|

市场调查报告书

商品编码

1536852

垃圾发电 (WtE):市场占有率分析、产业趋势/统计、成长预测(2024-2029)Waste-to-Energy (WtE) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

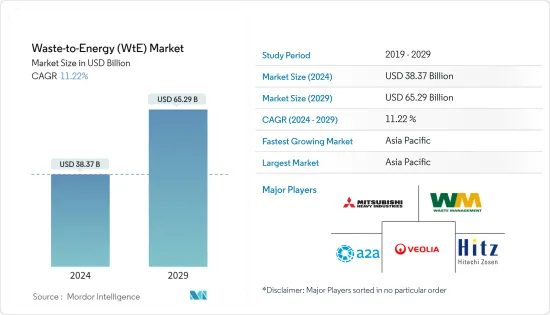

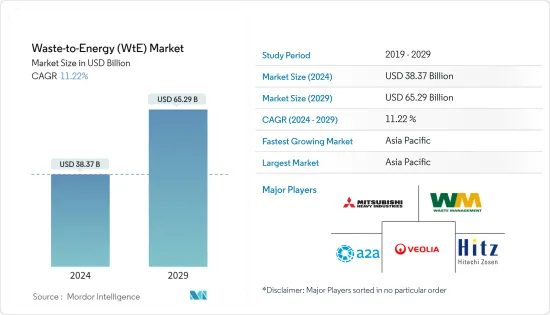

2024年,全球垃圾发电(WtE)市场规模将达到383.7亿美元,2024-2029年预测期间复合年增长率为11.22%,预计到2029年将达到652.9亿美元。

主要亮点

- 从中期来看,废弃物产生量的增加、为满足永续城市生活的需求而对废弃物管理的兴趣日益浓厚以及对非石化燃料能源来源的日益关注等因素将推动废弃物能源市场的发展。

- 另一方面,焚烧厂的昂贵性质、能源价格下降以及一些工厂无力支付营运成本预计将阻碍市场成长。这些因素在预测期内对垃圾发电(WtE)市场构成威胁。

- 也就是说,Dendro 液体能源 (DLE) 等新兴垃圾发电 (WtE) 技术的发电效率提高了四倍,而且还具有无现场排放或废水问题的额外优势,因此预计未来几年将实现这一目标。为市场相关人员提供重大商机。

- 预计亚太地区将主导市场,大部分需求来自中国、印度和日本等国家。

垃圾发电 (WtE) 市场趋势

热垃圾发电 (WtE) 领域主导市场

- 由于全球新兴市场对废弃物焚化设施的开发不断开拓,预计热技术将在预测期内占据垃圾发电(WtE)市场的最高市场占有率。

- 利用热电汽电共生(暖气、冷气)和发电的工厂预计可达到 80% 的最佳效率。 2024 年 1 月,塞尔维亚三个城市(Vrnjacka Banja、Trstenik 和 Kraljevo)与 Comef 进行讨论,以提供废弃物发电 (WtE) 解决方案。这将有助于塞尔维亚排放二氧化碳排放,主要来自发电部门。

- 在目前的情况下,焚烧是都市固态废弃物(MSW)处理中最突出的废弃物化技术。然而,废弃物处理技术,特别是焚烧,会产生污染并带来潜在的健康和安全风险。为了减少颗粒物和气相排放,焚化厂业主采用了一系列製程装置来清洁烟道气流。

- 此外,废弃物燃烧产生的热量也可作为热废弃物用于能源产出。 2023年10月,英国赫尔区议会同意建立计划,利用建筑废弃物产生能源。所获得的热能将促进城市区域集中供热的使用。根据国际可再生能源机构预测,2023年可再生城市垃圾装置容量为21,436MW,与前一年同期比较成长5.1%。

- 基于热的废弃物转换预计将引领市场,特别是在亚太地区不断增长的经济体中。城市人口成长预计将成为城市固态废弃物(MSW)成长的主要驱动力。

亚太地区主导市场

- 过去几年,亚太地区垃圾发电 (WtE) 产业取得了显着发展。该地区将采用更好的城市固态废弃物(MSW)管理实践,以资本补助和上网电价补贴的形式奖励垃圾发电(WtE)计划,并在成本分摊的基础上为研发计划提供资金。支持,主导市场。

- 由于经济发展和快速都市化,印度产生的城市固体废物(MSW)量正在迅速增加。印度政府正积极推动垃圾发电(WtE)计划进行发电。

- 例如,2023年8月,电力金融公司与日本签署约128万美元的贷款协议,在卡纳塔克邦建立11兆瓦垃圾发电(WtE)计划。该计划每天将利用600多吨城市固态废弃物发电。

- 日本是亚太地区主要的垃圾发电 (WtE) 市场之一。该国的垃圾发电 (WtE) 市场是由高效的固态废弃物管理以及国家和地方政府对垃圾发电 (WtE)计划的财政支持推动的。预计国家将引进废弃物管理和回收技术来保护环境,有效地将废弃物转化为资源并妥善处置。

- 国际可再生能源机构表示,亚太地区可再生城市固体废弃物总设备容量为15,063兆瓦,高于一年前的14,089兆瓦。

- 因此,废弃物增加以及各国政府为解决此问题所做的努力等因素预计将在预测期内推动亚太地区垃圾发电(WtE)的需求。

垃圾发电 (WtE) 产业概览

垃圾发电 (WtE) 市场较为分散。市场的主要企业包括(排名不分先后)三菱重工有限公司、废弃物管理公司、A2A SpA、威立雅环境公司、日立造船公司。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 市场规模/需求预测(单位:美元),~2029

- 都市固态废弃物(MSW)产生量(单位:亿吨),~2029年

- 政府法规政策

- 最新趋势和发展

- 市场动态

- 市场驱动因素

- 废弃物产生量不断增加,人们对废弃物管理的兴趣日益浓厚,以满足永续城市生活的需求

- 日益关注非石化燃料能源来源

- 市场限制因素

- 焚烧炉的成本

- 市场驱动因素

- 供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品/服务的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 依技术

- 身体的

- 热的

- 生物

- 区域市场分析(2029年之前的市场规模与需求预测)

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 欧洲

- 西班牙

- 北欧的

- 英国

- 俄罗斯

- 土耳其

- 德国

- 义大利

- 欧洲其他地区

- 中东/非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 奈及利亚

- 卡达

- 埃及

- 其他中东/非洲

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 北美洲

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Mitsubishi Heavy Industries Ltd

- Waste Management Inc.

- A2A SpA

- Veolia Environnement SA

- Hitachi Zosen Corp

- MVV Energie AG

- Martin GmbH

- Babcock & Wilcox Enterprises Inc.

- China Jinjiang Environment Holding Co. Ltd

- Suez Group

- Xcel Energy Inc.

- Wheelabrator Technologies Holdings Inc.

- Covanta Holding Corp.

- China Everbright Group

- Market Ranking/Share Analysis

第七章 市场机会及未来趋势

- 新的废弃物技术,例如 Dendro Liquid Energy (DLE)

简介目录

Product Code: 52528

The Waste-to-Energy Market size is estimated at USD 38.37 billion in 2024, and is expected to reach USD 65.29 billion by 2029, growing at a CAGR of 11.22% during the forecast period (2024-2029).

Key Highlights

- Over the medium term, factors such as the increasing amount of waste generation, the growing concern for waste management to meet the need for sustainable urban living, and the increasing focus on non-fossil fuel sources of energy are expected to drive the waste-to-energy market.

- On the other hand, the expensive nature of incinerators, declining energy prices decline, and the inability of several plants to cover operating costs are expected to hinder the growth of the market. These factors pose a threat to the waste-to-energy market during the forecast period.

- Nevertheless, emerging waste-to-energy technologies, such as Dendro Liquid Energy (DLE), which is four times more efficient in terms of electricity generation, with additional benefits of no emission discharge and effluence problems at plant sites, are expected to create significant opportunities for the market players, over the coming years.

- Asia-Pacific is expected to dominate the market, with the majority of demand coming from countries such as China, India, and Japan.

Waste-to-Energy (WtE) Market Trends

Thermal-based Waste-to-Energy Segment to Dominate the Market

- Thermal technology is expected to account for the highest market share in the waste-to-energy market during the forecast period, owing to the increasing development of waste incineration facilities worldwide.

- It is estimated that plants that utilize thermal power cogeneration (heating and cooling) and electricity generation can reach optimum efficiencies of 80%. In January 2024, three municipalities of Serbia, Vrnjacka Banja, Trstenik, and Kraljevo, held deliberations with Comef to provide waste-to-thermal-based waste-to-energy solutions. This is likely to help Serbia curb carbon emissions primarily originating from the power generation sector.

- In the present scenario, incineration is the most well-known waste-to-energy technology for municipal solid waste (MSW) processing. However, waste-to-energy technologies, particularly incineration, produce pollution and carry potential health safety risks. To reduce particulate and gas-phase emissions, incineration plant owners have adopted a series of process units for cleaning the flue gas stream, which has, in turn, led to a significant improvement in environmental sustainability.

- Moreover, the heat generated from burning waste is also used as thermal waste for energy generation. In October 2023, the council of Hull District in England gave consent to establish a project worth about USD 33 million that would utilize the energy from building waste. The heat energy obtained would facilitate district heating applications in the city. As per the International Renewable Energy Agency, the installed capacity of renewable municipal waste in 2023 accounted for 21,436 MW, a rise of 5.1% from the previous year.

- Thermal-based waste-to-energy conversion is expected to lead the market, especially in Asia-Pacific's growing economies. The rising urban population is projected to be the key contributing factor to increasing municipal solid waste (MSW).

Asia-Pacific to Dominate the Market

- Asia-Pacific witnessed significant development in the waste-to-energy industry in the past few years. The region dominates the market with increasing efforts taken by the governments to adopt better municipal solid waste (MSW) management practices, providing incentives for waste-to-energy projects in the form of capital subsidies and feed-in tariffs and financial support for R&D projects on a cost-sharing basis.

- Due to economic development and rapid urbanization in India, the generation of municipal solid waste (MSW) has increased rapidly. The Indian government is actively pursuing waste-to-energy projects for electricity generation.

- For instance, in August 2023, the power finance corporation inked a loan agreement with Japan worth about USD 1.28 million to set up an 11 MW waste-to-energy project in Karnataka. The project is likely to consume over 600 tonnes per day of municipal solid waste for electricity generation.

- Japan is one of the leading waste-to-energy markets in Asia-Pacific. The country's waste-to-energy market is driven by efficient solid waste management and financial support for waste-to-energy projects from both national and local governments. The country is expected to introduce waste management and recycling technologies to preserve the environment, effectively turning waste into resources or appropriately disposing of it.

- As per the International Renewable Energy Agency, the total installed capacity of renewable municipal waste in Asia-Pacific hovered around 15063 MW, a rise from 14089 MW from the previous year.

- Therefore, factors such as the increasing amount of waste generated and the efforts taken by various governments to tackle this situation are expected to boost the demand for waste-to-energy plants in Asia-Pacific during the forecast period.

Waste-to-Energy (WtE) Industry Overview

The waste-to-energy (WtE) market is semi-fragmented. Some of the major players operating in this market (in no particular order) include Mitsubishi Heavy Industries Ltd, Waste Management Inc., A2A SpA, Veolia Environnement SA, and Hitachi Zosen Corp., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast, in USD, till 2029

- 4.3 Municipal Solid Waste (MSW) Generation, in billion metric ton, till 2029

- 4.4 Government Policies and Regulations

- 4.5 Recent Trends and Developments

- 4.6 Market Dynamics

- 4.6.1 Market Drivers

- 4.6.1.1 Increasing Amount of Waste Generation, Growing Concern for Waste Management to Meet the Needs for Sustainable Urban Living

- 4.6.1.2 Increasing Focus on Non-fossil Fuel Sources of Energy

- 4.6.2 Market Restraints

- 4.6.2.1 Expensive Nature of Incinerators

- 4.6.1 Market Drivers

- 4.7 Supply Chain Analysis

- 4.8 Industry Attractiveness - Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Technology

- 5.1.1 Physical

- 5.1.2 Thermal

- 5.1.3 Biological

- 5.2 By Geography (Regional Market Analysis {Market Size and Demand Forecast till 2029 (for regions only)})

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of the North America

- 5.2.2 Asia-Pacific

- 5.2.2.1 China

- 5.2.2.2 India

- 5.2.2.3 Japan

- 5.2.2.4 Malaysia

- 5.2.2.5 Thailand

- 5.2.2.6 Indonesia

- 5.2.2.7 Vietnam

- 5.2.2.8 Rest of the Asia-Pacific

- 5.2.3 Europe

- 5.2.3.1 Spain

- 5.2.3.2 Nordic

- 5.2.3.3 United Kingdom

- 5.2.3.4 Russia

- 5.2.3.5 Turkey

- 5.2.3.6 Germany

- 5.2.3.7 Italy

- 5.2.3.8 Rest of the Europe

- 5.2.4 Middle East and Africa

- 5.2.4.1 United Arab Emirates

- 5.2.4.2 Saudi Arabia

- 5.2.4.3 South Africa

- 5.2.4.4 Nigeria

- 5.2.4.5 Qatar

- 5.2.4.6 Egypt

- 5.2.4.7 Rest of Middle East and Africa

- 5.2.5 South America

- 5.2.5.1 Brazil

- 5.2.5.2 Argentina

- 5.2.5.3 Colmbia

- 5.2.5.4 Rest of South America

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Mitsubishi Heavy Industries Ltd

- 6.3.2 Waste Management Inc.

- 6.3.3 A2A SpA

- 6.3.4 Veolia Environnement SA

- 6.3.5 Hitachi Zosen Corp

- 6.3.6 MVV Energie AG

- 6.3.7 Martin GmbH

- 6.3.8 Babcock & Wilcox Enterprises Inc.

- 6.3.9 China Jinjiang Environment Holding Co. Ltd

- 6.3.10 Suez Group

- 6.3.11 Xcel Energy Inc.

- 6.3.12 Wheelabrator Technologies Holdings Inc.

- 6.3.13 Covanta Holding Corp.

- 6.3.14 China Everbright Group

- 6.4 Market Ranking/Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emerging Waste-to-Energy Technologies, such as Dendro Liquid Energy (DLE)

02-2729-4219

+886-2-2729-4219