|

市场调查报告书

商品编码

1524101

整合工作场所管理系统 -市场占有率分析、产业趋势/统计、成长预测(2024-2029)Integrated Workplace Management System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

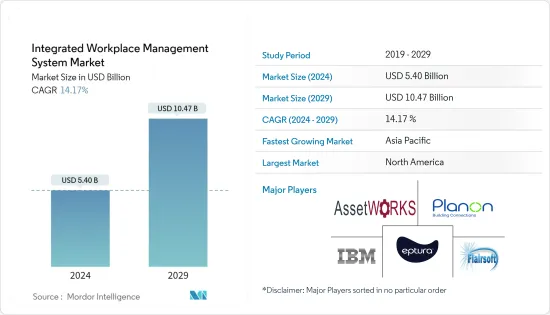

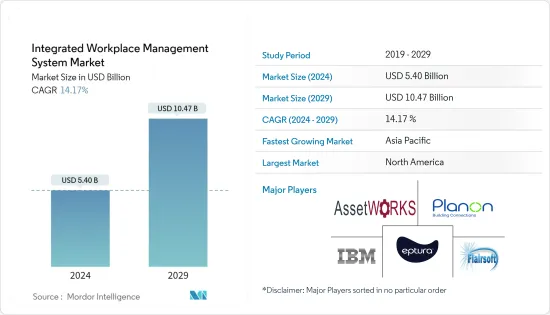

预计2024年整合工作场所管理系统市场规模为54亿美元,预计2029年将达到104.7亿美元,在预测期内(2024-2029年)复合年增长率为14.17%。

随着房地产公司的崛起,越来越多地采用工作流程自动化解决方案,对提高生产力和降低成本的需求正在推动市场成长。

* 近年来,由于各种政府措施、都市化的加快以及已开发经济体和新兴经济体商业建设计划数量的增加,建设活动活性化,产生了对综合设施管理服务的需求。

*对绿色和永续建筑实践以及建设活动恢復的日益重视正在推动综合工作场所管理系统市场的成长。

*近年来,办公和零售建筑的增加以及对商业物业更有效率和更具成本效益的管理的需求不断增加,推动了商业领域对综合工作场所管理服务的需求。疫情发生以来,商办的角色不断改变。为商业部门创造更好的员工体验、提高协作和生产力以及降低成本变得越来越重要。

*然而,专业人才的缺乏对全球综合工作场所管理市场的成长构成了重大挑战。由于该市场涵盖从资产管理到设施管理的广泛服务,人才短缺阻碍了服务供应商发挥其服务潜力,而在这些多个类别中寻找专家的困难正在抑制市场的成长。

*COVID-19 爆发对职场管理公司产生了重大经济影响。对人员流动的限制减少了计划工作并减少了一些客户现场的活动。 COVID-19 后的未来将对转型、创造性解决方案和独特的规划策略的需求不断增加。随着焦点转向更高的卫生相关法规、更好的职场安全和清洁,以及数位化职场环境的发展至关重要,采购将在 COVID-19 后改变、恢復和重启设施管理行业。

整合工作场所管理系统市场趋势

环境永续性促进强劲成长

- IWMS 协助组织在努力实现环境永续性和法规遵循时监控和报告相关资料。 IWMS 有助于监控能源消耗、废弃物管理、碳排放以及 LEED 和 ISO 等标准的遵守情况。这使用户能够确定需要改进的领域并展示组织对永续性的承诺。

- 随着监管和宏观环境的快速变化,主动的能源管理和永续性已成为组织长期成功的关键。由于越来越多的公司专注于永续性, IWMS 市场对环境永续性领域的需求正在增加。

- 公司正在采用 IWMS 平台来优化和追踪资源使用、遵守法规、减少碳排放并提高其作为对环境负责的营业单位的声誉,从而实现强大的永续性。

- 各国政府透过引入永续解决方案来持续收集、监控、基准测试和报告 ESG 绩效,不断扩大立法和企业永续发展目标 (SDG)。例如,在美国,EPAA已经推出了多项永续战略计画。因此,预计企业中的此类法律法规将推动对环境永续性解决方案的需求。

- 从地区来看,由于对环境友善企业实践、环境合规监管要求以及对气候变迁日益关注的关注,美国预计将出现成长。这些关键原因正在推动环境咨询市场的发展。据全国房地产经纪人协会称,人们期望商业建筑更加节能和环保。

亚太地区将显着成长

- 中国快速的都市化和基础设施发展增加了对高效能职场管理解决方案的需求。随着越来越多的商业和工业设施的新建或重建,对优化空间利用、设施维护和资源分配的整合工作场所管理系统的需求也在增加。

- 随着中国工作场所的现代化,人们开始转向技术更先进的解决方案来管理设施、资产和营运。整合的工作场所管理平台提供管理房地产投资组合、工作空间设计、能源消耗和环境永续性的整合功能,满足现代工作场所的目标。

- 印度对资产和维护管理软体的需求不断增长。该国能源、製造业和公共工程等多个领域的基础设施建设进展迅速。随着基础设施计划投资的增加,对确保建筑物高效运作和维护的资产和维护管理软体的需求不断增长。

- 为了满足这项需求,许多公司正在推出新的解决方案。例如,2023年3月,索迪斯设施管理服务印度私人有限公司在兰契的AHPI附属医疗机构和诊断中心推出了用于诊所维修和维护的软体。位于兰契的办公室仓库设有一个维修实验室,用于存放对患者照护至关重要的设备的关键备件和配件。这些投资显示对资产和维护管理软体的需求不断增长。

整合工作场所管理系统产业概述

由于对改善决策和确保业务成本效益的需求不断增加,综合职场管理市场变得支离破碎。主要市场参与者包括 Planon Group BV、AssetWorks Inc.、Eptura Inc.、IBM Corporation 和 Flairsoft Ltd.。

*2023 年 12 月,作为精简数位技术、全球工程和专业服务营运的一部分,科进在其全球办事处增加了 Causeway 排水设计解决方案。

*2023 年 11 月,德勤宣布与 IBM 合作,协助客户将永续性计画嵌入其组织的核心营运中,并加速实施排放策略。它还有助于监控资产监控、管理、预测性维护和可靠性规划的绩效目标和脱碳计划,并与 IBM Maximo Application Suite(IBM 的可持续发展软体解决方案套件)中的其他产品整合。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场动态

- 市场驱动因素

- 提高生产力和降低成本的需求推动市场成长

- 由于房地产公司的崛起,工作流程自动化解决方案的采用增加

- 市场限制因素

- 缺乏维护已安装系统的专业知识阻碍了市场成长

第六章 市场细分

- 按服务

- 解决方案

- 房地产和租赁管理

- 设施/空间管理

- 资产/维护管理

- 计划管理

- 环境永续性

- 其他解决方案

- 服务

- 专业的服务

- 管理服务

- 解决方案

- 按配置

- 云

- 本地

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 其他亚太地区

- 拉丁美洲

- 墨西哥

- 巴西

- 其他拉丁美洲

- 中东/非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 其他中东和非洲

- 北美洲

第七章 竞争格局

- 公司简介

- Planon Group BV

- AssetWorks Inc.

- Eptura Inc.

- IBM Corporation

- Flairsoft Ltd

- Trimble Inc.

- Causeway Technologies Limited

- FM:Systems(Johnson Controls International PLC)

- MRI Software LLC

- Accruent LLC(Fortive Corporation)

第八章投资分析

第9章市场的未来

The Integrated Workplace Management System Market size is estimated at USD 5.40 billion in 2024, and is expected to reach USD 10.47 billion by 2029, growing at a CAGR of 14.17% during the forecast period (2024-2029).

The demand for increased productivity and cost reduction are driving the market growth and the rise of real estate enterprises, increasing the adoption of workflow automation solutions.

* The growing construction activities due to various government initiatives, rising urbanization, and growing commercial construction projects in developed and developing economies have necessitated the demand for integrated facility management services in the past few years.

* Growing emphasis on Green and Sustainable Building Practices and rebounding construction activity are driving the growth of the integrated workplace management market.

* The growing construction of offices and retail outlets in the past few years and the increasing demand for more efficient and cost-effective management of commercial facilities are driving the demand for integrated workplace management services in the commercial sector. The role of commercial offices is constantly changing post-pandemic. It is becoming increasingly crucial to create a better employee experience, improve collaboration and productivity, and reduce costs in the commercial sector.

* However, the lack of specialized talents poses a significant challenge to the growth of the integrated workplace management market worldwide. The talent gap hinders the service providers from delivering the potential of their services as the market involves a broad range of services from asset management to facility management and the difficulty in finding professionals with expertise in these multiple categories is restraining the market's growth.

* The COVID-19 pandemic had a substantial economic impact on workplace management companies. People's mobility restrictions resulted in declining project work and decreased activity at several customer sites. In the post-COVID-19 future, there is an increased demand for transformation, creative solutions, and unique planning strategies. Since the emphasis shifted toward higher hygiene-related rules, better workplace safety and cleanliness, and developing a digitized work environment, sourcing and procurement are essential in the post-COVID-19 transformation, recovery, and restart of the facilities management industry.

Integrated Workplace Management System Market Trends

Environmental Sustainability to Witness Significant Growth

- IWMS helps an organization monitor and report relevant data if it is committed to environmental sustainability and legal compliance. They can help users monitor energy consumption, waste management, carbon dioxide emissions, and compliance with standards like LEED or ISO. It allows users to determine the areas of improvement and demonstrate the organization's commitment to sustainability.

- With a quickly changing regulatory and macro environment, active energy management and sustainability have become essential to long-term organizational success. The demand for the environmental sustainability segment in the IWMS market is increasing due to the rising corporate emphasis on sustainability initiatives.

- Businesses are adopting IWMS platforms to optimize and track resource usage, comply with regulations, reduce carbon footprint, and improve their reputation as environmentally responsible entities, thereby driving the demand for IWMS solutions with robust sustainability features and reporting capabilities.

- Governments continue to broaden laws and corporate sustainable development goals (SDGs) by deploying sustainable solutions that continuously collect, monitor, benchmark, and report ESG performance. In the United States, for example, several sustainable strategic plans have been launched by EPAA. Therefore, such laws and regulations in companies are expected to drive the demand for environmental sustainability solutions.

- By region, the United States is expected to grow due to the growing emphasis on environmentally friendly company practices, regulatory requirements for environmental compliance, and rising concerns about climate change. These key reasons are propelling the environmental consulting market. People expect commercial buildings to be more energy-efficient and eco-friendly, according to the National Association of Realtors.

Asia-Pacific to Witness Major Growth

- China's rapid urbanization and infrastructure development have increased the need for efficient workplace management solutions. As more commercial and industrial facilities are built or renovated, a demand for integrated workplace management systems to optimize space utilization, facility maintenance, and resource allocation is also growing.

- With the modernization of workplaces in China, there is a shift toward more technologically advanced solutions for managing facilities, assets, and operations. Integrated workplace management platforms offer integrated functionalities for managing real estate portfolios, workspace design, energy consumption, and environmental sustainability, aligning with the goals of modern workplaces.

- India is witnessing a growing demand for asset and maintenance management software. The country is undergoing rapid infrastructure development across various sectors, including energy, manufacturing, utility, and others. With increased investments in infrastructure projects, there is a growing need for asset and maintenance management software to ensure the efficient operation and maintenance of the buildings.

- Many companies are launching new solutions to cater to this demand. For instance, in March 2023, Sodexo Facilities Management Services India Private Limited launched its software at Ranchi's AHPI-affiliated healthcare providers and diagnostic centers to repair and maintain clinics. The office warehouse in Ranchi comprises a repair laboratory that houses vital spare parts and accessories for equipment crucial to patient care. These investments indicate the growing demand for asset and maintenance management software.

Integrated Workplace Management System Industry Overview

The integrated workplace management market is fragmented due to increasing demand for improved decision-making and ensuring cost-effective operations. Some key market players include Planon Group BV, AssetWorks Inc., Eptura Inc., IBM Corporation, and Flairsoft Ltd.

* In December 2023, as part of a drive to streamline its digital technologies, global engineering, and professional services business, WSP added a Causeway solution for drainage design across its global offices, showing the collaboration among the office building spaces and the company to increase its business in workplace management.

* In November 2023, Deloitte announced its collaboration with IBM to help clients make sustainability programs an embedded part of their organization's core business and accelerate emissions reduction strategies. It will also help monitor performance targets and decarbonization programs, which are integrated with other products from IBM's suite of Sustainability Software solutions, IBM Maximo Application Suite, for asset monitoring, management, predictive maintenance, and reliability planning.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Competitive Rivalry Within the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Demand for Increased Productivity and Cost Reduction is Driving the Market Growth

- 5.1.2 Rise of Real Estate Enterprises Increasing in Adoption of Workflow Automation Solutions

- 5.2 Market Restraints

- 5.2.1 Lack of Expertise to Maintain the Deployed System is Discouraging the Market Growth

6 MARKET SEGMENTATION

- 6.1 By Offering

- 6.1.1 Solution

- 6.1.1.1 Real Estate and Lease Management

- 6.1.1.2 Facilities and Space Management

- 6.1.1.3 Asset and Maintenance Management

- 6.1.1.4 Project Management

- 6.1.1.5 Environmental Sustainability

- 6.1.1.6 Other Solutions

- 6.1.2 Service

- 6.1.2.1 Professional Services

- 6.1.2.2 Managed Services

- 6.1.1 Solution

- 6.2 By Deployment

- 6.2.1 Cloud

- 6.2.2 On-premise

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Mexico

- 6.3.4.2 Brazil

- 6.3.4.3 Rest of Latin America

- 6.3.5 Middle East and Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 Rest of Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Planon Group BV

- 7.1.2 AssetWorks Inc.

- 7.1.3 Eptura Inc.

- 7.1.4 IBM Corporation

- 7.1.5 Flairsoft Ltd

- 7.1.6 Trimble Inc.

- 7.1.7 Causeway Technologies Limited

- 7.1.8 FM: Systems (Johnson Controls International PLC)

- 7.1.9 MRI Software LLC

- 7.1.10 Accruent LLC (Fortive Corporation)