|

市场调查报告书

商品编码

1524193

金融科技全球市场:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Global Fintech - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

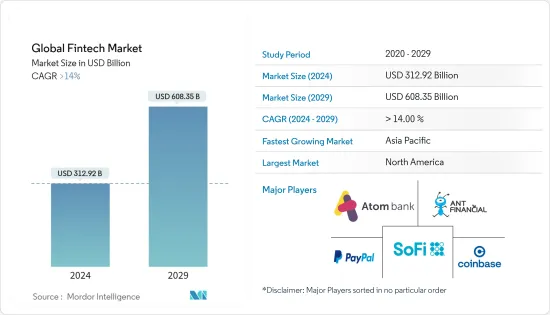

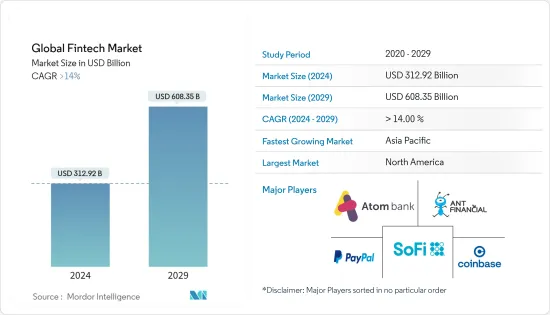

预计2024年全球金融科技市场规模为3,129.2亿美元,2029年预计将达到6,083.5亿美元,复合年增长率预计将成长14%以上。

在金融业,FinTech代表金融科技。在提供自动化和增强型金融服务的业务中,金融科技指的是电脑程式和其他现代技术。随着时间的推移,金融科技领域取得了显着发展,导致公司变得更加以客户为导向。因此,新兴企业公司到高科技公司再到老字型大小企业,在全球众多企业中找到一席之地可能很困难。金融科技和金融服务机构在不断变化的商业环境中追求新的创造性理念,并以协作或竞争的方式抢占彼此的先机。

一系列危机一直是金融科技业成长的推动力。自上次全球金融危机以来,金融科技投资稳定成长。传统金融服务业在危机期间和危机后受到严重挤压,其弱点转化为技术反弹,导致该行业扩张。同样,COVID-19大流行也对全球经济造成了灾难性影响,标誌着衰退的开始。受这场危机的影响,金融科技业发展更加迅速。大型金融机构透过与新兴科技公司合作来应对这场流行病,以进入新市场。即使公司本身寻求与主要银行建立合作伙伴关係以扩大其客户群和服务范围,金融科技业务仍在继续成长。

近年来,出现了许多金融科技子类型,包括保险科技、监管科技和支付服务,它们采用针对特定行业和角色量身定制的最尖端科技。如今,金融科技领域不再只是一种时尚,组织实现其计画的程度变得更加重要。金融科技业务在技术方面正在经历快速成长。人们越来越多地采用能够提高准确性、效率和敏捷性的技术,例如区块链、流程自动化、应用程式介面 (API)、机器人和资料分析。

金融科技市场趋势

数位付款的快速成长推动市场

汇款和付款在金融科技产业中发挥基础性作用,是金融服务创新和数位转型的基石。汇款和付款有助于服务不足的人群(包括银行帐户和银行帐户)获得金融服务。汇款和付款领域的金融科技创新透过提供便利、高效和用户友好的付款解决方案来改善整体客户体验。

数位付款提供了更快、更有效率、更安全的汇款和金融交易方式,彻底改变了金融科技产业。近年来,由于智慧型手机、网路和其他数位科技的普及,数位付款的使用不断扩大。数位付款是许多金融科技创新的基础。金融科技公司利用数位付款基础设施提供各种服务,包括P2P(P2P) 转帐、线上借贷、机器人顾问和保险。这些解决方案透过利用数位付款管道提高金融可近性和包容性。数位付款让客户可以随时随地进行交易,无需实体货币或银行卡。这种便利性导致数位付款的使用显着增加。

与传统银行交易相比,金融科技主导的数位付款通常具有较低的交易费用,尤其是跨国交易。这种成本效率使消费者和企业受益,减少了与交易相关的财务障碍,并促进了金融科技付款解决方案的采用。金融科技公司正在透过实施强大的加密、生物识别和诈欺检测机制来优先考虑数位付款的安全性。这些措施使金融交易更加安全,增强用户信心,并鼓励数位付款解决方案的广泛采用。

亚太地区由于数位化的提高和支持性法规结构而引领市场

由于几个关键因素,亚太地区金融科技市场正在经历强劲成长和不断增长的需求。首先,在网路和智慧型手机普及的推动下,快速扩张的数位经济正在为金融科技创新和采用创造肥沃的土壤。许多消费者精通数位技术,对透过数位管道提供的便利、可及的金融服务的需求正在增加。

此外,旨在促进数位化和金融包容性的政府倡议,加上支持性的法律规范,正在创造有利于该地区金融科技发展的环境。中国、印度、新加坡和澳洲等国家正成为金融科技中心,吸引了大量投资和人才。多项政府措施和法律规范正在支持亚太地区金融科技的发展。例如,印度央行推出了多项措施来促进印度金融科技的发展,例如统一付款介面(UPI),它可以实现不同银行之间的无缝即时付款并促进数位交易。同样,金融科技公司可以利用新加坡金融管理局(MAS)建立的监管沙箱计划在安全的环境中测试新产品和服务。 MAS 也通过了《付款服务法》,为数位钱包、付款处理和加密货币服务等各种付款活动提供了法律规范。

亚太地区继续作为金融科技创新和投资的中心,推动产业的长期成长和转型,因为金融科技颠覆了传统金融服务并改变了产业格局。

金融科技业概况

在持续的技术创新、不断变化的消费者偏好、监管发展以及各行业参与者之间的策略联盟的推动下,金融科技市场正在动态发展。该市场的主要企业包括蚂蚁金服、Atom Bank、SoFi、Paypal 和 Coinbase。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察与动态

- 市场概况

- 市场驱动因素

- 数位付款的兴起

- 加大对金融科技公司的投资

- 市场限制因素

- 激烈的竞争

- 网路安全风险增加

- 市场机会

- 不断发展的区块链技术和加密货币

- 与传统金融机构合作

- 价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

- 洞察市场创新

- COVID-19 对市场的影响

第五章市场区隔

- 按服务主张

- 汇款/付款

- 储蓄/投资

- 数位借贷/贷款市场

- 线上保险/保险市场

- 其他服务建议

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 其他欧洲国家

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 其他拉丁美洲

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 中东/非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 其他中东/非洲

- 北美洲

第六章 竞争状况

- 市场集中度概况

- 公司简介

- Ant Financials

- Zhong An International

- Atom Bank

- Paypal

- SoFi

- CoinBase

- Robinhood

- Adyen

- N 26

- Ally Financials

- Oscar Health

- Klarna

- Avant*

第七章 市场趋势

第 8 章 免责声明与出版商讯息

The Global Fintech Market size is estimated at USD 312.92 billion in 2024, and is expected to reach USD 608.35 billion by 2029, growing at a CAGR of greater than 14% during the forecast period (2024-2029).

In the financial industry, fintech stands for financial technology. In businesses that offer automated and enhanced financial services, fintech refers to computer programs and other contemporary technologies. The fintech sector has developed significantly over time, which has caused businesses to become more customer-focused. It is, therefore, difficult to find a position among the many businesses that exist worldwide, which range from startups to tech enterprises to well-established businesses. Fintech and financial service organizations have pursued disruptive and new ideas in an ever-changing business landscape, taking up each other's lanes with either a collaborative or a competing attitude.

Multiple crises have served as a driving force behind the growth of the fintech industry. Fintech investments have been rising since the last global financial crisis. The traditional financial services sector was severely pressed both during and after the crisis, and its weaknesses led to a technological reaction that resulted in the sector's expansion. In a similar vein, the COVID-19 pandemic also had a disastrous effect on the world economy and started the recession. The fintech industry developed more quickly as a result of this crisis. Large financial institutions collaborated with up-and-coming tech firms in response to the pandemic in order to gain access to the new market. The fintech business is growing even though the companies themselves are looking to collaborate with big banks to broaden their clientele and offerings.

In recent years, numerous fintech subtypes, such as insurtech, regtech, payment services, and others, have emerged that employ cutting-edge technologies customized for certain industries or roles. The degree of execution attained in an organization's plan is becoming more significant now that the fintech sector is more than just a fad. The fintech business is experiencing fast growth in its technological side. There has been an increased adoption of technology that allows for better accuracy, efficiency, and agility, such as blockchain, process automation, application programming interface (API), robotic and data analytics.

Fintech Market Trends

Surging Adoption of Digital Payments is Driving the Market

Money transfers and payments play a fundamental role in the fintech industry, serving as a cornerstone for financial services innovation and digital transformation. Money transfers and payments facilitate access to financial services for underserved populations, including the unbanked and underbanked. Fintech innovations in money transfers and payments improve the overall customer experience by offering convenient, efficient, and user-friendly payment solutions.

Digital payments have revolutionized the fintech industry by providing faster, more efficient, and more secure ways to transfer money and make financial transactions. The use of digital payments has grown in recent years due to the increasing adoption of smartphones, the Internet, and other digital technologies. Digital payments serve as the foundation upon which many fintech innovations are built. Fintech companies leverage digital payment infrastructure to offer different services, including peer-to-peer (P2P) transfers, online lending, robo-advisory, insurance, and more. These solutions enhance financial accessibility and inclusion by leveraging digital payment channels. With digital payments, customers can make transactions irrespective of the time and place without the need for physical currency or cards. This convenience has led to a significant increase in the use of digital payments.

Fintech-driven digital payments often have lower transaction fees when compared to traditional banking methods, especially for cross-border transactions. This cost efficiency benefits both consumers and businesses, reducing the financial barriers associated with conducting transactions and driving the adoption of fintech payment solutions. Fintech companies prioritize security in digital payments by implementing robust encryption, biometric authentication, and fraud detection mechanisms. These measures enhance the security of financial transactions, instilling trust in users and encouraging wider adoption of digital payment solutions.

Asia-Pacific Leading the Market Owing to Growing Digitalization Coupled with Supportive Regulatory Frameworks

Asia-Pacific is experiencing robust growth and rising demand in the fintech market, driven by several key factors. Firstly, the region's rapidly expanding digital economy, fueled by increasing Internet and smartphone penetration, is creating a fertile ground for fintech innovation and adoption. With a large population of digitally savvy consumers, there is a growing demand for convenient and accessible financial services delivered through digital channels.

Additionally, government initiatives aimed at promoting digitalization and financial inclusion, coupled with supportive regulatory frameworks, are fostering a conducive environment for fintech growth in the region. Countries like China, India, Singapore, and Australia are emerging as fintech hubs, attracting significant investment and talent. Several government initiatives and regulatory frameworks have supported the growth of fintech in Asia-Pacific. For instance, the RBI has introduced several measures to promote fintech growth in India, such as the Unified Payments Interface (UPI), which enables seamless real-time payments between different banks and promotes digital transactions. Similarly, fintech companies can test new goods and services in a safe setting by utilizing the regulatory sandbox program established by the Monetary Authority of Singapore (MAS). The Payment Services Act, which offers a regulatory framework for a range of payment activities such as digital wallets, payment processing, and cryptocurrency services, has also been adopted by MAS.

Asia-Pacific is well-positioned to continue serving as a center for fintech innovation and investment, propelling the industry's long-term growth and transformation as fintech disrupts traditional financial services and changes the industry landscape.

Fintech Industry Overview

The fintech market is dynamic and evolving, driven by ongoing technological innovation, changing consumer preferences, regulatory developments, and strategic partnerships among various industry players. The major players in the market include Ant Financials, Atom Bank, SoFi, Paypal, and Coinbase.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise of Digital Payments

- 4.2.2 Rising Investments in FinTech Firms

- 4.3 Market Restraints

- 4.3.1 Intense Competition

- 4.3.2 Increasing Cybersecurity Risks

- 4.4 Market Opportunites

- 4.4.1 Evolving Blockchain Technology and Cryptocurrency

- 4.4.2 Collaboration with Traditional Financial Institutions

- 4.5 Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights into Technological Innovations in the Market

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Service Proposition

- 5.1.1 Money Transfer and Payments

- 5.1.2 Savings and Investments

- 5.1.3 Digital Lending and Lending Marketplaces

- 5.1.4 Online Insurance and Insurance Marketplaces

- 5.1.5 Other Service Propositions

- 5.2 By Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 United Kingdom

- 5.2.2.2 Germany

- 5.2.2.3 France

- 5.2.2.4 Spain

- 5.2.2.5 Rest of Europe

- 5.2.3 Latin America

- 5.2.3.1 Brazil

- 5.2.3.2 Argentina

- 5.2.3.3 Mexico

- 5.2.3.4 Rest of Latin America

- 5.2.4 Asia-Pacific

- 5.2.4.1 China

- 5.2.4.2 India

- 5.2.4.3 Japan

- 5.2.4.4 South Korea

- 5.2.4.5 Rest of Asia-Pacific

- 5.2.5 Middle East and Africa

- 5.2.5.1 United Arab Emirates

- 5.2.5.2 Saudi Arabia

- 5.2.5.3 Rest of Middle East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Ant Financials

- 6.2.2 Zhong An International

- 6.2.3 Atom Bank

- 6.2.4 Paypal

- 6.2.5 SoFi

- 6.2.6 CoinBase

- 6.2.7 Robinhood

- 6.2.8 Adyen

- 6.2.9 N 26

- 6.2.10 Ally Financials

- 6.2.11 Oscar Health

- 6.2.12 Klarna

- 6.2.13 Avant*