|

市场调查报告书

商品编码

1536901

汽车防撞系统:市场占有率分析、产业趋势、成长预测(2024-2029)Automotive Collision Avoidance Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

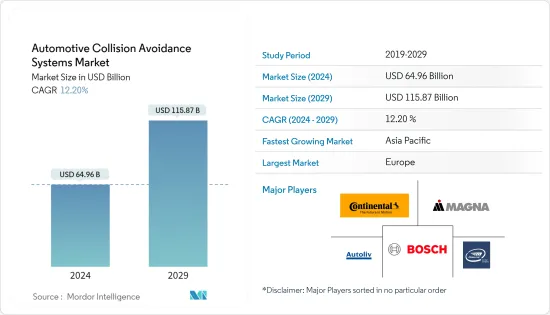

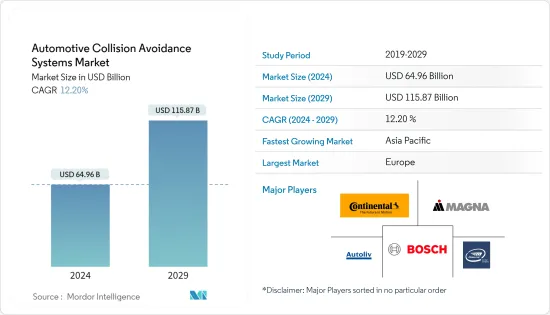

汽车防撞系统市场规模预计到2024年为649.6亿美元,预计到2029年将达到1158.7亿美元,在预测期内(2024-2029年)复合年增长率为12.20%。

汽车防撞系统透过接收环境输入并进行相应调整来防止即将发生的碰撞。它在复杂的情况下为驾驶员进行控制并执行复杂的功能。它还使用感测器和摄影机来收集资料,然后由控制器单元进行处理。这些装置会向驾驶员发送信号,提醒他们注意自己的驾驶和其他驾驶员的驾驶,这可能会增加碰撞或受伤的风险。

政府为改善车辆安装的安全系统而采取的各种措施被认为是主要的成长要素。例如,美国国家运输安全委员会 (NTSB) 发布了 10 项最需要的运输安全改进措施清单。该清单提案了可以安装在汽车中以确保乘客安全的技术。

对自动驾驶汽车不断增长的需求正在推动对汽车防撞系统的需求。然而,高昂的安装成本阻碍了市场的成长。同时,人们对车辆安全标准的日益关注以及车辆电子整合的增加预计将为防撞系统市场创造进一步扩张的机会。

汽车防撞系统市场趋势

光达市场在预测期内将显着成长

ADAS(高阶驾驶辅助系统)市场预计在预测期内将出现显着成长。各种组织和大型OEM所进行的安全宣传活动数量不断增加,是提高公众车辆安全意识的一个主要因素。

客户意识的提高导致对具有自动驾驶功能和先进安全功能的汽车的需求增加。 LiDAR 透过将雷射光束照射到目标上并用感测器测量其反射来测量距离。汽车光达系统主要用于半自动或全自动驾驶辅助功能,例如碰撞警告和避免系统、盲点监控、车道维持车道维持系统、车道偏离警告和主动车距控制巡航系统。它还为自动驾驶汽车的所有驾驶模式提供完全自动化。

自动驾驶和半自动驾驶汽车行业新兴市场的发展、政府对配备 ADAS 的车辆的日益关注以及对 LiDAR新兴企业的投资和资金筹措激增预计将推动市场成长。

例如,2023 年 11 月,AEye Inc. 宣布推出 4Sight(TM) Flex 舱内雷射雷达系统。它拥有 120° 水平 (H) x 30° 垂直 (V) 视野、高达 0.05° x 0.05° 的超高分辨率以及在 10% 反射率下长达 275m 的远距检测,是AEye 的第一代产品所有设计的尺寸大约是原来的一半,耗电量却比原来的低 40%。

汽车製造商和设备供应商的这种开拓,加上现有车辆的巨大规模和扩充性潜力,预计在预测期内该细分市场将出现强劲的成长率。

亚太地区是一个快速成长的市场

对配备 ADAS 的车辆的需求不断增长以及政府的建设性支持预计将在预测期内推动目标市场的成长。随着客户需求的不断增加,汽车製造商正在加大研发投入。感测器和技术的结合从根本上改变了汽车产业。此外,创新技术正在吸引新客户,市场可能在预测期内显着成长。

中国是亚太地区重要的汽车製造国家之一。中国拥有大量汽车製造商,可能在预测期内为市场创造利润丰厚的机会。根据中国工业协会统计,2022年7月中国汽车销量快速成长至242万辆,与前一年同期比较同期成长29.7%。 2022年7月,包括纯电动车、插电式混合动力汽车、氢燃料电池车在内的新能源车与前一年同期比较同期成长120%。

中国不仅是全球最大的电动车市场之一,也是成长最快的电动车製造商之一。许多企业也随着中国汽车产业的发展,与合作伙伴一起拥抱创新,透过创新的新产品实现双赢。

2023年2月,吉利汽车正式宣布推出全新超紧凑型电动车「熊猫Mini」。标准配备为9.2吋彩色仪錶板、ABS(防锁死煞车系统)、EBD(电子煞车力道分配系统)。部分车型配备8吋中央显示器和倒车相机,可在各种驾驶情况下为驾驶员提供协助。

汽车防撞系统产业概况

几家公司主导着汽车防撞系统市场,包括大陆集团、德尔福、电装、奥托立夫、Mobileye、松下和海拉。然而,该市场仍然吸引着一些新参与企业,表明该市场潜力巨大。这些公司计划合作并投资最新的 ADAS 功能。例如,2023年11月,禾赛科技宣布与长城汽车建立汽车光达设计伙伴关係。长城汽车多款乘用车将搭载禾赛超高解析度远距光达AT128,计画于2024年交付。

此外,2023 年 6 月,日产宣布开发一种基于光达的新型高级驾驶员辅助技术,具有十字路口防撞功能。该技术采用基于利用下一代雷射雷达的地面实况感知技术的交叉路口防撞新控制逻辑。可以从侧面检测物体的速度、位置和潜在的碰撞风险。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 自动驾驶汽车需求的扩大推动市场成长

- 市场限制因素

- 高安装成本可能阻碍市场成长

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 依功能类型

- 适应性

- 自动化

- 监控

- 警告

- 依技术类型

- 雷达

- LiDAR

- 相机

- 超音波

- 按车型分类

- 客车

- 商用车

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 挪威

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 世界其他地区

- 南美洲

- 中东/非洲

- 北美洲

第六章 竞争状况

- 供应商市场占有率

- 公司简介

- Continental AG

- Delphi Automotive

- Denso Corporation

- Infineon Technologies

- Panasonic Corporation

- Robert Bosch GmbH

- ZF Group

- Autoliv Inc.

- Siemens AG

- Bendix Commercial Vehicle Systems LLC

- Toyota

- WABCO Vehicle Control Services

- Fujitsu Laboratories Ltd

- Magna International

- Mobileye

- Hyundai Mobis

- Hella KGaA Hueck & Co.

- National Instruments Corp.

第七章 市场机会及未来趋势

- 扩大研发投入

The Automotive Collision Avoidance Systems Market size is estimated at USD 64.96 billion in 2024, and is expected to reach USD 115.87 billion by 2029, growing at a CAGR of 12.20% during the forecast period (2024-2029).

Automotive collision avoidance systems prevent imminent crashes by receiving environmental inputs and adapting accordingly. It takes control and performs complicated functions for drivers in complex situations. It also uses sensors and cameras to collect data and process it through controller units. These units send signals to drivers to alert them about concerns that increase the risk of collision and injury, both regarding their driving and other's driving.

Various initiatives by governments of different countries to improve the safety systems onboard a car are considered significant growth factors. For instance, the National Transportation Safety Board (NTSB) of the United States released a list of the 10 most wanted transportation safety improvements. This list suggests incorporating technologies that can be used to equip vehicles for passenger safety.

Growing demand for autonomous vehicles drives the demand for automobile collision avoidance systems. However, market growth is hindered by a high installation cost. On the other hand, rising concerns about automotive safety norms and increased electronic integration in vehicles are anticipated to generate further opportunities for expansion in the collision avoidance systems market.

Automotive Collision Avoidance Systems Market Trends

LiDAR Segment to Grow Significantly During The Forecast Period

The advanced driver assistance system (ADAS) market is expected to grow significantly during the forecast period. Increasing safety campaigns by different organizations and large-scale OEMs are significant factors for the increased public awareness of vehicle safety.

Rising awareness among customers is leading to a growth in the demand for vehicles with autonomous and advanced safety features. LiDAR is used to measure distances by illuminating the target with laser light and measuring the reflection with a sensor. The automotive LiDAR system is used mainly in Semi or fully autonomous vehicle assistance features such as collision warning & avoidance systems, blind-spot monitors, lane-keep assistance, lane-departure warning, and adaptive cruise control. They also offer complete automation under all driving modes for self-driving cars.

Increasing developments across the autonomous and semi-autonomous vehicle industry, rising emphasis from the governments for ADAS-incorporated vehicles, and a surge in investments and funding in LiDAR startups are some of the keys that are expected to drive the market growth.

For instance, in November 2023, AEye Inc. announced the launch of 4Sight(TM) Flex, In-cabin Lidar system. It boasts a 120o horizontal (H) x 30o vertical (V) field of view, with ultra-high resolution of up to 0.05° x 0.05° and long-range detection of up to 275 meters at 10% reflectivity, all at approximately half the size and up to 40% lower power consumption compared to AEye's first-generation design.

Due to such developments from both vehicle manufacturers and equipment suppliers, combined with the immense size and potential for scalability to existing vehicles, this segment of the market is anticipated to witness a significant growth rate during the forecast period.

Asia-Pacific is the Fastest-growing Market

Growing demand for ADAS-equipped vehicles and constructive government support are expected to boost the target market growth over the forecast period. With increased customer demand, automakers invest more in research and development. The combination of sensors and technology has fundamentally transformed the automotive industry. Furthermore, innovative technologies attract new customers, which is likely to witness major growth for the market during the forecast period.

China is one of the prominent countries in terms of vehicle manufacturing in Asia-Pacific. China has a major presence of automotive manufacturers, which is likely to create lucrative opportunities for the market during the forecast period. According to the China Association of Automobile Manufacturers (CAAM), China's auto sales surged 29.7% in July 2022, standing at 2.42 million units, compared to the previous year. The sales of new energy vehicles, including pure electric vehicles, plug-in hybrids, and hydrogen fuel-cell vehicles, increased by 120% in July 2022 from the previous year.

China is not only one of the world's largest EV markets, but it is also one of the fastest-growing EV manufacturers. Many players are also expanding alongside the Chinese automobile industry, embracing reforms alongside its partners in order to achieve win-win solutions through innovative new products.

In February 2023, Geely officially announced the launch of the new Panda Mini micro-electric vehicle. In standard configuration, the vehicle features a 9.2-inch color instrument panel, ABS (Anti-lock Braking System), and EBD (Electronic Brakeforce Distribution). Some models feature an 8-inch central display and a backup camera, assisting drivers in various driving scenarios.

Automotive Collision Avoidance Systems Industry Overview

A few players, such as Continental, Delphi, Denso, Autoliv, Mobileye, Panasonic, and Hella, dominate the automotive collision avoidance systems market. However, the market still attracts several new players, which indicates the great potential this market exhibits. They are entering partnerships and planning to invest in the latest ADAS features. For instance, in November 2023, Hesai Technology announced an automotive LIDAR design partnership with Great Wall Motors. Multiple passenger vehicle models from GWM will equip Hesai's ultra-high resolution long-range lidar AT128, with plans for mass production and delivery starting in 2024.

Additionally, in June 2023, Nissan Motors announced the development of new LIDAR-based advanced driver-assistance technology, which features intersection collision avoidance. The technology features a new control logic for intersection collision avoidance based on ground-truth perception technology utilizing next-generation LIDAR. It can detect an object's speed, location, and potential risk of a collision from a lateral direction.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Growing Autonomous Vehicle Demand To Propel The Market Growth

- 4.2 Market Restraints

- 4.2.1 High Installation Cost May Hamper The Market Growth

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Function Type

- 5.1.1 Adaptive

- 5.1.2 Automated

- 5.1.3 Monitoring

- 5.1.4 Warning

- 5.2 By Technology Type

- 5.2.1 Radar

- 5.2.2 Lidar

- 5.2.3 Camera

- 5.2.4 Ultrasonic

- 5.3 By Vehicle Type

- 5.3.1 Passenger Vehicle

- 5.3.2 Commercial Vehicle

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Norway

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Continental AG

- 6.2.2 Delphi Automotive

- 6.2.3 Denso Corporation

- 6.2.4 Infineon Technologies

- 6.2.5 Panasonic Corporation

- 6.2.6 Robert Bosch GmbH

- 6.2.7 ZF Group

- 6.2.8 Autoliv Inc.

- 6.2.9 Siemens AG

- 6.2.10 Bendix Commercial Vehicle Systems LLC

- 6.2.11 Toyota

- 6.2.12 WABCO Vehicle Control Services

- 6.2.13 Fujitsu Laboratories Ltd

- 6.2.14 Magna International

- 6.2.15 Mobileye

- 6.2.16 Hyundai Mobis

- 6.2.17 Hella KGaA Hueck & Co.

- 6.2.18 National Instruments Corp.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Investment In Research and Development