|

市场调查报告书

商品编码

1537604

Biochar:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Biochar - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

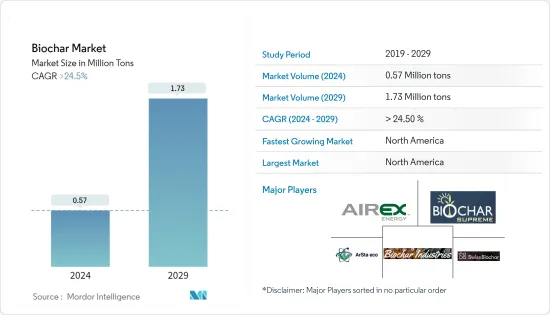

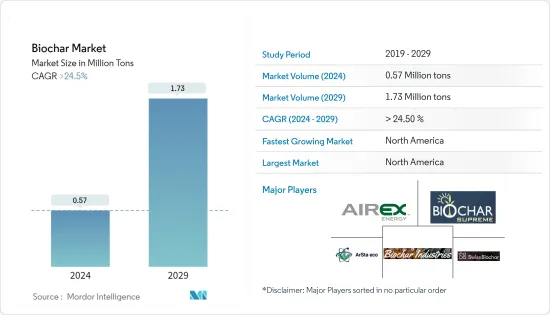

预计2024年全球生物炭市场规模将达57万吨,2029年将达到173万吨,2024-2029年预测期间复合年增长率将超过24.5%。

COVID-19 大流行对生物炭市场产生了负面影响。由于封锁影响了生物炭生产所需的原料和劳动力的供应,导致一些地区延误和短缺,生物炭市场受到供应链的干扰。然而,这场流行病凸显了包括农业在内的各部门永续復原力的重要性。因此,人们对永续农业(例如生物炭的应用)的兴趣增加,导致对生物炭产品的需求增加。

主要亮点

- 新兴国家对有机食品的需求不断增长,以及在植物生长和市场开拓中的应用不断增加,预计将推动对生物炭市场的需求。

- 另一方面,高生产成本和替代资源的竞争预计将阻碍未来几年的市场成长。

- 此外,对土壤健康和农业生产力的日益关注、对可再生能源和生物质能增值的需求不断增加预计将为生物炭产业在预测期内提供成长机会。

- 由于全部区域对有机食品的需求不断增加,预计北美将主导市场。

生物炭市场趋势

农业领域主导市场

- 生物炭是透过生物质热解获得的固体产品。它富含碳。它是一种多孔材料,用于土壤改良和净化等多种用途。

- 生物炭因其改善土壤健康和肥力的能力而受到广泛认可。当添加到土壤中时,生物炭可以增强土壤结构,增加持水能力,并促进有益的微生物活动。这些特性可提高作物产量和农业生产力,使生物炭成为农民的宝贵投入。

- 因此,在农业生产中使用生物炭可以提高产量,同时减少对环境的负面影响。

- 目前,中国和美国是生物炭农业利用的先驱。

- 根据美国人口普查局、美国农业部和美国商务部发布的资料,2023年美国农产品出口总额将达1,845亿美元。

- 此外,根据美国农业部和国家农业统计局的数据,美国小麦总产量从 2021 年的 16.4 亿蒲式耳增至 2023 年的 18.1 亿蒲式耳。

- 因此,预计上述因素将在未来几年增加农业应用中生物炭的需求。

北美市场占据主导地位

- 北美是生物炭生产和消费的领先地区之一。美国和加拿大等国家对用于农业、环境修復和碳封存目的的生物炭越来越感兴趣。

- 北美,特别是美国和加拿大,农业部门高度发展。这些国家的农民越来越多地采用生物炭作为土壤还原剂,以提高土壤肥力、保水性和作物生产力。该地区先进的耕作方法正在推动对生物炭产品的需求。

- 例如,加拿大透过林业转型投资 (IFIT) 计划从加拿大自然资源部 (NRCan) 获得了 750 万加元(550 万美元)。该计划旨在支持加拿大林业部门先进技术和产品的竞争力和转换。

- 此外,在加拿大,Airex Energy Inc.、Groupe Remabec 和 SUEZ 联手组成了 CARBONITY。这是加拿大第一家工业生物炭生产厂,位于魁北克省卡地亚港。 SUEZ和Airex Energy之间的合作计画到2035年生产35万吨生物炭。

- 此外,加拿大石油和天然气公司 Petrox Resources Corporation (Petrox) 也签署了一份谅解备忘录,与该国可再生能源计划开发商 M&L Renewable Energy Group Ltd 合作。该谅解备忘录是为了在亚伯达埃德蒙顿开发生物炭设施,目的是在加拿大多个地点开发类似的工厂。

- 根据美国农业部和经济研究局的数据,到年终,德克萨斯州将拥有约 246,000 个农场,成为美国农业产量最大的州。截至2022年,密苏里州持有95,000个农场,在前10名州中排名第二。

- 因此,预计上述因素将在预测期内推动北美生物炭市场。

生物炭产业概况

生物炭市场部分整合,少数主要企业控制市场的很大一部分。主要企业(排名不分先后)包括Biochar Industries、Biochar Supreme、Swiss Biochar、Arsta Eco、Airex Energy等。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 增加植物生长和发育的用途

- 新兴国家对有机食品的需求不断成长

- 抑制因素

- 生产成本高

- 替代产品的竞争

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模:基于数量)

- 科技

- 热解

- 气化系统

- 其他技术

- 目的

- 农业

- 家畜

- 工业的

- 其他用途

- 地区

- 亚太地区

- 中国

- 澳洲

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 瑞典

- 奥地利

- 瑞士

- 英国

- 欧洲其他地区

- 其他领域

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟和协议

- 市场占有率(%)/排名分析

- 主要企业策略

- 公司简介

- Airex Energy

- Arsta Eco

- Biochar Industries

- Biochar Now LLC

- Biochar Supreme

- BIOSORRA

- Carbon Gold Ltd

- Diacarbon Energy Inc.

- Karr Group

- Phoenix Energy

- Pyreg GmbH

- PyroCore

- Sunriver Biochar

- Swiss Biochar

- Wonjin Group

第七章 市场机会及未来趋势

- 人们日益关注土壤健康和农业生产力

- 可再生能源和生物质的增值导致需求增加

The Biochar Market size is estimated at 0.57 Million tons in 2024, and is expected to reach 1.73 Million tons by 2029, growing at a CAGR of greater than 24.5% during the forecast period (2024-2029).

The COVID-19 pandemic negatively affected the biochar market. The biochar market experienced disruptions in supply chains due to lockdowns affecting the availability of raw materials and labor required for biochar production, leading to delays and shortages in some regions. However, the pandemic highlighted the importance of sustainability resilience in various sectors, including agriculture. As a result, there was a growing interest in sustainable agricultural practices such as biochar application, leading to increased demand for biochar products.

Key Highlights

- The growing demand for organic foods in developing countries and increasing applications for plant growth and development are expected to drive the demand in the biochar market.

- On the flip side, high production costs and competition from alternate sources are expected to hinder the growth of the market studied in the coming years.

- Furthermore, increasing concerns regarding soil health and agricultural productivity and rising demand for renewable energy and biomass valorization are expected to provide growth opportunities to the biochar industry over the forecast period.

- North America is expected to dominate the market due to the growing demand for organic food across the region.

Biochar Market Trends

Agriculture Segment to Dominate the Market

- Biochar is a solid byproduct obtained from biomass pyrolysis. It is rich in carbon. It is a porous material that is used for various applications, such as soil improvement and remediation.

- Biochar is widely recognized for its ability to improve soil health and fertility. When added to soil, biochar enhances soil structure, increases water retention capacity, and promotes beneficial microbial activity. These properties lead to higher crop yields and improved agricultural productivity, making biochar a valuable input for farmers.

- Hence, using biochar in agriculture production increases yields while decreasing negative environmental impacts.

- Currently, China and the United States are the forerunners in using biochar for agricultural purposes.

- The total value of agricultural exports in the United States reached USD 184.5 billion in 2023, according to the data published by the US Census Bureau, the US Department of Agriculture, and the US Department of Commerce.

- Moreover, according to the US Department of Agriculture and the National Agricultural Statistics Service, the total wheat production in the United States increased from 1.64 billion bushels in 2021 to 1.81 billion bushels in 2023.

- Thus, the factors mentioned above are expected to increase the demand for biochar in agriculture applications in the coming years.

North America to Dominate the Market

- North America has been one of the leading regions in terms of biochar production and consumption. Countries such as the United States and Canada have seen increased interest in biochar for agriculture, environmental remediation, and carbon sequestration purposes.

- North America, particularly the United States and Canada, has a highly developed agricultural sector. Farmers in these countries are increasingly adopting biochar as a soil redemption for enhancing soil fertility, water retention, and crop productivity. The advanced agricultural practices in the region drive demand for biochar products.

- For instance, Canada received a contribution of CAD 7.5 million (USD 5.5 million) from the Natural Resources Canada (NRCan) through the Investments in Forest Industry Transformation (IFIT) program. This program aims to support the competitiveness and transformation of Canada's forest sector in advanced technologies and products.

- Furthermore, in Canada, Airex Energy Inc., Groupe Remabec, and SUEZ have collaborated to create CARBONITY. It is Canada's first industrial biochar production plant situated at Port-Cartier, Quebec (QC). This collaboration between SUEZ and Airex Energy is intended to produce 350,000 tonnes of biochar by 2035.

- Moreover, Canadian oil and gas company Petrox Resources Corporation (Petrox) has signed a Memorandum of Understanding (MoU) to co-operate with compatriot M&L Renewable Energy Group Ltd, a renewable energy project developer. This MoU is intended to develop a biochar facility in Edmonton, Alberta, with the intention of developing similar plants at multiple locations in Canada.

- According to the US Department of Agriculture and the Economic Research Service, by the end of 2022, Texas had about 246,000 farms, making it the largest US state in terms of agricultural production. As of 2022, Missouri ranked second among the top ten states, with 95,000 farm holdings.

- Thus, the factors mentioned above are expected to drive the biochar market in North America during the forecast period.

Biochar Industry Overview

The biochar market is partially consolidated, with a few major players dominating a significant portion of the market. The major players (not in any particular order) include Biochar Industries, Biochar Supreme, Swiss Biochar, Arsta Eco, and Airex Energy, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Applications for Plant Growth and Development

- 4.1.2 Growing Demand for Organic Foods in Developing Countries

- 4.2 Restraints

- 4.2.1 High Production Costs

- 4.2.2 Competition from Alternative Products

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Technology

- 5.1.1 Pyrolysis

- 5.1.2 Gasification Systems

- 5.1.3 Other Technologies (Hydrothermal Carbonization)

- 5.2 Application

- 5.2.1 Agriculture

- 5.2.2 Animal Farming

- 5.2.3 Industrial Uses

- 5.2.4 Other Applications (Environmental Remediation)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 Australia

- 5.3.1.3 South Korea

- 5.3.1.4 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 Sweden

- 5.3.3.3 Austria

- 5.3.3.4 Switzerland

- 5.3.3.5 United Kingdom

- 5.3.3.6 Rest of Europe

- 5.3.4 Rest of the World

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Airex Energy

- 6.4.2 Arsta Eco

- 6.4.3 Biochar Industries

- 6.4.4 Biochar Now LLC

- 6.4.5 Biochar Supreme

- 6.4.6 BIOSORRA

- 6.4.7 Carbon Gold Ltd

- 6.4.8 Diacarbon Energy Inc.

- 6.4.9 Karr Group

- 6.4.10 Phoenix Energy

- 6.4.11 Pyreg GmbH

- 6.4.12 PyroCore

- 6.4.13 Sunriver Biochar

- 6.4.14 Swiss Biochar

- 6.4.15 Wonjin Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Concerns Regarding Soil Health and Agricultural Productivity

- 7.2 Rising Demand from Renewable Energy and Biomass Valorization