|

市场调查报告书

商品编码

1683451

北美工业离心机市场:市场占有率分析、行业趋势和成长预测(2025-2030 年)North America Industrial Centrifuge - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

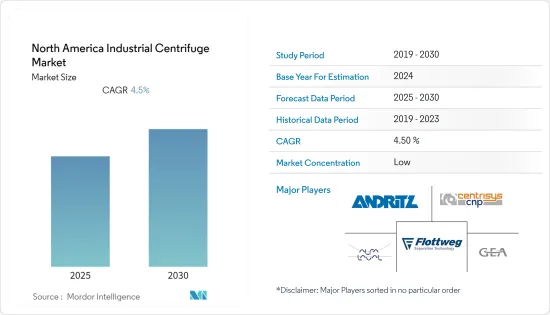

预计预测期内北美工业离心机市场复合年增长率将达到 4.5%。

2020 年,新冠疫情对市场产生了负面影响。目前市场已恢復至疫情前的水准。

关键亮点

- 从中期来看,该地区对製药和生物技术行业扩张的投资增加预计将推动离心机的需求。

- 然而,高昂的营运和维护成本预计会阻碍市场成长。

- 增加技术投资以生产节能、降噪的离心机预计将为鼓风机市场创造重大机会。

由于行业数量的增加和人口的庞大,预计美国将在预测期内占据市场主导地位。

北美工业离心分离机市场趋势

水和污水处理预计将成为成长最快的市场领域

- 工业离心机是一种分离流体和颗粒的设备。离心机利用旋转力产生比地球引力大数百至数千倍的力。离心分离机广泛用于汽车工业(可溶性油)、钢铁厂和农业食品产业的污水处理。应用包括萃取含有富油污泥的悬浮液。

- 在石油和天然气作业中,原油、天然气和水在生产后被分离。政府对处理水处理的严格监管预计将促进北美工业离心机市场的发展。随着该地区原油产量的增加,预计预测期内工业离心机的需求将会增加。

- 该地区 2021 年的原油总产量为 10.747 亿吨 (MT),高于 2020 年的 105,870 吨。原油产量的增加预计也将导致使用工业离心机的污水处理增加。

- 2023 年 3 月,Biigtigong Nishnaabeg 宣布建造新的原水取水和处理设施。该计划是透过 Biigtigong Nishnaabeg 和加拿大原住民服务部 (ISC) 的合作实现的。一旦建成,预计将为住宅、行政办公室、学校、教师宿舍、卫生中心、社区中心和日託中心等非住宅建筑提供安全、干净的饮用水。新厂计划于2024年11月投产,耗资约5,800万美元。

- 因此,预计预测期内水和污水处理领域将成为北美工业离心机市场中成长最快的市场。

预计美国将主导市场

- 预计北美工业离心机市场将由美国主导,这主要归因于该国能源需求的持续增长以及商业和工业活动的增加。

- 此外,美国透过其加工食品产业在全球经济中发挥关键作用,该产业积极参与外国直接投资和出口。全球前50家食品和饮料加工公司中超过33%的总部位于美国。

- 2021年,美国表现出压倒性的地位,约占北美初级能源消费量的81.76%。美国能源消耗份额的不断上升预计将对电力和化学工业产生重大影响,而这两项工业正在推动美国工业离心机市场的成长。

- 2023 年 1 月,Thirumalai Chemicals Limited(TCL)的子公司 TCL Specialties LLC(TCLS)宣布将在西维吉尼亚马歇尔县破土动工兴建两个製造地。一个是生产食品原料(苹果酸、富马酸)的工厂,另一个是生产顺丁烯二酸酐的工厂。该专案预计于 2023 年 1 月开工,并于 2024 年中期开始生产。

- 鑑于上述情况,预计美国将在预测期内主导北美工业离心机市场。

北美工业离心机产业概况

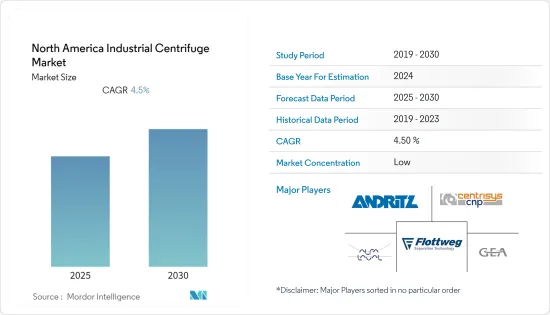

北美工业离心机市场适度细分。该市场的一些主要企业包括(不分先后顺序)Alfa Laval AB、Andritz AG、GEA Group AG、Centrisys Corporation 和 Flottweg SE。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 2028 年市场规模与需求预测(十亿美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场区隔

- 类型

- 沉淀

- 滤

- 设计

- 水平离心机

- 直立式离心机

- 操作模式

- 批次

- 常规使用

- 产业

- 饮食

- 药品

- 用水和污水处理

- 化学

- 金属与矿业

- 力量

- 纸浆和造纸

- 其他的

- 地区

- 美国

- 加拿大

- 北美其他地区

第六章 竞争格局

- 合併、收购、合作及合资

- 主要企业策略

- 公司简介

- Alfa Laval AB

- Andritz AG

- Hiller Separation & Process GmbH

- GEA Group AG

- Acutronic USA Inc

- Centrisys Corporation

- Centrifuges Unlimited Inc.

- Flottweg SE

- CentraSep Technologies Inc.

第七章 市场机会与未来趋势

The North America Industrial Centrifuge Market is expected to register a CAGR of 4.5% during the forecast period.

COVID-19 negatively impacted the market in 2020. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the medium term, the increasing investment in increasing industries in pharmaceuticals and biotechnology in the region is expected to increase the demand for the centrifuge market.

- On the other hand, high operations and maintenance costs are expected to hinder market growth.

- Nevertheless, the increasing technological investments in the market to produce energy- and sound-efficient centrifuges are expected to create huge opportunities for the blower market.

The United States is expected to dominate the market during the forecasted period due to its increasing number of industries and large populations.

North America Industrial Centrifuge Market Trends

Water and Wastewater Treatment Expected to be the Fastest Growing Market Segment

- An industrial centrifuge is an equipment that separates fluids or particles. Centrifuges use rotational force to generate hundreds or thousands of times the gravity of the Earth. Centrifuges are widely used to treat wastewater from the automotive industry (soluble oils), steel mills, and agri-food sectors. The application also includes the extraction of high-oil-content, sludge-laden suspensions.

- The oil and gas business separates crude oil, natural gas, and water after production. A stringent government regulation governing the disposal of treated water is expected to push the North American industrial centrifuge market. With the increasing crude oil production in the region, the demand for industrial centrifuges is expected to increase during the forecasted period.

- The total crude oil produced in the region in 2021 was 1074.7 million metric tons (MT), which was greater than the 1058.7 MT produced in 2020. The increase in crude oil output is also likely to increase wastewater treatment using industrial centrifuges.

- In March 2023, Biigtigong Nishnaabeg announced the construction of a new raw water intake and treatment facility. This initiative was created in collaboration with Biigtigong Nishnaabeg and Indigenous Services Canada (ISC). When completed, it is expected to provide safe, clean drinking water for homes and non-residential structures such as the administration office, schools, teacherage, health centers, community centers, and nurseries. The new plant is likely to open in November 2024 and cost roughly USD 58 million.

- Hence, owing to the above points, the water and wastewater treatment segment is likely going to be the fastest-growing market for the North American industrial centrifuge market during the forecast period.

United States Expected to Dominate the Market

- North America's leading market for industrial centrifuges is expected to be the United States, primarily due to the country's continuously growing energy demand and increasing commercial and industrial activities.

- Moreover, the United States plays a crucial role in the global economy through its processed food industry, which is actively involved in both foreign direct investment and exports. Over 33% of the world's top 50 food and beverage processing companies are based in the United States.

- In 2021, the United States dominated North America's primary energy consumption, accounting for approximately 81.76% of the total energy consumption. This rising share of energy consumption in the country is expected to significantly impact the power and chemical industries, which are the driving forces behind the growth of the industrial centrifuge market in the United States.

- In January 2023, TCL Specialties LLC (TCLS), a subsidiary of Thirumalai Chemicals Limited (TCL), announced that two manufacturing sites in Marshall County, West Virginia, would break ground. One plant produces food ingredients (malic and fumaric acids), while the other produces maleic anhydride. Construction on the site was expected to begin in January 2023, with production set to begin in mid-2024.

- Hence, owing to the above points, the United States is expected to dominate the North American industrial centrifuge market during the forecast period.

North America Industrial Centrifuge Industry Overview

The North American industrial centrifuge market is moderately fragmented. Some of the key players in this market include (in no particular order) Alfa Laval AB, Andritz AG, GEA Group AG, Centrisys Corporation, and Flottweg SE.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Sedimentaion

- 5.1.2 Filtering

- 5.2 Design

- 5.2.1 Horizontal Centrifuge

- 5.2.2 Vertical Centrifuge

- 5.3 Operation Mode

- 5.3.1 Batch

- 5.3.2 Continuous

- 5.4 Industry

- 5.4.1 Food and Beverage

- 5.4.2 Pharmaceutical

- 5.4.3 Water and Wastewater Treatment

- 5.4.4 Chemical

- 5.4.5 Metal and Mining

- 5.4.6 Power

- 5.4.7 Pulp and Paper

- 5.4.8 Other Industries

- 5.5 Geography

- 5.5.1 United States

- 5.5.2 Canada

- 5.5.3 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Collaboration and Joint Ventures

- 6.2 Strategies Adopted by Key Players

- 6.3 Company Profiles

- 6.3.1 Alfa Laval AB

- 6.3.2 Andritz AG

- 6.3.3 Hiller Separation & Process GmbH

- 6.3.4 GEA Group AG

- 6.3.5 Acutronic USA Inc

- 6.3.6 Centrisys Corporation

- 6.3.7 Centrifuges Unlimited Inc.

- 6.3.8 Flottweg SE

- 6.3.9 CentraSep Technologies Inc.