|

市场调查报告书

商品编码

1694043

欧洲汽车半导体:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)Europe Automotive Semiconductor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

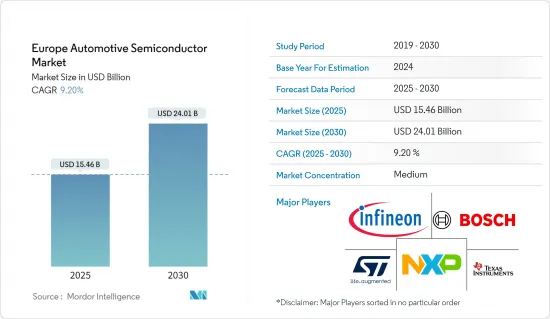

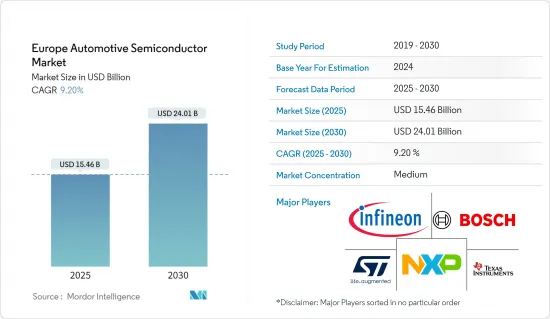

预计欧洲汽车半导体市场规模在 2025 年将达到 154.6 亿美元,在 2030 年将达到 240.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 9.2%。

关键亮点

- 汽车半导体是专门为汽车产业设计和使用的半导体晶片。这些晶片在汽车各种电子元件和系统的运作中发挥着至关重要的作用。它负责为许多功能和特性提供动力和控制,包括安全系统、资讯娱乐系统、引擎控制单元和感测器。

- 随着汽车技术越来越先进,汽车半导体变得越来越重要。它对于整合自动驾驶、电动动力传动系统和连网汽车系统等先进技术至关重要。这些半导体旨在满足汽车行业的特定要求,包括耐用性、可靠性和在恶劣环境下运行的能力。

- 车载半导体的主要应用之一是ADAS(高级驾驶辅助系统)。这些系统使用感测器、摄影机和处理器来提高车辆的安全性并即时协助驾驶员。半导体实现了主动车距控制巡航系统、车道维持辅助、自动紧急煞车、盲点侦测和行人侦测等功能,使驾驶更安全并降低事故风险。

- 半导体在车辆先进资讯娱乐系统的开发中发挥关键作用。这些系统无缝整合了娱乐、导航和通讯功能。汽车半导体支援触控萤幕、语音辨识、连接选项和多媒体播放,将驾驶体验转变为个人化和互联的驾驶体验。

- 在欧洲,汽车半导体产业的投资正在增加,支持市场发展。例如,2023年8月,罗伯特·博世有限公司、台积电、恩智浦半导体公司和英飞凌科技股份公司宣布,计划共同投资位于德国德勒斯登的欧洲半导体製造公司有限公司(ESMC),提供先进的半导体製造服务。 ESMC 表示,它已朝着建造 300 毫米晶圆厂迈出了实质性的一步,以满足快速增长的汽车和工业领域未来的产能需求。

- 该计划是在欧洲晶片法的框架内设计的。计画中的晶圆厂将采用台积电的28/22奈米平面CMOS和16/12奈米FinFET製程技术,每月生产能力为40,000片晶圆(12吋),预计将以先进的FinFET电晶体技术加强欧洲半导体製造生态系统,并为约2,000名专业高科技专业创造直接就业机会。 ESMC 计划于 2024 年下半年开始建造工厂,并于 2027 年底开始生产。

- 半导体实现了车载连接并构成了联网汽车技术的基础。半导体为无线通讯系统提供动力,使车辆能够与其他车辆(V2V)、基础设施(V2I)和互联网(V2X)连接。这种连接有利于即时数据交换,从而实现交通更新、远端车辆诊断、无线更新甚至自动驾驶等功能。

- 由于人们日益关注环境永续性和减少碳排放的需要,电动车(EV)在欧洲越来越受欢迎。电动车的电源管理、电池管理和马达控制系统严重依赖半导体技术。随着对电动车的需求不断增长,对汽车半导体的需求也不断增长。

- 根据欧洲工业协会 (ACEA) 的数据,欧洲电池电动车 (BEV) 和插电式混合动力电动车 (PHEV) 的销量从 2022 年第二季的 559,810 辆增加到 2023 年第三季的 757,830 辆。电动车需求的成长可能为受调查市场的成长提供有利的机会。

- 然而,高昂的开发和生产成本成为市场成长的主要障碍。复杂的製造流程和测试要求使得这些半导体价格昂贵,限制了製造商和消费者的负担能力。

- 此外,俄罗斯和乌克兰之间的衝突预计将对半导体产业产生重大影响。这场争端已经加剧了电子和半导体供应链问题以及一段时间以来一直影响该行业的晶片短缺问题。这种中断可能导致镍、钯、铜、钛和铝等主要原料价格波动,可能导致材料短缺。这反过来可能会影响汽车半导体的製造。

欧洲汽车半导体市场趋势

乘用车市场可望推动市场成长

- 汽车半导体用于乘用车内的各种安全系统。这些半导体用于控制防锁死煞车系统 (ABS)、电子稳定控制 (ESC) 和高级驾驶辅助系统 (ADAS) 的电力电子模组。透过精确监控和调整功率流,这些系统提高了车辆的稳定性、牵引力和整体安全性。

- 此外,汽车半导体在乘用车的电源管理中发挥关键作用。这些半导体用于 DC-DC 转换器、电压调节器和其他电源控制模组,以确保高效的电力分配和电能的最佳利用。

- 这些微小的电子元件整合到车辆内的各个系统中,以实现先进的安全功能并确保更安全的驾驶体验。汽车半导体在乘用车安全方面的主要应用之一是防锁死煞车系统(ABS)。 ABS 使用感测器和微控制器来监控车轮速度并防止车轮在紧急煞车时锁死。透过快速调整煞车压力,汽车半导体可以保持车辆稳定性,防止打滑并降低事故风险。

- 它也用于电子稳定控制 (ESC) 系统。 ESC 使用感测器、加速计和微控制器来监控车辆动态并选择性地对各个车轮施加煞车。汽车半导体可实现即时资料处理和精确控制,提高车辆稳定性并防止在危险情况下失控。

- 欧洲汽车产量的成长可能会增加对汽车半导体的需求。例如,根据OICA的预测,2023年法国汽车产量将达150万辆左右,其中68.2%为乘用车。 2022年,法国生产了约130万辆汽车。

- 此外,联网汽车技术的普及彻底改变了使用者与汽车互动的方式。从资讯娱乐系统到高级驾驶辅助系统 (ADAS),联网汽车技术都依靠半导体晶片实现无缝通讯和资料处理。随着互联网连接、云端服务和数据分析在车辆中的整合不断推进,汽车半导体的需求预计将呈指数级增长。

德国:预计市场将实现高成长

- 德国以其强大的汽车工业而闻名,已成为全球汽车半导体市场的主要参与企业之一。德国拥有由汽车製造商、供应商和技术公司组成的强大生态系统,是半导体开发和生产的中心。英飞凌科技、博世和大陆集团等半导体公司在德国占有重要地位。这些公司专门生产各种汽车半导体,包括微控制器、感测器、电源管理积体电路和连接解决方案。

- 德国半导体公司经常与汽车製造商、研究机构和新兴企业合作,以促进创新、推动技术进步并提高其市值。

- 例如,2024 年 1 月,英飞凌科技股份公司与格芯宣布达成一项新的多年期协议,供应英飞凌的 AURIX TC3x 40 奈米汽车微控制器以及电源管理和连接解决方案。预计新增产能将有助于确保英飞凌在 2024 年至 2030 年期间的业务成长。此次合作的核心是高度可靠的嵌入式非挥发性记忆体技术解决方案,旨在支援关键任务汽车应用,同时满足下一代汽车系统严格的安全要求。

- 在欧洲,汽车产量正在增加,该市场的需求可能会扩大。例如,根据国际工业组织(OICA)的预测,到2023年,德国将成为欧洲最大的汽车生产国,汽车产量约410万辆。

- 对电动车 (EV) 和自动驾驶系统日益增长的需求正在推动专用半导体的发展,以满足这些应用的独特要求。例如,根据联邦车辆交通局 (KBA) 的数据,近年来德国新註册的电动车数量大幅增加,从 2022 年的 470,559 辆增加到 2023 年的 524,219 辆。

- 德国汽车製造商不断致力于提高汽车的能源效率。半导体技术可以实现更有效率的电源管理和控制系统,从而降低能耗并提高整体效率。随着燃油经济性和排放法规变得越来越严格,对有助于节能解决方案的汽车半导体的需求预计将持续成长。

- 自动驾驶是交通运输的未来,而半导体是这场科技革命的核心。这些组件为先进的感测器、摄影机、光达、雷达和人工智慧处理器提供动力,使自动驾驶汽车能够感知、解释和响应其环境。半导体促进复杂的决策演算法,以确保自动驾驶系统的安全性和可靠性。德国半导体公司在感测器、视觉系统和人工智慧晶片的开发方面处于领先地位,这些晶片使车辆能够感知周围环境并即时做出智慧决策。

欧洲汽车半导体产业概况

欧洲汽车半导体市场是一个半固定市场,拥有恩智浦半导体公司、英飞凌科技股份公司、义法半导体公司、德州仪器公司、罗伯特博世有限公司和美光科技公司等知名市场参与企业。为了满足消费者不断变化的需求,市场参与企业正努力透过大量投资研发、合作和合併来创新新产品。

- 2024年1月,德州仪器推出了旨在提高车载安全性和智慧化的新型半导体。 AWR2544 77GHz 毫米波雷达感测器晶片专为卫星雷达架构而设计,透过改善 ADAS 中的感测器融合和决策来实现更大的自主性。

- 2023 年 8 月,欧洲最大的半导体契约製造商和设计公司之一意法半导体 (STMicroelectronics NV) 与美国汽车零件供应商博格华纳 (BorgWarner) 合作,将 SiC 技术整合到博格华纳的 VIPER 功率模组中。此次整合旨在支持沃尔沃汽车到 2030 年向全电动汽车转型。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

- COVID-19、其后遗症等宏观经济趋势对市场的影响;

第五章市场动态

- 市场驱动因素

- 车载产量增加及EVS普及

- 政府法规推动对先进安全和舒适系统的需求

- 市场限制

- 由于功能增加而导致成本增加

第六章市场区隔

- 汽车模型

- 搭乘用车

- 离散的

- 光电子

- 感测器和致动器

- 逻辑

- 记忆

- 类比IC

- 微

- 轻型商用车

- 离散的

- 光电子

- 感测器和致动器

- 逻辑

- 记忆

- 类比IC

- 微

- 重型商用车

- 离散的

- 光电子

- 感测器和致动器

- 逻辑

- 记忆

- 类比IC

- 微

- 搭乘用车

- 应用

- 底盘

- 电力电子

- 安全

- 车身电子

- 舒适/娱乐单元

- 其他的

- 国家

- 英国

- 德国

- 法国

- 义大利

第七章竞争格局

- 公司简介

- NXP Semiconductor NV

- Infineon Technologies AG

- Renesas Electronics Corporation

- STMicroelectronics NV

- Toshiba Electronic Devices & Storage Corporation(Toshiba Corporation)

- Texas Instrument Inc.

- Robert Bosch GmbH

- Micron Technology Inc.

- Onsemi(Semiconductor Components Industries LLC)

- Analog Devices Inc.

- ROHM Co. Ltd

第八章投资分析

第九章:市场的未来

The Europe Automotive Semiconductor Market size is estimated at USD 15.46 billion in 2025, and is expected to reach USD 24.01 billion by 2030, at a CAGR of 9.2% during the forecast period (2025-2030).

Key Highlights

- An automotive semiconductor is a type of semiconductor chip specifically designed and used in the automotive industry. These chips play a crucial role in the functioning of various electronic components and systems in vehicles. They are responsible for powering and controlling many features and functions, including safety systems, infotainment systems, engine control units, sensors, etc.

- Automotive semiconductors have become increasingly important as vehicles have become more technologically advanced. They are essential for integrating advanced technologies such as autonomous driving, electric powertrains, and connected car systems. These semiconductors are designed to meet the specific requirements of the automotive industry, including durability, reliability, and the ability to operate in harsh environments.

- One of the primary applications of automotive semiconductors is in Advanced Driver Assistance Systems (ADAS). These systems use sensors, cameras, and processors to enhance vehicle safety and assist drivers in real-time. Semiconductors enable features like adaptive cruise control, lane-keeping assist, automatic emergency braking, blind-spot detection, and pedestrian detection, making driving safer and reducing the risk of accidents.

- Semiconductors play a crucial role in developing advanced infotainment systems in vehicles. These systems provide a seamless integration of entertainment, navigation, and communication features. Automotive semiconductors enable touchscreens, voice recognition, connectivity options, and multimedia playback, transforming the driving experience into a personalized and connected one.

- The increasing investments in the automotive semiconductor industry in Europe are likely to aid the development of the market studied. For instance, in August 2023, Robert Bosch GmbH, TSMC, NXP Semiconductors NV, and Infineon Technologies AG announced a plan to jointly invest in ESMC (European Semiconductor Manufacturing Company GmbH) in Dresden, Germany, to offer advanced semiconductor manufacturing services. ESMC is claimed to mark a substantial step toward constructing a 300 mm fab to support the future capacity requirements of the fast-growing automotive and industrial sectors.

- The project is designed under the framework of the European Chips Act. The planned fab is anticipated to have a monthly production capacity of 40,000 wafers (12-inch) on TSMC's 28/22 nanometer planar CMOS and 16/12 nanometer FinFET process technology, bolstering Europe's semiconductor manufacturing ecosystem with advanced FinFET transistor technology and creating approximately 2,000 direct high-tech professional jobs. ESMC seeks to begin construction of the fab in the second half of 2024, with production targeted to commence by the end of 2027.

- Semiconductors enable vehicle connectivity, forming the foundation for connected car technology. They power wireless communication systems, allowing vehicles to connect with other vehicles (V2V), infrastructure (V2I), and the internet (V2X). This connectivity facilitates real-time data exchange, enabling features like traffic updates, remote vehicle diagnostics, over-the-air updates, and even autonomous driving capabilities.

- With the increasing concern for environmental sustainability and the necessity to reduce carbon emissions, electric vehicles (EVs) have gained immense popularity in Europe. EVs rely heavily on semiconductor technology for power management, battery management, and motor control systems. As the demand for EVs continues to rise, so does the demand for automotive semiconductors.

- According to the European Automobile Manufacturers Association (ACEA), the sales volume of battery electric (BEV) and plug-in hybrid electric vehicles (PHEV) in Europe increased from 559.81 thousand in Q2 2022 to 757.83 thousand in Q3 2023. Such an increase in the demand for EVs would offer lucrative opportunities for the growth of the studied market.

- However, the high cost of development and production is a significant barrier to the growth of the market studied. The complex manufacturing processes and testing requirements make these semiconductors expensive, limiting their affordability for both manufacturers and consumers.

- Furthermore, the conflict between Russia and Ukraine is expected to significantly impact the semiconductor industry. The conflict has already exacerbated the electronics & semiconductor supply chain issues and the chip shortage that have affected the industry for some time. The disruption may result in volatile pricing for critical raw materials such as nickel, palladium, copper, titanium, and aluminum, resulting in material shortages. This, in turn, could impact the manufacturing of automotive semiconductors.

Europe Automotive Semiconductor Market Trends

The Passenger Vehicles Segment is Expected to Drive the Market's Growth

- Automotive semiconductors find applications in various safety systems within passenger vehicles. These semiconductors are used in power electronics modules that control the anti-lock braking system (ABS), electronic stability control (ESC), and advanced driver-assistance systems (ADAS). By accurately monitoring and adjusting power flow, these systems enhance vehicle stability, traction, and overall safety.

- Moreover, automotive semiconductors play a crucial role in power management within passenger vehicles. These semiconductors are used in DC-DC converters, voltage regulators, and other power control modules, ensuring efficient power distribution and optimal utilization of electrical energy.

- These tiny electronic components are integrated into different systems within the vehicle, enabling advanced safety features and ensuring a safer driving experience. One of the primary applications of automotive semiconductors in passenger vehicle safety is the anti-lock braking system (ABS). ABS relies on sensors and microcontrollers to monitor wheel speed and prevent wheel lock-up during sudden braking. By rapidly modulating brake pressure, automotive semiconductors help maintain vehicle stability, prevent skidding, and reduce the risk of accidents.

- They are also employed in electronic stability control (ESC) systems. ESC uses sensors, accelerometers, and microcontrollers to monitor vehicle dynamics and apply selective braking to individual wheels. Automotive semiconductors enable real-time data processing and precise control, enhancing vehicle stability and preventing loss of control in hazardous situations.

- The increasing automotive production in Europe is likely to increase the demand for automotive semiconductors. For instance, according to OICA, around 1.5 million motor vehicles were produced in France in 2023, 68.2% of which were passenger cars. In 2022, approximately 1.3 million cars were produced in France.

- Furthermore, the proliferation of connected car technologies has transformed the way users interact with vehicles. From infotainment systems to advanced driver assistance systems (ADAS), connected car technologies rely on semiconductor chips to enable seamless communication and data processing. With the increasing integration of internet connectivity, cloud services, and data analytics in vehicles, the demand for automotive semiconductors is expected to grow exponentially.

Germany is Expected to Witness High Market Growth Rate

- Germany, known for its strong automotive industry, has established itself as one of the leading players in the global automotive semiconductor market. With a robust ecosystem of automotive manufacturers, suppliers, and technology companies, Germany has become a hub for semiconductor development and production. Semiconductor companies like Infineon Technologies, Bosch, and Continental AG have a significant presence in Germany. These companies specialize in producing a diverse range of automotive semiconductors, including microcontrollers, sensors, power management ICs, and connectivity solutions.

- German semiconductor companies often collaborate with automotive manufacturers, research institutions, and start-ups to foster innovation, drive technological advancements, and enhance their market capitalization.

- For instance, in January 2024, Infineon Technologies AG and GlobalFoundries announced a new multi-year agreement on the supply of Infineon's AURIX TC3x 40 nanometer automotive microcontrollers and power management and connectivity solutions. The additional capacity is anticipated to contribute to secure Infineon's business growth from 2024 through 2030. At the center of this collaboration is claimed to be a highly reliable embedded non-volatile memory technology solution that is designed to enable mission-critical automotive applications while satisfying the stringent safety and security requirements for next-generation vehicle systems.

- The increasing automobile production in Europe is likely to augment the demand for the market studied. For instance, according to the International Organization of Motor Vehicle Manufacturers (OICA), in 2023, Germany was the largest automobile manufacturing country in Europe, with approximately 4.1 million vehicles produced.

- The increasing demand for electric vehicles (EVs) and autonomous driving systems has driven the development of specialized semiconductors to meet the unique requirements of these applications. For instance, according to the Kraftfahrt-Bundesamt (Federal Motor Transport Authority - KBA), the number of new electric cars registered in Germany has grown significantly in recent years, increasing from 470,559 in 2022 to 524,219 in 2023.

- Automotive manufacturers in Germany are constantly striving to improve the energy efficiency of vehicles. Semiconductor technology enables more efficient power management and control systems, resulting in decreased energy consumption and increased overall efficiency. With stricter regulations on fuel economy and emissions, the demand for automotive semiconductors that contribute to energy-efficient solutions will continue to rise.

- Autonomous driving is the future of transportation, and semiconductors are at the heart of this technological revolution. These components power the advanced sensors, cameras, LiDAR, radar, and AI processors that enable autonomous vehicles to perceive, interpret, and respond to their surroundings. Semiconductors facilitate complex decision-making algorithms, ensuring the safety and reliability of autonomous driving systems. German semiconductor companies are at the forefront of developing sensors, vision systems, and AI chips that enable vehicles to perceive their surroundings and make intelligent decisions in real time.

Europe Automotive Semiconductor Industry Overview

The European automotive semiconductor market is a semiconsolidated market with the presence of several prominent market players like NXP Semiconductors NV, Infineon Technologies AG, STMicroelectronics NV, Texas Instruments Inc., Robert Bosch GMBH, Micron Technology Inc., etc. The market players are striving to innovate new products by way of extensive investments in R&D, collaborations, and mergers to cater to the evolving demands of consumers.

- January 2024: Texas Instruments introduced new semiconductors designed to enhance automotive safety and intelligence. The AWR2544 77 GHz millimeter-wave radar sensor chip is designed for satellite radar architectures, enabling higher levels of autonomy by improving sensor fusion and decision-making in ADAS.

- August 2023: STMicroelectronics NV, one of the largest European semiconductor contract manufacturing and design companies, and BorgWarner, an American automotive supplier, joined forces to integrate SiC technology into BorgWarner's VIPER power modules. This integration strives to support Volvo Cars' transition to full vehicle electrification by 2030.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19, Aftereffects, and Other Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Vehicle Production and Adoption of EVS

- 5.1.2 Growing Demand For Advanced Safety and Comfort Systems Augmented by Government Regulations

- 5.2 Market Restraint

- 5.2.1 Increasing Costs Associated With Growing Advance Features

6 MARKET SEGMENTATION

- 6.1 Vehicle Type

- 6.1.1 Passenger Vehicle

- 6.1.1.1 Discrete

- 6.1.1.2 Optoelectronics

- 6.1.1.3 Sensors and Actuators

- 6.1.1.4 Logic

- 6.1.1.5 Memory

- 6.1.1.6 Analog IC

- 6.1.1.7 Micro

- 6.1.2 Light Commercial Vehicle

- 6.1.2.1 Discrete

- 6.1.2.2 Optoelectronics

- 6.1.2.3 Sensors and Actuators

- 6.1.2.4 Logic

- 6.1.2.5 Memory

- 6.1.2.6 Analog IC

- 6.1.2.7 Micro

- 6.1.3 Heavy Commercial Vehicle

- 6.1.3.1 Discrete

- 6.1.3.2 Optoelectronics

- 6.1.3.3 Sensors and Actuators

- 6.1.3.4 Logic

- 6.1.3.5 Memory

- 6.1.3.6 Analog IC

- 6.1.3.7 Micro

- 6.1.1 Passenger Vehicle

- 6.2 Application

- 6.2.1 Chassis

- 6.2.2 Power Electronics

- 6.2.3 Safety

- 6.2.4 Body Electronics

- 6.2.5 Comfort/Entertainment Unit

- 6.2.6 Other Applications

- 6.3 Country

- 6.3.1 United Kingdom

- 6.3.2 Germany

- 6.3.3 France

- 6.3.4 Italy

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 NXP Semiconductor NV

- 7.1.2 Infineon Technologies AG

- 7.1.3 Renesas Electronics Corporation

- 7.1.4 STMicroelectronics NV

- 7.1.5 Toshiba Electronic Devices & Storage Corporation (Toshiba Corporation)

- 7.1.6 Texas Instrument Inc.

- 7.1.7 Robert Bosch GmbH

- 7.1.8 Micron Technology Inc.

- 7.1.9 Onsemi (Semiconductor Components Industries LLC)

- 7.1.10 Analog Devices Inc.

- 7.1.11 ROHM Co. Ltd