|

市场调查报告书

商品编码

1537644

二手和翻新智慧型手机的市场占有率分析、行业趋势和统计数据以及成长预测(2024-2029)Used And Refurbished Smartphone - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

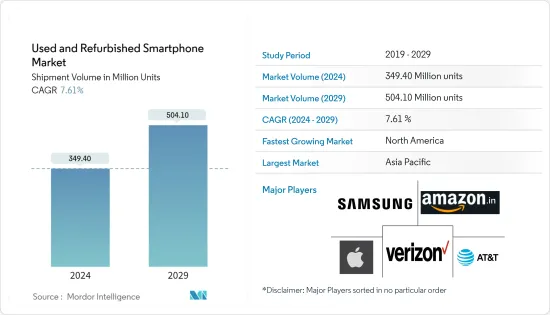

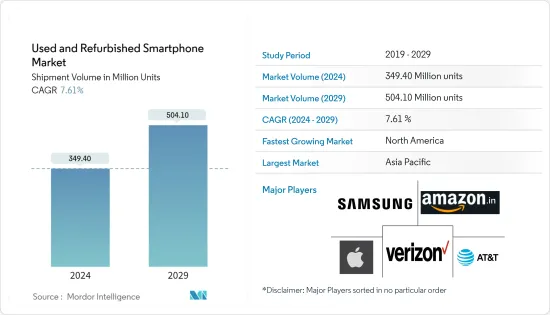

根据出货量,二手和翻新智慧型手机市场规模预计将从 2024 年的 3.494 亿部扩大到 2029 年的 5.041 亿部,预测期内(2024-2029 年)复合年增长率为 7.61%。

全球二手和翻新智慧型手机市场正在快速成长,为精打细算的消费者提供了实惠的选择。在成本效益和环境友善的推动下,该市场提供翻新或二手设备,延长产品生命週期并为永续技术生态系统做出贡献。

主要亮点

- 高阶智慧型手机领域的多种产品推出、更多的品牌选择、新的价格分布以及升级智慧型手机的整体理想价值正在迅速推动二手智慧型手机产业的发展,并扩展到世界多个地区。

- 可支配收入的显着增加和线上游戏的增加是消费者采用高阶智慧型手机的主要原因。由于技术的进步,升级规格的需求逐年增加。然而,此类规格的成本很高,因此消费者经常将现有的智慧型手机换成升级的二手或翻新的高端机型,以获得更好的回购价格。

- 随着越来越多的电子废弃物被倾倒在垃圾掩埋场,网路营运商正在寻求透过提供连接和低预算智慧型手机来增加用户,特别是在农村地区。包括印度在内的新兴国家是推动全球次市场的主要市场之一,并且在过去几年中取得了一些重大发展。

- 由于已开发经济体和新兴经济体的通膨上升减少了客户的可支配收入和现金储备,市场陷入停滞。结果,以旧换新量减少,影响了智慧型手机二级市场。此外,过去几个季度,印度等翻新和二手智慧型手机的主要市场智慧型手机销量大幅下降,进一步阻碍了市场成长。

- COVID-19 的爆发引发了一场在家学习和工作的运动。过去十年中,在家工作的趋势稳定成长。然而,COVID-19 的影响在很短的时间内急剧加速了这一趋势,迫使各种规模的企业迅速适应世界各国政府建议的自我隔离措施。

二手/翻新智慧型手机市场趋势

二手和翻新智慧型手机电子商务平台的日益普及推动了市场的发展

- 二手和翻新智慧型手机电子商务平台日益普及背后可能有几个因素。消费者越来越多地寻找新产品的经济高效替代品,而这些平台提供了更实惠的选择。越来越多具有环保意识的消费者越来越有兴趣透过购买二手设备来延长电子设备的使用寿命。线上交易的便利性以及比较价格和条件的便利性使得二手智慧型手机的电子商务更具吸引力。

- 根据 Monetate 的数据,世界各地的消费者透过手机进行线上购物的花费最多。 2022年7月至2023年9月,行动端购买的平均订单金额在2023年4月达到高峰。当月消费者在网上订单上的平均花费为 105.45 美元。

- 由于电子废弃物是全球成长最快的固态废弃物流,其成长速度比澳洲等国家的一般废弃物快三倍,因此市场情绪已转向购买翻新智慧型手机,它在Boost Mobile、Cole's 和等多家公司中越来越受欢迎。

- 全球线上零售商亚马逊设有专用的专区。用户可以将旧智慧型手机卖给亚马逊,并以折扣价购买新产品。此外,亚马逊还会检查您的旧智慧型手机并进行修復,使其看起来像新的一样。这些设备在服务部门出售,并附带有限的供应商或製造商保固。

- 还有一个类别称为製造商修復,它与本地维修公司进行的维修区分开来。与原始设备製造商一样,製造商将使用原始组件修復行动电话,验证其功能,并将其翻新至「像新的一样」状态。大多数人都会寻找这类行动电话,而客户更喜欢翻新的智慧型手机。

- 供应链问题和晶片短缺也有助于推动再製造品产业的发展。各组织正在转向再製造电子供应商来满足这些要求,而再製造电子产业预计将扩大,其中智慧型手机将成为焦点。

北美市场预计将显着成长

- 智慧型手机功能的改进和 5G 智慧型手机的普及正在推动北美二手和翻新智慧型手机市场的成长。美国是全球智慧型手机供应商的主要市场之一。全部区域都有创新智慧型手机的历史,主要来自苹果等供应商,这些智慧型手机改变了智慧型手机市场的动态。

- 北美二手和翻新智慧型手机市场的成长可归因于多种因素。消费者越来越注重成本,并正在寻找价格实惠的新设备替代品。经过认证的翻新行动电话提供可靠且经济实惠的选择。

- 据沃尔玛称,截至2023年9月,美国沃尔玛有许多翻新智慧型手机在售。 iPhone 11 (64GB) 是最畅销的翻新智慧型手机,售价约 264 美元。三星 Galaxy G998U S21 Ultra (128GB) 排名第二,售价 365 美元。

- 根据 GSMA 的数据,预计到 2022 年,北美 5G 连线数将超过 10 亿,到 2025 年将超过 20 亿。到2025年,北美将成为第一个5G连线数占总连线数超过50%的地区。

- 为了减少电子废弃物,美国环保署 (EPA) 要求品牌所有者、电子产品製造商和永续从企业、消费者和组织收集 100% 的废旧电子产品。赛,鼓励努力:将电子产品发送给第三方认证的再製造商和回收商。

- 随着越来越多的人选择翻新产品并为减少电子废弃物做出贡献,环境因素也发挥了作用。改进的服务可确保这些设备符合高品质标准,并解决先前有关可靠性的问题。

- 总体而言,製造商和零售商对好处和有效行销策略的认识不断提高,推动了北美地区二手和翻新智慧型手机的普及。随着消费者在购买决策中优先考虑永续性和可负担性,这种趋势可能会持续下去。

二手和翻新智慧型手机产业概述

由于世界各地存在各种智慧型手机品牌,二手和翻新智慧型手机供应商之间的竞争非常激烈。该市场的主要企业包括三星电子、苹果、亚马逊、Verizon Communications Inc.、AT&T Inc.等。近年来,随着智慧型手机在开发中国家的普及,翻新智慧型手机的需求迅速增加。市场参与者正在采取联盟和投资等策略来加强其产品阵容并获得永续的竞争优势。

- 2023 年 11 月 - Reboxed 宣布已获得由 ACF Investors主导的160 万英镑(203 万美元)种子资金筹措。 Reboxed 提供了一个商务平台,以更好、更永续的方式买卖技术,将客户和企业连结起来。我们提供优质翻新和行动电话、平板电脑、笔记型电脑、智慧型手錶等,透过注重品质、一致性和真正循环方式的「如新」体验。该公司将利用这笔资金来推动成长,并进一步开发其零售合作伙伴计画和为企业提供的 Reboxed 服务。

- 2023 年 9 月 - Back Market 发起了一项名为「让他们购买新产品」的挑衅性国际宣传活动。该宣传活动模仿了大型科技公司的行销做法,挑战了每次购买新产品的传统观念,质疑消费者对新产品的偏好,并暗示翻新产品可以是高品质、实惠且更环保的。的选择。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

- 评估 COVID-19 对产业的影响

第五章市场动态

- 市场驱动因素

- 高阶行动电话趋势(升级成本增加)

- 二手和翻新智慧型手机的电子商务平台越来越受欢迎

- 专注于行动电话并提供有吸引力的套餐的通讯业者

- 市场挑战

- 智慧型手机销量下降的短期影响

- 电子商务对智慧型手机销售的影响

第六章 分析师对全新、二手和翻新智慧型手机的市场趋势和前景的评论

第 7 章:分销通路格局 - OEM与第三方供应商/平台

第八章 5G对二手和翻新智慧型手机的影响

第九章市场区隔

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第10章竞争格局

- 公司简介

- Samsung Electronics Co. Ltd

- Apple Inc.

- Amazon.com Inc.

- Verizon Communications Inc.

- AT&T Inc.

- Reboxed Limited

- Nippon Telephone Inc.

- Best Buy Co. Inc.

- Alibaba Group Holding Limited

- Paytm(One97 Communications Limited)

- Back Market

- FoneGiant

- Flipkart Internet Private Limited(Walmart Inc.)

第十一章投资分析

第十二章市场的未来

The Used And Refurbished Smartphone Market size in terms of shipment volume is expected to grow from 349.40 Million units in 2024 to 504.10 Million units by 2029, at a CAGR of 7.61% during the forecast period (2024-2029).

The used and refurbished smartphone market has surged globally, providing affordable alternatives for budget-conscious consumers. Driven by cost-effectiveness and environmental worries, this market offers renewed or pre-owned devices, extending product life cycles and contributing to a sustainable tech ecosystem.

Key Highlights

- Multiple product launches in the premium smartphone segment, more brand options, new price points, and the overall aspirational value of an upgraded smartphone are some significant factors rapidly driving the second-hand smartphone industry to increase its market in multiple geographies globally.

- The significant increase in disposable incomes and the rise in online gaming have been major reasons consumers adopt premium smartphones. Technological advancement has increased the demand for upgraded specifications over the years. However, such specifications come with higher costs, and consumers often tend to exchange their existing smartphones with upgraded used or refurbished premium models against lucrative buyback value.

- With the increasing amount of e-waste being dumped in landfills, the network operators are venturing into new effective strategies to increase their subscribers, especially in rural areas, by offering connectivity and low-budgeted smartphones. Countries such as India have been one of the major markets driving the secondary smartphone market around the globe, witnessing several major developments in the past few years.

- The market witnessed a stagnant market due to decreased disposable income and cash in hand among the customers due to rising inflation in developed and developing economies. As a result, the trade-in volume decreased, affecting the secondary market of smartphones. In addition, major markets for refurbished and used smartphones, such as India, have witnessed a substantial decrease in smartphone sales in the past few quarters, thus further hindering the growth of the market.

- The outbreak of COVID-19 led to a movement toward studying and working from home. The trend shifting toward work from work steadily rose over the past decade. However, the effect of COVID-19 dramatically accelerated this trend in an extremely short period, forcing enterprises, irrespective of their size, to quickly adapt to the self-isolation measures governments worldwide were recommending.

Used and Refurbished Smartphone Market Trends

Growing Popularity of E-commerce Platforms for Used and Refurbished Smartphones to Drive the Market

- The growing popularity of e-commerce platforms for used and refurbished smartphones may be attributed to several factors. Consumers are increasingly seeking cost-effective alternatives to new devices, and these platforms offer more affordable options. The rise of environmentally conscious consumers has fueled interest in extending the lifespan of electronics by purchasing pre-owned devices. The convenience of online transactions and the ease of comparing prices and conditions further contribute to the appeal of e-commerce for used smartphones.

- According to Monetate, global consumers spend the most money on online purchases made through mobiles. Between July 2022 and September 2023, the average order value from mobile purchases peaked in April 2023. Shoppers spent an average of USD 105.45 on online orders that month.

- As e-waste is the global fastest-growing solid-waste stream, rising at a rate three times faster than general waste in the country such as Australia, the market sentiments have transferred over to buying refurbished smartphones, which have grown traction among several players like Boost Mobile, Cole's, and Phoenix Cellular.

- The global online retailer Amazon has a dedicated section for refurbished devices. Users can easily sell their old smartphones to Amazon in exchange for a discount on a new gadget. In addition, the business inspects them and makes the mandatory repairs to make them seem and function like new ones. These devices are then sold in the refurbished sector and backed by a vendor or manufacturer's limited warranty.

- There is also a category called manufacturer reconditioning, which distinguishes itself from fixes performed by local repair companies. Like original equipment makers, the manufacturer repairs the phone with original components, confirms its functionality, and renews it in a "like new" state. Most people look for such phones, and customers prefer refurbished smartphones.

- The supply chain issues and chip shortages are also helping propel the refurbishing sector forward. Organizations are turning to refurbished electronics suppliers to meet this requirement, which is anticipated to augment the refurbished electronics industry, particularly smartphones.

North America Expected to Witness Significant Growth in the Market

- The rising advancements in smartphone features and the increasing scope of the 5G smartphones are some of the major factors augmenting the growth of the North American used and refurbished smartphone market. The United States is among the advanced markets for smartphone vendors globally. The entire region has a history of developing innovative smartphones, mainly with vendors like Apple, that have transformed the smartphone market dynamics.

- The growth in North America's used and refurbished smartphone market may be attributed to several factors. Consumers are becoming more cost-conscious, seeking affordable alternatives to new devices. The availability of certified refurbished phones provides a reliable and budget-friendly option.

- As per Walmart, in the United States, as of September 2023, many refurbished smartphones were available at Walmart. The iPhone 11 (64GB) was the best-selling reconditioned smartphone, costing around USD 264. The Samsung Galaxy G998U S21 Ultra (128GB) ranked second and sold for USD 365.

- As per GSMA, North America surpass 1 billion 5G connections by 2022 and 2 billion by 2025, mainly driven by continued network investments from operators and the expanding range of 5G smartphones at varying price points. North America will have become the first region where 5G accounts for more than 50% of total connections by 2025.

- To reduce electronic waste, the US Environmental Protection Agency (EPA) has been conducting the Sustainable Materials Management Electronics Challenge, which encourages brand owners, electronics manufacturers, and retailers to strive to send 100% of the used electronics they collect from businesses, the public, and within their organizations to third-party certified electronics refurbishers and recyclers.

- Environmental concerns also play a role, as more individuals opt for refurbished devices, contributing to reduced electronic waste. Improvements in refurbishment ensure that these devices meet high-quality standards, addressing previous concerns about reliability.

- Overall, the increased awareness of manufacturers' and retailers' benefits and effective marketing strategies have contributed to the rising popularity of used and refurbished smartphones in North America. This trend is likely to continue as consumers prioritize sustainability and affordability in their purchasing decisions.

Used and Refurbished Smartphone Industry Overview

The competitive rivalry amongst the used and refurbished smartphone providers is very high, owing to the presence of various smartphone brands across the globe. Some major players in the market are Samsung Electronics Co. Ltd, Apple Inc., Amazon.com Inc., Verizon Communications Inc., and AT&T Inc. The demand for refurbished smartphones has spiked in recent years due to the massive smartphone penetration across developing countries. Players in the market are adopting strategies such as partnerships and investments to enhance their product offerings and gain sustainable competitive advantage.

- November 2023 - Reboxed announced that it secured GBP 1.6 million (USD 2.03 million) in seed funding led by ACF Investors. Reboxed offers a commerce platform connecting customers and businesses with a better and more sustainable way to buy and sell technology. It provides premium refurbished and pre-owned devices, including phones, tablets, laptops, and smartwatches, through a "like new" experience that focuses on quality, consistency, and a genuinely circular approach. The company will use the funds to drive growth and further develop its retail partner programs and Reboxed for business service.

- September 2023 - Back Market launched 'Let Them Buy New' - a provocative new international campaign that calls 'BS' on Big Tech's obsession with creating a need for new products. The campaign parodies Big Tech's marketing ploys to challenge the accepted norm of buying new tech every time, to question a consumer bias for new, and to show that refurbished devices are a high quality, more affordable, and more eco-friendly choice.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitutes

- 4.4 Assessment of COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Trend Toward Premium Phones (Rise in Upgrade Costs)

- 5.1.2 Growing Popularity of E-commerce Platforms for Used and Refurbished Smartphones

- 5.1.3 Telecom Operators Focusing on Used Phones with Attractive Plans

- 5.2 Market Challenges

- 5.2.1 Short-term Impact of Decreasing Smartphone Sales

- 5.2.2 Impact of E-commerce on Smartphone Sales

6 ANALYST COMMENTARY ON MARKET TRENDS AND OUTLOOK FOR NEW VS USED AND REFURBISHED SMARTPHONES

7 LANDSCAPE OF DISTRIBUTION CHANNEL - OEMs VS THIRD-PARTY VENDORS/PLATFORMS

8 IMPACT OF 5G ON USED AND REFURBISHED SMARTPHONES

9 MARKET SEGMENTATION

- 9.1 By Geography

- 9.1.1 North America

- 9.1.2 Europe

- 9.1.3 Asia-Pacific

- 9.1.4 Rest of the World

10 COMPETITIVE LANDSCAPE

- 10.1 Company Profiles*

- 10.1.1 Samsung Electronics Co. Ltd

- 10.1.2 Apple Inc.

- 10.1.3 Amazon.com Inc.

- 10.1.4 Verizon Communications Inc.

- 10.1.5 AT&T Inc.

- 10.1.6 Reboxed Limited

- 10.1.7 Nippon Telephone Inc.

- 10.1.8 Best Buy Co. Inc.

- 10.1.9 Alibaba Group Holding Limited

- 10.1.10 Paytm (One97 Communications Limited)

- 10.1.11 Back Market

- 10.1.12 FoneGiant

- 10.1.13 Flipkart Internet Private Limited (Walmart Inc.)