对感染疾病的研究活动中更多地采用冷藏培养箱

- 冷藏培养箱技术不断进步

- 市场限制因素

- 替代培养箱的可用性

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔(市场规模:金额)

- 按类型

- 小于 50 公升

- 51-200升

- 201-750升

- 751 至 1,500 公升

- 1,501公升或更多

- 按最终用户

- 医院

- 研究所/学术机构

- 製药和生物技术公司

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 其他亚太地区

- 其他地区

- 北美洲

第六章 竞争状况

- 公司简介

- Binder GmbH

- Thermo Fisher Scientific

- PHC Holdings Corporation

- Eppendorf AG

- Amerex Instruments Inc.

- Sheldon Manufacturing Inc.

- LEEC Ltd.

- Memmert GmbH+Co. KG

- Benchmark Scientific

- Gilson Inc.

第七章 市场机会及未来趋势

The Global Refrigerated Incubators Market size is estimated at USD 656.64 million in 2024, and is expected to reach USD 862.28 million by 2029, growing at a CAGR of 5.60% during the forecast period (2024-2029).

The refrigerated incubators market is expected to grow over the forecast period due to factors such as the rising adoption of refrigerated incubators for research activities targeting infectious diseases and increasing technological advancements in refrigerated incubators.

Research related to infectious diseases has been advancing, which is expected to create more demand for refrigerated incubators to maintain the optimum temperature required for specific reagents, microorganisms, etc., involved in the research. For instance, in September 2023, the University of Chicago received federal support with funding of USD 12.4 million from the National Institute of Allergy and Infectious Disease (NAID) to support research activities and studies in emerging infectious diseases. Such wide-scale research programs are expected to increase the demand for refrigerated incubators to maintain the optimum temperature of the microbes under study.

Additionally, technological advancements and the latest trends in the refrigerated incubator market, such as password-protected settings, door opening alarms, auto decontamination cycles, self-calibration, pre-set alarms, over-temperature alarms, and thermostats, safe, reproducible incubation, and even at high ambient temperatures are expected to drive the sales of refrigerated incubators during the forecast period. For instance, the new refrigerated incubators offered by Thermo Scientific, including Heratherm Refrigerated Incubators, Peltier Low-Temperature Incubators, and Precision Plant Growth Chambers, utilize powerful compressor technology. The technology is designed to provide optimal temperature conditions for applications that need thermal stability and uniformity above, around, or below the usual ambient laboratory temperature.

Moreover, the new product launches and strategic activities by major players in the market are positively affecting the growth of the market studied. For instance, in September 2023, Esco Lifesciences introduced the refrigerated incubator Isotherm, which was incorporated with pre-heat chamber technology, microprocessor PID technology, auto-defrost system, and other advanced features. It was available in various sizes, including 110 l, 170 l, and 240 l.

Therefore, owing to the aforementioned factors, including the increasing research and technological advancements of refrigerated incubators, the market studied is anticipated to witness growth during the forecast period. However, the availability of alternative incubators is likely to impede market growth.

Global Refrigerated Incubators Market Trends

51 to 200 l Segment is Expected to Witness Significant Growth During the Forecast Period

- The 51 to 200-l refrigerated incubators comprise powerful and highly efficient portable units with an internal fan to prevent thermal layering and keep a consistent temperature. Such incubators reduce daily manual tasks and repetitive instrument operations through real-time control.

- A wide range of applications of 51 to 200 l refrigerated incubators type involves microbiological analyses, determining germ count, biological specimen cultivation above and below room temperature, and accelerating aging tests. For instance, in November 2023, the Innovation Foundation at Oklahoma State University introduced the plan for Innovation Park and its aim to expand the services with genomic analysis capabilities by efficiently storing and managing biological samples from human, plant, and animal specimens for research activities in the future. Such factors highly support the adoption of refrigerated incubators in laboratories.

- Further, refrigeration plays a significant role in biologics maintenance, which increases awareness about the significance of refrigerated incubators, including 51 to 200-l refrigerated incubators that offer highly efficient refrigeration. Hence, owing to the above factors, the adoption of these products is likely to increase among the target population, driving market growth.

- Therefore, the 51 to 200 l segment is expected to witness significant growth during the forecast period due to the abovementioned factors, including its applications in the research.

North America is Expected to Witness Significant Growth During the Forecast Period

- North America is expected to witness significant growth during the forecast period, owing to factors such as the high burden of chronic and infectious diseases, high research investments, and the presence of leading players in the region. The region has a high prevalence of chronic and infectious diseases, requiring refrigerated incubators to maintain the optimum temperature of the therapeutic products. For instance, in November 2023, as per the data published by the Centers for Disease Control and Prevention (CDC), around 31 million people in the United States were infected with flu during 2022-2023. Further, as per the data published by the Canadian government in December 2023, over 163 laboratory-confirmed influenza outbreaks were reported in Canada from August 2023 to December 2023. These factors are expected to contribute to the growth of the market in North America.

- Furthermore, the high concentration of market players or manufacturers' presence in the region is also expected to drive the growth of the refrigerated incubators market in the country. For instance, in February 2023, PHC Corporation of North America (PHCNA) announced the launch of PHCbi brand VIP ECO SMART ultra-low temperature freezer series for use in facilities such as academic research institutes and pharmaceutical companies. These continuous product approvals in the region are anticipated to drive the country's growth in the market.

- Therefore, owing to the aforementioned factors, including the high burden of chronic and infectious diseases and the presence of leading market players, the market is anticipated to grow in North America.

Global Refrigerated Incubators Industry Overview

The refrigerated incubators market is fragmented in nature due to the presence of several companies operating globally and regionally. The key players operating in the market include Binder GmbH, Thermo Fisher Scientific, PHC Holdings Corporation, Eppendorf AG, and Amerex Instruments Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Adoption of Refrigerated Incubators for Research Activities Targeting Infectious Diseases

- 4.2.2 Increasing Technological Advancements in Refrigerated Incubators

- 4.3 Market Restraints

- 4.3.1 Availability of Alternative Incubators

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD)

- 5.1 By Type

- 5.1.1 Below 50 l

- 5.1.2 51 to 200 l

- 5.1.3 201 to 750 l

- 5.1.4 751 to 1,500 l

- 5.1.5 Above 1,501 l

- 5.2 By End User

- 5.2.1 Hospitals

- 5.2.2 Research Laboratories and Academic Institutes

- 5.2.3 Pharmaceutical and Biotechnology Companies

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Binder GmbH

- 6.1.2 Thermo Fisher Scientific

- 6.1.3 PHC Holdings Corporation

- 6.1.4 Eppendorf AG

- 6.1.5 Amerex Instruments Inc.

- 6.1.6 Sheldon Manufacturing Inc.

- 6.1.7 LEEC Ltd.

- 6.1.8 Memmert GmbH + Co. KG

- 6.1.9 Benchmark Scientific

- 6.1.10 Gilson Inc.