|

市场调查报告书

商品编码

1537593

碳化硅:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Silicon Carbide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

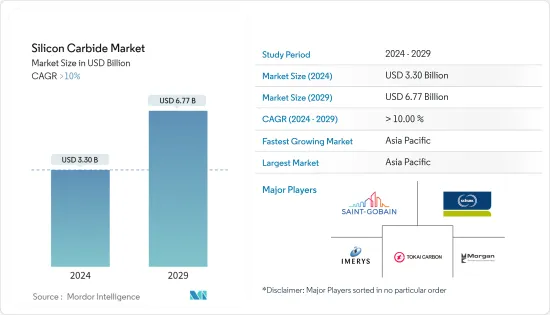

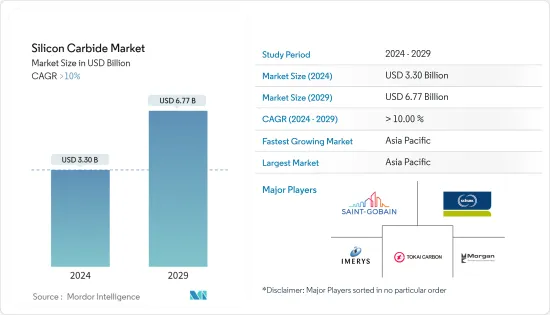

碳化硅市场规模预计到2024年为33亿美元,预计到2029年将达到67.7亿美元,在预测期内(2024-2029年)复合年增长率超过10%。

主要亮点

- 推动市场的主要因素是钢铁製造和钢铁加工业的强劲需求以及电子产业需求的快速扩张。

- 限制需求的因素包括煤炭和石油焦等原料成本的波动。另一个挑战是氮化镓等替代品的可用性。

- 电动车渗透率的上升预计将为市场成长提供各种机会。

- 亚太地区主导全球市场,消费量最高的国家为中国、印度和日本。

碳化硅市场趋势

扩大在电子和半导体领域的应用

- 碳化硅是一种含有硅和碳的半导体。碳化硅颗粒可以模压在一起形成极其坚硬的陶瓷,用于需要高耐用性的应用。

- 碳化硅因其能够在高温、高电压或两者兼有的情况下工作以及外形规格小等特性而被广泛应用于半导体製造。

- 根据世界半导体贸易统计(WSTS)显示,全球半导体市场销售额预计将创纪录的5,883.6亿美元,较2023年的5,201.3亿美元成长13.12%。因此,2024年该领域对碳化硅的需求将大幅增加。由于半导体是电子设备最重要的组件之一,预计市场在预测期内将大幅成长。

- 在北美,尤其是美国,电子产业预计将经历温和成长。对新技术产品的需求不断增长预计将有助于未来几年的市场扩张。

- 德国的电子工业是欧洲最大、世界第五大。电气和电子工业占德国工业总产值的11%,约占国内生产总值(GDP)的3%。

- 英国是欧洲最大的高阶家电市场,约有18,000家电子公司设在英国。

- Canalys 预计,2024 年全球智慧型手錶市场金额将较 2023 年成长 17%。全球电子设备需求不断增长的趋势预计将在预测期内推动市场成长。

- 由于上述因素,预计碳化硅市场在预测期内将快速成长。

亚太地区主导市场

- 预计亚太地区将在预测期内主导碳化硅市场。由于电子、汽车、国防等各领域对先进和升级技术的需求不断增加,中国、印度和日本等国家对碳化硅的需求不断增加。

- 中国是半导体的主要消费国之一,正在努力扩大半导体产量。半导体是政府主导的「中国製造2025」计画的重点领域,该计画旨在促进高付加产品的生产。到2025年,中国的目标是生产所用半导体的70%。

- 根据电子和资讯技术部的报告,印度每年设计超过2000个半导体晶片。半导体产量的增加可能会推动未来碳化硅市场的发展。

- 印度电子和半导体协会(IESA)与新加坡半导体行业协会(SSIA)签署了一份谅解备忘录,以建立和发展两国电子和半导体行业之间的贸易和技术合作。这有望带动各种创新半导体製造技术的发展,并进一步扩大印度半导体製造中碳化硅的消费范围。

- 印度政府推出了促进印度电子製造业发展的新倡议,即电子元件和半导体製造促进计划(SPECS)和改进电子製造群计划(EMC 2.0)以及生产相关激励计划(PLI)。根据PLI计划,如果製造商增加在印度的产量,政府可能会在五年内提供55亿美元的奖励。这可能会促进印度的电子产品生产。

- 印度汽车工业价值超过1000亿美元,占印度出口总额的8%,占印度GDP的2.3%。预计2025年将成为世界第三大城市。

- 2024年3月,中国宣布国防预算增加7.2%,达到约2,330亿美元。该国的最新计划是到2027年建立一支与美国同等水平的完全现代化的军队。近年来,中国一直在航空母舰和隐形飞机方面进行投资。此外,它还计划将世界各地的航空母舰数量增加到大约五到六艘,其中包括在北京的后院南海(SCS)。

- 上述因素加上政府的支持,导致预测期内该地区的需求增加。

碳化硅产业概况

碳化硅市场部分整合,企业占重要市场占有率。主要市场参与者(排名不分先后)包括 Saint-Gobain、Imerys、Tokai Carbon、Schunk Ingenieurkeramik GmbH 和 Morgan Advanced Materials。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章 简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 电子业需求旺盛

- 对精密陶瓷的需求增加

- 抑制因素

- 原料成本波动

- 氮化镓等替代品的可用性

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 副产品

- 绿色碳化硅

- 黑碳化硅

- 其他产品

- 按用途

- 钢

- 活力

- 车

- 航太/国防

- 电子/半导体

- 其他用途

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 俄罗斯

- 土耳其

- 西班牙

- 北欧的

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 卡达

- 奈及利亚

- 阿拉伯聯合大公国

- 埃及

- 其他中东和非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)/排名分析

- 主要企业策略

- 公司简介

- Blasch Precision Ceramics Inc.

- Christy Refractories

- Imerys

- Keith Company

- Morgan Advanced Materials

- NGK Insulators Ltd

- Silcarb Recrystallized Private Limited

- Saint Gobain

- Termo Refractaires

- The Pottery Supply House

- Fiven ASA

- KEYVEST

- Navarro SiC

- Schunk Ingenieurkeramik GmbH

- Superior Graphite

- Tateho Chemical Industries Co. Ltd

- ESD-SIC BV

- ELSID SA

- Zaporozhsky Abrasinvy Combinat

第七章 市场机会及未来趋势

- 电动车和自动驾驶汽车的扩张

- 扩大奈米技术的应用

简介目录

Product Code: 68929

The Silicon Carbide Market size is estimated at USD 3.30 billion in 2024, and is expected to reach USD 6.77 billion by 2029, growing at a CAGR of greater than 10% during the forecast period (2024-2029).

Key Highlights

- The major factors driving the market studied are strong demand from the steel manufacturing and steel processing industry and rapidly growing demand from the electronics industry.

- Some factors restraining the demand for the market include fluctuating costs of raw materials like coal and petroleum coke. Moreover, the availability of substitutes such as gallium nitride might also cause challenges.

- The rising penetration of electric vehicles is expected to offer various opportunities for the growth of the market.

- Asia-Pacific dominated the market globally, with the most significant consumption from countries such as China, India, and Japan.

Silicon Carbide Market Trends

Increasing Usage in Electronics and Semiconductor Segment

- Silicon carbide is a semiconductor containing silicon and carbon. Grains of silicon carbide can be molded together to form very hard ceramics that are used in applications requiring high endurance.

- Silicon carbide is widely used in manufacturing semiconductors due to its properties, like the ability to work at high temperature, high voltage, or both, and reduced form factor.

- According to the World Semiconductor Trade Statistics (WSTS), the revenue of the global semiconductor market is expected to register USD 588.36 billion, 13.12% higher than USD 520.13 billion in 2023. This will result in a substantial boost in the demand for silicon carbide in the segment in 2024. As semiconductors are one of the most crucial components of electronic devices, the market is expected to witness a substantial boost during the forecast period.

- In North America, especially in the United States, the electronics industry is expected to grow at a moderate rate. An increase in the demand for new technological products is expected to help the market expansion in the coming years.

- The German electronic industry is Europe's biggest and the fifth-largest, globally. The electrical and electronics industry accounted for 11% of the total German industrial production and about 3% of the country's gross domestic product (GDP).

- The United Kingdom is the largest European market for high-end consumer electronics products, with about 18,000 UK-based electronics companies in the market.

- According to Canalys, the global smartwatch market is expected to grow by 17% in value in 2024 compared to 2023. This trend of globally increasing demand for electronics is expected to propel the market's growth during the forecast period.

- Due to all the factors mentioned above for silicon carbide, its market is expected to grow rapidly during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific is expected to dominate the market for silicon carbide during the forecast period. In countries like China, India, and Japan, due to the increasing demand for advanced and upgraded technology across various sectors, including electronics, automotive, and defense, the demand for silicon carbide has been increasing in the region.

- China is one of the major consumers of semiconductors, and it is trying to ramp up semiconductor production. Semiconductors are a key area of the Made in China 2025 plan, a government initiative that aims to boost the production of higher-value products. China is aiming to produce 70% of the semiconductors it uses by 2025.

- According to reports from the Department of Electronics and Information Technology, over 2,000 semiconductor chips are designed in India every year. The increasing production of semiconductors may propel the silicon carbide market in the future.

- The India Electronics and Semiconductor Association (IESA) signed an MoU with the Singapore Semiconductor Industry Association (SSIA) to establish and develop trade and technical cooperation between the electronics and semiconductor industries of both countries. This is expected to result in the development of various breakthrough semiconductor manufacturing technologies that may further increase the scope for the consumption of silicon carbide in semiconductor manufacturing in India.

- The government launched new schemes to promote electronics production in India: the Scheme for Promotion of Manufacturing of Electronic Components and Semiconductors (SPECS) and the Scheme for Modified Electronics Manufacturing Clusters (EMC 2.0) alongside the Production Linked Incentive (PLI). According to the PLI scheme, the government is likely to offer incentives as manufacturers increase production in India, with USD 5.5 billion available over five years. This is likely to boost the country's production of electronics.

- The Indian automotive industry is worth more than USD 100 billion, contributes 8% of the country's total exports, and accounts for 2.3% of the Indian GDP. It is expected to become the third-largest in the world by 2025.

- In March 2024, China announced a 7.2% increase in its defense budget to about USD 233 billion. The country's recent plans are to build a fully modern military on par with the United States by 2027. The country has been investing in aircraft carriers and stealth aircraft in the past few years. Moreover, it plans to increase the number of aircraft carriers to about five to six worldwide, including Beijing's backyard, the South China Sea (SCS).

- The factors mentioned above, coupled with government support, contribute to the increasing demand in the region during the forecast period.

Silicon Carbide Industry Overview

The silicon carbide market is partially consolidated, with players accounting for a significant market share. Some key market players (not in any particular order) include Saint-Gobain, Imerys, Tokai Carbon Co. Ltd, Schunk Ingenieurkeramik GmbH, and Morgan Advanced Materials.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Strong Demand from the Electronics Industry

- 4.1.2 Increasing Demand for Advanced Ceramics

- 4.2 Restraints

- 4.2.1 Fluctuating Costs of Raw Materials

- 4.2.2 Availability of Substitutes such as Gallium Nitride

- 4.3 Industry Value Chain Analysis

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Product

- 5.1.1 Green SiC

- 5.1.2 Black SiC

- 5.1.3 Other Products

- 5.2 By Application

- 5.2.1 Steel Manufacturing

- 5.2.2 Energy

- 5.2.3 Automotive

- 5.2.4 Aerospace and Defense

- 5.2.5 Electronics and Semiconductor

- 5.2.6 Other Applications

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Russia

- 5.3.3.6 Turkey

- 5.3.3.7 Spain

- 5.3.3.8 NORDIC

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Qatar

- 5.3.5.4 Nigeria

- 5.3.5.5 United Arab Emirates

- 5.3.5.6 Egypt

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Blasch Precision Ceramics Inc.

- 6.4.2 Christy Refractories

- 6.4.3 Imerys

- 6.4.4 Keith Company

- 6.4.5 Morgan Advanced Materials

- 6.4.6 NGK Insulators Ltd

- 6.4.7 Silcarb Recrystallized Private Limited

- 6.4.8 Saint Gobain

- 6.4.9 Termo Refractaires

- 6.4.10 The Pottery Supply House

- 6.4.11 Fiven ASA

- 6.4.12 KEYVEST

- 6.4.13 Navarro SiC

- 6.4.14 Schunk Ingenieurkeramik GmbH

- 6.4.15 Superior Graphite

- 6.4.16 Tateho Chemical Industries Co. Ltd

- 6.4.17 ESD-SIC BV

- 6.4.18 ELSID SA

- 6.4.19 Zaporozhsky Abrasinvy Combinat

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increase Market Penetration of Electric Cars and Self-driving Cars

- 7.2 Growth of Usage in Nanotechnology

02-2729-4219

+886-2-2729-4219