|

市场调查报告书

商品编码

1851020

安全资讯和事件管理 (SIEM):市场份额分析、行业趋势、统计数据和成长预测 (2025-2030)Security Information And Event Management (SIEM) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

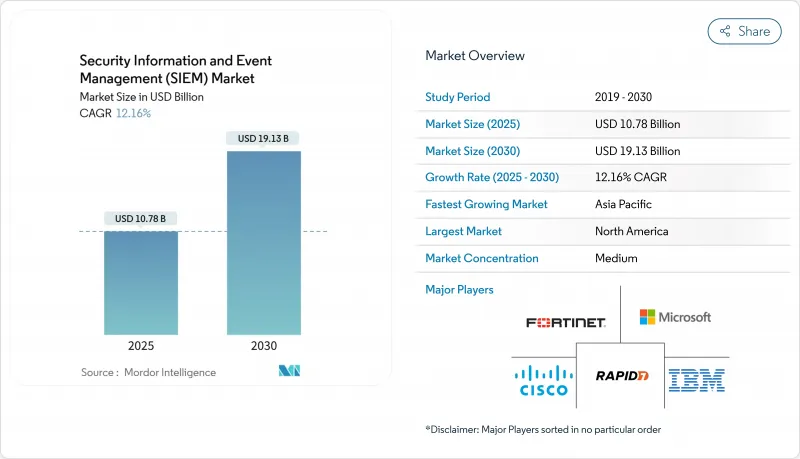

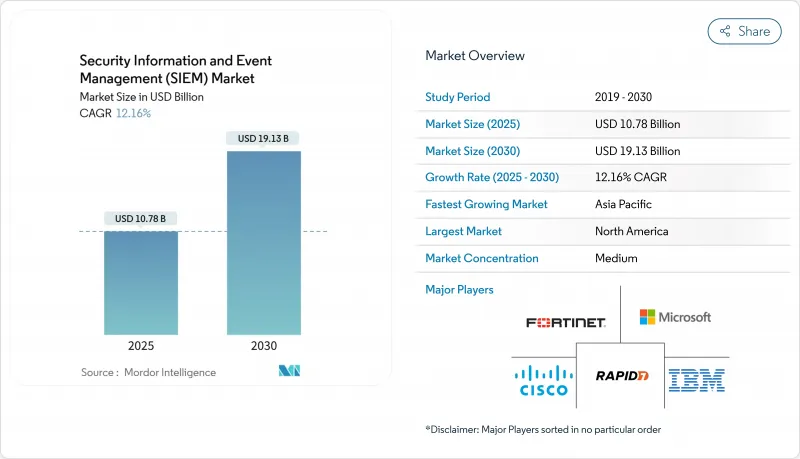

全球 SIEM 市场预计到 2025 年将达到 107.8 亿美元,到 2030 年将达到 191.3 亿美元,复合年增长率为 12.16%。

云端工作负载遥测技术的普及、严格的监管要求以及供应商的快速整合是推动成长要素。大型企业随着攻击面的扩大而持续扩展日誌采集,而中小企业则透过云端原生消费模式进入市场。北美市场的需求主要受SOX和PCI DSS法规的驱动,而欧洲市场的支出则因NIS2和DORA法规的实施而加速成长。供应商的蓝图目前围绕着人工智慧驱动的分析、整合资料管道和简化的授权模式展开——这些主题将在思科于2024年完成对Splunk的里程碑式收购后,推动产品更新换代。

全球安全资讯与事件管理 (SIEM) 市场趋势与洞察

安全遥测技术的指数级成长

企业每天从终端、云端服务和操作技术产生Terabyte的日誌。如此庞大的日誌量给传统的资料收集模型带来了巨大压力,同时也为威胁侦测提供了丰富的上下文资讯。 CPFL Energia 透过现代化的安全资讯和事件管理 (SIEM) 系统监控超过5万台智慧电网设备,该系统将高价值事件路由到资料湖以进行成本控制。云端原生弹性架构能够应对突发事件高峰,而选择性保留机制则确保了储存费用的可预测性。那些将低成本物件储存与查询元资料结合的供应商正受到客户的青睐,这些客户需要在覆盖范围和成本之间寻求平衡。

加重监管处罚和审核

在欧洲,NIS2 要求关键服务提供者记录、监控并保留事件资料以进行事件重建,这使得安全预算占 IT 支出的比例上升至 9.0%。在金融业,DORA 强制要求即时检测和报告。 Reimi 银行升级了其 SIEM 系统后,误报率降低了 70%,该系统专注于创建审核证据。医疗保健机构因违反 HIPAA 法规而面临罚款,平均罚款金额为 488 万美元。

总拥有成本高

传统的事件授权模式会造成安全盲点,迫使买家设定资料摄取上限。硬体关税将在2024年之前使设备成本增加20%,加重预算压力。储存、出口流量和进阶分析等隐性云端费用令初次使用者措手不及。供应商目前正在推广管道卸载层级和固定费率定价模式,以恢復价格的可预测性。

细分市场分析

到2024年,本地部署的SIEM将占据55.75%的市场。这个细分市场主要由受严格资料主权政策约束的行业支撑,但由于硬体成本上升和技能短缺日益严重,其成长速度正在放缓。云端SIEM将以13.40%的复合年增长率成长,透过弹性扩展和计量收费,扩大用户对高阶分析的存取。混合架构则扮演桥樑的角色,将受监管的资料保留在本地节点上,同时将远端检测资料串流传输到云端的低成本物件储存。

云端技术的采用将升级週期从多年的设备更新转变为持续的功能交付。西门子采用混合模式,在本地运行OT解析器,同时在云端丰富事件讯息,以进行威胁情报关联。随着授权模式转向资料使用,买家可以更清楚地了解每种部署方案的SIEM市场规模。供应商整合正在加速从老旧的本地部署架构向由超大规模云端服务商託管的现代化SaaS产品的转型。

到 2024 年,传统平台将占总收入的 46.20%,但随着资料规模的扩大,查询效能和规则调优能力下降,其市场份额将会减少。下一代云端原生引擎将以 18.10% 的复合年增长率 (CAGR) 实现最快成长,在所有架构类型中成长最高。这些系统透过将储存与计算解耦,并在资料摄取阶段整合机器学习,从而缩短平均发现时间。

Palo Alto Networks 将 QRadar SaaS 整合到 Cortex XSI AM 中,收购后的第一个季度就累计了超过 9,000 万美元的收入。开放原始码堆迭虽然在预算有限的情况下占有了一席之地,但需要深厚的工程技术能力。迁移工具和相容层简化了从传统规则语法到读取时模式模型的过渡。 SIEM 市场更倾向于将遥测资料视为巨量资料而非事件流的架构。

SIEM 市场报告按部署方式(本地部署、其他)、SIEM 架构(传统 SIEM、下一代 SIEM、其他)、组件(平台/软体、专业服务、託管 SIEM 服务 (MSSP))、组织规模(中小型企业、大型企业)、最终用户垂直行业(银行、金融服务、保险 (BFSI)、零售、电子商务、其他)和地区细分行业。

区域分析

2024年,北美将占据SIEM市场39.20%的收入份额,这主要得益于成熟的资料外洩通知法规和高额的网路保险费。由于董事会将安全控制与信託风险挂钩,预算拨款依然强劲。该地区对云端运算和人工智慧的早期应用进一步巩固了其市场领先地位。儘管市场基数已趋于饱和,但由于整合可观测性解决方案的提升销售,成长率仍保持在中等个位数水准。

亚太地区预计将以11.80%的复合年增长率实现全球最快成长。中国的多层防护体系和印度的《数位个人资料保护法》正在推动关键资讯基础设施的强制日誌。国内云端供应商正与全球安全资讯和事件管理(SIEM)厂商合作,以满足本地化法规要求。日本企业集团在主权和容量之间寻求平衡,倾向于采用混合型SIEM方案,将原始事件储存在东京地区,并将分析外包给全球云端。

在GDPR和NIS2的背景下,欧洲面临巨大的风险。董事会若监管不力,将面临高达全球营业额2%的罚款,促使企业加大投资。资料主权原则有利于OVHcloud和德国电信等区域云端服务商。 《数位营运弹性法案》强制要求金融业进行即时威胁侦测,从而推动了对安全资讯和事件管理(SIEM)的需求。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 安全遥测资料的快速成长

- 加强监管处罚力道和增加审核频率

- 加速企业工作负载的云端迁移与混合迁移

- 利用基于人工智慧/机器学习的分析提高信噪比

- 随着安全资料管路层的出现,降低 SIEM 的整体拥有成本

- 供应商的巨额交易(思科-Splunk、Exabeam-LogRhythm)触发刷新週期

- 市场限制

- 总拥有成本高,授权复杂

- 熟练的SOC分析师短缺

- 资料主权障碍阻碍了集中式日誌聚合

- 与 XDR/SOAR 平台重迭导致预算核准延迟

- 关键法规结构评估

- 价值链分析

- 技术展望

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 关键相关人员影响评估

- 主要用例和案例研究

- 宏观经济因素对市场的影响

- 投资分析

第五章 市场区隔

- 透过部署

- 本地部署

- 云

- 杂交种

- 按下 SIEM 架构

- 传统/传统安全资讯和事件管理 (SIEM)

- 云端原生/下一代安全资讯和事件管理 (SIEM)

- 开放原始码和事件管理 (SIEM)

- 按组件

- 平台/软体

- 专业服务

- 託管安全资讯和事件管理服务 (MSSP)

- 按组织规模

- 小型企业

- 大公司

- 按最终用户行业划分

- 银行、金融服务和保险(BFSI)

- 零售与电子商务

- 政府/国防

- 医疗保健和生命科学

- 製造业

- 能源与公共产业

- 电信和资讯技术

- 其他的

- 透过使用

- 威胁侦测与分析

- 合规与审核管理

- 事件回应和取证

- 日誌管理和彙报

- 云端工作负载安全监控

- 物联网/OT安全监控

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 北欧国家

- 其他欧洲地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 埃及

- 奈及利亚

- 其他非洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- ASEAN

- 澳洲

- 纽西兰

- 亚太其他地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Cisco Systems, Inc.(Splunk)

- International Business Machines Corporation

- Microsoft Corporation(Azure Sentinel)

- Google LLC(Chronicle Security Operations)

- Fortinet, Inc.

- LogRhythm, Inc.

- Exabeam, Inc.

- Rapid7, Inc.

- OpenText Corporation(ArcSight)

- RSA Security LLC

- Securonix, Inc.

- CrowdStrike Holdings, Inc.

- Elastic NV

- ATandT Cybersecurity(AlienVault)

- Micro Focus International plc

- SolarWinds Corporation

- Graylog, Inc.

- Logpoint A/S

- ManageEngine(Zoho Corp.)

- Hewlett Packard Enterprise Company

第七章 市场机会与未来展望

The global SIEM market stood at USD 10.78 billion in 2025 and is forecast to climb to USD 19.13 billion by 2030, advancing at a 12.16% CAGR.

A surge in cloud workload telemetry, strict regulatory mandates, and rapid vendor consolidation are the primary growth catalysts. Large enterprises continue to expand log ingestion as attack surfaces widen, while small and medium-sized businesses enter the market through cloud-native consumption models. North American demand is buoyed by SOX and PCI DSS rules, whereas European spending accelerates in response to NIS2 and DORA. Vendor roadmaps now revolve around AI-powered analytics, unified data pipelines, and simplified licensing, themes that spur refresh cycles following Cisco's landmark acquisition of Splunk in 2024.

Global Security Information And Event Management (SIEM) Market Trends and Insights

Exponential growth of security telemetry

Enterprises generate terabytes of logs each day from endpoints, cloud services, and operational technology. The volume strains traditional ingestion models yet unlocks richer context for threat hunting. CPFL Energia monitors more than 50,000 smart-grid devices through a modern SIEM that routes high-value events to a data lake for cost control. Cloud-native elasticity permits burst processing during incident spikes, and selective retention keeps storage fees predictable. Vendors that integrate low-cost object storage with query¬able metadata gain traction as customers balance coverage and cost.

Escalating regulatory penalties and audits

Europe's NIS2 obliges operators of essential services to log, monitor, and retain events for incident reconstruction, pushing security budgets up to 9.0% of IT spending. In finance, DORA compels real-time detection and reporting. Bank Leumi lowered false positives by 70% after a SIEM upgrade tailored to audit evidence generation. Health providers face HIPAA-driven breach fines that now average USD 4.88 million, a cost that underscores the need for continuous monitoring.

High total cost of ownership

Traditional per-event licenses force buyers to cap ingestion, creating security blind spots. Hardware tariffs raised appliance costs by as much as 20% during 2024, adding budget strain. Hidden cloud fees for storage, egress, and premium analytics surprise first-time adopters. Vendors now push pipeline off-load tiers and flat-rate pricing to restore predictability.

Other drivers and restraints analyzed in the detailed report include:

- Accelerated cloud and hybrid adoption

- AI and ML-driven analytics

- Shortage of skilled SOC analysts

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

On-premise deployments held 55.75% of SIEM market share in 2024. The segment remains favored by industries bound to strict data-sovereignty policies, yet growth is subdued as hardware costs rise and skills shortages deepen. The cloud cohort advances at 13.40% CAGR, propelled by elastic scaling and pay-as-you-go fees that widen access to advanced analytics. Hybrid designs act as a bridge, placing regulated data on local nodes while streaming telemetry to low-cost object storage in the cloud.

Cloud adoption shifts upgrade cycles from multi-year appliance refreshes to continuous feature delivery. Siemens uses a hybrid pattern that runs OT parsers on premises while enriching events in the cloud for threat intelligence correlation. As licensing shifts to data usage, buyers gain transparency on the SIEM market size for each deployment choice. Vendor consolidation accelerates moves away from aging on-prem stacks toward modern SaaS offerings hosted by hyperscalers.

Legacy platforms represented 46.20% revenue share in 2024, yet they lose ground as query performance and rule tuning falter under data scale. Next-generation cloud-native engines are forecast to rise at 18.10% CAGR, the fastest among architectural types. These systems decouple storage from compute and embed machine learning at ingestion, reducing mean time to detect.

Palo Alto Networks folded QRadar SaaS into Cortex XSIAM and booked more than USD 90 million in the first post-deal quarter. Open-source stacks carve a budget niche but demand deep engineering skills. Migration utilities and compatibility layers ease the shift from traditional rule syntax to schema-on-read models. The SIEM market aligns behind architectures that treat telemetry as big data rather than event streams.

The SIEM Market Report Segments the Industry by Deployment (On-Premise, and More), SIEM Architecture ( Traditional SIEM, Next-Gen SIEM, and More), Component (Platform / Software, Professional Services, and Managed SIEM Services (MSSP)), Organization Size (Small and Medium Enterprises, and Large Enterprises), End-User Industry (Banking, Financial Services and Insurance (BFSI), Retail and E-Commerce, and More), and Geography.

Geography Analysis

North America accounted for 39.20% of the SIEM market revenue in 2024, underpinned by mature breach notification statutes and high cyber insurance premiums. Budget allocations remain robust as boards tie security controls to fiduciary risk. The region's cloud adoption and early AI experimentation reinforce its leadership. Despite a saturated base, upsell to integrated observability keeps growth in mid-single digits.

Asia-Pacific is projected to post 11.80% CAGR, the fastest globally. China's Multi-Level Protection Scheme and India's Digital Personal Data Protection Act spur mandatory logging for critical information infrastructure. Domestic cloud vendors team with global SIEM players to satisfy localisation rules. Japanese conglomerates favour hybrid SIEM that parks raw events in Tokyo regions while outsourcing analytics to global clouds, balancing sovereignty and capability.

Europe maintains a sizeable stake on the back of GDPR and the incoming NIS2. Boards face fines reaching 2% of global turnover for monitoring lapses, incentivising investment. Data sovereignty drives preference for regional clouds such as OVHcloud and Deutsche Telekom. The Digital Operational Resilience Act imposes real-time threat detection in finance, fuelling premium SIEM demand.

- Cisco Systems, Inc. (Splunk)

- International Business Machines Corporation

- Microsoft Corporation (Azure Sentinel)

- Google LLC (Chronicle Security Operations)

- Fortinet, Inc.

- LogRhythm, Inc.

- Exabeam, Inc.

- Rapid7, Inc.

- OpenText Corporation (ArcSight)

- RSA Security LLC

- Securonix, Inc.

- CrowdStrike Holdings, Inc.

- Elastic N.V.

- ATandT Cybersecurity (AlienVault)

- Micro Focus International plc

- SolarWinds Corporation

- Graylog, Inc.

- Logpoint A/S

- ManageEngine (Zoho Corp.)

- Hewlett Packard Enterprise Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Exponential growth of security telemetry volumes

- 4.2.2 Escalating regulatory penalties and audit frequency

- 4.2.3 Accelerated cloud and hybrid adoption of enterprise workloads

- 4.2.4 AI/ML-infused analytics improve signal-to-noise ratios

- 4.2.5 Emergence of security-data-pipeline layer reduces SIEM TCO

- 4.2.6 Vendor mega-deals (Cisco-Splunk, Exabeam-LogRhythm) trigger refresh cycles

- 4.3 Market Restraints

- 4.3.1 High total cost of ownership and licensing complexity

- 4.3.2 Shortage of skilled SOC analysts

- 4.3.3 Data-sovereignty barriers to central log aggregation

- 4.3.4 Overlap with XDR/SOAR platforms delays budget approval

- 4.4 Evaluation of Critical Regulatory Framework

- 4.5 Value Chain Analysis

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Impact Assessment of Key Stakeholders

- 4.9 Key Use Cases and Case Studies

- 4.10 Impact on Macroeconomic Factors of the Market

- 4.11 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Deployment

- 5.1.1 On-premise

- 5.1.2 Cloud

- 5.1.3 Hybrid

- 5.2 By SIEM Architecture

- 5.2.1 Legacy / Traditional SIEM

- 5.2.2 Cloud-native / Next-Gen SIEM

- 5.2.3 Open-source SIEM

- 5.3 By Component

- 5.3.1 Platform / Software

- 5.3.2 Professional Services

- 5.3.3 Managed SIEM Services (MSSP)

- 5.4 By Organization Size

- 5.4.1 Small and Medium Enterprises

- 5.4.2 Large Enterprises

- 5.5 By End-user Industry

- 5.5.1 Banking, Financial Services and Insurance (BFSI)

- 5.5.2 Retail and E-commerce

- 5.5.3 Government and Defense

- 5.5.4 Healthcare and Life Sciences

- 5.5.5 Manufacturing

- 5.5.6 Energy and Utilities

- 5.5.7 Telecom and IT

- 5.5.8 Others

- 5.6 By Application

- 5.6.1 Threat Detection and Analytics

- 5.6.2 Compliance and Audit Management

- 5.6.3 Incident Response and Forensics

- 5.6.4 Log Management and Reporting

- 5.6.5 Cloud-Workload Security Monitoring

- 5.6.6 IoT / OT Security Monitoring

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Argentina

- 5.7.2.3 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 United Kingdom

- 5.7.3.2 Germany

- 5.7.3.3 France

- 5.7.3.4 Italy

- 5.7.3.5 Spain

- 5.7.3.6 Nordics

- 5.7.3.7 Rest of Europe

- 5.7.4 Middle East and Africa

- 5.7.4.1 Middle East

- 5.7.4.1.1 Saudi Arabia

- 5.7.4.1.2 United Arab Emirates

- 5.7.4.1.3 Turkey

- 5.7.4.1.4 Rest of Middle East

- 5.7.4.2 Africa

- 5.7.4.2.1 South Africa

- 5.7.4.2.2 Egypt

- 5.7.4.2.3 Nigeria

- 5.7.4.2.4 Rest of Africa

- 5.7.5 Asia-Pacific

- 5.7.5.1 China

- 5.7.5.2 India

- 5.7.5.3 Japan

- 5.7.5.4 South Korea

- 5.7.5.5 ASEAN

- 5.7.5.6 Australia

- 5.7.5.7 New Zealand

- 5.7.5.8 Rest of Asia-Pacific

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Cisco Systems, Inc. (Splunk)

- 6.4.2 International Business Machines Corporation

- 6.4.3 Microsoft Corporation (Azure Sentinel)

- 6.4.4 Google LLC (Chronicle Security Operations)

- 6.4.5 Fortinet, Inc.

- 6.4.6 LogRhythm, Inc.

- 6.4.7 Exabeam, Inc.

- 6.4.8 Rapid7, Inc.

- 6.4.9 OpenText Corporation (ArcSight)

- 6.4.10 RSA Security LLC

- 6.4.11 Securonix, Inc.

- 6.4.12 CrowdStrike Holdings, Inc.

- 6.4.13 Elastic N.V.

- 6.4.14 ATandT Cybersecurity (AlienVault)

- 6.4.15 Micro Focus International plc

- 6.4.16 SolarWinds Corporation

- 6.4.17 Graylog, Inc.

- 6.4.18 Logpoint A/S

- 6.4.19 ManageEngine (Zoho Corp.)

- 6.4.20 Hewlett Packard Enterprise Company

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment