|

市场调查报告书

商品编码

1686569

金属包装:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)Metal Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

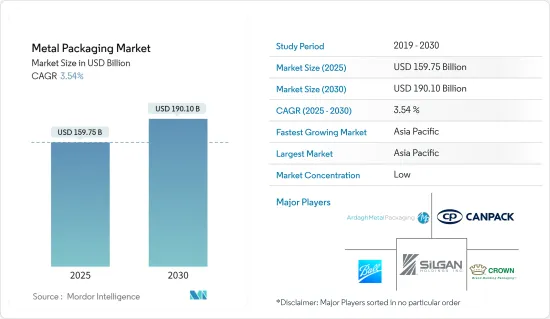

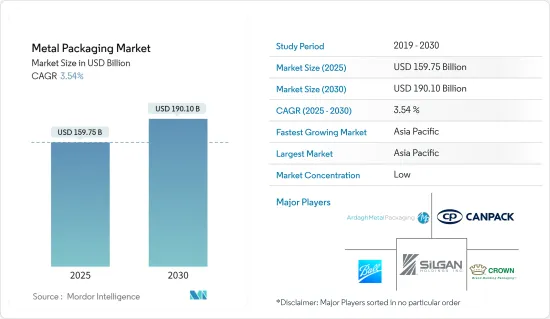

金属包装市场规模预计在 2025 年为 1,597.5 亿美元,预计到 2030 年将达到 1901 亿美元,预测期内(2025-2030 年)的复合年增长率为 3.54%。

主要亮点

- 受工业活动增加、食品和饮料消费成长以及环保意识增强等因素的推动,金属包装市场表现出韧性和成长。 IBC、散装容器、桶和封盖等工业金属包装由于其耐用性和保护性,在化学品、润滑剂和农产品等行业中保持稳定的需求。

- 受包装食品和饮料的储存罐需求不断增长的推动,金属罐市场正在经历强劲增长。此外,化妆品、汽车、工业、油漆和清漆、製药等行业对气雾罐的需求不断增加也促进了这一成长。

- 由于金属包装具有可回收性和环境效益,向永续包装解决方案的转变正在推动其采用。由于消费者偏好的不断变化以及有利于环保包装的监管措施,金属包装市场预计将继续扩大,为全球行业参与者提供创新和合作的机会。

- 金属具有无限的可回收性和经济价值,使我们能够最大限度地发挥包装的潜力。它可以帮助建立和加速您的品牌,同时吸引有环保意识的消费者,尤其是千禧世代。当今的消费者要求更加客製化的产品,并且越来越关注环境的永续性。

- 气雾罐包装具有高度可回收性,并保留了其物理特性,可供子孙后代使用。随着越来越多的公司采用气雾罐包装其产品,这种包装类型的未来前景光明。

- 金属容器,尤其是钢和铝容器,具有出色的耐用性和保护性,使其成为产品完整性优先考虑的行业的首选。

- 预计持续的全球扩张和工业化,尤其是新兴经济体的扩张和工业化将刺激对工业润滑油和流体的需求。预计这一趋势将推动对可靠、坚固的包装解决方案的需求,从而导致金属包装的显着增长。

- 由于材料可用性的变化、成本的增加以及包装、组件和功能设计的进步,工业润滑剂、油和液体的包装发生了重大变化。随着环保实践受到优先重视,永续性在润滑剂包装产业中变得越来越重要。

- 金属包装面临替代包装解决方案的激烈竞争。对生物分解性塑胶开发的大量投资阻碍了市场的成长。由于经济优势,塑胶通常比金属更受青睐。塑胶桶比钢桶轻,更容易移动和运输。此外,由于重量较轻,塑胶桶的运输成本比金属桶低。

金属包装市场趋势

饮料罐预计将大幅成长

- 金属罐,尤其是用于酒精饮料的金属罐,由于其实用优势和符合消费者偏好而变得非常受欢迎。这些罐子提供标准的份量,使得监测酒精摄取量变得更加容易,特别是对于酒精浓度含量较高的饮料。铝是饮料包装的理想材料,因为它重量轻,可提高运输性,同时降低运输成本和碳排放。

- 非酒精饮料行业新产品的推出对金属罐市场的成长做出了重大贡献。 2023年1月,百事可乐推出了罐装柠檬莱姆碳酸饮料Starry。同样,Monster Energy Ltd 推出了一种铝罐罐装的新型零糖饮料,进一步推动了对金属包装的需求。

- 铝罐因其可回收性、导热性以及重量轻而越来越受欢迎。为了回应人们对塑胶包装日益增长的环境担忧,越来越多的饮料品牌开始采用金属罐。根据世界统计组织统计,全球啤酒和汽水消费量每年约 1800 亿罐,相当于每秒钟 6,700 罐,每 17 小时绕地球一圈。

- 消费者健康意识的增强导致能量饮料的需求激增,进而导致金属罐的需求激增。消费者现在更加重视糖的摄取量,对无糖、天然和有机饮料的需求增加。消费者偏好的这些变化是非酒精饮料产业金属罐市场成长的主要驱动力。

- 红牛是美国领先的能量饮料品牌,占据美国约 39.5% 的市场占有率,其报告称,到 2023 年,其销量将达到 121 亿罐,高于 2022 年的 116 亿罐。

亚太地区预计将经历最快成长

- 中国拥有世界上最大的金属包装市场之一,得益于庞大的製造业和消费品产业。金属包装的需求主要来自食品和饮料、製药、化妆品和家居用品行业。

- 在中国,受环保意识增强和监管措施的推动,永续包装解决方案的采用正在增加。製造商正在探索环保选择,例如可回收金属和环保罐涂层。日益严格的环境法规和消费者对永续包装的需求预计将推动可回收材料和环保生产流程的发展。

- 2023年10月,百威亚太有限公司在中国启动「罐对罐」回收计画。该计画旨在扩大再生铝罐的使用,为公司2025年减少35%二氧化碳排放的目标做出贡献。该公司致力于主导中国实现碳减排目标,到2040年实现整个价值链的净零排放。中国到2030年二氧化碳排放达到高峰、2060年实现碳中和的国家目标,预计将进一步刺激中国金属包装解决方案的成长。

- 印度罐头和工业金属包装市场正在稳步增长,这得益于该国油漆和涂料、个人护理以及食品和饮料行业的扩张。金属包装解决方案因其强度、可回收性和阻隔性受到重视。这些特性使其在食品和饮料、製药、个人护理和化学品(包括油漆和涂料)等行业中广受欢迎。

- 技术和製造工艺的创新提高了印度金属包装解决方案的品质、效率和客製化能力。作为世界第六大经济体,印度正快速实现工业化,为各种规模的企业创造新的机会。预计经济成长将进一步扩大该国的金属包装市场。

- 根据香港交易及结算所有限公司的数据,机能饮料占据市场主导地位,2019 年零售约为 111.1 亿美元。预计到 2024 年机能饮料零售将超过 176.1 亿美元。

- 随着机能饮料市场的成长,包括金属罐在内的包装解决方案的需求可能会相应增长。机能饮料通常采用金属罐包装,因为金属罐耐用、重量轻,而且能够保持饮料的新鲜度。这种需求的成长将直接使金属包装产业受益。

金属包装产业概况

金属包装市场分散,主要参与者包括:Ball Corporation、Crown Holdings Inc.、Silgan Holdings Inc.、Can-Pack SA(CANPACK Group)和 Ardagh Metal Packaging SA(Ardagh Group)。市场的主要参与者正致力于透过推出新产品、扩大营运以及进行策略併购来增加其市场占有率。

- 2024 年 6 月全球永续包装製造商 Sonoco Products Company 同意以 39 亿美元的价格从 KPS Capital Partners 手中收购欧洲食品罐、瓶盖和封盖供应商 Eviosys。 Sonoco 表示,此次收购推进了其专注于并扩大核心业务的策略,同时透过内部成长和外部收购投资于更高商机。

- 2024 年 2 月,Ardagh Metal Packaging 宣布与 Britvic Soft Drinks 建立合作关係。该品牌还推出了新款 Tango Mango 罐头的创新高端设计。引人注目的高端设计帮助品牌透过视觉外观提升消费者体验。

- 2023 年 11 月,Mauser Packaging Solutions 同意收购墨西哥锡钢气雾槽和钢桶製造商 Taenza SA de CV。此次收购策略将使我们能够将 Taenza 的专业知识与我们强大的本地影响力相结合,从而更好地服务我们的客户。

- 2023年10月,Colep Packaging宣布与Envases Group合资在墨西哥兴建气雾剂包装厂。这将使公司能够集中其专业知识为北美和中美洲的客户提供服务,并透过扩大其生产能力和产品组合来保持竞争力。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 地缘政治情势如何影响市场

第五章市场动态

- 市场驱动因素

- 金属包装回收率高

- 罐装食品和饮料方便且价格低廉

- 市场限制

- 替代包装解决方案的可用性

第六章市场区隔

- 依材料类型

- 铝

- 钢

- 依产品类型

- 能

- 食品罐

- 饮料罐

- 气雾罐

- 散装容器

- 运输桶和鼓

- 瓶盖和瓶塞

- 能

- 按最终用户产业

- 饮料

- 食物

- 化妆品和个人护理

- 家用

- 油漆和清漆

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 亚洲

- 中国

- 印度

- 日本

- 韩国

- 澳洲和纽西兰

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 北美洲

第七章竞争格局

- 公司简介

- Ardagh Metal Packaging SA(Ardagh Group)

- Ball Corporation

- Crown Holdings Inc.

- CANPACK SA(CANPACK Group)

- Silgan Holdings Inc.

- Greif Inc.

- TUBEX Packaging GmbH

- Mauser Packaging Solutions

- Nampak Limited

- Colep Packaging

第八章投资分析

第九章:市场的未来

The Metal Packaging Market size is estimated at USD 159.75 billion in 2025, and is expected to reach USD 190.10 billion by 2030, at a CAGR of 3.54% during the forecast period (2025-2030).

Key Highlights

- The metal packaging market exhibits resilience and growth, propelled by factors such as increased industrial activities, expanding food and beverage consumption, and growing environmental awareness. Industrial metal packaging, such as IBCs, bulk containers, drums, and closures, maintains steady demand from industries like chemicals, lubricants, and agricultural products due to its durability and protective qualities.

- The metal cans segment experiences robust growth, driven by rising demand for storage cans in packing food and beverages. Additionally, increasing demand for aerosol cans in industries such as cosmetics, automotive, industrial, paints and varnishes, and pharmaceuticals contributes to this growth.

- The shift toward sustainable packaging solutions enhances the adoption of metal packaging, given its recyclability and environmental benefits. With evolving consumer preferences and regulatory measures favoring eco-friendly packaging, the metal packaging market is set for continued expansion, offering opportunities for innovation and collaboration among industry players worldwide.

- Metal, being infinitely recyclable and economically valuable, can unlock the full potential of packaging. It can help build and accelerate brands while appealing to environmentally conscious consumers, particularly millennials. Today's consumers demand more customized products and are increasingly concerned with environmental sustainability.

- Aerosol can packaging is highly recyclable and retains its physical properties, ensuring its availability for future generations. As more companies adopt aerosol cans for their products, this packaging type's future appears promising.

- Metal containers, particularly those made of steel and aluminum, provide exceptional durability and protection, making them the preferred choice for industries that prioritize product integrity.

- The continued global expansion and industrialization, especially in developing economies, are expected to stimulate demand for industrial lubricants and fluids. This trend is expected to increase the requirement for reliable and robust packaging solutions, positioning metal packaging for significant expansion.

- The packaging of industrial lubricants, oils, and fluids has evolved significantly due to fluctuations in material availability, rising costs, and advancements in packaging components and functional design. Sustainability has become an increasingly critical aspect of lubricant packaging as the industry prioritizes environmentally responsible practices.

- Metal packaging faces significant competition from alternative packaging solutions. Substantial investments in the development of biodegradable plastics impede the market's growth. Plastic is often preferred due to its economic advantages over metal. Plastic drums are lighter than steel drums, making them easier to move and transport. Additionally, plastic barrels have lower shipping costs than metal drums due to their weight difference.

Metal Packaging Market Trends

Beverage Cans are Expected to Witness Major Growth

- Metal cans, particularly for alcoholic beverages, have gained significant popularity due to their practical benefits and alignment with consumer preferences. These cans offer standard portion sizes, facilitating easier alcohol intake monitoring, especially for high-alcohol content drinks. The lightweight nature of aluminum makes it ideal for beverage packaging, enhancing transportability while reducing transportation costs and carbon emissions.

- New product launches in the non-alcoholic beverage industry contribute significantly to the growth of the metal can market. In January 2023, PepsiCo introduced Starry, a lemon and lime carbonated soft drink packed in cans. Similarly, Monster Energy Ltd launched new zero-sugar beverages in aluminum cans, further driving demand for metal packaging.

- Aluminum cans are gaining traction due to their recyclability, thermal conductivity, and lightweight properties. Beverage brands are increasingly adopting metal cans in response to growing environmental concerns about plastic packaging. According to The World Counts, global beer and soda consumption amounts to approximately 180 billion aluminum cans annually, equivalent to 6,700 cans per second, which could encircle the planet every 17 hours.

- The increasing health awareness among consumers has led to a surge in demand for energy drinks and, consequently, metal cans. Consumers are now more conscious of their sugar intake, driving the need for sugar-free, natural, and organic beverages. This shift in consumer preferences has been a key factor in the growth of the metal cans market within the non-alcoholic beverage industry.

- Red Bull, a leading energy drink brand in the United States with approximately 39.5% market share, reported sales of 12.10 billion cans in 2023, an increase from 11.60 billion cans in 2022.

Asia-Pacific is Expected to Register the Fastest Growth

- China boasts one of the world's largest metal packaging markets, supported by its substantial manufacturing and consumer goods industries. The demand for metal packaging is primarily driven by the food and beverage, pharmaceutical, cosmetic, and home goods industries.

- China has experienced an increase in the adoption of sustainable packaging solutions, influenced by growing environmental awareness and regulatory measures. Manufacturers are exploring environmentally friendly options such as recyclable metals and eco-friendly can coatings. Stricter environmental regulations and consumer demand for sustainable packaging are expected to drive the development of recyclable materials and environmentally conscious production processes.

- In October 2023, Budweiser Brewing Company APAC Limited launched a "Can-to-Can" recycling program in China. This initiative aims to increase the use of recycled aluminum cans and contribute to the company's goal of reducing carbon emissions by 35% by 2025. The company has committed to leading efforts toward China's carbon reduction targets and achieving net-zero emissions across its value chain by 2040. China's national goals of peaking carbon dioxide emissions before 2030 and achieving carbon neutrality by 2060 are expected to further stimulate the growth of metal packaging solutions in the country.

- India's can and industrial metal packaging market has been experiencing steady growth, driven by the expansion of the country's paint and coating, personal care, and food and beverage industries. Metal packaging solutions are valued for their strength, recyclability, and barrier properties. These characteristics make them popular in industries such as food and beverage, pharmaceuticals, personal care, and chemicals, including paints and coatings.

- Innovations in technology and manufacturing processes have enhanced the quality, efficiency, and customization capabilities of metal packaging solutions in India. As the world's sixth-largest economy and rapidly industrializing nation, India is creating new opportunities for businesses of all sizes. This economic growth is expected to drive further expansion in the country's metal packaging market.

- According to Hong Kong Exchanges and Clearing Limited, energy beverages accounted for the majority of the market, with retail sales of around USD 11.11 billion in 2019. The value of retail sales of energy drinks was expected to exceed USD 17.61 billion by 2024.

- As the energy beverage market grows, the demand for packaging solutions, including metal cans, will rise correspondingly. Energy drinks are commonly packaged in metal cans due to their durability, lightweight nature, and ability to preserve the beverage's freshness. This increase in demand directly benefits the metal packaging industry.

Metal Packaging Industry Overview

The metal packaging market is fragmented, consisting of significant players such as Ball Corporation, Crown Holdings Inc., Silgan Holdings Inc., Can-Pack SA (CANPACK Group), and Ardagh Metal Packaging SA (Ardagh Group). The key players in the market are focusing on increasing their market presence by introducing new products, expanding their operations, or entering strategic mergers and acquisitions.

- June 2024: Sonoco Products Company, a global manufacturer of sustainable packaging, agreed to acquire Eviosys, a European provider of food cans, ends, and closures, from KPS Capital Partners for USD 3.9 billion. Sonoco stated that this acquisition will advance its strategy to concentrate on and expand its core businesses while investing in high-return opportunities, both through internal growth and external acquisitions.

- February 2024: Ardagh Metal Packaging announced its collaboration with Britvic Soft Drinks. It also announced the launch of the innovative high-end design for the brand's new Tango Mango cans. The high-end, eye-catching design will help the brand elevate the consumer experience through visual appearance.

- November 2023: Mauser Packaging Solutions agreed to acquire Taenza SA de CV, a manufacturer of tin-steel aerosol cans and steel pails based in Mexico. The acquisition strategy will help the company better serve its customers by combining Taenza's expertise and strong local presence.

- October 2023: Colep Packaging announced a joint venture with Envases Group to build an aerosol packaging plant in Mexico. This will help the company combine expertise to serve North and Central American customers and remain competitive by expanding production capacity and portfolio.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of Geopolitical Scenario on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 High Recyclability Rates of Metal Packaging

- 5.1.2 Convenience and Lower Price Offered by Canned Food and Beverage

- 5.2 Market Restraints

- 5.2.1 Presence of Alternate Packaging Solutions

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Aluminum

- 6.1.2 Steel

- 6.2 By Product Type

- 6.2.1 Cans

- 6.2.1.1 Food Cans

- 6.2.1.2 Beverage Cans

- 6.2.1.3 Aerosol Cans

- 6.2.2 Bulk Containers

- 6.2.3 Shipping Barrels and Drums

- 6.2.4 Caps and Closures

- 6.2.1 Cans

- 6.3 By End-user Industry

- 6.3.1 Beverage

- 6.3.2 Food

- 6.3.3 Cosmetics and Personal Care

- 6.3.4 Household

- 6.3.5 Paints and Varnishes

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Spain

- 6.4.2.5 Italy

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Japan

- 6.4.3.4 South Korea

- 6.4.3.5 Australia and New Zealand

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Mexico

- 6.4.4.3 Argentina

- 6.4.5 Middle East and Africa

- 6.4.5.1 United Arab Emirates

- 6.4.5.2 Saudi Arabia

- 6.4.5.3 South Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Ardagh Metal Packaging SA (Ardagh Group)

- 7.1.2 Ball Corporation

- 7.1.3 Crown Holdings Inc.

- 7.1.4 CANPACK SA (CANPACK Group)

- 7.1.5 Silgan Holdings Inc.

- 7.1.6 Greif Inc.

- 7.1.7 TUBEX Packaging GmbH

- 7.1.8 Mauser Packaging Solutions

- 7.1.9 Nampak Limited

- 7.1.10 Colep Packaging