|

市场调查报告书

商品编码

1689964

下一代网路 -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Next Generation Network - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

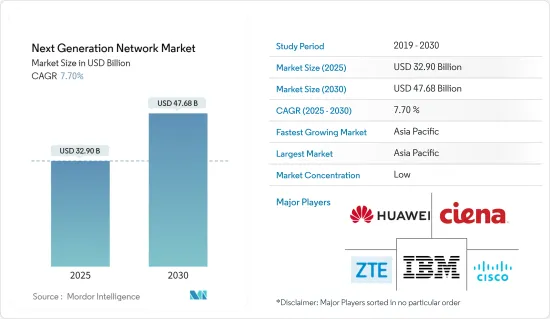

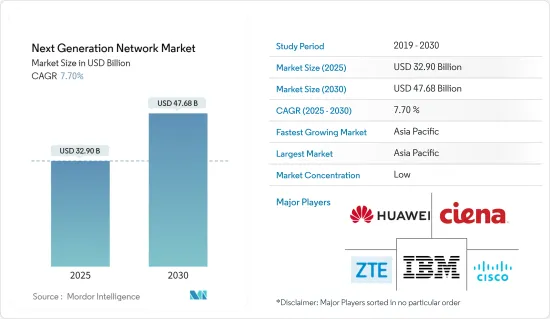

下一代网路市场规模预计在 2025 年为 329 亿美元,预计到 2030 年将达到 476.8 亿美元,在市场估计和预测期(2025-2030 年)内以 7.7% 的复合年增长率增长。

下一代网路是用于电话和资料的基于分组的网路。我们将充分利用众多宽频技术和QoS(服务品质)传输技术,建构先进的通讯系统。这些网路可以在单一平台上处理多种类型的服务/流量,例如语音、视讯、音讯和其他多媒体,从长远来看更具成本效益。

对频宽的需求不断增长,推动着市场的成长。由于串流媒体、游戏、虚拟实境和云端基础的应用程式等活动的增加,资料的生成和资料消费量迅速增长,这给传统网路带来了越来越大的压力,导致速度变慢和拥塞。

此外,全球众多电信业者快速扩大5G部署也刺激了市场成长。下一代通讯网络,即5G,在过去几年中取得了长足的发展,并且还在继续扩展。例如,2023年12月,华为表示,其5.5G智慧封包核心网路网路产品已拥抱下一代行动互联网,支援智慧5.5G核心网路。该公司做出这项改变是为了满足其对 10Gbps 管道和网路智慧日益增长的需求。

软体定义网路正在为下一代变革性政府网路提供动力。随着政府机构意识到使用 SDN 以低成本建立软体定义广域网路 (SD-WAN) 的好处,该网路的发展有望推动市场成长。

然而,这个市场面临许多挑战。其中包括完全遵守和互联互通各种网路标准,包括 IPv4、MPLS、IPv6 和都会乙太网路;按时交付基于分组的软体,满足NGN设备的要求;以及在技术快速发展的市场中跨不同硬体平台的软体投资。所有这些因素预计都会对下一代网路市场的成长构成挑战。

科技环境的快速变化也正在改变服务环境,为下一代服务和疫情后的弹性网路运作铺路。远端部署支援、远端网路营运中心 (NOC) 管理和预测性维护变得至关重要。

下一代网路市场趋势

硬体占很大份额

- 新一代网路 (NGN) 硬体由交换器、路由器、闸道器、伺服器和安全设备组成,旨在支援先进的通讯技术。这些硬体组件可实现宽频化、增强的网路安全性、更快的资料传输以及与物联网、5G和边缘运算等新技术的无缝整合。云端运算 NGN 硬体构成了现代数位基础设施的支柱,促进了跨不同网路的高效可靠通讯。

- 对下一代网路 (NGN) 硬体的需求受到资料流量不断增长、物联网和 5G 等技术发展对频宽、云端迁移不断扩大、安全问题、远端工作和边缘运算的推动。

- NGN 硬体(包括交换器、路由器、伺服器和安全设备)对于跟上指数级资料成长、支援频宽密集型应用程式、确保网路安全、促进云端基础的服务、实现远端伙伴关係关係以及支援边缘运算解决方案至关重要。随着数位领域的扩展,NGN 硬体对于提供可靠、快速且安全的网路基础设施以满足现代连接需求至关重要。

- 此外,扩大5G连线将需要支援更高频宽、更低延迟和更高网路容量的先进交换器、路由器和伺服器,从而推动对NGN硬体的需求。据爱立信称,预计 5G 用户总数将从 2023 年的 15.7 亿增加到 2029 年的 53.3 亿。

- 从地理来看,由于 5G 连接的扩展和市场参与者的产品推出,欧洲预计将实现成长。例如,2023 年 9 月,EE 宣布了其家庭宽频服务的首个未来策略计划,这是其成为英国最以消费者为中心的品牌的雄心壮志的一部分。

- EE 将与 Qualcomm Technologies Inc. 合作,在未来几年推出由 Qualcomm Wi-Fi 7 平台驱动的新型家用硬件,这是向英国各地的客户提供一流家用连接的战略的一部分,使世界上最早的一些客户能够使用下一代 Wi-Fi。此外,市场上的各种供应商正在采取各种策略来提高竞争力,这有望促进该领域的成长。

亚太地区预计将占据主要市场占有率

- 中国、韩国、日本等国家正在快速推进5G和6G基础设施建设,对透过网路视觉化和软体定义网路(SDN)等功能支援网路优化的下一代解决方案的需求日益增长。

- 下一代网路市场的成长得益于不同地区的国家透过更新其网路基础设施来实现其数位化目标的努力。例如,2023年9月,韩国政府宣布「K-Network 2030」计划,推动公私合作研发下一代网路、卫星通讯、量子通讯等。该计划还旨在加强基于软体的网路的创新和供应链。

- 日本正在快速开发和投入实用化基于光纤技术的下一代网络,目标是建立面向未来通讯的光纤核心网络。 2023 年 6 月,NTT 和富士通合作进行试验,旨在日本开发下一代光纤核心网路。富士通先进的光纤传输平台1FINITY超光系统已被NTT采用为支援其网路扩展计划的检验系统。

- 通讯公司已开始提供下一代网路服务,透过将电讯号转换为光讯号并处理快速增长的网路流量,降低功耗并实现大容量通讯。 2023年3月,日本电信业者日本电报电话株式会社(NTT)透露,其基于光学技术的下一代网路计画下的首批面向企业客户的服务现已推出。

- 电讯营运商和互联网服务供应商正在亚太地区迅速推出 5G 网络,并大力投资基础设施升级,以部署能够支援广泛应用和服务的高速、低延迟网络,从而推动对下一代网路解决方案的需求。

下一代网路产业概览

新一代网路市场高度分散,主要参与者包括Cisco、华为技术、中兴通讯、Ciena 和 IBM 等。市场参与者正在采取收购和伙伴关係等策略来获得永续的竞争优势并增强其产品供应。

2023年12月,华为宣布5.5G智慧封包核心网路网,拥抱下一代行动互联网,支撑智慧5.5G核心网。该公司做出这项改变是为了满足其对 10Gbps 管道和网路智慧日益增长的需求。

2023 年 9 月 - 诺基亚推出全新 7730 服务互连路由器 (SXR) 产品系列,扩展其 IP 路由器产品组合。它为先进的 IP 存取和聚合网路带来了客户所依赖的诺基亚 IP 边缘和核心服务路由器的效能、保证、安全性和永续性。新平台的规模和功能非常适合小型分散式 IP 边缘位置,满足宽频投资和云端网路架构发展所推动的对容量和功能日益增长的需求。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 市场驱动因素

- 高速服务需求不断成长

- 市场限制

- 基础设施成本高

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19对下一代网路市场的影响

第五章市场区隔

- 按产品

- 硬体

- 软体

- 按服务

- 按最终用户

- 电信和网际网路服务供应商

- 政府

- 其他最终用户

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第六章 竞争格局

- 公司简介

- Cisco Systems, Inc.

- Huawei Technologies Co., Ltd.

- ZTE Corporation

- Ciena Corporation

- IBM Corporation

- Samsung Electronics Co., Ltd.

- NEC Corporation

- Juniper Networks, Inc.

- Nokia Corporation

- Telefonaktiebolaget LM Ericsson

第七章投资分析

第八章:市场的未来

The Next Generation Network Market size is estimated at USD 32.90 billion in 2025, and is expected to reach USD 47.68 billion by 2030, at a CAGR of 7.7% during the forecast period (2025-2030).

A next-generation network is a packet-based network used for telephony and data. It uses numerous broadband and quality of services (QoS) transport technologies to create advanced communication systems. These networks are capable of handling multiple types of services/traffic, such as voice, video, audio, and other multimedia, in a single platform and are cost-effective in the long run.

The increasing need for bandwidth is driving market growth. Data generation and consumption are increasing rapidly due to the increased activities such as streaming, gaming, virtual reality, and cloud-based applications, increasing strain on traditional networks and leading to slowdowns and congestion.

The rapid growth in rolling out of 5G from numerous telecom companies globally also adds to the market growth. The next generation of telecom networks, or 5G, has grown significantly in the past few years and continuously expands. For instance, in December 2023, Huawei stated that its 5.5G Intelligent Packet Core Network offering had accepted the Next-Generation Mobile Internet to support an intelligent 5.5G core network. The company has made these changes in response to the rising necessity for 10 Gbps pipes and network intelligence.

Software-defined networks are powering the next generation of government networks undergoing transformation. As government agencies are realizing the benefits of using SDN to build software-defined wide-area networks (SD-WAN) at lower cost, the development of this network is anticipated to drive market growth.

However, the market is facing many challenges, such as complete compliance and inter-networking with a broad range of IPv4, MPLS, IPv6, metro Ethernet, and networking standards, on-time delivery of packet-based software to address requirements for NGN equipment, software investments across diverse hardware platforms in the rapid technologically evolving market. All these factors are expected to challenge the growth in the next-generation network market.

The rapid change in the technology landscape is also transforming the services landscape, paving the way for next-generation services and resilient network operations post-pandemic. Remote deployment support, remote Network Operations Center (NOC) management, and predictive maintenance are becoming a necessity.

Next Generation Network Market Trends

Hardware Offering Holds Significant Market Share

- Next-generation network (NGN) hardware comprises switches, routers, gateways, servers, and security devices designed to assist advanced communication technologies. These hardware components allow higher bandwidth capabilities, enhanced network security, faster data transmission, and seamless integration with emerging technologies like IoT, 5G, and edge computing. Cloud computing NGN hardware forms the backbone of modern digital infrastructure, easing efficient and reliable communication across diverse networks.

- The demand for next-generation network (NGN) hardware is driven by growing data traffic, higher bandwidth requirements for developing technologies, including IoT and 5G, growing cloud migration, security concerns, remote work, and edge computing.

- NGN hardware, including switches, routers, servers, and security devices, is essential for handling the surge in data volume, supporting bandwidth-intensive applications, ensuring network security, facilitating cloud-based services, enabling remote partnerships, and powering edge computing solutions. As the digital landscape grows, NGN hardware is critical in providing reliable, high-speed, and secure networking infrastructure to meet modern connectivity demands.

- Moreover, the growing 5G connectivity fuels demand for NGN hardware by requiring advanced switches, routers, and servers to assist higher bandwidth, low latency, and increased network ability. According to Ericsson, the total number of 5G subscriptions is expected to increase from 1.57 billion in 2023 to 5.33 billion by 2029.

- Based on region, Europe is expected to grow due to growing 5G connectivity and developments by market players such as product launches. For instance, in September 2023, EE launched the initial of its future strategic strategies for its home broadband service as part of its goal to become the United Kingdom's most individual customer-focused brand.

- Collaborating with Qualcomm Technologies Inc., EE will roll out novel in-home hardware in the coming years that will feature Qualcomm Wi-Fi 7 platforms as part of its strategies to provide best-in-class home connectivity to clients throughout the UK, allowing them to be among the first in the globe to get admittance to the next generation of Wi-Fi. Further, various vendors in the market are involved in different strategies for a competitive edge, which is expected to drive the segment growth.

Asia-Pacific is Expected to Hold Significant Market Share

- The rapid growth in the development of 5G and 6G infrastructure in countries such as China, South Korea, and Japan is expected to drive market growth, creating the need for next-generation solutions as they help in network optimization through features such as network visualization, software-defined networking (SDN), etc.

- The next-generation network market growth is supported by the initiatives taken in various regional countries to meet digital goals by updating network infrastructures. For instance, in September 2023, the South Korean government announced the nation's K-Network 2030 program to promote cooperation between the public and private sectors in the R&D of next-generation networks, satellite communications, and quantum communications. Also, the program targets innovation in software-based networks and strengthening supply chains.

- The optical technology-based next-generation networks are rapidly being developed and implemented in Japan to establish optical core networks for the future of communication. In June 2023, NTT Corporation and Fujitsu partnered to conduct trials aimed at developing their next-generation optical core network in the country. Fujitsu's advanced optical transport platform, the "1FINITY Ultra Optical System," was selected as a verification system to support NTT's network expansion plans.

- Telecom companies started offering next-generation network services to reduce energy consumption and achieve high-capacity communication by converting electric signals into optical ones and catering to surging network traffic. In March 2023, Nippon Telegraph and Telephone Corp. (NTT), a Japan-based telecom company, revealed the availability of its first services to its corporate clients under an optical technology-based next-generation network initiative.

- The telecom and internet service providers are rapidly rolling out 5G networks in the Asia-Pacific and investing heavily in infrastructure upgrades to deploy high-speed, low-latency networks that can support a broad range of applications and services, driving the need for next-generation network solutions.

Next Generation Network Industry Overview

The next-generation network market is highly fragmented, due to the presence of major players like Cisco Systems Inc., Huawei Technologies Co. Ltd, ZTE Corporation, Ciena Corporation, and IBM Corporation. Market players are adopting strategies like acquisitions and partnerships to gain sustainable competitive advantage and enhance their product offerings.

December 2023 - Huawei stated that its 5.5G Intelligent Packet Core Network offering had accepted the Next-Generation Mobile Internet to support an intelligent 5.5G core network. The company has made these changes in response to the rising necessity for 10 Gbps pipes and network intelligence.

September 2023 - Nokia expanded its IP router portfolio by introducing the new 7730 Service Interconnect Router (SXR) product family, which brings the service router performance, assurance, security, and sustainability customers rely on from Nokia at the IP edge and core into advanced IP access and aggregation networks. The new platforms' scale and capabilities make them suitable for smaller/distributed IP edge locations, which addresses the increased capacity and capability demands driven by broadband investments and developing cloud network architectures.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand for High-Speed Services

- 4.3 Market Restraints

- 4.3.1 High Costs Related to the Infrastructure

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Impact of COVID-19 on the Next-generation Network Market

5 MARKET SEGMENTATION

- 5.1 By Offering

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By End User

- 5.2.1 Telecom and Internet Service Providers

- 5.2.2 Government

- 5.2.3 Other End-users

- 5.3 By Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Cisco Systems, Inc.

- 6.1.2 Huawei Technologies Co., Ltd.

- 6.1.3 ZTE Corporation

- 6.1.4 Ciena Corporation

- 6.1.5 IBM Corporation

- 6.1.6 Samsung Electronics Co., Ltd.

- 6.1.7 NEC Corporation

- 6.1.8 Juniper Networks, Inc.

- 6.1.9 Nokia Corporation

- 6.1.10 Telefonaktiebolaget LM Ericsson