|

市场调查报告书

商品编码

1537605

磁性材料:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Magnetic Materials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

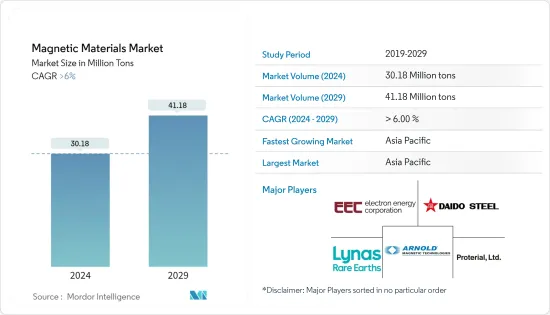

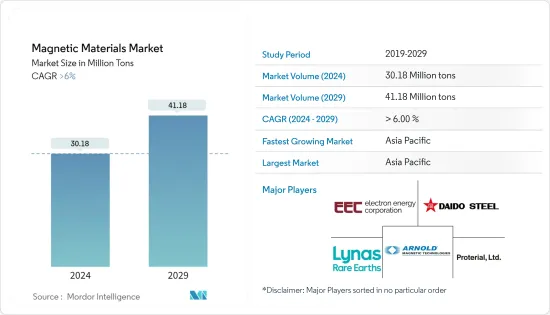

预计2024年全球磁性材料市场规模将达3,018万吨,2024年至2029年复合年增长率将超过6%,2029年将达4,118万吨。

磁性材料市场受到COVID-19大流行的影响,多个国家采取全国性的封锁措施和严格的社交距离措施,导致汽车和电子元件的生产停止,这对磁性材料市场产生了负面影响。然而,在COVID-19大流行之后,大多数工业生产设施和汽车製造商恢復运营,导致磁性材料市场復苏。近年来,由于汽车、电子和发电行业需求的增加,市场出现了显着的成长。

发电行业中磁性材料采用率的上升以及电子终端用户行业中磁性材料使用率的增加预计将推动当前的研究市场。

另一方面,稀土元素材料的高开采成本预计将阻碍市场成长。

混合电动车对磁性材料的需求不断增长预计将在预测期内创造市场机会。

预计亚太地区将主导市场。由于汽车、电子和发电行业对磁性材料的需求不断增长,预计在预测期内复合年增长率将达到最高。

磁性材料市场趋势

发电业需求增加

- 磁性材料越来越多地用于发电。这些材料用于发电和传输的马达。磁性材料应用于马达、发电机、变压器、致动器等设备。

- 电子机械由硬磁性材料製成,用于一个主要功能:提供磁通量。硬磁材料具有高矫顽力,可以承受电路退磁和高温下的热退磁。

- 根据能源与资源研究所的数据,2022年全球发电量为29,165四瓦时,而2021年为28,520四瓦时,成长率为2.26%。因此,发电能力的增加预计将推动磁性材料市场的发展。

- 美国的发电能力仅次于中国,位居第二。 2022 年,美国公共产业规模发电设施发电量约为 42,430 亿度 (kWh)。大约 60% 的发电量来自煤炭、天然气、石油和其他气体等石化燃料。

- 此外,风力发电厂对磁性材料的需求不断增加。过去两年,中国增加了风电装置容量。 2022年,中国建设的风电场数量将比欧洲多出46%。根据IEA预测,2022年中国陆上风电发电量预计将达到30.9GW,到年终将达到59GW。

- 因此,发电应用领域预计将在预测期内主导磁性材料市场。

亚太地区主导市场

- 由于中国和印度发电行业高度发达,以及多年来持续投资发展电子和汽车行业,亚太地区预计将主导全球市场。

- 此外,亚太地区日益增长的环境问题正在增加政府对内燃机汽车的监管。这导致该地区对电动车的需求不断增长,支持了各种应用中磁性材料的消耗。

- 在中国,随着消费者越来越喜欢电动车,汽车产业正在呈现转型趋势。此外,中国政府预计2025年电动车产量的渗透率将达到20%。这反映在该国电动车销售趋势上,2022年电动车销量创下历史新高。

- 根据中国乘用车协会的数据,2022年中国电动车和插电式混合动力车销量为567万辆,几乎是2021年销量的两倍。由于该国对润滑油添加剂的需求预计将下降,市场预计将维持目前的销售速度。

- 同样,在印度,重点正在转向电动车,以减少温室气体排放。政府承诺,到 2023 年,印度新车销量的 30% 将是电动车。此外,多家公司正在该国建立电动车製造设施,以增加电动车的生产数量。

- 例如,日产和雷诺在2023年2月宣布,计画未来三到五年在印度投资6亿美元,扩大乘用车和电动车市场占有率。这将提振电动车市场并推动对磁性材料的需求。

- 由于上述因素,预测期内该地区对磁性材料的需求可能会增加。

磁性材料行业概况

磁性材料市场部分整合。市场主要企业包括(排名不分先后)Arnold Magnetic Technologies、Daido Steel、Electron Energy Corporation、PROTERIAL, Ltd.、Lynas Rare Earths Ltd.。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 发电业越来越多地采用磁性材料

- 扩大电子领域的应用

- 其他司机

- 抑制因素

- 稀土开采成本高

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模:基于数量)

- 类型

- 硬磁性材料

- 软磁性材料

- 半硬磁性材料

- 最终用户产业

- 车

- 电子产品

- 发电

- 工业的

- 其他最终用户产业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟和协议

- 市场占有率(%)/排名分析

- 主要企业策略

- 公司简介

- Adams Magnetic Products

- Arnold Magnetic Technologies

- Daido Steel Co., Ltd.

- Dexter Magnetic Technologies

- Electron Energy Corporation

- GKN Powder Metallurgy

- Lynas Rare Earths Ltd.

- Molycorp Inc

- PROTERIAL, Ltd.

- Quadrant.

- Shin-Etsu Chemical Co., Ltd.

- Steward Advanced Materials LLC.

- TDK Corporation

- Tengam

- Toshiba Materials Co., Ltd.

第七章 市场机会及未来趋势

- 混合动力汽车对磁性材料的需求不断增加

- 其他机会

The Magnetic Materials Market size is estimated at 30.18 Million tons in 2024, and is expected to reach 41.18 Million tons by 2029, growing at a CAGR of greater than 6% during the forecast period (2024-2029).

The magnetic materials market was negatively affected by the COVID-19 pandemic due to nationwide lockdowns in several countries and strict social distancing measures, which resulted in production halts of automotive vehicles and electronic components, thereby affecting the market for magnetic materials. However, post-COVID-19 pandemic, most of the industrial manufacturing facilities and automotive manufacturers resumed their operations, which helped to revive the market for magnetic materials. In recent years, the market registered a significant growth rate due to increasing demand from the automotive, electronics, and power generation industries.

The rising adoption of magnetic materials in the power generation industry and the increasing usage in the electronics end-user industry are expected to drive the current studied market.

On the flip side, the high cost of extracting rare earth materials is expected to hinder the growth of the market.

The rising demand for magnetic materials in hybrid electric vehicles is expected to create opportunities for the market during the forecast period.

The Asia-Pacific region is expected to dominate the market. It is also expected to register the highest CAGR during the forecast period due to the rising demand for magnetic materials in the automotive, electronics, and power generation industries.

Magnetic Materials Market Trends

Growing Demand from Power Generation Sector

- Magnetic Materials have been increasingly used in the power generation sector. These materials are used in motors to generate power and transmission of electricity. Magnetic materials are applied in equipment such as motors, generators, transformers, and actuators, amongst others.

- Electric machines are made of hard magnetic materials and are used for one primary function, which is to provide magnetic flux. Ard magnetic materials have high coercivity to resist demagnetization from the electric circuit and thermal demagnetization under high operating temperatures.

- According to the Energy and Resource Institute, the global electricity generation capacity is registered at 29,165 tetra watt-hours in the year 2022 at a growth rate of 2.26% as compared to 28,520 tetra watt-hours of electricity generated in the year 2021. Thus, the increasing electricity generation capacity is anticipated to drive the market for magnetic materials.

- The United States occupies second place after China regarding power generation capacity. In 2022, about 4,243 billion kilowatt hours (kWh) of electricity were generated at utility-scale electricity generation facilities in the United States.1 About 60% of this electricity generation was from fossil fuels-coal, natural gas, petroleum, and other gases.

- Furthermore, the demand for magnetic materials is increasing in wind power stations. China added more wind generation capacity in the past two years. In 2022, China generated 46% more wind power than Europe by installing more wind power stations. According to the IEA, the onshore wind electricity generation in China registered at 30.9 GW in 2022, and it is expected to reach 59 GW by the end of 2023.

- Thus, the power generation applications segment is anticipated to dominate the market for magnetic materials during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to dominate the global market owing to the highly developed power generation sector in China and India, coupled with continuous investments in the region to advance the electronics and automotive industry through the years.

- Moreover, the growing environmental issues in the Asia-Pacific region have increased government regulations on combustion engine vehicles. This has increased the need for electric cars in the area, supporting the consumption of magnetic materials in various applications.

- In China, the automotive industry is witnessing switching trends as the consumer inclination toward battery-operated vehicles is higher. Moreover, the government of China estimates a 20% penetration rate of electric vehicle production by 2025. This is reflected in the electric vehicle sales trend in the country, which went to a record-breaking high in 2022.

- As per the China Passenger Car Association, the country sold 5.67 million EVs and plug-ins in 2022, almost double the sales figures achieved in 2021. Anticipating a decline in the nation's need for lubricant additives, the market is poised to sustain sales at the current pace.

- Similarly, in India, the focus is shifting to electric vehicles to reduce greenhouse gas emissions. The government has committed that 30% of the new vehicle sales in India will be electric by 2023. Furthermore, various companies are establishing electric vehicle manufacturing facilities in the country to increase the production volume of electric vehicles.

- For instance, in February 2023, Nissan and Renault announced their plan to invest USD 600 million in India over the next 3-5 years to expand their market share in passenger cars and electric vehicles. It will boost the market for electric vehicles, thereby driving the demand for magnetic materials.

- Due to the factors above, the demand for magnetic materials will likely increase in the region during the forecast period.

Magnetic Materials Industry Overview

The magnetic materials market is partially consolidated in nature. Some of the major players in the market (not in any particular order) include Arnold Magnetic Technologies, Daido Steel Co., Ltd, Electron Energy Corporation, PROTERIAL, Ltd., and Lynas Rare Earths Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 The Rising Adaption of Magnetic Materials in Power Generation Industry

- 4.1.2 Increasing Applications in Electronics

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 High Cost in Extracting Rare Earth Materials

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Hard Magnetic Materials

- 5.1.2 Soft Magnetic Materials

- 5.1.3 Semi-Hard Magnetic Materials

- 5.2 End-user Industry

- 5.2.1 Automotive

- 5.2.2 Electronics

- 5.2.3 Power Generation

- 5.2.4 Industrial

- 5.2.5 Other End-user Industries (Consumer Goods, Communication and Technology, etc.)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Adams Magnetic Products

- 6.4.2 Arnold Magnetic Technologies

- 6.4.3 Daido Steel Co., Ltd.

- 6.4.4 Dexter Magnetic Technologies

- 6.4.5 Electron Energy Corporation

- 6.4.6 GKN Powder Metallurgy

- 6.4.7 Lynas Rare Earths Ltd.

- 6.4.8 Molycorp Inc

- 6.4.9 PROTERIAL, Ltd.

- 6.4.10 Quadrant.

- 6.4.11 Shin-Etsu Chemical Co., Ltd.

- 6.4.12 Steward Advanced Materials LLC.

- 6.4.13 TDK Corporation

- 6.4.14 Tengam

- 6.4.15 Toshiba Materials Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Demand for Magnetic Materials in Hybrid Electric Vehicles

- 7.2 Other Opportunities