|

市场调查报告书

商品编码

1537621

工业离心机:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Industrial Centrifuges - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

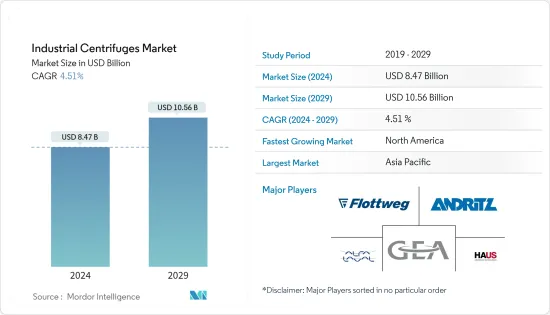

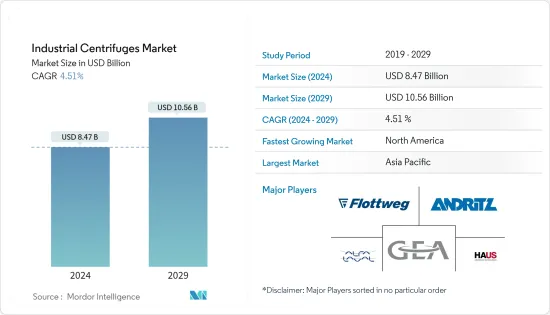

预计2024年全球工业离心机市场规模将达84.7亿美元,2024-2029年预测期间复合年增长率为4.51%,2029年将达到105.6亿美元。

从长远来看,化学工业需求的增加预计将刺激工业离心机的成长。化学和製造业投资的增加预计将推动市场成长。

另一方面,离心机的高资本成本和技术缺陷预计将阻碍预测期内的市场成长。

然而,随着能源使用既成为成本问题又成为长期环境问题的趋势日益明显,工业过程的各个阶段对节能离心机的需求不断增长。因此,根据客户对能源来源需求的增加和能源消耗的减少,离心机的技术进步预计将在预测期内为市场参与者创造充足的机会。

亚太地区可能会主导市场,并预计在预测期内保持最高的复合年增长率。这一成长是由加工食品、製药和污水处理行业的投资和需求增加所推动的。

工业离心机市场趋势

化学工业主导市场

- 在化学工业中,工业离心机是重要的工具,具有多种用途,有助于提高各种製程的效率和品质。主要应用之一是从混合物中分离化学品,这是化学品製造的基本过程。

- 工业离心机在化学工业中的另一个重要角色是澄清和精製。离心机通过去除杂质、污染物或不需要的颗粒来澄清和精製化学溶液。工业离心机根据分子量和粒度等物理特性分离不同的成分,有助于化学产品的精製。

- 化工离心分离技术也随着化学工业的快速发展而不断增加。例如,2023 年 3 月,GEA订单化学集团 Albemarle 的安装离心机的订单。两台离心机套装的订单价值约为2555万美元。具体来说,我们将为每个炼油厂的生产线提供四种类型的离心机:卧螺离心机、筛螺旋离心机、推料离心机和削皮离心机。

- 化学工业在全球经济和供应链网路中发挥重要作用。根据美国工业理事会统计,2022年全球工业工业总收入达5.72兆美元。 2022年,化学工业收益达到近15年来的最高水准。

- 全球各行业(包括製药、农业和製造业)对化学品的需求不断增长,正在推动基础设施投资,以满足不断增长的生产需求。例如,2023年9月,四川禾方生物科技有限公司宣布巨额投资8亿美元,在爪哇综合工业港园区(JIIPE)内建造化学生产设施。工程完成后,预计形成年产60万吨碳酸钠、氯化铵、20万吨Glyphosate的生产能力。

- 随着化学品处理能力的增加,对离心机等分离和精製技术的需求不断增长,以处理更大量的化学品并确保产品品质和纯度。因此,离心机製造商将从全球工业产业不断扩大的商机中受益。

- 由于这些因素,在预测期内,化学工业对工业离心机的需求将增加,以满足化学品的製造和生产量。

亚太地区将在预测期内主导市场

- 由于中国的化学与製造、製药和污水处理行业的需求量最大,亚太地区是成长最快的离心机市场之一。此外,由于人口快速成长和工业扩张,印度、印尼和马来西亚等南亚国家的电力需求迅速增加。

- 中国是世界第二大经济体,也是电力、医药、化学、製造、食品饮料等多个产业的领先国家之一。由于这些因素,中国在全球工业离心机市场中占有很大份额。

- 以GDP计算,中国是世界第二大经济体。 2023年,国内生产毛额达到17.66兆美元。随着人口老化和经济从製造业转向服务业、从外需转向内需、从投资转向消费的再平衡,国家成长逐渐下滑。

- 中国国家能源局(NEA)正在考虑是否有可能在本十年内加大国家清洁能源计画的雄心壮志。国家能源局提案,2030年,中国40%的电力来自核能和可再生能源,目标是2030年核能发电达到120至150吉瓦。这些政府政策和目标预计将支持该国未来几年的核能发电厂开拓,并为工业离心机市场创造重大机会。

- 同样,由于各行业的开发活动不断增加,印度成为亚太地区最大的工业离心机市场之一。

- 印度石化业务投资取得进展,工业离心机需求预计将增加。例如,2024 年 4 月,Chatterjee Group (TCG) 宣布计划与控股石化公司 Haldia Petrochemicals Ltd (HPL) 以及本地和全球公司合作,在印度南部建造一个价值超过 100 亿美元的计划。这家私募股权公司正计划在泰米尔纳德邦古达洛尔建设一个石油化工计划,从 2028 年到 2029 年,每年可生产 350 万吨乙烯和丙烯。

- 亚太地区的精製产业在过去十年中显着成长,工业离心机在精製过程中发挥至关重要的作用。根据《世界能源数据统计回顾》,2022年亚太地区炼油产能为36,189,000桶/日,较2013年成长8.9%。由于未来几年将推出许多计划,因此在预测期内,这一数字将大幅上升。

- 因此,亚太地区各个最终用户产业的需求正在增加,亚太地区可能在预测期内引领市场。

工业离心机的产业概况

全球工业离心机市场适度分散。市场上的主要企业(排名不分先后)包括 Andritz AG、HAUS Centrifuge Technologies、Alfa Laval AB、GEA Group 和 Flottweg SE。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 市场规模/需求预测,美元,~2029

- 最新趋势和发展

- 政府法规政策

- 市场动态

- 促进因素

- 各个最终用户产业的需求不断增长

- 抑制因素

- 资本和营运成本上升

- 促进因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 类型

- 沉淀

- 澄清/浓缩离心机

- 卧螺离心机

- 碟片离心机

- 水力旋流器

- 其他沉降离心机

- 过滤

- 篮式离心机

- 涡旋筛离心机

- 剥离式离心机

- 推料离心机

- 其他过滤离心机

- 沉淀

- 设计

- 水平离心机

- 直立式离心机

- 操作方式

- 批次

- 连续的

- 产业

- 食品/饮料

- 製药

- 用水和污水处理

- 化学

- 金属/矿业

- 电力

- 纸浆/造纸製造

- 其他行业

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 西班牙

- 俄罗斯

- 北欧的

- 土耳其

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 智利

- 哥伦比亚

- 南美洲其他地区

- 中东/非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 卡达

- 南非

- 奈及利亚

- 埃及

- 其他中东/非洲

- 北美洲

第六章 竞争状况

- 併购、合资、联盟和协议

- 主要企业策略

- 公司简介

- MSE Hiller

- Andritz AG

- Alfa Laval AB

- GEA Group AG

- Multotec Pty Ltd

- Thomas Broadbent & Sons Ltd

- Flottweg SE

- Ferrum Ltd

- HAUS Centrifuge Technologies

- 市场占有率分析

第七章市场机会与未来趋势

- 节能工业离心机的需求不断增长

The Industrial Centrifuges Market size is estimated at USD 8.47 billion in 2024, and is expected to reach USD 10.56 billion by 2029, growing at a CAGR of 4.51% during the forecast period (2024-2029).

Over the long term, the growing demand from the chemical industry is expected to stimulate the growth of industrial centrifuges. Increasing investments in the chemical and manufacturing industry are expected to drive the growth of the market.

On the other hand, centrifuges' high capital costs and technical drawbacks are expected to hamper the growth of the market during the forecast period.

However, there is increased demand for energy-efficiency centrifuges in every step of the industrial process, with the growing trend that energy used is both a cost and a long-term environmental issue. Hence, depending on the energy sources and increased customer need for lower energy consumption, technical advancements in centrifuges are expected to create ample opportunities for the market players during the forecast period.

Asia-Pacific will likely dominate the market and is expected to register the highest CAGR during the forecast period. This growth is attributed to the increasing investments and demands from the processed food, pharmaceutical, and wastewater treatment industries.

Industrial Centrifuges Market Trends

The Chemical Industry to Dominate the Market

- In the chemical industry, industrial centrifuges are indispensable tools with many applications that contribute to the efficiency and quality of various processes. One primary application lies in separating chemicals from mixtures, a fundamental process in chemical manufacturing.

- Another critical role of industrial centrifuges in the chemical industry is clarification and purification. They clarify and purify chemical solutions by removing impurities, contaminants, or unwanted particles. Industrial centrifuges aid in refining chemical products by separating different components based on their physical properties, such as molecular weight or particle size.

- Chemical centrifuges' separation technology has also increased with the chemical industry's rapid development. For instance, in March 2023, GEA received an order from the chemical group Albemarle to install centrifuges. The order value for the two centrifuge packages is approximately USD 25.55 million. Specifically, GEA is going to supply four different types of centrifuges: decanter centrifuges, screen screw centrifuges, pusher centrifuges, and peeler centrifuges, and for the processing lines of each refinery.

- The chemical industry plays a significant role in the global economy and supply chain network. According to the American Chemistry Council, in 2022, the chemical industry's total worldwide revenue stood at USD 5.72 trillion. In 2022, the chemical industry revenue reached the highest value in the last 15 years.

- Rising global demand for chemicals across various industries, including pharmaceuticals, agriculture, and manufacturing, is prompting investments in infrastructure to meet increasing production needs. For instance, in September 2023, Sichuan Hebang Biotechnology Co. announced a significant investment of USD 800 million to establish a chemical production facility within the Java Integrated Industrial and Port Estate (JIIPE). Upon completion, the facility is expected to achieve an annual production capacity of 600,000 tons of sodium carbonate and ammonium chloride, with a glyphosate production capacity estimated at 200,000 tons.

- As chemical processing capacities grow, there is a greater need for separation and purification technologies like centrifuges to handle larger volumes of chemicals and ensure product quality and purity. As a result, centrifuge manufacturers stand to benefit from the growing opportunities in the global chemical industry.

- Owing to this factor, the demand for industrial centrifuges in the chemical sector will increase during the forecast period to meet the manufacturing and production quantities of chemicals.

Asia-Pacific to Dominate the Market During the Forecast Period

- Asia-Pacific is one of the fastest growing centrifuges markets, owing to the presence of China, which has one of the highest demands from the chemical and manufacturing, pharmaceutical, and wastewater treatment industries. Additionally, the electricity demand is growing rapidly in South Asian countries like India, Indonesia, and Malaysia due to a surge in population and industrial expansion.

- China is the second largest economy globally and one of the leaders in numerous power, pharmaceutical, chemical, manufacturing, food, and beverage industries. Due to these factors, China accounts for a significant share of the global industrial centrifuges market.

- In terms of GDP, China is the second-largest economy in the world. In 2023, the country's GDP reached USD 17.66 trillion. The growth in the country is gradually diminishing as the aging population, manufacturing to services, and external to internal demand, and the economy is rebalancing from investment to consumption.

- China's National Energy Administration (NEA) is examining the possibility of increasing the ambition of the country's clean energy programs this decade. The NEA proposes that China obtain 40% of its electricity from nuclear and renewable sources by 2030 and set its nuclear capacity target to 120-150 gigawatts by 2030. Such government policies and targets aid the country's development of nuclear power plants in the coming years and are anticipated to provide significant opportunities for the industrial centrifuges market.

- Similarly, India is one of the largest markets for industrial centrifuges in Asia-Pacific, owing to the increasing development activities in various industries.

- India is also investing in its petrochemical business, which is anticipated to create a rising demand for industrial centrifuges. For instance, in April 2024, the Chatterjee Group (TCG) announced plans to partner with local and global companies with its majority-owned petrochemical firm Haldia Petrochemicals Ltd (HPL) to build a more than USD 10 billion project in southern India. The private equity firm plans to make the oil-to-chemical project, capable of producing 3.5 million metric tons per year of ethylene and propylene, at Cuddalore in Tamil Nadu from 2028 to 2029.

- The refinery sector of Asia-Pacific has risen significantly over the last 10 years, and industrial centrifuge is vitally used during the refinery process. According to Statistical Review of World Energy Data, in 2022, the refinery capacity of Asia-Pacific was 36,189 thousand barrels daily, increased by 8.9 % compared to 2013. The number rises significantly during the forecast period, as many projects will start in the coming years.

- Therefore, with increasing demand from various end-user industries in the region, Asia-Pacific will likely be a market leader during the forecast period.

Industrial Centrifuges Industry Overview

The global industrial centrifuges market is moderately fragmented. Some of the major players in the market (in no particular order) include Andritz AG, HAUS Centrifuge Technologies, Alfa Laval AB, GEA Group, and Flottweg SE.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Demand from Various End-user Industries

- 4.5.2 Restraints

- 4.5.2.1 Higher Capital and Operational Cost

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Sedimentation

- 5.1.1.1 Clarifier/Thickener Centrifuges

- 5.1.1.2 Decanter Centrifuges

- 5.1.1.3 Disc Stack Centrifuges

- 5.1.1.4 Hydrocyclones

- 5.1.1.5 Other Sedimentation Centrifuges

- 5.1.2 Filtering

- 5.1.2.1 Basket Centrifuges

- 5.1.2.2 Scroll Screen Centrifuges

- 5.1.2.3 Peeler Centrifuges

- 5.1.2.4 Pusher Centrifuges

- 5.1.2.5 Other Filtering Centrifuges

- 5.1.1 Sedimentation

- 5.2 Design

- 5.2.1 Horizontal Centrifuges

- 5.2.2 Vertical Centrifuges

- 5.3 Operation Mode

- 5.3.1 Batch

- 5.3.2 Continuous

- 5.4 Industry

- 5.4.1 Food and Beverages

- 5.4.2 Pharmaceutical

- 5.4.3 Water and Wastewater Treatment

- 5.4.4 Chemical

- 5.4.5 Metal and Mining

- 5.4.6 Power

- 5.4.7 Pulp and Paper

- 5.4.8 Other Industries

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 France

- 5.5.2.3 United Kingdom

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 NORDIC

- 5.5.2.8 Turkey

- 5.5.2.9 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Malaysia

- 5.5.3.7 Thailand

- 5.5.3.8 Indonesia

- 5.5.3.9 Vietnam

- 5.5.3.10 Rest of the Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Chile

- 5.5.4.4 Colombia

- 5.5.4.5 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Qatar

- 5.5.5.4 South Africa

- 5.5.5.5 Nigeria

- 5.5.5.6 Egypt

- 5.5.5.7 Rest of the Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 MSE Hiller

- 6.3.2 Andritz AG

- 6.3.3 Alfa Laval AB

- 6.3.4 GEA Group AG

- 6.3.5 Multotec Pty Ltd

- 6.3.6 Thomas Broadbent & Sons Ltd

- 6.3.7 Flottweg SE

- 6.3.8 Ferrum Ltd

- 6.3.9 HAUS Centrifuge Technologies

- 6.4 Market Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Demand for the Energy-efficient Industry Centrifuges