|

市场调查报告书

商品编码

1690704

电子束固化涂料:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Electron Beam Curable Coating - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

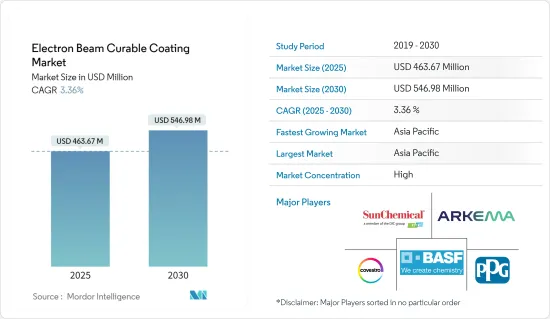

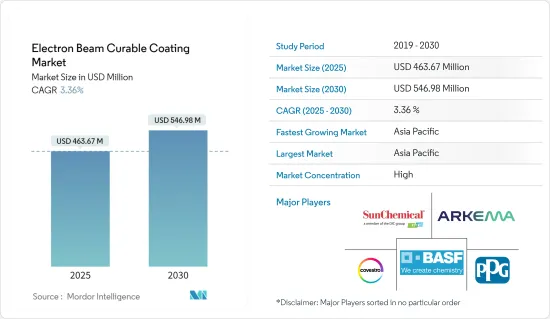

电子束固化涂料市场规模预计在 2025 年为 4.6367 亿美元,预计到 2030 年将达到 5.4698 亿美元,预测期内(2025-2030 年)的复合年增长率为 3.36%。

COVID-19 疫情阻碍了电子束固化涂料市场的发展。多个国家实施了全国封锁和严格的社交隔离措施,影响了航太、电气电子、汽车和包装等终端用户产业,从而衝击了市场。然而,在限制解除后,由于包装、电气和电子行业的需求復苏,市场实现了显着的成长率。

关键亮点

- 包装行业产品需求的不断增长以及航太行业产品的日益普及预计将推动电子束固化涂料市场的发展。

- 电子束固化涂料的高製造成本预计会阻碍市场的成长。

- 预计电动车领域需求的不断增长将在 2024 年至 2029 年期间为市场创造机会。

- 亚太地区已成为主导市场。此外,由于终端用户产业不断扩大的需求,该地区预计将在 2024 年至 2029 年期间实现最高的复合年增长率。

电子束固化涂料市场趋势

包装产业需求不断成长

- 电子束固化涂层广泛应用于软包装应用,因为它是一种清洁、快速且节能的製程。由于人口增长、对永续性的兴趣日益浓厚、近期趋势中的消费能力不断增强以及对智慧包装的需求不断增加,对包装解决方案的需求最近有所增加。

- 健康和安全已成为许多企业的首要任务,导致食品和消费品製造商对保护性和防篡改包装的需求增加。保护性和防篡改包装可使公司提高其当前包装的安全性,并允许消费者快速识别产品是否已被破坏或篡改。

- 此外,随着数位化浪潮的兴起和电子商务产业的快速成长,全球包装产业也正在经历快速成长。据印度包装协会称,印度的包装消费量在过去十年中成长了200%,预计到2025年将达到2,048.1亿美元。

- 此外,由于德国国内电子商务的大幅成长和海外出口的成长,德国包装产业正在经历快速成长。此外,人们对包装食品和饮料的日益增长的偏好也推动了包装行业的发展。

- 在英国,改进的设计和技术创新,加上转向使用可回收材料的包装,预计将为市场成长提供许多机会。预计这将扩大将新产品推向市场的可能性。英国包装製造业的年营业额为110亿英镑(约136亿美元)。根据政府数据,该国每年使用超过 200 万吨塑胶包装(一个主要产品部分)。

- 在美国,食品和饮料市场的成长正在推动该国的包装市场的发展。根据产业报告,预计 2024 年食品业收益将达到 11,097 亿美元。预计收益复合年增长率将超过 3.81%(2024-2028 年),到 2028 年市场规模将达到 11737.4 亿美元。预计这将增加包装产业对电子束固化被覆剂的需求,从而在 2024-2029 年期间推动市场发展。

- 因此,上述因素以及近期包装产业的成长预计将在 2024-2029 年期间推动电子束固化被覆剂的市场需求。

亚太地区可望主导市场

- 预计亚太地区将在 2024 年至 2029 年期间主导电子束固化涂料市场。中国、印度和日本预计将推动该地区对电子束固化涂料的需求。

- 电子束固化涂层因其独特的优势而广为人知和青睐,例如室温固化、色盲固化,且显着减少了基板和多维基材的基板。这为加速符合运输业汽车轻量化标准的新流程提供了机会。中国是世界最重要的汽车生产基地。预计2023年汽车总产量将达到30,160,966辆,较去年的27,020,615辆成长11.6%。根据国际贸易管理局(ITA)预测,2025年国内汽车产量将达3,500万辆。

- 中国包装工业是世界重要的包装工业之一。该国的包装产业预计将会成长。中国政府的一份报告预测,到 2025 年,该产业的价值将达到 2 兆元(2,900 亿美元)。

- 在印度,包装是该国第五大产业,也是成长最快的产业之一。过去十年,印度的包装产品消费量增加了 200%,从每人每年 4.3 公斤增加到 8.6 公斤。此外,根据印度包装工业协会 (PIAI) 的数据,包装产业的复合年增长率为 22% 至近 25%。同样,根据印度贸易促进委员会的数据,印度包装产业正在经历显着成长,预计到 2025 年将达到 2,048 亿美元。

- 此外,由于软包装越来越受欢迎,预计日本包装产业在未来几年将呈现成长动能。在目前的市场情势下,日本是全球人均包装材料消费量量最高的国家。在亚洲,日本的包装食品消费份额则位居第二,仅次于中国。

- 日本的电子产业正在蓬勃发展。根据电子情报技术产业协会(JEITA)统计,2023年12月工业电子设备产值为2935.77亿日圆(约208,085万美元),年增近100%。此外,2023年12月家用电子电器产值达357.75亿日圆(2.5357亿美元),较去年同期大幅成长112.2%。

- 由于上述因素,预计亚太地区将在 2024 年至 2029 年期间占据市场主导地位。

电子束固化涂料产业概况

电子束固化涂料市场正在经历整合。市场的主要企业包括阿科玛 (Arkema)、BASF SE)、PPG 工业公司 (PPG Industries Inc.)、太阳化学 (Sun Chemical) 和科思创 (Covestro AG)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 包装产业的产品需求不断增加

- 航太工业产品日益普及

- 限制因素

- 生产成本上升

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 最终用户产业

- 航太

- 电气和电子

- 车

- 包装

- 其他终端用户产业(电池)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧国家

- 土耳其

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 卡达

- 阿拉伯聯合大公国

- 奈及利亚

- 埃及

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作与协议

- 市场排名分析

- 主要企业策略

- 公司简介

- Abrisa Technologies

- Allnex GmbH

- Arkema

- BASF SE

- Beckers Group

- Cork Industries Inc.

- Covestro AG

- Dai Nippon Printing Co. Ltd

- Dainichiseika Color & Chemicals MFG Co. Ltd

- Estron

- IGM Resins BV

- INX International Ink Co.

- Polytex Environmental Inks

- PPG Industries Inc.

- R&D Coatings LLC

- Sun Chemical

第七章 市场机会与未来趋势

- 电动车领域的需求不断增长

The Electron Beam Curable Coating Market size is estimated at USD 463.67 million in 2025, and is expected to reach USD 546.98 million by 2030, at a CAGR of 3.36% during the forecast period (2025-2030).

The COVID-19 pandemic hampered the electron beam curable coating market as nationwide lockdowns in several countries and strict social distancing measures affected the end-user industries such as aerospace, electrical and electronics, automotive, and packaging, thereby affecting the market. However, the market registered a significant growth rate after the restrictions were lifted due to the recovering demand from the packaging, electrical, and electronic industries.

Key Highlights

- The increasing product demand in the packaging industry and the rising product popularity in the aerospace industry are expected to drive the market for electron beam curable coating.

- Higher production costs of electron beam curable coatings are expected to hinder the market's growth.

- The increasing demand from the electric vehicles segment is expected to create opportunities for the market between 2024 and 2029.

- Asia-Pacific emerged as the dominant market. It is also expected to register the highest CAGR from 2024 to 2029 due to the high demand from the expanding end-user industries in the region.

Electron Beam Curable Coating Market Trends

Increasing Demand from the Packaging Industry

- Electron beam curable coatings are widely adopted in flexible packaging applications owing to their clean, fast, and energy-efficient way of processing. With the increasing population, growing sustainability concerns, more spending power in developing regions, and the growing demand for smart packaging, the demand for packaging solutions has been increasing recently.

- Health and safety have become a top priority for many businesses, resulting in the increasing demand for protective and tamper-evident packaging from food and consumer goods manufacturers. Protective and tamper-evident packaging materials enable businesses to improve the safety of their current packaging containers while also allowing consumers to quickly identify if their products have been compromised or tampered with.

- Additionally, amid the significant growth in the e-commerce industry backed by a surge in digitalization, the packaging industry is witnessing sharp growth across the world. According to the Indian Institute of Packaging, packaging consumption in India increased by 200% in the past decade and is expected to reach USD 204.81 billion by 2025.

- Furthermore, the packaging industry in Germany is also growing at a rapid pace, owing to the huge increase in domestic e-commerce and the rise in foreign exports. In addition, the increasing preference for packaged food and beverages is also leading to the growth of the packaging industry.

- In the United Kingdom, design improvements and innovation, combined with a shifting focus toward the usage of recyclable materials for packaging, are expected to offer numerous opportunities for market growth. This is expected to open up the possibility of launching new products into the market. The UK packaging manufacturing industry has annual sales of GBP 11 billion (~USD 13.6 billion). According to government figures, more than 2 million metric tons of plastic packaging (the leading product segment) are used in the country annually.

- In the United States, the growing food and beverage market is boosting the country's packaging market. According to the industry report, the revenue from the food industry is expected to reach USD 1,010.97 billion in 2024. The revenue is expected to register a CAGR of over 3.81% (2024-2028), resulting in a projected market value of USD 1,173.74 billion by 2028. This is expected to increase the demand for electron beam curable coatings in the packaging industry, thereby boosting the market studied between 2024 and 2029.

- Hence, the aforementioned factors and growth in the packaging industry in the near future are expected to boost the market demand for electron beam curable coatings from 2024 to 2029.

Asia-Pacific is Expected to Dominate the Market

- Asia-Pacific is expected to dominate the market for electron beam curable coating between 2024 and 2029. China, India, and Japan are expected to drive the demand for electron beam curable coating in this region.

- The electron beam curing process for coatings is well-known and well-positioned, as it offers the unique advantage of delivering room-temperature, color-blind curing for both inline and multidimensional substrates within greatly reduced footprints. This enables opportunities to accelerate new processes designed for compliance with the automotive light-weighting standards within the transportation industry. China has the most significant automotive production base in the world. In 2023, total vehicle production was 30,160,966 units, an increase of 11.6% compared to 27,020,615 units produced last year. According to the International Trade Administration (ITA), domestic automotive production is expected to reach 35 million units by 2025.

- The Chinese packaging industry is one of the significant global packaging industries. The packaging industry in the country is expected to grow. The report published by the Chinese government foresees the industry achieving a valuation of CNY 2 trillion (USD 290 billion) by 2025.

- In India, packaging is the 5th largest industry in the country and is also one of the fastest-growing sectors. The consumption of packaging products in India has increased by 200% over the last decade, rising from 4.3 kg per person per year to 8.6 kg per person per year. Also, as per the Packaging Industry Association of India (PIAI), the packaging sector is growing at a CAGR of nearly 22% to 25%. Similarly, according to the Trade Promotion Council of India, the Indian packaging industry is experiencing remarkable growth and is expected to reach USD 204.8 billion by 2025.

- Moreover, the Japanese packaging industry is expected to witness growth in the coming years, owing to the increasing popularity of flexible packaging. In the present market scenario, Japan has the highest per capita consumption of packaging materials in the world. In Asia, Japan holds the second-highest packaged food consumption share, next to China.

- The electronics industry is growing in Japan. According to the Japan Electronics and Information Technology Industries (JEITA), the production value of industrial electronic devices stood at JPY 293,577 million (USD 2,080.85 million) in December 2023, increasing by almost 100% annually. Furthermore, the production value of consumer electronic equipment in the country stood at JPY 35,775 million (USD 253.57 million) in December 2023, increasing by a significant 112.2% during the same period last year.

- Owing to the above-mentioned factors, Asia-Pacific is expected to dominate the market between 2024 and 2029.

Electron Beam Curable Coating Industy Overview

The electron beam curable coating market is consolidated in nature. Some of the major players in the market are Arkema, BASF SE, PPG Industries Inc., Sun Chemical, and Covestro AG.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Product Demand in the Packaging Industry

- 4.1.2 Rising Product Popularity in the Aerospace Industry

- 4.2 Restraints

- 4.2.1 Higher Production Cost

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 End-user Industry

- 5.1.1 Aerospace

- 5.1.2 Electrical and Electronics

- 5.1.3 Automotive

- 5.1.4 Packaging

- 5.1.5 Other End-user Industries (Batteries)

- 5.2 Geography

- 5.2.1 Asia-pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Malaysia

- 5.2.1.6 Thailand

- 5.2.1.7 Indonesia

- 5.2.1.8 Vietnam

- 5.2.1.9 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 France

- 5.2.3.4 Italy

- 5.2.3.5 Spain

- 5.2.3.6 Nordic Countries

- 5.2.3.7 Turkey

- 5.2.3.8 Russia

- 5.2.3.9 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Colombia

- 5.2.4.4 Rest of South America

- 5.2.5 Middle East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 Qatar

- 5.2.5.3 United Arab Emirates

- 5.2.5.4 Nigeria

- 5.2.5.5 Egypt

- 5.2.5.6 South Africa

- 5.2.5.7 Rest of Middle East and Africa

- 5.2.1 Asia-pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers And Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Abrisa Technologies

- 6.4.2 Allnex GmbH

- 6.4.3 Arkema

- 6.4.4 BASF SE

- 6.4.5 Beckers Group

- 6.4.6 Cork Industries Inc.

- 6.4.7 Covestro AG

- 6.4.8 Dai Nippon Printing Co. Ltd

- 6.4.9 Dainichiseika Color & Chemicals MFG Co. Ltd

- 6.4.10 Estron

- 6.4.11 IGM Resins BV

- 6.4.12 INX International Ink Co.

- 6.4.13 Polytex Environmental Inks

- 6.4.14 PPG Industries Inc.

- 6.4.15 R&D Coatings LLC

- 6.4.16 Sun Chemical

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand from the Electric Vehicles Segment