|

市场调查报告书

商品编码

1686553

汽车半导体:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Automotive Semiconductor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

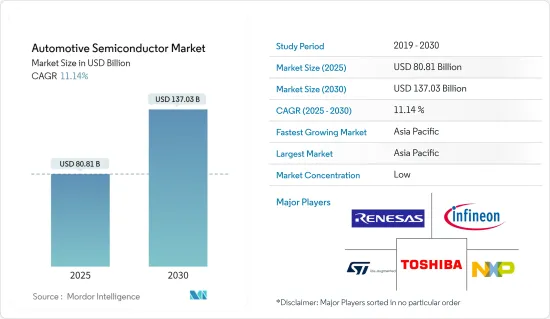

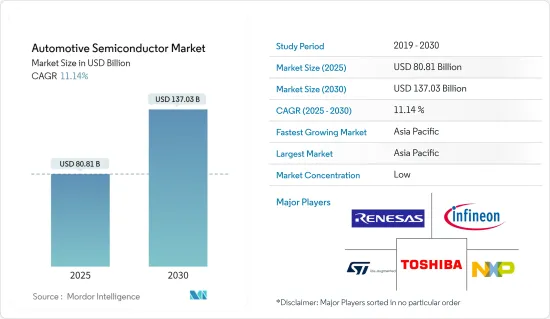

预计 2025 年汽车半导体市场规模为 808.1 亿美元,到 2030 年将达到 1,370.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 11.14%。

主要亮点

- 近年来,随着 3D 地图应用、电动车和车辆自动化等众多先进技术的出现,汽车产业经历了快速转型。这推动了对各种尖端半导体的需求,包括感测器、储存设备和积体电路。

- 全球汽车半导体销售趋势主要受汽车销售和生产趋势以及由于车辆整个电子元件的激增而导致每辆汽车的半导体部署增加所驱动。由于全球范围内严格监管和安全要求,汽车半导体市场具有零缺陷品质流程、严格的资格认证流程、功能安全的设计架构、广泛的设计时间范围、高可靠性和长的产品生命週期等特点,这意味着汽车行业对半导体的需求巨大。

- 根据国际汽车工业组织(OICA)的数据,2023年全球汽车产量将超过9,300万辆,比2022年成长约10%。新冠疫情带来了购车行为和消费者态度的许多变化。人们欣然接受能够帮助他们保持联繫、安全和可追踪的数位服务和功能。

- 因此,随着车载萤幕变得越来越普及,我们可以期待许多其他数位功能将轻鬆整合。由于人们对触控表面的担忧日益增加,虚拟助理、语音辨识、个人化和手势控制的需求也可能增加。汽车市场正在加速标准化,A-PHY(串行器-解串器 (SerDes) 物理层介面)有望成为主要的连接解决方案。汽车生态系统正在围绕该标准融合,预计A-PHY将在不久的将来成为全球汽车的主导连接解决方案。然而,由于在极冷和极热条件下运作的缺陷,汽车半导体市场可能会面临不可避免的挑战。

- 自 COVID-19 以来,市场上的各种公司正在采取各种策略,例如发布、收购和合併,以获得竞争优势。

汽车半导体市场趋势

乘用车占主要市场占有率

- 电动车需求的不断成长是加速乘用车对汽车半导体需求的主要因素之一。例如,根据彭博经济论坛报道,2023年印度电动车销量将在各个领域实现成长,其中乘用车电动车销量将成长近一倍,达到 96,000 辆,占乘用车总销量的 2.3%。

- 从组成部分来看,感测器产业预计将成为市场成长的主要推动力。这是因为对主动式车距维持定速系统和自动紧急煞车等 ADAS 功能的需求不断增加,从而推动了对更先进、更强大的汽车半导体的需求。这些系统依靠感测器和处理器才能有效运作。

- 安全系统需求的增加可能与 ADAS 和自动紧急煞车系统的引入以及道路安全规则的完善有关,从而推动全球对汽车半导体元件的需求。

- 欧盟 (EU) 计画从 2024 年中期开始强制使用 ADAS 系统,联合国计画于 2025 年 1 月开始实施关于提供额外驾驶辅助系统 (DCAS 和 ADAS) 的新法规,这些计画预计将透过增加对汽车半导体的需求来进一步推动市场成长。

- 欧洲、北美和亚太地区的多个国家已核准立法,强制消费车辆配备各种类型的 ADAS。

- 自动驾驶和自动驾驶汽车的日益普及是 ADAS 市场的关键成长要素,从而推动了汽车半导体市场的成长。例如,据英特尔称,预计到2030年全球汽车销量将达到约1.014亿辆,而自动驾驶汽车预计将占2030年汽车註册量的12%左右。

亚太地区成长迅速

- 汽车製造业的崛起以及汽车原始设备製造商和半导体製造商之间不断加深的伙伴关係正在推动亚太汽车半导体市场的发展。买家更重视车辆的舒适性和豪华性,而不是成本和燃油经济性等传统因素。

- 为了满足人们对豪华和半豪华汽车日益增长的需求,全球汽车製造商越来越多地在汽车上配备电子元件。这一趋势正在推动亚太汽车半导体市场的发展,使该地区成为产业成长的中心。

- 电动车需求的激增将进一步推动亚太地区汽车半导体产业的发展。随着主要汽车製造国对自动驾驶汽车的兴趣日益浓厚,製造商面临创新和部署此类技术的压力。完全自动驾驶汽车的未来取决于多种因素,从技术进步和消费者接受度到产业解决定价和安全问题的能力。这些因素可能会影响未来几年自动驾驶汽车的发展轨迹。

- 汽车和半导体行业正在加强对技术改进和原材料谈判的关注,以便将更可靠的技术融入车辆中。例如,Nvidia与丰田合作增强自动驾驶能力,凸显了该产业对先进汽车技术的承诺。

- 丰田采用 NVIDIA 的 DRIVE PX AI 汽车电脑平台,彰显了其致力于开发尖端自动驾驶系统的决心。这样的伙伴关係和创新对于推动亚太汽车半导体市场的发展至关重要。

- 中国是亚太地区汽车半导体领域的重要参与者。中国对安全功能的关注、导航等资讯娱乐应用的兴起、以及具有停车辅助和车道偏离警告等先进功能的 ADAS(高级驾驶辅助系统)的日益普及,是推动市场成长的主要驱动力。

汽车半导体产业概况

由于整合不断加强、技术进步和地缘政治情势的变化,市场出现波动。随着IDM和代工厂之间的垂直整合不断加强,考虑到其收益所带来的投资能力,预计市场竞争将更加激烈。

在透过创新获得永续竞争优势相当高的市场中,鑑于各汽车公司的需求预计激增,竞争可能会加剧。

在这种背景下,品牌标识发挥重要作用,因为汽车公司希望半导体製造企业重视品质。此外,由于恩智浦半导体公司、英飞凌科技股份公司、联发科瑞萨电子株式会社和德州仪器公司等现有参与者的存在,市场渗透率很高。

- 2024年2月:英飞凌科技股份公司宣布,英飞凌与本田汽车工业签署了谅解备忘录(MoU),建立策略合作关係。本田选择英飞凌作为其半导体合作伙伴,以协调其未来的产品和技术蓝图。两家公司同意继续讨论供应安全问题,并鼓励在加快产品上市时间的技术相关计划上进行相互知识转移和合作。

- 2023 年 11 月,恩智浦半导体公司 (NXP Semiconductors NV) 宣布投资和合作 Zendar Inc.,这是一家致力于使用高解析度雷达创新自动驾驶系统的软体新兴企业。此项投资将加速并推进高级驾驶辅助系统(ADAS)和自动驾驶(AD)的高解析度雷达解决方案,补充恩智浦可扩展的雷达产品组合。

- 2023 年 11 月瑞萨电子株式会社宣布了其下一代微控制器 (MCU) 和系统晶片(SoC) 计划,目标是汽车数位领域的一系列关键应用。该公司宣布了两款 MCU 产品的开发计划,这些产品将成为下一代 R-Car 系列的特色。首先,我们最近推出了一系列跨界 MCU,可提供下一代 E/E 汽车架构中域和区域电控系统(ECU) 所需的高效能。第二,该公司计划推出专门针对车辆控制市场的独立MCU平台。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- 产业价值链分析

- 评估新冠疫情和其他宏观经济趋势对市场的影响

- 自动驾驶汽车对射频设备的需求概述

第五章 市场动态

- 市场驱动因素

- 汽车产量增加

- 对先进安全和舒适系统的需求不断增加

- 市场限制

- 先进车辆成本上升

第六章 市场细分

- 按车型

- 搭乘用车

- 轻型商用车

- 重型商用车

- 按组件

- 处理器

- 感应器

- 储存装置

- 积体电路

- 分离式功率元件

- 射频设备

- 按应用

- 底盘

- 电力电子

- 安全

- 车身电子

- 舒适/娱乐单元

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- NXP Semiconductor NV

- Infineon Technologies AG

- Renesas Electronics Corporaton

- STMicroelectronics NV

- Toshiba Electronic Devices & Storage Corporation(Toshiba Corporation)

- Texas Instrument Inc.

- Robert Bosch GmbH

- Micron Technology

- Onsemi(Semiconductor Components Industries LLC)

- Analog Devices Inc.

- ROHM Co. Ltd

第八章投资分析

第 9 章:未来趋势

The Automotive Semiconductor Market size is estimated at USD 80.81 billion in 2025, and is expected to reach USD 137.03 billion by 2030, at a CAGR of 11.14% during the forecast period (2025-2030).

Key Highlights

- The automobile industry has transformed rapidly over the past few years with the advent of numerous advanced technologies, such as 3D mapping applications, electric vehicles, and automobile automation. This has increased the demand for several advanced semiconductors, including sensors, memory devices, ICs, and many more.

- Growth in automotive semiconductor sales globally mainly depends on vehicle sales and production trends, along with the increase in semiconductor deployment per vehicle, driven by the proliferation of electronic elements throughout the car. Due to the high degree of regulatory scrutiny and safety requirements worldwide, the automotive semiconductor market is characterized by zero-defect quality processes, stringent qualification processes, functionally safe design architecture, extensive design-in timeframes, high reliability, and long product life cycles, which would lead to significant demand for semiconductors in the automotive sector.

- According to the International Organization of Motor Vehicle Manufacturers (OICA), in 2023, over 93 million automobiles were manufactured worldwide. This was an increase of around 10% from 2022. The COVID-19 pandemic led to various changes in car buying behavior and customer attitudes. People readily accept digital services and features to stay connected, safe, and trackable.

- Hence, the increasing penetration of in-vehicle screens is expected to lead to the easy integration of many other digital features. Virtual assistants, voice recognition, personalization, and gesture control may also experience increased demand for growing concerns over touching surfaces. The automotive market is racing toward standardization, and A-PHY (serializer-deserializer (SerDes) physical layer interface) is expected to be the leading connectivity solution. The automotive ecosystem is merging around this standard, and it is expected that A-PHY will soon become a dominant connectivity solution in cars worldwide. However, the automotive semiconductor market is likely to face compelling challenges because of operating flaws in climatic conditions like extreme cold and heat.

- Post-COVID-19, various companies in the market are involved in different strategies, such as launches, acquisitions, and mergers, to gain a competitive edge.

Automotive Semiconductor Market Trends

Passenger Vehicles to Hold Major Market Share

- The growing demand for passenger electric vehicles is among the key drivers accelerating the demand for automotive semiconductors in passenger vehicles, as electric vehicles need a greater number of semiconductors compared to traditionally powered vehicles. For instance, according to Bloomberg Economy Forum, electric vehicle sales in India increased across all segments in 2023, with passenger electric vehicles approximately doubling to 96,000 units, 2.3% of all passenger vehicle sales.

- Based on components, the sensors segment is expected to drive market growth significantly. This is due to the increasing demand for ADAS features like adaptive cruise control and automatic emergency braking, driving the need for more sophisticated and powerful automotive semiconductors. These systems rely on sensors and processors to function efficiently.

- The increasing demand for safety systems can be linked to the introduction of ADAS or automated emergency braking systems and improved road safety rules, driving the demand for automotive semiconductor components worldwide.

- The European Union's compulsion of ADAS systems starting mid-2024 and a plan to introduce new regulations by the United Nations for the provision of additional driver assistance systems (DCAS and ADAS) that will come into force in January 2025 are anticipated further to drive market growth with increased demand for automotive semiconductors.

- Some countries in Europe, North America, and Asia-Pacific have approved legislation mandating different types of ADAS in consumer vehicles.

- The rising adoption of self-driving or autonomous vehicles is a crucial growth factor for the ADAS market, driving the growth of the automotive semiconductors market. For instance, according to Intel, global car sales are anticipated to reach around 101.4 million units in 2030, and autonomous vehicles are estimated to account for around 12% of car registrations by 2030.

Asia Pacific to Register Significant Growth

- The increased automotive manufacturing and deepening partnerships between automotive OEMs and semiconductor manufacturers are propelling the Asia-Pacific automotive semiconductor market. Buyers prioritize a vehicle's comfort and luxury over traditional factors like cost and fuel efficiency.

- Global automakers, responding to the rising demand for luxury and semi-luxury vehicles, are increasingly outfitting their cars with electronic components. This trend is boosting the Asia-Pacific automotive semiconductors market, making the region a focal point for industry growth.

- The surge in electric vehicle demand is set to drive the Asia-Pacific automotive semiconductor sector further. As key automotive manufacturing nations witness a growing interest in self-driving cars, manufacturers are pressured to innovate and introduce such technologies. The future of fully autonomous vehicles hinges on various factors, from technological advancements and consumer acceptance to pricing and the industry's ability to address safety concerns. These factors will shape the trajectory of autonomous vehicles in the coming years.

- The automotive and semiconductor sectors are intensifying their focus on technology enhancements and raw material negotiations, integrating reliable technology into vehicles. For instance, NVIDIA's collaboration with Toyota, which enhances autonomous driving capabilities, highlights the industry's push toward advanced automotive technologies.

- Toyota's adoption of NVIDIA's DRIVE PX AI car computer platform underscores the commitment to developing cutting-edge autonomous driving systems. Such partnerships and innovations are pivotal in propelling the Asia-Pacific automotive semiconductor market forward.

- China is a key player in the Asia-Pacific automotive semiconductor landscape. The country's emphasis on safety features, the rise of infotainment applications like navigation, and the growing popularity of ADAS systems, featuring advanced functionalities such as parking assist and lane-departure warnings, are significant drivers of market growth.

Automotive Semiconductor Industry Overview

The market studied fluctuates due to growing consolidation, technological advancement, and geopolitical scenarios. With the rising vertical integration of IDMs and foundries, the intensity of competition in the market is expected to increase, considering their ability to invest, which results from their revenues.

In a market where the sustainable competitive advantage through innovation is considerably high, the competition is likely to increase, considering the anticipated surge in demand from various automotive firms.

In such a situation, brand identity plays a major role, considering the importance of quality that the automotive firms expect from a semiconductor manufacturing player. The market penetration levels are also high with the presence of large market incumbents, such as NXP Semiconductor NV, Infineon Technologies AG, MediaTek Renesas Electronics Corporation, and Texas Instrument Inc..

- February 2024: Infineon Technologies AG announced that Infineon and Honda Motor Co. Ltd signed a memorandum of understanding (MoU) to build a strategic collaboration. Honda selected Infineon as a semiconductor partner to align future product and technology roadmaps. The two companies agreed to continue discussions on supply stability and encourage the transfer of mutual knowledge and collaboration on projects to accelerate the time-to-market technologies.

- November 2023: NXP Semiconductors NV announced the investment in and collaboration with Zendar Inc., a software start-up dedicated to revolutionizing autonomous vehicle systems with high-resolution radar. The investment accelerated and improved high-resolution radar solutions for advanced driver assistance systems (ADAS) and autonomous driving (AD) to complement NXP's leading scalable radar portfolio.

- November 2023: Renesas Electronics Corporation laid out plans for its next-generation microcontrollers (MCUs) and system-on-chips (SoCs), targeting all significant applications across the automotive digital domain. The company shared its plans for two forthcoming MCU product advancements in the next-generation R-Car family. One is a recent crossover MCU series that delivers the high performance required for domain and zone electronic control units (ECU) in next-generation E/E automobile architectures. Secondly, the group plans to introduce a separate MCU platform tailored to the vehicle control market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 and Other Macroeconomic Trends on the Market

- 4.5 Overview of RF Device Demand in Autonomous Vehicles

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Vehicle Production

- 5.1.2 Rising Demand for Advanced Safety and Comfort Systems

- 5.2 Market Restraints

- 5.2.1 Higher Cost of Advanced Featured Vehicles

6 MARKET SEGMENTATION

- 6.1 By Vehicle Type

- 6.1.1 Passenger Vehicle

- 6.1.2 Light Commercial Vehicle

- 6.1.3 Heavy Commercial Vehicle

- 6.2 By Component

- 6.2.1 Processors

- 6.2.2 Sensors

- 6.2.3 Memory Devices

- 6.2.4 Integrated Circuits

- 6.2.5 Discrete Power Devices

- 6.2.6 RF Devices

- 6.3 By Application

- 6.3.1 Chassis

- 6.3.2 Power Electronics

- 6.3.3 Safety

- 6.3.4 Body Electronics

- 6.3.5 Comforts/Entertainment Unit

- 6.3.6 Other Applications

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 NXP Semiconductor NV

- 7.1.2 Infineon Technologies AG

- 7.1.3 Renesas Electronics Corporaton

- 7.1.4 STMicroelectronics NV

- 7.1.5 Toshiba Electronic Devices & Storage Corporation (Toshiba Corporation)

- 7.1.6 Texas Instrument Inc.

- 7.1.7 Robert Bosch GmbH

- 7.1.8 Micron Technology

- 7.1.9 Onsemi (Semiconductor Components Industries LLC)

- 7.1.10 Analog Devices Inc.

- 7.1.11 ROHM Co. Ltd