|

市场调查报告书

商品编码

1687262

袋装包装:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Pouch Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

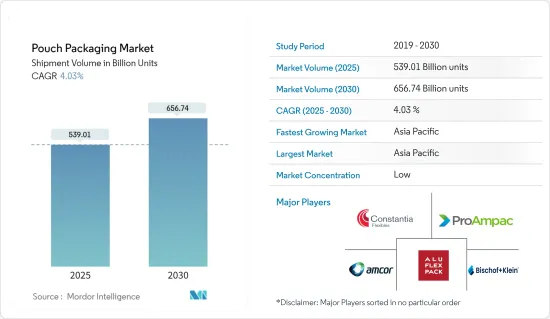

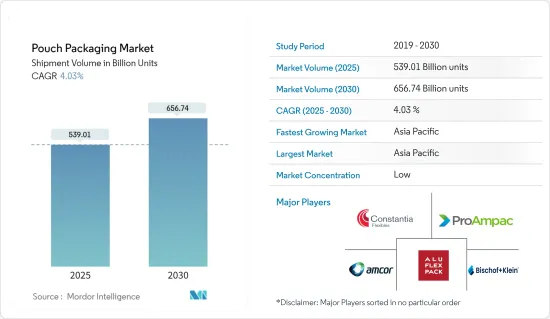

根据出货量计算,袋装包装市场规模预计将从 2025 年的 539,010 百万个扩大到 2030 年的 656,740 百万个,预测期内(2025-2030 年)的复合年增长率为 4.03%。

主要亮点

- 袋子是食品和饮料行业使用最广泛的包装产品之一,例如宠物食品、婴儿食品、液体包装(茶、咖啡、果汁)等。袋子的各种特性使其易于打开(撕裂槽口、雷射穿孔等)、易于使用(拉炼、形状)和可重新密封。

- 近年来,袋子取得了长足的进步,越来越注重永续性、创新性和设计灵活性。此外,由于其化学惰性,它被广泛应用于製药、宠物食品、化妆品等各个行业。

- 例如,2023年8月,美国化学公司陶氏与中国乳製品公司蒙牛合作,推出了可回收的全聚乙烯(PE)优格袋。该款新产品的推出将使两家公司在中国实现循环经济。

- 在永续性考量、智慧包装技术和印刷进步的推动下,立式袋正在经历重大转变。使用生物分解性和可堆肥材料的品牌展示了其对环境的承诺,同时也促进了消费者的环保意识。例如,家乐氏推出了一系列用植物来源塑胶製成的谷物包装袋。这些包装袋是可回收的,该公司的目标是到 2025 年使所有谷物包装实现 100% 可回收。

- 袋装包装市场的成长归因于多种因素,包括对适合消费者忙碌生活方式的方便、便携、单份食品和饮料产品的需求不断增加。袋装包装以其轻巧、易于重新密封的特点满足了这种日益增长的需求。

- 包装行业最重要的趋势之一是向环保和永续材料的转变。消费者和监管机构都越来越重视包装废弃物对环境的影响。此外,製造商正在探索传统塑胶袋的替代品,例如生物分解性和可堆肥的袋子。 2023 年 7 月,Wolki 和 Robema 设计了一种纸质糖果零食袋来取代塑胶袋。该公司开发了加固型 Eurohole 袋,以保持包装的完整性和环境永续。

袋装包装市场趋势

糖果和零嘴零食市场预计将推动袋装包装需求

- 全球消费者生活方式的改变导致即食食品的需求增加,其数量达到了历史最高水准。随着新时代劳动力全天候工作以及 Z 世代对一切便利的渴求,即食食品已成为首选的解决方案。

- 此外,袋装包装製造商已经开始整合新的先进技术,以提供卓越的阻隔功能并有效保护产品免受湿气和氧气的影响。这种便捷的包装对于已调理食品的长期储存至关重要,因为产品的完整性至关重要。

- 软包装袋为烘焙点心和零嘴零食的消费者和生产商提供了便利。在过去十年中,繁忙的生活方式、劳动力数量的增加以及工业化程度的提高等方面推动了全球对即食包装食品和零食的需求。

- 零嘴零食行业的成长和对各种零嘴零食软包装解决方案的需求不断增加正在推动市场的成长。每家公司都致力于调整零食包装设计以满足不断变化的消费者偏好,并提供针对零食袋量身定制的创新灵活的包装解决方案。例如,2023 年 10 月,英国零食公司 Walkers 宣布将为其烘焙多包装零食系列推出纸袋。

- 此外,2024 年 1 月,Nomadic Snacks 将为生活忙碌的人们推出方便携带的小袋装食品。这些小袋子便于携带,营养丰富,非常适合经常出游的人。预计在预测期内,这种持续的技术创新将会增强市场。

- 随着消费者生活方式的改变,不同场合、不同口味的点心越来越受欢迎,北美咸味零食的消费量正在上升。预计这将对市场产生积极影响。据美国SNAC国际公司称,2023年美国在超级杯週期间消费了约1.18亿磅咸味零食,与前一年同期比较增加29%。

- 根据政府机构加拿大农业及食品部的资料,加拿大零食零售额预计将从 2022 年的 123.8 亿美元成长至 2023 年的 134 亿美元。预计到 2025年终将达到 150 亿美元。由于对便捷包装解决方案的需求,零嘴零食销售的成长预计将促进袋装包装市场的成长。

拉丁美洲袋装包装市场转向永续性和宠物友善趋势

- 袋装包装在当地各行各业被广泛采用,用于各种用途。食品和饮料产业是袋装包装的主要采用者之一,这得益于饮料製造商的生产能力不断提高、长期需求增加以及各国政府采取措施适应可回收塑胶。

- 拉丁美洲袋装包装市场的一个新兴趋势是更加重视永续性。为了解决环境问题,製造商使用可回收材料进行袋装包装。全球也越来越重视生态良好实践和发展进程,以减少水消费量和二氧化碳排放。

- 巴西转换器公司 Plastrela 于 2023 年 11 月为 Adimax 开发了一种零食大小的 PET立式袋。这种立式袋比传统的 PET/PE SUP 结构更容易回收。传统的多层PET基材和聚乙烯(PE)密封剂已被更易于回收的新型单一材料PE(聚乙烯)包装所取代。

- 此外,饲养和照顾宠物是一种非常都市化的现象,在拉丁美洲国家也逐渐增加。与世界上任何其他国家相比,阿根廷的人均宠物拥有率最高。推动宠物食品需求的主要因素包括宠物拥有率的增加、人均可支配收入的提高以及核心家庭的趋势,尤其是在都市区。

- 立式袋具有较高的包装性能,因此是包装高品质宠物食品的首选。一些製造商不断加大对精緻宠物食品包装的投入。随着即食宠物食品越来越受欢迎,便利性可能会在该行业的发展中发挥不可或缺的作用。

袋装包装市场概述

袋装包装市场较为分散,全球有多家市场参与者。主要参与者包括 Bischof+Klein SE &Co.KG、Amcor Group GmbH、Aluflexpack Group、ProAmpac Intermediate Inc.、Constantia Flexibles Group GmbH、Mondi Group 和 Coveris Management GmbH。市场参与者预计将利用多个终端用户垂直市场成长所提供的机会,并进行创新以扩大其在市场上的份额。

- 2024 年 2 月 - Amcor Group GmbH 与北美优格和起司纸盒及袋装包装製造商 Stonyfield Organic 和 Cheer Pack 合作推出了首款全聚乙烯 (PE) 喷口袋。新包装袋由 Amkor 的 Amprima Plus 製成,这是一种可回收的聚乙烯 (PE) 薄膜。 Amcor 的研发团队与 Cheer Pack 的包装团队密切合作,并对包装检验。

- 2024 年 2 月-ProAmpac Intermediate Inc. 推出了一种高阻隔纤维可持续包装袋,可用于冷藏已烹调、冷切鸡肉和鱼类等多种产品。本产品符合OPRL规定,纤维含量超过90%。这种永续袋装包装的推出和发展预计将对肉类、家禽和鱼贝类製造商产生重大影响,并在预测期内推动这些产品的需求。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场动态

- 市场驱动因素

- 对经济高效的包装解决方案和品牌提升的需求不断增加

- 对方便即食食品的需求不断增加

- 市场限制

- 人们对环境问题和回收的关注度日益增加

- 贸易情景

- 进出口资料

- 贸易分析(前五大出口/进口国家、价格分析、主要港口等)

- 行业法规、政策和标准

- 技术状况

- 价格趋势分析

- 塑胶树脂(当前价格和历史趋势)

- 产品类型(主要包装形式)

第六章 市场细分

- 按材质

- 塑胶

- 聚乙烯

- 聚丙烯

- PET

- PVC

- EVOH

- 其他树脂

- 纸

- 铝

- 塑胶

- 按产品

- 平面(枕头形状和侧封)

- 起来

- 按最终用户产业

- 食物

- 糖果零食

- 冷冻食品

- 生鲜食品

- 乳製品

- 干货

- 肉类、家禽、鱼贝类

- 宠物食品

- 其他食品(香辛料、酱料、酱汁、调味品等)

- 饮料

- 医疗和製药

- 个人护理及家居产品

- 其他终端使用者产业(汽车、化工、农业)

- 食物

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 法国

- 德国

- 义大利

- 英国

- 西班牙

- 波兰

- 北欧的

- 亚洲

- 中国

- 印度

- 日本

- 泰国

- 澳洲和纽西兰

- 印尼

- 越南

- 拉丁美洲

- 巴西

- 墨西哥

- 哥伦比亚

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 埃及

- 南非

- 奈及利亚

- 摩洛哥

- 北美洲

第七章 竞争格局

- 公司简介

- Amcor Group Gmbh

- Bischof+Klein SE & Co. KG

- Aluflexpack Group

- ProAmpac Intermediate Inc.

- Constantia Flexibles Group GmbH

- Coveris Management GmbH

- FLAIR Flexible Packaging Corporation

- Gualapack SpA

- Hood Packaging Corporation

- Mondi Group

- Scholle IPN

- Sealed Air Corporation

- Sonoco Products Company

- Toppan Printing Co. Ltd

- Berry Global

- Huhtamaki Oyj

- Heat Map Analysis

- Competitor Analysis-Emerging vs. Established Players

第 8 章回收与永续性展望

第九章:未来展望

The Pouch Packaging Market size in terms of shipment volume is expected to grow from 539.01 billion units in 2025 to 656.74 billion units by 2030, at a CAGR of 4.03% during the forecast period (2025-2030).

Key Highlights

- Pouches are among the most widely used packaging products in the food and beverage industry, including pet food, baby food, and liquid packaging (tea, coffee, and juices). Owing to their different features, they are easy to open (like a tear notch and laser perforation), easy to use (with zippers and shapes), and reclosable.

- Pouches have experienced significant advancements in recent years, fueled by a growing emphasis on sustainability, technological innovation, and design flexibility. Moreover, as they are chemically inert, they are widely used in various industries, such as pharmaceuticals, pet food, and cosmetics.

- For instance, in August 2023, Dow Inc., a United States-based chemicals company, partnered with Mengniu, a China-based dairy company, to launch an all-polyethylene (PE) yogurt pouch designed for recyclability. The new product launch enables both companies to achieve a circular economy in China.

- Stand-up pouches are experiencing a remarkable transformation driven by sustainability concerns, intelligent packaging technologies, and printing advancements. Brands that use biodegradable and compostable materials demonstrate their commitment to the environment while promoting eco-conscious consumers. For instance, Kellogg's has launched a range of cereal pouches made from plant-based plastic. Pouches are recyclable, and the company aims to make all of its cereal packaging 100% recyclable by 2025.

- The pouch packaging market growth can be attributed to several factors, such as the rising demand for convenient, portable, and single-serve food and beverage products that align well with consumers' on-the-go lifestyles. Pouche packaging caters to this increasing demand with its lightweight and easily resealable features.

- One of the most significant trends in the packaging industry is the shift toward eco-friendly and sustainable materials. Consumers and regulators alike are increasingly concerned about the environmental consequences of packaging waste. In addition, manufacturers are exploring alternatives to traditional plastic pouches, such as biodegradable and compostable pouches. In July 2023, Walki and Rovema designed a paper pouch for confectionery to replace plastic. The company developed a reinforced euro-hole pouch to keep the packaging intact and environmentally sustainable.

Pouch Packaging Market Trends

The Candy and Snack Foods Segment is Expected to Drive the Demand for Pouch Packaging

- The changing lifestyles of consumers worldwide have resulted in increased demand for ready-to-eat foods, which are at an all-time high. With the new-age working population working round the clock and Gen Z looking for everything handy, ready-to-eat foods have emerged as the best solution.

- In addition, pouch packaging manufacturers have started integrating new and advanced technologies that offer superior barrier capabilities and effectively protect the product from moisture and oxygen. This convenient packaging is essential for the long shelf life of ready-to-eat food products, where the integrity of the product is of prime importance.

- Flexible pouches offer convenience to consumers and producers of baked goods and snack foods. Over the past decade, aspects such as busy lifestyles, more women in the workforce, and growing industrialization have strengthened the need for ready-to-eat snack packaged foods and snacks globally.

- The growing snack food industry and the increasing demand for flexible packaging solutions for various snack foods boost the market's growth. Companies focus on snack packaging designs that cater to evolving consumer preferences and provide innovative, flexible packaging solutions specifically for snack pouches. For instance, in October 2023, Walkers, a British snack food firm, announced launching paper pouches for its baked multipacks snacks range.

- Additionally, in January 2024, Nomadic Snacks introduced ready-to-go pouches for people with busy lifestyles. These pouches are portable, nourishing filling, and ideal for people constantly moving. Such constant innovations are expected to bolster the market during the forecast period.

- The increasing consumption of savory snacks in North America is due to the changing consumer lifestyle and the growing popularity of different flavors of snacks for various occasions. This is expected to have a positive impact on the market. According to SNAC International, a United States-based organization, Americans consumed around 118 million pounds of savory snacks during Super Bowl Week in 2023, which increased by 29% compared to the previous year.

- According to data by Agriculture and Agri-Food Canada, a government agency, the retail sales of snacks in Canada reached USD 13.40 billion in 2023 from USD 12.38 billion in 2022. They are projected to reach USD 15 billion by the end of 2025. The increasing sales of snacks are expected to aid the growth of the pouch packaging market owing to the need for convenient packaging solutions.

The Latin American Pouch Packaging Market is Shifting Toward Sustainability and Pet-Friendly Trends

- Pouch packaging is widely adopted across regional industries for varied purposes. One of the primary adopters of pouch packs is the food and beverage industry, owing to the beverage companies increasing production capacities, long-term demand, and adaptation of recyclable plastics through government initiatives in different countries.

- The Latin American pouch packaging market has increasingly emphasized sustainability as an emerging trend. To address environmental concerns, manufacturers use recycled and recyclable materials for the pouch packaging. Production processes are also developing to reduce water consumption and carbon emissions, according to the increasing emphasis on ecological good practices worldwide.

- Plastrela, a Brazilian converter, developed a snack-size PET standup pouch for Adimax in November 2023. The standup pouch is more easily recycled than the conventional PET/PE SUP structure. It replaces the traditional multilayer PET substrate and polyethylene (PE) sealant with a new mono-material PE (polyethylene) packaging that is easier to recycle.

- Additionally, owning and caring for pets is a very urban phenomenon and is gradually increasing in Latin American countries. Argentina has the highest rate of pet ownership per capita compared to other countries in the world. The major factors driving the demand for pet food included increasing pet ownership, rising per capita disposable income, and increasing nuclear families, particularly in urban areas.

- A standup pouch is preferred for packing high-quality pet food as it delivers high packaging performance. Several manufacturers are constantly increasing their investments in sophisticated pet food packaging. As the popularity of instant pet food grows, convenience will play an essential role in developing this industry.

Pouch Packaging Market Overview

The pouch packaging market is fragmented, with the presence of several market players globally. Some major players are Bischof + Klein SE & Co. KG, Amcor Group GmbH, Aluflexpack Group, ProAmpac Intermediate Inc., Constantia Flexibles Group GmbH, Mondi Group, and Coveris Management GmbH. The market players are expected to leverage the opportunity posed by the growth of several end-user verticals and are innovating to expand their market presence.

- February 2024 - Amcor Group GmbH collaborated with Stonyfield Organic, a maker of yogurt and cheese packs and pouch packaging in North America, and Cheer Pack to launch the first all-polyethylene (PE) spouted pouch. The new pouch is made with Amcor's AmPrima Plus, a polyethylene (PE) film designed for recyclability. Amcor's research and development team worked closely with Cheer Pack's pouching team to validate the packaging.

- February 2024 - ProAmpac Intermediate Inc. introduced a high-barrier fiber-based sustainable pouch for several products, including chilled cooked meats, cold-cut chicken, and fish. The product complies with OPRL regulations and has over 90% fiber content. Such sustainable launches and developments in pouch packaging would thereby significantly impact the meat, poultry, and seafood manufacturers to enhance the products' demand during the forecast period.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Requirements for Cost-effective Packaging Solutions and Brand Enhancement

- 5.1.2 Increasing Demand for Convenience and Ready-to-eat Food

- 5.2 Market Restraints

- 5.2.1 Increasing Environmental Concerns and Recycling

- 5.3 Trade Scenario

- 5.3.1 EXIM Data

- 5.3.2 Trade Analysis (Top 5 Import-Export Countries, Price Analysis, and Key Ports, among others)

- 5.4 Industry Regulation, Policy and Standards

- 5.5 Technology Landscape

- 5.6 Pricing Trend Analysis

- 5.6.1 Plastic Resins (Current Pricing and Historic Trends)

- 5.6.2 Product Type (Key Packaging Formats)

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Plastic

- 6.1.1.1 Polyethylene

- 6.1.1.2 Polypropylene

- 6.1.1.3 PET

- 6.1.1.4 PVC

- 6.1.1.5 EVOH

- 6.1.1.6 Other Resins

- 6.1.2 Paper

- 6.1.3 Aluminum

- 6.1.1 Plastic

- 6.2 By Product

- 6.2.1 Flat (Pillow & Side-Seal)

- 6.2.2 Stand-up

- 6.3 By End-User Industry

- 6.3.1 Food

- 6.3.1.1 Candy & Confectionery

- 6.3.1.2 Frozen Foods

- 6.3.1.3 Fresh Produce

- 6.3.1.4 Dairy Products

- 6.3.1.5 Dry Foods

- 6.3.1.6 Meat, Poultry, And Seafood

- 6.3.1.7 Pet Food

- 6.3.1.8 Other Food Products (Seasonings & Spices, Spreadables, Sauces, Condiments, etc.)

- 6.3.2 Beverage

- 6.3.3 Medical and Pharmaceutical

- 6.3.4 Personal Care and Household Care

- 6.3.5 Other End user Industries ( Automotive, Chemical, Agriculture)

- 6.3.1 Food

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 France

- 6.4.2.2 Germany

- 6.4.2.3 Italy

- 6.4.2.4 United Kingdom

- 6.4.2.5 Spain

- 6.4.2.6 Poland

- 6.4.2.7 Nordic

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Japan

- 6.4.3.4 Thailand

- 6.4.3.5 Australia and New Zealand

- 6.4.3.6 Indonesia

- 6.4.3.7 Vietnam

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Mexico

- 6.4.4.3 Colombia

- 6.4.5 Middle East and Africa

- 6.4.5.1 United Arab Emirates

- 6.4.5.2 Saudi Arabia

- 6.4.5.3 Egypt

- 6.4.5.4 South Africa

- 6.4.5.5 Nigeria

- 6.4.5.6 Morocco

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor Group Gmbh

- 7.1.2 Bischof + Klein SE & Co. KG

- 7.1.3 Aluflexpack Group

- 7.1.4 ProAmpac Intermediate Inc.

- 7.1.5 Constantia Flexibles Group GmbH

- 7.1.6 Coveris Management GmbH

- 7.1.7 FLAIR Flexible Packaging Corporation

- 7.1.8 Gualapack SpA

- 7.1.9 Hood Packaging Corporation

- 7.1.10 Mondi Group

- 7.1.11 Scholle IPN

- 7.1.12 Sealed Air Corporation

- 7.1.13 Sonoco Products Company

- 7.1.14 Toppan Printing Co. Ltd

- 7.1.15 Berry Global

- 7.1.16 Huhtamaki Oyj

- 7.2 Heat Map Analysis

- 7.3 Competitor Analysis - Emerging vs. Established Players