|

市场调查报告书

商品编码

1687452

端点检测与反应 (EDR):市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Endpoint Detection and Response (EDR) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

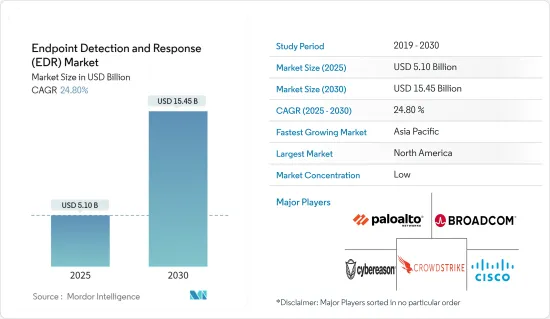

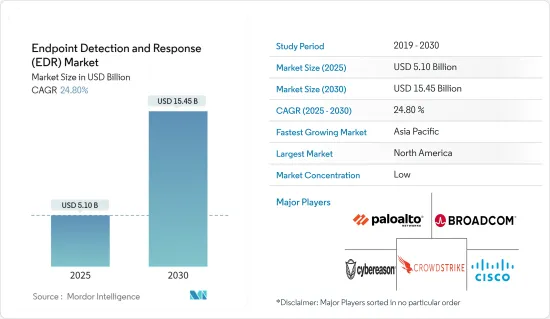

端点检测与反应 (EDR) 市场规模预计在 2025 年为 51 亿美元,预计到 2030 年将达到 154.5 亿美元,预测期内(2025-2030 年)的复合年增长率为 24.8%。

主要亮点

- 随着经济的成长,资料密集型方法和决策的采用也越来越多,这主要归因于数位化程度的提高导致全球网路攻击数量的增加。全球范围内资料外洩事件的增加正促使企业采用更加分散、基于边缘的安全技术。这推动了对 EDR(端点侦测和回应)解决方案的需求。

- 这种成长主要归因于端点设备的急剧增加、端点攻击和漏洞的持续增加和复杂化,以及对打击端点攻击的高安全性解决方案的需求的相应增加。此外,物联网、人工智慧、机器学习和巨量资料等颠覆性技术的出现,以及由于法律体制快速变化而导致的日益复杂的法规环境中的 IT 风险缓解等因素也推动了安全端点市场的成长。

- 企业行动性是一种使员工能够使用各种设备和应用程式在任何地方工作的方法。这些设备可以透过多种方式融入公司的安全基础设施。端点的数量正在以两位数的速度增长,这主要是由于工业 4.0、机器对机器通讯和智慧城市的出现而导致的自动化快速普及。

- 企业越来越多地采用 BYOD 趋势,导致不同笔记型电脑、桌上型电脑和智慧型手机的涌入,从而产生各种易受攻击的端点。仅靠安全措施不足以阻止攻击。预计全球行动装置采用率的大幅成长将在预测期内创造巨大的商机。

- 客户需要一种多层次的方法来实现端点检测和回应 (EDR),结合具有卓越效能、低成本和集中管理等特点的工具。它还为所有端点提供威胁防护,帮助保护实体、虚拟或混合环境中的客户资料。

EDR(端点检测与反应)市场趋势

小型企业强劲成长

- 中小企业对全球GDP成长至关重要。例如,根据欧盟委员会的预测,2023年欧盟内中小企业(SME)的数量将达到约2,440万家。中小企业对欧洲经济的贡献中小企业(SME)是欧洲经济的支柱。针对中小企业的网路攻击日益复杂,传统的端点保护机制无法轻易阻止。在这种情况下,及时发现事件对于最大限度地减少潜在的负面影响至关重要。

- 随着企业越来越意识到将资料迁移到云端而不是建置和维护新的资料储存来节省成本和资源的重要性,对云端基础的解决方案的需求正在增长,从而导致采用云端基础的端点检测和回应 (EDR) 解决方案。由于这些优势,云端基础的解决方案越来越多地被世界各地的大、中、小型企业所采用。

- 此外,满足中小企业日益增长的需求的技术创新预计将推动市场成长率。例如,2024 年 2 月,网路安全公司 ESET 宣布推出 ESET MDR,这是一项创新解决方案,旨在应对中小企业面临的日益严峻的网路安全挑战。新服务扩展了 ESET 的企业服务“检测与响应终极版”,使中小型企业能够立即响应事件,加强其安全态势,减少误报并提高其威胁检测、调查和响应能力。

- ESET MDR 将人工智慧自动化与人类专业知识和全面的威胁情报知识相结合,提供无与伦比的威胁侦测和事件回应。全天候保全服务还可以帮助填补专业知识空白,减轻内部安全团队的压力,使中小企业能够专注于策略计画。

亚太地区可望创下最快成长

- 在中国,随着智慧製造工厂的成长,各行各业的连网设备数量不断增加以及物联网技术的采用,预计将刺激端点侦测和回应服务的成长,为企业提供具有端点网路弹性的业务环境。

- 此外,企业的数位转型和云端运算采用等技术进步也增加了该国遭受网路攻击的风险。由于廉价劳动力的推动,该国製造设施的成长正刺激工业领域电脑和 M2M通讯的成长,增加了透过勒索软体和恶意软体进行网路攻击的脆弱性,从而推动了市场需求。

- 日本工业领域正在广泛采用云端基础的解决方案,包括数位双胞胎、感测器、客户关係和 ERP 软体,以支援电脑系统和资料储存伺服器需求的成长。

- 印度 EDR 市场在新兴企业资金筹措方面取得了重大进展,以支持企业对新兴 EDR 解决方案的需求。预计这将透过加强市场供应方来满足未来的需求,从而促进市场成长。

端点检测与回应 (EDR) 市场概览

端点检测和回应 (EDR) 市场日益分散,参与者数量不断增加。对于大型企业来说,在这个快速变化的世界中保护个人资料安全已成为首要任务。 Palo Alto Networks Inc.、Cisco Systems Inc.、CrowdStrike Inc.、Broadcom Inc. 和 Cybereason Inc. 等主要公司都开发了 EDR 工具来为这些组织提供服务。

- 2023 年 12 月,商业软体和服务评论提供者 G2 在 2024 年冬季报告中将 Sophos 评为端点保护、EDR、XDR、防火墙和 MDR 领域的关键参与者。

- 2023 年 9 月 Cybereason Inc. 于 2023 年 4 月 23 日宣布成功扩大资金筹措轮次,使本轮融资总金额达到 1.2 亿美元。本笔资金筹措将使该公司扩大全球规模并加强其在预防、检测和回应领域的地位。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 产业价值链分析

- COVID-19 市场影响

第五章 市场动态

- 市场驱动因素

- 扩大企业移动性

- BYOD(自带设备)的采用和远端工作的兴起

- 市场挑战

- 技术创新成本上升

- 侦测并响应行动装置上保护不足的端点

第六章 市场细分

- 按组件

- 解决方案

- 按服务

- 依部署类型

- 云端基础

- 本地

- 按解决方案类型

- 工作站

- 行动装置

- 伺服器

- POS 终端

- 按组织规模

- 中小企业

- 大型企业

- 按最终用户产业

- BFSI

- 资讯科技/通讯

- 製造业

- 卫生保健

- 零售

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 亚洲

- 中国

- 日本

- 印度

- 澳洲和纽西兰

- 中东和非洲

- 拉丁美洲

- 北美洲

第七章 竞争格局

- 公司简介

- Palo Alto Networks Inc.

- Cisco Systems Inc.

- CrowdStrike Inc.

- Broadcom Inc.

- Cybereason Inc.

- Deep Instinct Ltd

- Fortra LLC

- Musarubra US LLC(Trellix)

- Open Text Corporation

- Sophos Ltd

- Fortinet Inc.

第八章投资分析

第九章:未来市场展望

The Endpoint Detection and Response Market size is estimated at USD 5.10 billion in 2025, and is expected to reach USD 15.45 billion by 2030, at a CAGR of 24.8% during the forecast period (2025-2030).

Key Highlights

- The key drivers contributing to the increase in the adoption of data-intensive approaches and decisions with the growth include the increase in the number of cyber-attacks globally with the growing digitalization. Due to increasing data breaches worldwide, enterprises are increasingly adopting more decentralized and edge-based security techniques. This drives the demand for endpoint detection and response (EDR) solutions.

- The growth is mainly due to an increase in exponential endpoint devices, a continuously increasing & sophisticated nature of endpoint attacks and breaches, and a proportionally increasing demand for high-security solutions to combat endpoint attacks. In addition, the growth of the security endpoint market is supported by factors such as the advent of innovative technologies like IoT, Al, ML, and Big Data, among others, and IT risk mitigation in an increasingly complex regulatory environment with fast-changing legal frameworks.

- Enterprise mobility is an approach where employees can work from anywhere using various devices and applications. These devices can fit into the enterprise security infrastructure in various ways. There has been a double-digit growth in the number of endpoints, primarily owing to the rapidly increasing adoption of automation, which is a result of Industry 4.0, machine-to-machine communication, and the emergence of smart cities.

- The increasing adoption of BYOD trends in organizations has increased the influx of different laptops, desktops, and smartphones, which has created different endpoints vulnerable to attacks. Security measures on their own are not enough to stop them. The massive growth in the adoption of mobile devices worldwide is expected to create significant opportunities during the forecast period.

- Customers require a multi-layered approach to endpoint detection and response, incorporating tools that combine superior performance with low cost and centralized management. It also helps deliver threat protection across all endpoints, ensuring customer data is safe in a physical, virtual, or hybrid environment.

Endpoint Detection and Response (EDR) Market Trends

Small and Medium Enterprises (SMEs) to Witness Major Growth

- Small and medium enterprises are imperative to global GDP growth. For instance, according to the European Commission, approximately 24.4 million small and medium-sized enterprises (SMEs) were estimated to be in the European Union in 2023. The Contribution of SMEs to the European Economy Small and medium-sized enterprises (SMEs) form the backbone of the European economy. The cyber attacks that are taking place on small and medium enterprises (SMEs) are increasingly becoming more sophisticated, implying that the traditional endpoint protection mechanisms cannot easily prevent them. In these cases, timely incident detection is essential to minimize potential negative impacts.

- The increasing awareness among enterprises about the importance of saving money and resources by moving their data to the cloud instead of building and maintaining new data storage drives the demand for cloud-based solutions and, hence, the adoption of cloud-based endpoint detection and response solutions. Due to these benefits, SMEs and large enterprises worldwide have increasingly adopted cloud-based solutions.

- Further, the growing innovations to meet the increasing demand for small and medium enterprises are set to boost the market growth rate. For instance, in February 2024, ESET, a player in cybersecurity, announced the launch of ESET MDR, an innovative solution to address the growing cybersecurity challenges faced by small and medium-sized businesses. This new offering enables small and medium-sized businesses to respond immediately to incidents, enhance their security posture, reduce false positives, and strengthen their threat detection, investigation, and response capabilities by expanding ESET's Detection and Response Ultimate service for enterprises.

- ESET MDR combines AI-powered automation with human expertise and comprehensive threat intelligence knowledge for unmatched threat detection and incident response. In addition to facilitating regulatory compliance and helping businesses achieve key cyber security controls necessary for insurability, access to 24/7/365 security services that bridge expertise gaps and alleviate the pressure on internal security teams, allowing SMBs to focus on strategic initiatives.

Asia-Pacific is Expected to Register the Fastest Growth

- The rising number of connected devices and the adoption of the Internet of Things technologies across different industries in China, supported by the growth of its smart manufacturing plants in the country, are expected to fuel the growth of endpoint detection and response due to their application in providing organizations to have an endpoint cyber resilient business environment.

- Additionally, technological advancements, including digital transformation and cloud adoptions in businesses, are fueling the risk of cyber attacks in the country. The country's growth of manufacturing facilities, supported by its low-cost workforce availability, is fueling the growth of computer and M2M communications in the industrial landscape, raising the vulnerability of ransomware and malware cyber attacks, which can drive the market's demand.

- Japan has been registering a significant advancement in implementing cloud-based solutions, including the digital twin, sensors, customer relationships, and ERP software in its industrial sector, supporting the growth of computer systems and data storage server requirements in the country, which would drive the demand for EDR solutions and services, the market in the country due to its application in safeguarding the endpoint security of the enterprises, fueling the market growth.

- The EDR market in India has been registering a significant development in startup funding to support the demand for emerging EDR solutions in enterprises. This would fuel the market growth by strengthening the market's supply side to address future demand.

Endpoint Detection and Response (EDR) Market Overview

The endpoint detection and response market is fragmented due to the increasing number of players. For large organizations, storing personal data securely in this fast-paced world has become the most critical task. Giants like Palo Alto Networks Inc., Cisco Systems Inc., CrowdStrike Inc., Broadcom Inc., and Cybereason Inc. are developing EDR tools to cater to such organizations.

- December 2023: G2, a business software and service review provider, named Sophos a significant player for Endpoint Protection, EDR, XDR, Firewall, and MDR in their Winter 2024 Reports, which would fuel the company's brand positioning to support its market growth in the future.

- September 2023: Cybereason Inc. announced the successful expansion of its funding round on April 23, 2023, bringing the total round to USD 120 million. The funding will help the company to scale its global operations and strengthen its position in the prevention, detection, and response space.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitues

- 4.2.5 Degree of Competition

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Expansion of Enterprise Mobility

- 5.1.2 Bring your Own Device (BYOD) Adoption and Increased Remote Working

- 5.2 Market Challenges

- 5.2.1 Higher Innovation Costs

- 5.2.2 Endpoint Detection and Response Falling Short of Protecting Mobile Devices

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Solutions

- 6.1.2 Services

- 6.2 By Deployment Type

- 6.2.1 Cloud-based

- 6.2.2 On-premise

- 6.3 By Solution Type

- 6.3.1 Workstations

- 6.3.2 Mobile Devices

- 6.3.3 Servers

- 6.3.4 Point of Sale Terminals

- 6.4 By Organization Size

- 6.4.1 Small And Medium Enterprises (SMES)

- 6.4.2 Large Enterprises

- 6.5 By End-user Industry

- 6.5.1 BFSI

- 6.5.2 IT and Telecom

- 6.5.3 Manufacturing

- 6.5.4 Healthcare

- 6.5.5 Retail

- 6.5.6 Other End-user Industries

- 6.6 By Geography

- 6.6.1 North America

- 6.6.1.1 United States

- 6.6.1.2 Canada

- 6.6.2 Europe

- 6.6.2.1 Germany

- 6.6.2.2 United Kingdom

- 6.6.2.3 France

- 6.6.3 Asia

- 6.6.3.1 China

- 6.6.3.2 Japan

- 6.6.3.3 India

- 6.6.4 Australia and New Zealand

- 6.6.5 Middle East and Africa

- 6.6.6 Latin America

- 6.6.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Palo Alto Networks Inc.

- 7.1.2 Cisco Systems Inc.

- 7.1.3 CrowdStrike Inc.

- 7.1.4 Broadcom Inc.

- 7.1.5 Cybereason Inc.

- 7.1.6 Deep Instinct Ltd

- 7.1.7 Fortra LLC

- 7.1.8 Musarubra US LLC (Trellix)

- 7.1.9 Open Text Corporation

- 7.1.10 Sophos Ltd

- 7.1.11 Fortinet Inc.