|

市场调查报告书

商品编码

1524195

全球空调市场:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Global Air Conditioner - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

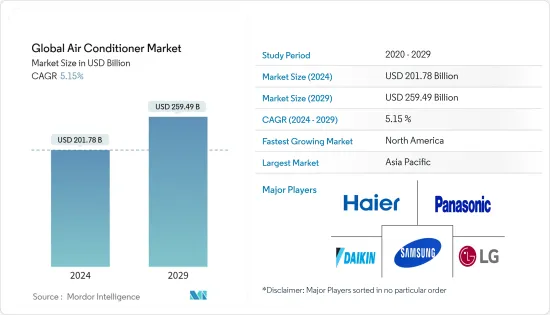

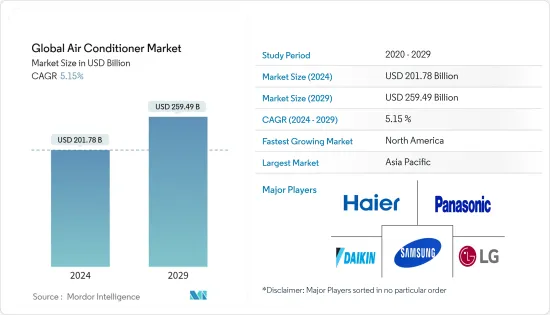

预计2024年全球空调市场规模为2017.8亿美元,预计2029年将达2,594.9亿美元,预测期(2024-2029年)复合年增长率为5.15%。

全球气温和湿度水平不断上升,以及空调作为公共事业而非奢侈品的认知度不断提高,预计将推动空调业务的显着成长。由于配备空气净化系统和逆变器的型号等高性能空调的推出,空调市场预计在预测期内将成长。

全球供应链和市场需求受到了 COVID-19 疫情的影响。中国在空调市场中占有重要地位。我们也向许多国家出口製造成品所需的各种原料。中国的企业倒闭迫使其他美国和欧洲空调製造商暂时停止最终产品生产。受此影响,市场供需失衡进一步扩大。

推动智慧空调市场的主要成长要素是智慧设备的日益普及,这些设备可以将传统的远端控制空调转变为智慧设备。由于购物中心、办公大楼和工业的开发许可率提高,预计箱型冷气将适度增长,而住宅标准的提高将推动室内空调的需求。

空调市场趋势

全球空调需求不断扩大

全球空调需求的扩张是由多种因素共同推动的。由于气候变迁和城市热岛效应导致的全球气温上升,增加了对空调的需求,以维持舒适的室内环境,特别是在炎热的夏季。快速的都市化,特别是在新兴经济体,导致保温现象普遍存在的都市区人口密度增加,进一步增加了住宅、商业和机构建筑对空调的需求。人们对空调的舒适性和健康益处的了解不断增加,包括改善室内空气品质、管理湿度和缓解与炎热相关的健康状况,从而推动了住宅和商业环境对空调系统的需求。

办公大楼、零售空间、医疗设施、资料中心和製造工厂对空调的需求不断增长,推动市场成长,因为公司优先考虑员工舒适度、生产力和设备冷却。政府努力提高能源效率和减少温室气体排放,透过法规、奖励和能源效率标准鼓励采用节能空调系统,这推动了市场需求。

亚太地区主导空调市场

快速都市化、气温上升、可支配收入增加以及对舒适解决方案的需求不断增加等因素使亚太地区成为世界领先的市场之一。该地区由中国、印度、印尼和日本等人口稠密的国家组成。这些国家的人口成长和都市化不断加快,住宅、商业和教育领域对空调系统的需求不断增加。气候变迁加剧了气温上升,推动了该地区对空调解决方案的需求。东南亚和南亚国家气候炎热潮湿,对提供舒适冷却的空调系统的需求不断增加。

推动市场成长的是空调系统的技术进步,例如变频技术、智慧连网型功能和节能设计。这些进步提高了能源效率,降低了营业成本,并改善了用户体验,从而提高了采用率。例如,大金、三菱电机和Panasonic等公司提供采用变频技术和智慧功能的先进空调系统,吸引了亚太地区的消费者。为了鼓励采用节能模式,亚太地区许多国家都推出了能源效率标准和空调系统标籤计画。例如,印度政府推出了节能建筑规范(ECBC)和能源效率局(BEE)星级评定计划,以推广节能空调系统。

空调市场产业概况

空调市场竞争激烈。无数的选手在世界各地参加比赛。竞争格局的特点是成熟的跨国公司和区域参与者,每个公司都寻求透过技术创新、能源效率、产品功能和定价策略来实现其产品的差异化。主要参与者包括海尔集团、大金业、LG电子、三星电子、松下公司等。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态与洞察

- 市场概况

- 市场驱动因素

- 气温上升和气候变迁

- 逆变器技术、智慧功能、连网型功能等方面的创新。

- 市场限制因素

- 高能耗

- 初始成本和维护成本高

- 市场机会

- 节能空调系统的需求

- 空调系统与物联网集成

- 价值链分析

- 产业吸引力波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

- 洞察产业技术进步

- COVID-19 对市场的影响

第五章市场区隔

- 按类型

- 窗型冷气

- 分离式/多联机空调

- 箱型冷气

- 可变冷媒流量 (VRF)

- 中央空调

- 其他的

- 依技术

- 逆变器

- 非逆变器

- 按最终用户

- 住宅

- 商业的

- 按分销管道

- 多品牌商店

- 专卖店

- 网路商店

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 英国

- 德国

- 法国

- 俄罗斯

- 义大利

- 西班牙

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 阿拉伯聯合大公国

- 南非

- 其他中东/非洲

- 北美洲

第六章 竞争状况

- 市场集中度概况

- 公司简介

- Haier Group

- Daikin Industries

- LG Electronics

- Samsung Electronics

- Panasonic Corporation

- Mitsubishi Electric Corporation

- Carrier

- Hitachi Ltd.

- Whirlpool Corporation

- Toshiba Corporation*

第七章 市场机会及未来趋势

第 8 章 免责声明与出版商讯息

The Global Air Conditioner Market size is estimated at USD 201.78 billion in 2024, and is expected to reach USD 259.49 billion by 2029, growing at a CAGR of 5.15% during the forecast period (2024-2029).

The rising global temperatures and humidity levels and the growing recognition of air conditioners as a utility rather than luxury goods are predicted to drive significant growth in the air conditioning (AC) business. Driven by the introduction of sophisticated air conditioners, including models equipped with air purification systems and inverters, the AC market is anticipating growth in the forecast period.

The worldwide supply chain and market demand were both affected by the COVID-19 outbreak. China plays a significant role in the air conditioner market. Still, it also exports a variety of input supplies, which are needed to make finished items, to a wide range of nations. Due to the closure of their operations in China, other American and European air conditioning manufacturers have been forced to stop producing final goods temporarily. As a result, the market's imbalance between supply and demand widened.

The primary growth factor driving the smart air conditioner market is the growing adoption of smart devices that can transform traditional remote-controlled air conditioners into smart devices. While packaged air conditioners are expected to expand at a moderate rate due to rising permit rates for the development of malls, offices, and industries, the demand for room air conditioners is being driven by improvements in housing standards.

Air Conditioner Market Trends

Growing Demand for Air Conditioners Globally

The growing demand for air conditioners worldwide is propelled by a convergence of factors. Increasing global temperatures, attributed to climate change and urban heat island effects, are driving the need for air conditioning to maintain comfortable indoor environments, especially during hot summer months. Rapid urbanization, particularly in emerging economies, is leading to higher population densities in urban areas where heat retention is common, further increasing the demand for air conditioning in residential, commercial, and institutional buildings. The demand for air conditioning systems in both residential and commercial settings is being driven by the increased knowledge of the comfort and health benefits of air conditioning, including enhanced indoor air quality, humidity management, and relief from heat-related health conditions.

The increasing demand for air conditioning in office buildings, retail spaces, healthcare facilities, data centers, and manufacturing plants is driving market growth as businesses prioritize employee comfort, productivity, and equipment cooling. Government initiatives that aim to improve energy efficiency and reduce greenhouse gas emissions are encouraging the adoption of energy-efficient air conditioning systems through regulations, incentives, and energy efficiency standards, thereby driving market demand.

Asia-Pacific Dominating the Air Conditioner Market

Factors such as rapid urbanization, rise in temperatures, increase in disposable income, and increased demand for comfort solutions are driving the Asia-Pacific region to be one of the major markets worldwide. The region comprises some of the most densely populated countries, including China, India, Indonesia, and Japan. Increased population growth and urbanization in these countries have led to an increase in demand for air conditioning systems in the residential, business, and educational sectors. Rising temperatures, exacerbated by climate change, are driving the region's need for air conditioning solutions. Southeast and South Asian countries experience scorching and humid climates, leading to higher demand for air conditioning systems to provide comfortable cooling.

The growth of the market is driven by technological advances in air conditioning systems, such as inverter technology, intelligent and connected features, and energy-efficient designs. These advancements improve energy efficiency, reduce operating costs, and enhance user experience, leading to higher adoption rates. For example, companies like Daikin, Mitsubishi Electric, and Panasonic offer advanced air conditioning systems with inverter technology and smart features that appeal to consumers in the Asia-Pacific region. In order to encourage the adoption of energy-efficient models, a number of countries in the Asia-Pacific region have introduced Energy Efficiency Standards and Air Conditioning System Labelling Programmes. For example, the Indian government has introduced the Energy Conservation Building Code (ECBC) and the Bureau of Energy Efficiency (BEE) star rating program to promote energy-efficient air conditioning systems.

Air Conditioner Market Industry Overview

The market for air conditioners is highly competitive. There are a number of players competing around the world. The competitive landscape is characterized by both established multinational corporations and regional players, each striving to differentiate their products through innovation, energy efficiency, product features, and pricing strategies. Major players include Haier Group, Daikin Industries, LG Electronics, Samsung Electronics, and Panasonic Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Temperatures and Climate Change

- 4.2.2 Technological Innovations such as Inverter Technology, Smart and Connected Features

- 4.3 Market Restraints

- 4.3.1 High Energy Consumption

- 4.3.2 High Initial and Maintenance Costs

- 4.4 Market Opportunities

- 4.4.1 Demand for Energy-Efficient Air Conditioning Systems

- 4.4.2 Integration of Air Conditioning Systems with loT

- 4.5 Value Chain Analysis

- 4.6 Industry Attractiveness: Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights into Technological Advancements in the Industry

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Window AC

- 5.1.2 Split and Multi-Split AC

- 5.1.3 Packaged AC

- 5.1.4 Variable Refrigerant Flow (VRF)

- 5.1.5 Central AC

- 5.1.6 Others

- 5.2 By Technology

- 5.2.1 Inverter

- 5.2.2 Non-Inverter

- 5.3 By End-User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.4 By Distribution Channel

- 5.4.1 Multi-Brand stores

- 5.4.2 Exclusive Stores

- 5.4.3 Online Stores

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Russia

- 5.5.2.5 Italy

- 5.5.2.6 Spain

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 India

- 5.5.3.2 China

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle-East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Haier Group

- 6.2.2 Daikin Industries

- 6.2.3 LG Electronics

- 6.2.4 Samsung Electronics

- 6.2.5 Panasonic Corporation

- 6.2.6 Mitsubishi Electric Corporation

- 6.2.7 Carrier

- 6.2.8 Hitachi Ltd.

- 6.2.9 Whirlpool Corporation

- 6.2.10 Toshiba Corporation*