|

市场调查报告书

商品编码

1536938

连网型卡车:市场占有率分析、行业趋势和统计、成长预测(2024-2029)Connected Truck - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

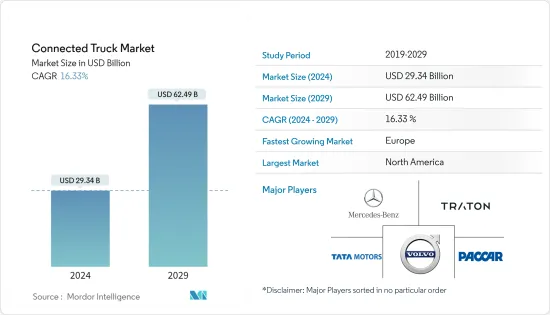

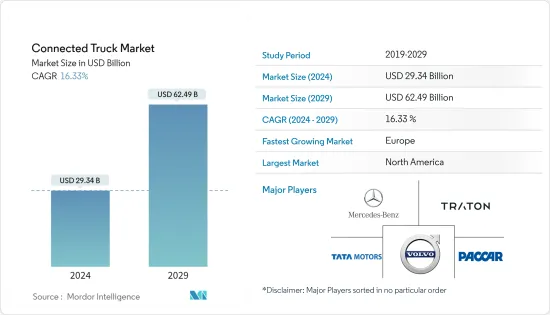

连网型卡车市场规模预计到 2024 年为 293.4 亿美元,预计到 2029 年将达到 624.9 亿美元,在预测期内(2024-2029 年)复合年增长率为 16.33%。

由于先进技术快速融入运输和物流领域,连网型卡车市场正经历强劲成长。该市场的特点是商用车中对远端资讯处理解决方案、物联网连接和资料分析应用程式的需求激增。主要驱动因素包括需要更有效率的车队管理、提高安全性以及遵守更严格的排放气体和监管标准。

电子商务的兴起和工业化的不断发展正在推动商用车即时追踪、远距离诊断和预测性维护的需求。车队营运商越来越多地采用连网型卡车技术来优化路线、监控驾驶员行为、最大限度地减少停机时间并提高整体业务效率。透过连网型卡车技术,车队营运商希望优化燃料、维护和司机薪资等因素,这些因素占总拥有成本的 60% 以上。预计未来五年内,全球将有超过 3,500 万辆卡车实现连网型。

此外,在其已建立的基础设施和法规结构的推动下,北美和欧洲主导了连网型卡车市场。然而,由于新兴经济体越来越多地采用连网型解决方案,亚太地区正在成为一个潜在市场。市场格局竞争激烈,主要企业专注于策略联盟、合作伙伴关係和产品创新,以获得竞争优势。例如

2023年5月,戴姆勒卡车、MFTBC、日野汽车和丰田将透过开发CASE技术(连网型/自动驾驶/自动驾驶/共享/电动)并在全球加强其商用车业务来实现碳中和。为实现这些目标并实现繁荣的移动社会而合作。 MFTBC 和日野将创造协同效应,增强日本卡车製造商的竞争力。

儘管成长前景广阔,但资料安全问题、互通性问题和初始实施成本等挑战对市场扩张构成了潜在障碍。然而,持续的技术进步和政府推动智慧交通的有利倡议预计将保持连网型卡车市场的积极发展轨迹。

连网型卡车市场趋势

商用车市场远端资讯处理的使用增加推动连网型卡车市场

远端资讯处理在开发高效供应链物流和车队管理的独特解决方案方面发挥关键作用。远端资讯处理提供即时可见性和资料,以优化程序和流程、保持产品完整性、优化保质期并降低整个供应链的损失和保险风险。

远端资讯处理正在成为商业物流和供应链中的关键要素,以解决安全、监管合规、驾驶员监控、保险和基础设施方面的关键问题。

远端资讯处理解决方案整合了即时交通资讯、智慧路线和追踪、发生事故或故障时的快速道路救援系统、自动付款和保险远端资讯处理等功能。因此,优化车辆营运指标至关重要,例如降低燃油成本、优化资源和即时连接。

电子商务行业的成长和网路购物活动的增加也极大地促进了连网型卡车需求的成长。 2022年,全球零售电商销售额突破6兆美元,年增率达11.16%。光是在亚洲国家,2022 年线上零售总额就将接近 1.7 兆美元。

此外,大多数电子商务公司都经营自己的物流业务,并订购具有整合远端资讯处理控制单元的大型连网型卡车车队。配备远端资讯处理控制单元的卡车可以远端监控卡车的安全性、车辆性能、燃油效率、驾驶员行为和预测性维护。例如

亚马逊于 2022 年 10 月宣布,将在未来五年内在欧洲投资 10 亿欧元用于电动货车、卡车和低排放气体包装中心。这些车辆还将配备远端资讯处理等下一代连网型技术。该公司的目标是将其电动和连网型货车持有从 3,000 辆增加到 10,000 辆。该公司还计划在欧洲部署 1,500 辆重型电动卡车,用于中距离运输。

此外,该公司还花费大量资金来推进远端资讯处理技术并将远端资讯处理设备整合到商用车辆中。例如

戴姆勒卡车北美公司于2022 年10 月宣布建立新的合作伙伴关係,Lytx Inc. 宣布推出新的远端资讯处理和摄影机解决方案,该解决方案将在工厂安装在我在北美销售的部分Western Star和Freightliner 车型上。

基于上述所有因素,远端资讯处理的使用增加和电子商务公司的大规模车辆订单预计将在预测期内推动连网型卡车市场的成长。

北美和欧洲将在连网型卡车市场成长中发挥关键作用

从地区来看,欧洲和北美占据了连网型卡车市场的主要份额。这两个地区强大的交通基础设施为将连网型技术融入卡车运输业务提供了坚实的基础。此外,完善的道路网路和通讯系统有助于在商用车中无缝实施远端资讯处理解决方案、即时追踪和资料驱动分析。

此外,北美和欧洲严格的法规环境在推动连网型卡车解决方案的采用方面发挥关键作用。有关安全、排放气体和燃油效率标准的法规正在推动对能够实现即时监控和合规性的先进技术的需求。例如,北美ACF(高级清洁车队)法规规定,自2024年1月1日起,卡车必须在CARB(加州空气资源委员会)线上系统註册,才能在加州进行拖曳业务。

产业合作也是这些地区优势发挥的关键因素。领先的卡车製造商、技术提供商和车队管理公司已建立战略合作伙伴关係,以加速连网型卡车解决方案的开发和部署。北美的主要电讯公司正在与领先的连网型公司合作,以扩大其产品系列。例如

2022 年 10 月,连网型卡车服务的领导者和北美最大的公私称重站旁路网路营运商 Drivewyze 与通讯巨头 Verizon Connect 合作,为 Verizon Connect Reveal 客户提供 Drivewyze Weigh Station Bypass 和 Drivewyze Safety+ 服务。

由于该地区经济的快速成长以及对智慧交通解决方案的日益重视,预计亚太地区对连网型卡车的需求将在未来五年内快速成长。中国政府正在重点发展多项先进车辆技术,包括 ADAS 功能和电动车。该国领先的汽车製造商正在透过引入新的 2 级和 3 级 ADAS 功能来更新其产品组合。例如

2022年7月,东风乘龙H5获准成为中国首款重型自动驾驶卡车。乘龙H5的远端驾驶系统运作在中国移动5G网路上。

儘管北美和欧洲目前处于领先地位,但其他地区,尤其是亚太地区,预计将在预测期内赶上成长速度。

连网型卡车产业概述

连网型卡车市场整合,主要由戴姆勒卡车公司、Traton SE、塔塔汽车有限公司、沃尔沃卡车公司和 PACCAR 等几家全球公司主导。这些公司也参与合资、併购、新产品发布和产品开拓,以扩大其品牌组合併巩固其市场地位。

例如,2022年10月,Aurora Innovation Inc.和Ryder Technology Inc.合作试行车辆现场维修。 Rider 将僱用熟练的技术人员,他们将与 Aurora 南达拉斯园区的 Aurora 技术人员一起工作。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 要求商用车采用连网型技术的政府规范推动成长

- 其他司机

- 市场限制因素

- 新兴国家缺乏IT基础设施限制了连网型卡车市场的成长

- 网路安全威胁仍然是市场关注的问题

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 车辆类型

- 轻型商用车

- 大型商用车

- 通讯距离

- 专用近距离通讯(DSRC)

- 盲点警告(BSW)

- 前方碰撞警报(FCW)

- 车道偏离警示(LDW)

- 紧急煞车辅助系统 (EBA)

- 其他通讯距离

- 远距(远端资讯处理控制单元)

- 专用近距离通讯(DSRC)

- 通讯类型

- 车对车通讯(V2V)

- 车到云(V2C)

- 车辆到基础设施 (V2I)

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 世界其他地区

- 南美洲

- 中东/非洲

- 北美洲

第六章 竞争状况

- 供应商市场占有率

- 公司简介

- Robert Bosch GmbH

- Continental AG

- Denso Corporation

- Aptiv Global Operations Limited

- ZF Friedrichshafen AG

- NXP Semiconductors NV

- Magna International Inc.

- Sierra Wireless

- Mercedes-Benz Group AG

- AB Volvo

- Harman International

第七章 市场机会及未来趋势

- 未来的趋势将是5G与云端技术在汽车领域的融合。

第八章 市场规模(单位基数)及预测

第九章连网型卡车市场技术趋势与创新分析

第十章影响连网型卡车市场的法规结构分析

The Connected Truck Market size is estimated at USD 29.34 billion in 2024, and is expected to reach USD 62.49 billion by 2029, growing at a CAGR of 16.33% during the forecast period (2024-2029).

The connected truck market is experiencing robust growth, fuelled by the rapid integration of advanced technologies into the transportation and logistics sector. A surge in demand for telematics solutions, IoT-enabled connectivity, and data analytics applications in commercial vehicles characterizes the market. Key drivers include the need for enhanced fleet management efficiency, improved safety, and compliance with stringent emissions and regulatory standards.

The rise of e-commerce and increasing industrialization are driving the demand for real-time tracking, remote diagnostics, and predictive maintenance in commercial vehicles. Fleet operators increasingly adopt connected truck technologies to optimize routes, monitor driver behavior, and minimize downtime, improving overall operational efficiency. Through connected truck technology, fleet operators anticipate optimizing factors, such as fuel, maintenance, and wages of drivers, which together contribute more than 60% of the total cost of ownership. More than 35 million trucks globally are expected to be connected within the next five years.

Furthermore, North America and Europe dominate the connected truck market, propelled by established infrastructure and regulatory frameworks. However, the Asia-Pacific region is emerging as a potential market with the increasing adoption of connected solutions in emerging economies. The market landscape is characterized by intense competition, with major players focusing on strategic collaborations, partnerships, and product innovations to gain a competitive edge. For instance,

In May 2023, Daimler Truck, MFTBC, Hino, and Toyota joined hands to achieve carbon neutrality and create a prosperous mobility society by developing CASE technologies (Connected / Autonomous & Automated / Shared / Electric) and strengthening the commercial vehicle business on a global scale. MFTBC and Hino would create synergies and enhance the competitiveness of Japanese truck manufacturers.

Despite the promising growth, challenges such as data security concerns, interoperability issues, and initial implementation costs pose potential barriers to market expansion. However, ongoing technological advancements and favorable government initiatives promoting smart transportation are expected to sustain the positive trajectory of the connected truck market.

Connected Truck Market Trends

Increasing Use of Telematics in the Commercial Vehicle Market to Drive the Connected Truck Market

Telematics plays a significant role in developing unique solutions for efficient supply chain logistics and fleet management. Telematics provides real-time visibility and data to optimize procedures and processes, maintain product integrity, optimize shelf-life, and reduce losses and insurance risks across the supply chain.

Telematics is becoming a critical component in commercial logistics and supply chains because it addresses key challenges related to safety and regulatory compliance, driver monitoring, insurance, and infrastructure.

Telematics solutions integrate capabilities like live traffic updates, smart routing and tracking, rapid roadside assistance in case of accidents or breakdowns, automatic toll transactions, and insurance telematics. Therefore, they are critical to optimizing the operational metrics of fleets, such as fuel cost reduction, resource optimization, and real-time connectivity.

The growing e-commerce sector and increased online shopping activities also significantly contribute to the growing demand for connected trucks. Retail e-commerce sales worldwide in 2022 remained over USD 6 trillion, registering an annual growth rate of 11.16%. The total online retail revenue in Asian countries alone added up to nearly USD 1.7 trillion in 2022.

Additionally, most e-commerce companies have in-house logistics operations and are ordering large fleets of connected trucks incorporating telematics control units. Trucks with telematics control units enable them to monitor trucks remotely for safety, fleet performance, fuel efficiency, the behavior of drivers, and predictive maintenance. For instance,

In October 2022, Amazon announced it would invest EUR 1 billion in electric vans, trucks, and low-emission package hubs across Europe over the next five years. These vehicles also feature next-generation connected technologies like telematics. The company aims to increase its electric and connected vans fleet from 3,000 to 10,000. The company also plans to deploy 1,500 heavy-duty electric trucks in Europe for middle-mile deliveries.

Moreover, companies are spending huge amounts on making telematics technology more advanced and integrating telematics devices in commercial vehicles. For instance,

In October 2022, Lytx Inc. and Daimler Trucks, North America, announced their new partnership wherein Lytx Inc. would launch a new telematics and camera solution factory-fitted on select Western Star and Freightliner models sold in North America.

Based on all the above factors, the growing usage of telematics and the large fleet orders from e-commerce companies are expected to drive the growth of the connected trucks market over the forecast period.

North America and Europe are Playing Key Role in the Connected Truck Market Growth

Geographically, Europe and North America hold the major shares of the connected truck market, owing to the expansion of the automotive sector in these regions. The robust transportation infrastructures in both regions provide a solid foundation for integrating connected technologies into trucking operations. Additionally, well-developed road networks and communication systems facilitate the seamless implementation of telematics solutions, real-time tracking, and data-driven analytics in commercial vehicles.

Furthermore, stringent regulatory environments in North America and Europe play a pivotal role in propelling the adoption of connected truck solutions. Regulations addressing safety, emissions, and fuel efficiency standards drive the need for advanced technologies that enable real-time monitoring and compliance. For instance, North America's Advanced Clean Fleets (ACF) regulation states that beginning January 1, 2024, trucks must be registered in the CARB (California Air Resources Board) Online System to conduct drayage activities in California.

Industry collaboration is another key factor contributing to the dominance of these regions. Major truck manufacturers, technology providers, and fleet management companies have garnered strategic partnerships, accelerating the development and deployment of connected truck solutions. Major telecom companies across North America are partnering with leading connected truck companies to expand their product portfolios. For instance,

In October 2022, Drivewyze, the leader in connected truck services and operator of the largest public-private weigh station bypass network in North America, partnered with telecom major Verizon Connect to provide Verizon Connect Reveal customers with integrated access to Drivewyze weigh station bypass and Drivewyze Safety+ services.

The demand for connected trucks in Asia-Pacific is anticipated to grow rapidly over the next five years owing to the region's burgeoning economies and increasing emphasis on smart transportation solutions. The Chinese government focuses on several advanced vehicle technologies, like ADAS features and electric mobility. Major automakers in the country are updating their portfolio by introducing the new level 2 and level 3 ADAS features. For instance,

In July 2022, the Dongfeng Chenglong H5 was licensed for its first heavy-duty autonomous truck in China. The Chenglong H5's remote driving system runs on China Mobile's 5G network.

While North America and Europe currently lead the way, other regions, particularly the Asia-Pacific, are expected to catch up with the growth pace during the forecast period.

Connected Truck Indsutry Overview

The connected truck market is consolidated and majorly dominated by a few global players, which include Daimler Truck SE, Traton SE, Tata Motors Ltd, Volvo Trucks Corporation, and PACCAR. These players also engage in joint ventures, mergers and acquisitions, new product launches, and product development to expand their brand portfolios and cement their market positions.

For instance, in October 2022, Aurora Innovation Inc. and Ryder Technology Inc. collaborated to pilot on-site fleet maintenance. Ryder would embed skilled technicians to work alongside Aurora technicians at Aurora's South Dallas campus.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Government Norms Mandating the Integration of Connected Technologies in Commercial Vehicles are Driving the Growth

- 4.1.2 Other Drivers

- 4.2 Market Restraints

- 4.2.1 Lack of IT Enabled Infrastructure in Emerging Economies Restricts the Connected Truck Market Growth

- 4.2.2 Cyber Security Threats Remain a Concern for the Market

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD Billion)

- 5.1 Vehicle Type

- 5.1.1 Light Commercial Vehicles

- 5.1.2 Heavy Commercial Vehicles

- 5.2 Range

- 5.2.1 Dedicated Short-Range Communication (DSRC)

- 5.2.1.1 Blind Spot Warning (BSW)

- 5.2.1.2 Forward Collision Warning (FCW)

- 5.2.1.3 Lane Departure Warning (LDW)

- 5.2.1.4 Emergency Brake Assist (EBA)

- 5.2.1.5 Other Ranges

- 5.2.2 Long-range (Telematics Control Unit)

- 5.2.1 Dedicated Short-Range Communication (DSRC)

- 5.3 Communication Type

- 5.3.1 Vehicle-to-Vehicle (V2V)

- 5.3.2 Vehicle-to-Cloud (V2C)

- 5.3.3 Vehicle-to-Infrastructure (V2I)

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Robert Bosch GmbH

- 6.2.2 Continental AG

- 6.2.3 Denso Corporation

- 6.2.4 Aptiv Global Operations Limited

- 6.2.5 ZF Friedrichshafen AG

- 6.2.6 NXP Semiconductors NV

- 6.2.7 Magna International Inc.

- 6.2.8 Sierra Wireless

- 6.2.9 Mercedes-Benz Group AG

- 6.2.10 AB Volvo

- 6.2.11 Harman International

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Integration of 5G and Cloud-based Technology in Automobiles to be a Future Trend