|

市场调查报告书

商品编码

1851995

汽车半导体:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Automotive Semiconductor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

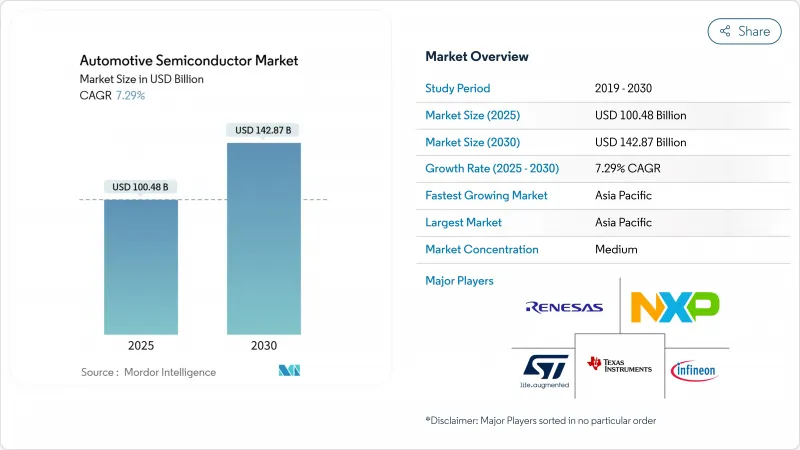

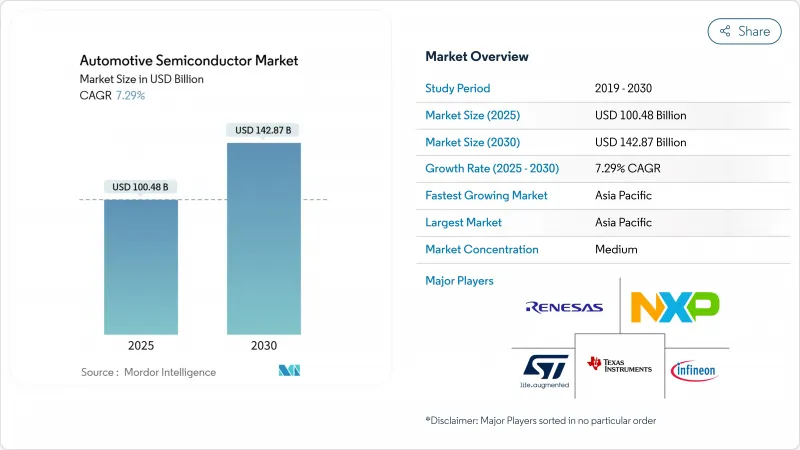

预计到 2025 年,汽车半导体市场规模将达到 1,004.8 亿美元,到 2030 年将达到 1,428.7 亿美元,年复合成长率为 7.29%。

电气化强制令、高级驾驶辅助功能的快速普及以及向软体定义汽车的转型,正在推动所有车型对晶片的需求成长。汽车製造商竞相确保长期晶圆代工产能,而分区架构的普及则促使投资集中于高效能处理器、记忆体和功率元件。供应链弹性计画与多源采购策略相结合,正在重塑采购格局,而宽能带隙装置和整合功率模组则带来了新的设计机会,即使成熟节点组件价格趋于稳定,也能保持定价权。

全球汽车半导体市场趋势与洞察

电气化将增加每辆车的半导体含量。

纯电动平台增加了内燃机车型所没有的电力电子元件、电池管理积体电路和温度控管控制器。从400V到800V的电气系统升级需要碳化硅(SiC)MOSFET来承受更高的电压并降低开关损耗。英飞凌的沟槽式SiC超接面电阻降低了40%,电流容量提高了25%,从而可以製造更小的牵引逆变器并加快充电速度。恩智浦的超宽频无线电池管理系统无需笨重的电缆,减轻了车辆重量,并为更高能量密度的电池组腾出了空间。高压架构还需要增强隔离、闸极驱动器和高精度电流感测器。所有这些因素加在一起,使得电动车的半导体成本比传统汽车高出许多倍。

对先进安全和舒适系统的需求不断增长

二级及以上驾驶辅助系统整合了包括雷达、光达和高解析度摄影机在内的多模态感测器套件,每小时产生Terabyte的资料。即时感测器融合工作负载需要专用处理器和嵌入式神经网路加速器。恩智浦半导体 (NXP) 的 28 奈米射频CMOS 雷达单晶片系列提供 360 度全方位覆盖和内建 AI 目标分类功能,从而降低物料成本并简化系统结构。诸如欧司朗 (ams Osram) 的 8 通道脉衝雷射等互补的光学创新技术,可提供 1000 瓦的峰值光功率,从而扩展雷射雷达在高速公路自动驾驶功能中的探测范围。 ISO 26262 法规要求推动了冗余运算路径和安全诊断技术的应用,进一步增加了晶片成本。

持续的供应链瓶颈和晶片短缺

汽车产业的前置作业时间仍然比消费性电子产业的标准更长,尤其是成熟节点的微控制器、感测器和类比元件。汽车级专用封装能力集中在东亚,这造成了单一故障点。为了应对地域风险,GlobalFoundries 和 NXP 扩大了合作,将 22FDX 的生产分别在德勒斯登和纽约进行,为汽车製造商提供了符合一级认证的双源供应路径。

细分市场分析

预计到2024年,积体电路将占汽车半导体市场866亿美元的份额,并在2030年之前以8.5%的复合年增长率成长。随着网关、车身和动力传动系统总成等细分市场向更高时脉频率和更大记忆体容量发展,微控制器正引领着这一趋势。英飞凌将其AURIX系列扩展到RISC-V架构,使其在汽车半导体微控制器市场占据了28.5%的份额,加速了该领域的技术创新。儘管晶片系统整合给旧款装置带来了价格压力,但类比IC在电源管理、感测器介面和电压调节方面仍然发挥着至关重要的作用。

分立元件、光电子元件和感测器/MEMS类别构成了剩余部分。分离式IGBT和MOSFET为牵引逆变器和继电器替代开关供电,而功率模组设计越来越多地将多个晶粒整合到单一基板上。光电子装置受益于自我调整LED照明和新兴的光达单元,而MEMS加速计、陀螺仪和压力感测器在ADAS和舒适性功能中也变得越来越普遍。将原本独立的元件整合到更高价值的积体电路中的区域架构,解释了为什么积体电路持续优于更广泛的汽车半导体市场。

区域分析

预计到2024年,亚太地区将占全球汽车半导体出货量的71.5%,到2030年将以7.8%的复合年增长率成长。中国新能源汽车渗透率在2024年超过39%,同年成立了300多家国内晶片设计公司,以实现北京提出的100%国产化目标。总部位于上海的地平线机器人公司获得了一项重要的设计订单,占据了国内ADAS处理器33.97%的市场份额,而晶圆代工厂中芯国际则设定了2026年汽车市场10%的产能目标。印度正透过总额达7,600亿卢比的「印度半导体计画」拓展其半导体生态系。核准的提案总额达210亿美元,其中包括塔塔电子、海麦克斯和台积电在显示器和超低功耗人工智慧伙伴关係。

北美则位居第二,这主要得益于《晶片与科学法案》提供的390亿美元激励措施,以及台积电在亚利桑那州投资66亿美元的扩建项目等重大计划。特斯拉与三星签署了一项价值165亿美元、为期八年的晶圆供应协议,确保了在德克萨斯生产的用于自动驾驶晶片的先进节点产能。加拿大半导体理事会接纳英飞凌为成员,旨在推动电动车价值链政策的协调一致。

欧洲正通过一项价值430亿欧元(约486亿美元)的欧盟晶片法案,追求战略自主,目标是到2030年占据全球晶片产量的20%。义法半导体(STMicroelectronics)已在义大利卡塔尼亚破土动工兴建一座整合碳化硅(SiC)晶圆厂,而德勒斯登的一个财团也获得了50亿欧元(约57亿美元)的国家援助,用于建造一座新的逻辑晶片工厂。像Stellantis这样的汽车製造商正与英飞凌(Infineon)合作开发电源转换系统,从而获得优先供应碳化硅MOSFET的机会。儘管仍处于发展阶段,但中东/非洲和南美洲的电动车渗透率已达到两位数,一旦当地供应链成熟,这些地区将成为未来的成长节点。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 新兴国家汽车产量增加

- 对先进安全和舒适系统的需求不断增长

- 电气化将增加每辆车上安装的半导体数量。

- 区域电子/电气架构和软体定义车辆推动高阶处理器的发展

- 政府对汽车级铸造产能的补贴

- 电动车动力传动系统中采用碳化硅和氮化镓功率装置

- 市场限制

- 高性能车辆高成本

- 持续的供应链瓶颈和晶片短缺

- 宽能带隙基板(SiC/GaN)的稀缺性和高成本

- 汽车品质评估週期过长,导致产品上市时间延长。

- 产业价值链分析

- 监管环境

- 技术展望

- 自动驾驶汽车对射频设备的需求

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 投资分析

- 宏观经济趋势的影响

第五章 市场规模与成长预测

- 依设备类型(设备类型出货互为补充)

- 离散半导体

- 二极体

- 电晶体

- 功率电晶体

- 整流器和闸流体

- 其他分立元件

- 光电子学

- 发光二极体(LED)

- 雷射二极体

- 影像感测器

- 光耦合器

- 其他设备类型

- 感测器和微机电系统

- 压力

- 磁场

- 致动器

- 加速度和偏航率

- 温度和其他

- 积体电路

- 依积体电路类型

- 模拟

- 微

- 微处理器(MPU)

- 微控制器(MCU)

- 数位讯号处理器

- 逻辑

- 记忆

- 按技术节点(出货量不适用)

- 小于3奈米

- 3nm

- 5nm

- 7nm

- 16nm

- 28nm

- 大于28奈米

- 离散半导体

- 按经营模式

- IDM

- 设计/无晶圆厂供应商

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲国家

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 埃及

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- NXP Semiconductors NV

- Infineon Technologies AG

- Renesas Electronics Corporation

- STMicroelectronics NV

- Texas Instruments Inc.

- Toshiba Electronic Devices & Storage Corp.

- Micron Technology Inc.

- onsemi

- Analog Devices Inc.

- Robert Bosch GmbH(Semiconductor Division)

- ROHM Co., Ltd.

- NVIDIA Corporation

- Qualcomm Technologies Inc.

- Intel Corporation(Mobileye)

- Samsung Electronics Co., Ltd.(System LSI)

- MediaTek Inc.

- BYD Semiconductor Co. Ltd.

- Semtech Corporation

- Diodes Incorporated

- Microchip Technology Inc.

- Melexis NV

- Elmos Semiconductor SE

- Allegro Microsystems, Inc.

- Skyworks Solutions, Inc.

- Ambarella Inc.

- Wolfspeed Inc.

第七章 市场机会与未来展望

The automotive semiconductor market size reached USD 100.48 billion in 2025 and is forecast to expand at a 7.29% CAGR, lifting the market value to USD 142.87 billion in 2030.

Mounting electrification mandates, rapid adoption of advanced driver-assistance features, and the pivot toward software-defined vehicles are pushing silicon content higher across every vehicle class. Automakers are racing to secure long-term foundry capacity, and the spread of zonal architectures is concentrating spend on high-performance processors, memory, and power devices. Supply-chain resiliency programs combined with multi-sourcing strategies are reshaping procurement, while wide-bandgap devices and integrated power modules open fresh design-in opportunities that sustain pricing power even as mature-node components normalize.

Global Automotive Semiconductor Market Trends and Insights

Electrification Boosting Semiconductor Content Per Vehicle

Battery-electric platforms add power electronics, battery-management ICs, and thermal-management controllers absent in internal-combustion models. The transition from 400 V to 800 V electrical systems demands silicon-carbide (SiC) MOSFETs that sustain higher voltages with lower switching losses. Infineon's trench-based SiC super-junction devices deliver 40% lower resistance and 25% higher current capability, enabling smaller traction inverters and faster charging times. NXP's ultra-wideband wireless battery-management system removes heavy cabling, trims vehicle weight, and frees space for higher energy-density packs. Higher-voltage architectures also need reinforced isolation, gate drivers, and precision current sensors that command premium average selling prices. Collectively, these factors lift semiconductor dollar content per EV to multiples of conventional vehicles.

Rising Demand for Advanced Safety and Comfort Systems

Level 2+ driver-assistance packages integrate multi-modal sensor suites-radar, LiDAR, and high-resolution cameras-producing terabytes of data per hour. Real-time sensor-fusion workloads require application-specific processors and embedded neural-network accelerators. NXP's 28 nm RFCMOS radar one-chip family now offers 360-degree coverage and built-in AI object classification, cutting bill-of-materials and simplifying system architecture. Complementary optical innovations, such as ams OSRAM's eight-channel pulsed lasers, deliver 1,000 W peak optical power, extending LiDAR range for highway autopilot features. Regulatory demands under ISO 26262 reinforce the adoption of redundant compute paths and safety diagnostics, further elevating silicon spend.

Persistent Supply-Chain Constraints and Chip Shortages

Automotive lead times remain longer than consumer electronics norms, especially for mature-node microcontrollers, sensors, and analog components. Specialized automotive-grade packaging capacity is heavily concentrated in East Asia, creating single points of failure. To address geographic risk, GlobalFoundries and NXP broadened their collaboration on 22FDX production split between Dresden and New York, giving automakers a dual-sourced pathway that meets Grade 1 qualification.Automakers are now embedding foundry capacity clauses into long-term supply agreements to shield vehicle launches from component shortages.

Other drivers and restraints analyzed in the detailed report include:

- Zonal E/E Architectures and Software-Defined Vehicles Spur High-End Processors

- SiC and GaN Power Devices Adoption in EV Powertrains

- Scarcity and Cost of Wide-Bandgap Substrates (SiC/GaN)

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Integrated circuits represented USD 86.6 billion of the automotive semiconductor market size in 2024 and are forecast to post an 8.5% CAGR through 2030. Microcontrollers lead the pack as gateway, body, and powertrain domains migrate to higher clock speeds and expanded memory footprints. Infineon captured 28.5% share of the automotive semiconductor market within microcontrollers by expanding its AURIX family to a RISC-V architecture, reinforcing the segment's technological churn. Analog ICs retain a pivotal role in power management, sensor interfacing, and voltage regulation, although system-on-chip consolidation exerts price pressure on older node devices.

Discrete devices, optoelectronics, and sensor/MEMS categories account for the balance. Discrete IGBTs and MOSFETs underpin traction inverters and relay-replacement switches, but design-ins increasingly favor integrated power modules that collapse multiple dies into a single substrate. Optoelectronics benefit from adaptive LED lighting and emerging LiDAR units, while MEMS accelerometers, gyros, and pressure sensors proliferate across ADAS and comfort features. Zonal architectures bundle former standalone components into higher-value ICs, explaining why integrated circuits continue to outpace the wider automotive semiconductor market.

Automotive Semiconductor Market Report is Segmented by Device Type (Discrete Semiconductors [Diodes, and More], Optoelectronics [Laser Diodes, and More], Sensors and MEMS [Pressure, Actuators, and More], and Integrated Circuits), Business Model (IDM, and Design/ Fabless Vendor), and Geography (North America, South America, Europe, Asia-Pacific, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific commanded 71.5% of automotive semiconductor shipments in 2024 and is expected to grow at a 7.8% CAGR to 2030. China's new-energy vehicle penetration surpassed 39% in 2024, and more than 300 domestic chip design firms were established that year to chase Beijing's 100% sourcing target. Shanghai-based Horizon Robotics secured major design wins, claiming 33.97% share of local ADAS processor volume, while foundry SMIC set a 10% automotive revenue goal for 2026 production. India is scaling its semiconductor ecosystem under the USD 76,000 crore India Semiconductor Mission; approved proposals total USD 21 billion, including display and ultralow-power AI partnerships between Tata Electronics, Himax, and PSMC.

North America ranks second, buoyed by the USD 39 billion CHIPS and Science Act incentives and marquee projects such as TSMC's USD 6.6 billion Arizona expansion. Tesla inked a USD 16.5 billion, eight-year wafer-supply pact with Samsung, locking in advanced-node capacity for autonomous-driving silicon manufactured in Texas. Canada's Semiconductor Council added Infineon as a member to drive policy alignment on electric-mobility value chains.

Europe pursues strategic autonomy via the EUR 43 billion (USD 48.6 billion) EU Chips Act, aiming to capture 20% global output by 2030. STMicroelectronics broke ground on an integrated SiC fab in Catania, Italy, while a Dresden consortium secured EUR 5 billion (USD 5.7 billion) in state aid for a new logic facility. Automakers such as Stellantis co-develop power-conversion systems with Infineon, ensuring preferential access to SiC MOSFET supply. The Middle East, Africa, and South America remain nascent but exhibit double-digit EV adoption trajectories, positioning them as future growth nodes once local supply chains mature.

- NXP Semiconductors N.V.

- Infineon Technologies AG

- Renesas Electronics Corporation

- STMicroelectronics N.V.

- Texas Instruments Inc.

- Toshiba Electronic Devices & Storage Corp.

- Micron Technology Inc.

- onsemi

- Analog Devices Inc.

- Robert Bosch GmbH (Semiconductor Division)

- ROHM Co., Ltd.

- NVIDIA Corporation

- Qualcomm Technologies Inc.

- Intel Corporation (Mobileye)

- Samsung Electronics Co., Ltd. (System LSI)

- MediaTek Inc.

- BYD Semiconductor Co. Ltd.

- Semtech Corporation

- Diodes Incorporated

- Microchip Technology Inc.

- Melexis NV

- Elmos Semiconductor SE

- Allegro Microsystems, Inc.

- Skyworks Solutions, Inc.

- Ambarella Inc.

- Wolfspeed Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing vehicle production in emerging economies

- 4.2.2 Rising demand for advanced safety and comfort systems

- 4.2.3 Electrification boosting semiconductor content per vehicle

- 4.2.4 Zonal E/E architectures and software-defined vehicles spur high-end processors

- 4.2.5 Government subsidies for auto-grade foundry capacity

- 4.2.6 SiC and GaN power devices adoption in EV powertrains

- 4.3 Market Restraints

- 4.3.1 High cost of advanced-feature vehicles

- 4.3.2 Persistent supply-chain constraints and chip shortages

- 4.3.3 Scarcity and cost of wide-bandgap substrates (SiC/GaN)

- 4.3.4 Lengthy automotive qualification cycles slow time-to-market

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 RF Device Demand in Autonomous Vehicles

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Products

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Investment Analysis

- 4.10 Impact of Macroeconomic Trends

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Device Type (Shipment Volume for Device Type is Complementary)

- 5.1.1 Discrete Semiconductors

- 5.1.1.1 Diodes

- 5.1.1.2 Transistors

- 5.1.1.3 Power Transistors

- 5.1.1.4 Rectifier and Thyristor

- 5.1.1.5 Other Discrete Devices

- 5.1.2 Optoelectronics

- 5.1.2.1 Light-Emitting Diodes (LEDs)

- 5.1.2.2 Laser Diodes

- 5.1.2.3 Image Sensors

- 5.1.2.4 Optocouplers

- 5.1.2.5 Other Device Types

- 5.1.3 Sensors and MEMS

- 5.1.3.1 Pressure

- 5.1.3.2 Magnetic Field

- 5.1.3.3 Actuators

- 5.1.3.4 Acceleration and Yaw Rate

- 5.1.3.5 Temperature and Others

- 5.1.4 Integrated Circuits

- 5.1.4.1 By Integrated Circuit Type

- 5.1.4.1.1 Analog

- 5.1.4.1.2 Micro

- 5.1.4.1.2.1 Microprocessors (MPU)

- 5.1.4.1.2.2 Microcontrollers (MCU)

- 5.1.4.1.2.3 Digital Signal Processors

- 5.1.4.1.3 Logic

- 5.1.4.1.4 Memory

- 5.1.4.2 By Technology Node (Shipment Volume Not Applicable)

- 5.1.4.2.1 < 3nm

- 5.1.4.2.2 3nm

- 5.1.4.2.3 5nm

- 5.1.4.2.4 7nm

- 5.1.4.2.5 16nm

- 5.1.4.2.6 28nm

- 5.1.4.2.7 > 28nm

- 5.1.1 Discrete Semiconductors

- 5.2 By Business Model

- 5.2.1 IDM

- 5.2.2 Design/ Fabless Vendor

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 South America

- 5.3.2.1 Brazil

- 5.3.2.2 Argentina

- 5.3.2.3 Rest of South America

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Rest of Europe

- 5.3.4 Asia-Pacific

- 5.3.4.1 China

- 5.3.4.2 Japan

- 5.3.4.3 South Korea

- 5.3.4.4 India

- 5.3.4.5 Rest of Asia-Pacific

- 5.3.5 Middle East and Africa

- 5.3.5.1 Middle East

- 5.3.5.1.1 Saudi Arabia

- 5.3.5.1.2 United Arab Emirates

- 5.3.5.1.3 Turkey

- 5.3.5.1.4 Rest of Middle East

- 5.3.5.2 Africa

- 5.3.5.2.1 South Africa

- 5.3.5.2.2 Nigeria

- 5.3.5.2.3 Egypt

- 5.3.5.2.4 Rest of Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 NXP Semiconductors N.V.

- 6.4.2 Infineon Technologies AG

- 6.4.3 Renesas Electronics Corporation

- 6.4.4 STMicroelectronics N.V.

- 6.4.5 Texas Instruments Inc.

- 6.4.6 Toshiba Electronic Devices & Storage Corp.

- 6.4.7 Micron Technology Inc.

- 6.4.8 onsemi

- 6.4.9 Analog Devices Inc.

- 6.4.10 Robert Bosch GmbH (Semiconductor Division)

- 6.4.11 ROHM Co., Ltd.

- 6.4.12 NVIDIA Corporation

- 6.4.13 Qualcomm Technologies Inc.

- 6.4.14 Intel Corporation (Mobileye)

- 6.4.15 Samsung Electronics Co., Ltd. (System LSI)

- 6.4.16 MediaTek Inc.

- 6.4.17 BYD Semiconductor Co. Ltd.

- 6.4.18 Semtech Corporation

- 6.4.19 Diodes Incorporated

- 6.4.20 Microchip Technology Inc.

- 6.4.21 Melexis NV

- 6.4.22 Elmos Semiconductor SE

- 6.4.23 Allegro Microsystems, Inc.

- 6.4.24 Skyworks Solutions, Inc.

- 6.4.25 Ambarella Inc.

- 6.4.26 Wolfspeed Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment