|

市场调查报告书

商品编码

1685862

零售业巨量资料分析:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Big Data Analytics in Retail - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

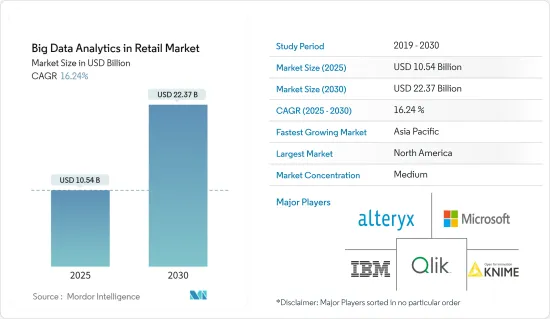

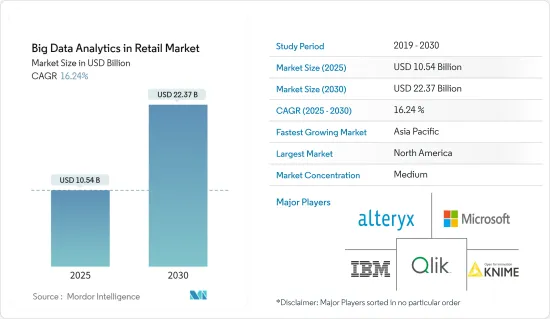

零售巨量资料分析市场规模预计在 2025 年为 105.4 亿美元,预计到 2030 年将达到 223.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 16.24%。

推动市场成长的关键因素是不断发展的技术、资产、工程导向的价值链以及工业4.0驱动的快速工业自动化。市场规模和估值反映了市场供应商透过向半导体、航太和汽车等各类终端用户提供製造解决方案的巨量资料分析而产生的收益。

主要亮点

- 复杂的生产流程、供应链中公司之间的关係以及持续避免错误的压力是工业製造商必须应对的。因此,製造商需要扩大资料来源以降低成本、提高产品品质和提高效率。使用巨量资料分析的公司可以改善关键流程、消除瓶颈、预测需求并预测潜在的故障和延误。

- 连网型设备和感测器的普及以及M2M通讯的实现,正在急剧增加製造业产生的资料。这些资料点的范围可以是材料经过一个製程週期所需时间的详细指标,也可以是汽车产业中材料应力容量等更复杂的计算。

- 随着世界各地的製造商意识到在石油和天然气、汽车、食品和饮料、炼油厂、塑胶和化学品等行业的製造业中整合巨量资料分析的好处,製造业巨量资料正在兴起。製造公司越来越多地采用巨量资料分析解决方案来生产高度准确和精确的产品和设备。例如,以製造喷射发动机、机车、涡轮机和医学成像设备而闻名的通用电气公司也在利用其产生的大量资料开发其设备的智慧连网版本。

- 阻碍市场成长的因素之一是缺乏有效处理和分析非结构化资料的数位技能和意识。对巨量资料安全性的担忧也是阻碍工业製造商采用大数据的一个主要因素。

- 新冠肺炎疫情扰乱了一些企业的经营,但也加速了一些产业向数位化的转变。在一些数位技术采用缓慢的地区,这可能永久改变了各个行业製造商的行为。

零售业巨量资料分析市场趋势

汽车产业是快速成长的终端用户

- 全球汽车产业正在经历变革时期,车型和燃料选项数量不断增加,二手车价值波动,以及供应链挑战,使得OEM难以预测未来价值和了解总体拥有成本。透过利用巨量资料、分析和洞察,行业供应商可以建立解决方案来帮助OEM适应不断变化的行业需求。

- 巨量资料分析使汽车产业能够从 ERP 系统收集资料,并结合来自业务和供应链成员的多个功能领域的资讯。 M2M/IoT 连接是一种网路通讯,它使不同的设备能够共用资料并在无需人工干预的情况下执行自动化任务。

- RFID、感测器、条码阅读器和机器人现已成为工业製造车间的标准。这些设备成倍地增加了资料生成点的数量。

- 汽车产业目前正在发展成为一个更资料主导的产业,以降低与组装缺陷和库存过剩相关的成本。现在可以更准确地进行组装的维护计划。这一切都归功于在产业中引入预测分析。

北美将经历最高成长

- 在工业4.0的推动下,美国在巨量资料分析产业不断创新,巩固了在全球市场的地位。智慧技术在市场上的采用也对国民经济产生直接影响。

- 美国是提供巨量资料分析解决方案的供应商的重要市场。由于工厂自动化的早期采用,预计在预测期内将显着增长。此外,受访的市场上所有领先供应商都位于美国。美国正处于第四次工业革命的边缘,利用资料进行大规模生产,同时整合整个供应链中不同的製造系统和资料。这刺激了该国引进先进的系统。

- 此外,中国汽车产业巨量资料成长的一个主要驱动力是技术供应商的大量存在。这些参与者专注于建立伙伴关係、进行併购并提供创新解决方案,以在区域和全球竞争格局中取得进展。

- 汽车产业是工业自动化系统最大的消费者之一。加拿大拥有丰田、雪佛兰、本田和福特等汽车品牌的八家大型製造厂。此外,加拿大拥有700家製造商,生产满足汽车产业需求的零件。汽车产业是该地区最重要的产业,因为它对製造业的贡献最大,因此预计会对所研究的市场产生正面影响。

零售巨量资料分析市场概况

製造业市场的巨量资料分析是半静态的。随着开放原始码工具的出现以及巨量资料分析技术功能的大幅扩展,企业在必须与其他参与者竞争的环境中,可能会倾向于在提高产品性能方面投入过多资金,从而导致成本不断上升并侵蚀行业盈利。主要参与者包括 Alteryx Inc.、IBM Corporation、Knime AG、Microsoft Corporation 和 Qliktech International AB。

- 2023 年 12 月,KNIME AG 宣布推出 KNIME Analytics Platform 5.2。新版本具有改进的使用者介面、更聪明、更透明的人工智慧助理以及现代化的人工智慧脚本体验。

- 2023 年 6 月,穆迪公司与微软宣布建立伙伴关係,为金融服务提供下一代资料、分析、研究、协作和风险解决方案。此次伙伴关係将藉助微软人工智慧和穆迪专有的资料、分析和研究,创造创新产品,增强企业情报和风险评估洞察力。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

- COVID-19 产业影响评估

第五章 市场动态

- 市场驱动因素

- 不断发展的技术、资产和工程驱动的价值链

- 利用工业 4.0 实现快速工业自动化

- 市场限制

- 缺乏意识和安全问题

- 市场机会

- 增加预测分析工具的使用

- 工业物联网 (IIoT) 的采用日益增多

第六章 市场细分

- 按最终用户产业

- 半导体

- 航太

- 车

- 其他最终用户产业

- 按应用

- 状态监测

- 品管

- 库存管理

- 其他用途

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 拉丁美洲

- 中东和非洲

- 北美洲

第七章 竞争格局

- 公司简介

- Alteryx Inc.

- IBM Corporation

- Knime AG

- Microsoft Corporation

- Qliktech International AB

- Oracle Corporation

- Altair Engineering Inc.(RapidMiner Inc.)

- SAP SE

- SAS Institute Inc.

- Tibco Software Inc.(Cloud Software Group)

- NEC Corporation

- Fujitsu Ltd

- Toshiba Digital Solutions Corporation

第八章投资分析

第九章:市场的未来

The Big Data Analytics in Retail Market size is estimated at USD 10.54 billion in 2025, and is expected to reach USD 22.37 billion by 2030, at a CAGR of 16.24% during the forecast period (2025-2030).

The primary factors driving the market's growth include evolving technology, assets, engineering-oriented value chains, and rapid industrial automation led by Industry 4.0. The market sizing estimates reflect the revenue generated by the market vendors by offering big data analytics in manufacturing solutions to various end-users, such as semiconductors, aerospace, and automotive.

Key Highlights

- Complex production processes, cross-company relationships in the supply chain, and constant pressure to avoid errors must be addressed by industrial manufacturers. Therefore, manufacturers need to expand their data sources so that costs can be reduced, the quality of products can be improved, and efficiency is increased. Companies using big data analytics improve key processes, eliminate bottlenecks, predict demand, and anticipate potential failures and delays.

- With the widespread use of connected devices and sensors, along with the enabling of M2M communication, there has been a significant increase in the data generated in the manufacturing industry. These data points can be of different types, from a metric detailing the time a material takes to pass through one process cycle to a more complex one, such as calculating the material stress capability in the automotive industry.

- Big data in manufacturing is increasing as manufacturers across the globe are seeing the benefits of integrating big data analytics in manufacturing across industries like oil and gas, automotive, food and beverages, refineries, plastics, and chemicals. Manufacturing companies are increasingly adopting big data analytics solutions to manufacture products and devices with high precision and accuracy. For instance, GE, known as the manufacturer of jet engines, locomotives, turbines, and medical imaging equipment, also develops smart, connected versions of the equipment in the massive data they generate.

- One of the factors hindering the growth of the market studied is the lack of digital skills and awareness to handle the unstructured data effectively for analysis. Big data security concerns are another major factor restraining the market adoption of industrial manufacturers.

- The COVID-19 pandemic disrupted several businesses but accelerated the shift to digitization in several sectors. In several regions that have been lagging in adopting digital technologies, manufacturers' behavior in various sectors may have been permanently changed.

Big Data Analytics in Retail Market Trends

Automotive Industry to be the Fastest Growing End User

- The global automobile industry is undergoing a transformation that includes an ever-increasing array of models and fuel types, fluctuations in used car values, and supply chain challenges that hinder OEMs in projecting future value and understanding the total cost of ownership. By leveraging big data, analytics, and insights, industry vendors can create a solution that helps OEMs adapt to the changing industry demands.

- Big data analytics allows the automobile industry to collect data from ERP systems and combine information from multiple functional units of the business and the supply chain members. With the emergence of industry IoT, a networked system, and M2M communication, the automotive industry is positioning itself towards Industry 4.0, Where M2M/IoT connections are networked communications that allow different devices to share data and carry out automatic tasks without the need for human interaction.

- RFIDs, sensors, barcode readers, and robots are now standard in the industry's manufacturing floor. These devices have increased the data generation points exponentially.

- The automotive industry is now evolving into a more data-driven industry to reduce the costs associated with faulty assembly and over-inventory stockings. It can now plan the maintenance of the assembly lines more accurately. It has all been possible due to the adoption of predictive analytics in the industry.

North America to Witness Highest Growth

- Fueled by Industry 4.0, the United States continues to innovate and consolidate its position in the global market in the big data analytics industry. The embracing of smart technologies in the market has also directly impacted the national economy.

- The United States is a substantial market for vendors offering solutions for big data analytics. It is expected to grow significantly over the forecast period, owing to the early adoption of factory automation. Moreover, all the major vendors studied in the market are US-based. The United States is on the verge of the fourth industrial revolution, where data is used in large-scale production while integrating data with various manufacturing systems throughout the supply chain. This is fueling the country's adoption of the advanced system.

- Moreover, the major driver for the growth of big data in the country's automotive sector is the significant presence of technology providers. These players focus on entering into partnerships, merger acquisitions, and innovative solutions offerings to stay in the regional and globally competitive landscape.

- The automotive industry is one of the largest consumers of industrial automation systems. Canada has eight large manufacturing plants operated by Toyota, Chevrolet, Honda, and Ford. Moreover, the country has 700 manufacturers that create parts that meet the automotive industry's requirements. The automotive industry is the most significant in this region as it contributes the most to the manufacturing sector, and it is expected to impact the market studied positively.

Big Data Analytics in Retail Market Overview

Big data analytics in the manufacturing market is semi-consolidated. The huge expansion of capabilities in big data analytics technology, with the availability of open-source tools, may tempt companies to compete with other players and give away too much of their improved product performance in an environment that escalates costs and erodes industry profitability. Some of the major players include Alteryx Inc., IBM Corporation, Knime AG, Microsoft Corporation, and Qliktech International AB.

- In December 2023, Knime AG announced that KNIME Analytics Platform 5.2. is now available. The new version features user interface improvements, a smarter and more transparent Artificial Intelligence assistant, and a modernized scripting experience with AI.

- In June 2023, Moody's Corporation and Microsoft announced a partnership to deliver next-generation data, analytics, research, collaboration, and risk solutions for financial services. The partnership would create innovative products to enhance insights into corporate intelligence and risk assessment with the help of Microsoft's AI and Moody's proprietary data, analytics, and research.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Competitive Rivalry within the Industry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Evolving Technology, Asset, and Engineering-oriented Value Chain

- 5.1.2 Rapid Industrial Automation led by Industry 4.0

- 5.2 Market Restraints

- 5.2.1 Lack of Awareness and Security Concerns

- 5.3 Market Opportunities

- 5.3.1 Increasing Use of Predictive Analytics Tools

- 5.3.2 Increasing Adoption of IIoT

6 MARKET SEGMENTATION

- 6.1 By End-user Industry

- 6.1.1 Semiconductor

- 6.1.2 Aerospace

- 6.1.3 Automotive

- 6.1.4 Other End-user Industries

- 6.2 By Application

- 6.2.1 Condition Monitoring

- 6.2.2 Quality Management

- 6.2.3 Inventory Management

- 6.2.4 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Rest of the Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Rest of the Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Alteryx Inc.

- 7.1.2 IBM Corporation

- 7.1.3 Knime AG

- 7.1.4 Microsoft Corporation

- 7.1.5 Qliktech International AB

- 7.1.6 Oracle Corporation

- 7.1.7 Altair Engineering Inc. (RapidMiner Inc.)

- 7.1.8 SAP SE

- 7.1.9 SAS Institute Inc.

- 7.1.10 Tibco Software Inc.(Cloud Software Group)

- 7.1.11 NEC Corporation

- 7.1.12 Fujitsu Ltd

- 7.1.13 Toshiba Digital Solutions Corporation